Short-term goals provide quick wins that boost motivation and maintain momentum toward larger achievements. Mini-retirements offer extended breaks to recharge and reassess priorities, preventing burnout while sustaining long-term progress. Balancing short-term goals with periodic mini-retirements enhances productivity and overall well-being in goal pursuit.

Table of Comparison

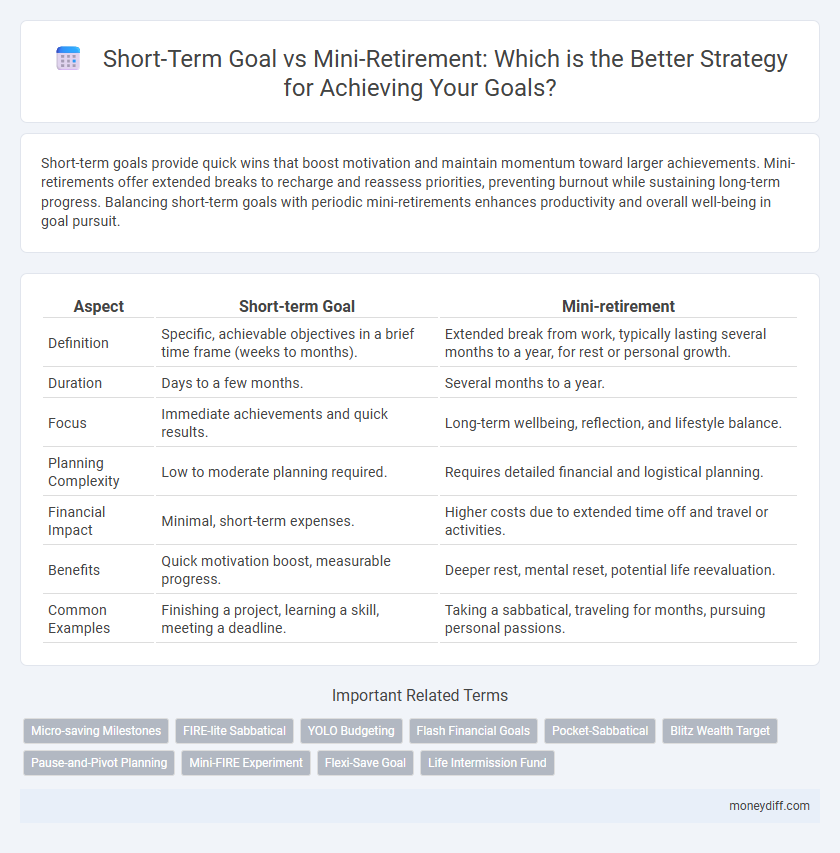

| Aspect | Short-term Goal | Mini-retirement |

|---|---|---|

| Definition | Specific, achievable objectives in a brief time frame (weeks to months). | Extended break from work, typically lasting several months to a year, for rest or personal growth. |

| Duration | Days to a few months. | Several months to a year. |

| Focus | Immediate achievements and quick results. | Long-term wellbeing, reflection, and lifestyle balance. |

| Planning Complexity | Low to moderate planning required. | Requires detailed financial and logistical planning. |

| Financial Impact | Minimal, short-term expenses. | Higher costs due to extended time off and travel or activities. |

| Benefits | Quick motivation boost, measurable progress. | Deeper rest, mental reset, potential life reevaluation. |

| Common Examples | Finishing a project, learning a skill, meeting a deadline. | Taking a sabbatical, traveling for months, pursuing personal passions. |

Understanding Short-term Financial Goals

Short-term financial goals typically span from a few months to a couple of years and focus on immediate financial needs such as building an emergency fund or saving for a vacation. Unlike mini-retirements, which involve extended breaks from work to pursue personal interests or travel, short-term goals require disciplined budgeting and saving strategies that prioritize liquidity and accessibility. Understanding the timeline and specific purpose of short-term financial goals helps in creating actionable plans that align with overall financial stability and future wealth building.

What is a Mini-Retirement?

A mini-retirement is a planned extended break from work, typically lasting several months to a year, allowing individuals to recharge, travel, or pursue personal passions without waiting until traditional retirement age. Unlike short-term goals that focus on immediate or near-future achievements, mini-retirements provide a strategic pause to enhance long-term wellbeing and life satisfaction. This approach integrates financial planning, time management, and lifestyle design to create meaningful experiences outside the conventional career timeline.

Key Differences: Short-term Goals vs Mini-Retirement

Short-term goals typically span weeks to months and focus on immediate achievements like completing a project or saving a specific amount of money, emphasizing quick progress and tangible outcomes. Mini-retirements extend over several months to a year, prioritizing extended breaks from work to pursue personal growth, travel, or rest, integrating life balance into long-term planning. The key difference lies in timeframe and purpose: short-term goals drive rapid accomplishments, while mini-retirements offer a structured pause for rejuvenation within a broader life strategy.

Financial Planning for Short-term Goals

Short-term goals in financial planning typically span from a few months to a few years, requiring precise budgeting and disciplined saving strategies to ensure timely achievement. Mini-retirements, as extended breaks taken intermittently throughout life, demand more comprehensive financial preparation to cover living expenses without steady income. Prioritizing liquidity and risk management is crucial when allocating funds for short-term goals to maintain financial flexibility and avoid compromising long-term investments.

Benefits of Pursuing a Mini-Retirement

Pursuing a mini-retirement offers significant benefits such as enhanced mental rejuvenation and sustained motivation compared to conventional short-term goals. Mini-retirements provide extended breaks that promote deeper personal reflection and skill development, which short-term goals typically lack. This approach to goal setting fosters long-term productivity by balancing work and rest in a flexible, revitalizing manner.

Risk Factors: Short-term Goals and Mini-Retirements

Short-term goals carry risks such as limited time for adjustment and potential stress from tight deadlines, which can impact performance and motivation. Mini-retirements offer a risk of career disruption and financial instability if not carefully planned, yet they provide extended recovery and reflection periods that can enhance long-term productivity. Balancing the immediacy of short-term goals with the rejuvenation benefits of mini-retirements is crucial for sustainable personal and professional growth.

Savings Strategies: Short-term vs Mini-Retirement

Short-term savings strategies prioritize quick accumulation of funds for immediate goals, emphasizing high-yield savings accounts and budget adjustments to meet financial targets within months or a few years. Mini-retirement savings focus on building a larger financial cushion through diversified investments and passive income streams, enabling extended breaks from work without compromising long-term financial stability. Balancing liquid assets for short-term needs with growth-oriented investments supports both immediate financial goals and sustainable mini-retirement plans.

Impact on Career and Income

Short-term goals often provide immediate milestones that boost career momentum and can lead to incremental increases in income through promotions or bonuses. Mini-retirements, by contrast, temporarily pause professional activities, potentially slowing career progression but offering valuable time for skill development or personal growth that may enhance long-term earning potential. Balancing these approaches requires careful assessment of career objectives and financial stability to maximize overall impact.

Deciding Which Goal Suits You

Choosing between a short-term goal and a mini-retirement depends on your current life priorities and financial readiness. A short-term goal offers quick, measurable achievements that build momentum, while a mini-retirement provides extended time off to recharge and pursue passions without the stress of daily work. Evaluate your need for immediate progress versus long-term renewal to decide which goal best aligns with your personal and professional growth.

Case Studies: Short-term Goals vs Mini-Retirement Success Stories

Case studies reveal that short-term goals provide quick wins and maintain motivation by focusing on achievable milestones within weeks or months. Mini-retirement success stories highlight extended breaks lasting several months to a year, enabling profound personal growth and rejuvenation away from traditional career pressures. Data shows individuals who integrate mini-retirements often return with enhanced productivity and long-term goal clarity compared to those pursuing only short-term objectives.

Related Important Terms

Micro-saving Milestones

Short-term goals focus on achieving specific milestones within weeks or months, making micro-saving a practical strategy for incremental progress. Mini-retirements require more extensive planning but can be funded effectively by accumulating micro-saving milestones that bolster financial stability for extended breaks.

FIRE-lite Sabbatical

Short-term goals often target immediate achievements within months or a few years, whereas a mini-retirement, as seen in a FIRE-lite sabbatical, emphasizes an extended break from work to recharge financially and personally while maintaining moderate financial independence. The FIRE-lite sabbatical blends early retirement principles with flexible career pauses, enabling sustainable lifestyle adjustments without the full commitment of traditional FIRE.

YOLO Budgeting

Short-term goals prioritize immediate achievements within months, making YOLO budgeting ideal for balancing enjoyment and financial responsibility without long-term sacrifice. Mini-retirement involves extended breaks from work, requiring more substantial savings and strategic planning to support sustained freedom and lifestyle during these periods.

Flash Financial Goals

Flash Financial Goals prioritize immediate, actionable targets that boost motivation and track quick wins, contrasting with mini-retirements that focus on extended breaks to recharge. Short-term goals deliver rapid progress and clarity, while mini-retirements emphasize strategic pause and lifestyle balance.

Pocket-Sabbatical

Short-term goals typically focus on immediate achievements within weeks or months, while mini-retirements involve extended breaks from work to recharge and pursue personal interests, often lasting several months to a year. A pocket-sabbatical serves as a strategic mini-retirement, enabling professionals to balance career progress with meaningful rest without long-term career interruption.

Blitz Wealth Target

Short-term goals prioritize immediate financial milestones, while mini-retirements allow periodic breaks from work to recharge and reassess wealth strategies, aligning with Blitz Wealth Target's emphasis on agile wealth-building. Integrating mini-retirements within a short-term goal framework enhances sustainable progress and maintains motivation toward achieving Blitz Wealth Target objectives.

Pause-and-Pivot Planning

Short-term goals provide immediate focus and measurable milestones, while mini-retirements allow extended breaks to realign priorities and enhance long-term productivity. Pause-and-pivot planning leverages mini-retirements to reassess and adjust short-term goal trajectories for sustained motivation and successful outcomes.

Mini-FIRE Experiment

Mini-retirement, a core concept in the Mini-FIRE experiment, emphasizes taking extended breaks from traditional work early in life to pursue personal growth and experiences, contrasting with short-term goals focused on immediate, incremental achievements. This approach leverages financial independence attained through aggressive saving and investing to create flexible lifestyle choices, prioritizing meaningful life phases over constant career progression.

Flexi-Save Goal

Flexi-Save Goal offers a dynamic alternative to traditional short-term goals by integrating aspects of mini-retirement, allowing individuals to save flexibly for both immediate needs and planned breaks. This strategy enhances financial freedom by balancing consistent savings with periodic withdrawal opportunities, optimizing goal achievement and lifestyle flexibility.

Life Intermission Fund

Short-term goals often require focused savings for immediate needs, while a Life Intermission Fund supports mini-retirements, enabling extended breaks without financial stress. Prioritizing a Life Intermission Fund enhances financial flexibility, promoting personal growth and rejuvenation through planned life pauses.

Short-term Goal vs Mini-retirement for goal. Infographic

moneydiff.com

moneydiff.com