Setting a college fund goal prioritizes long-term financial security by accumulating savings for tuition, housing, and academic expenses, ensuring a solid foundation for higher education. In contrast, a gap year fund goal emphasizes flexibility and experience-based spending, covering travel, internships, or skill-building activities during a break before college. Balancing these goals requires strategic money management to accommodate both structured education costs and enriching gap year opportunities.

Table of Comparison

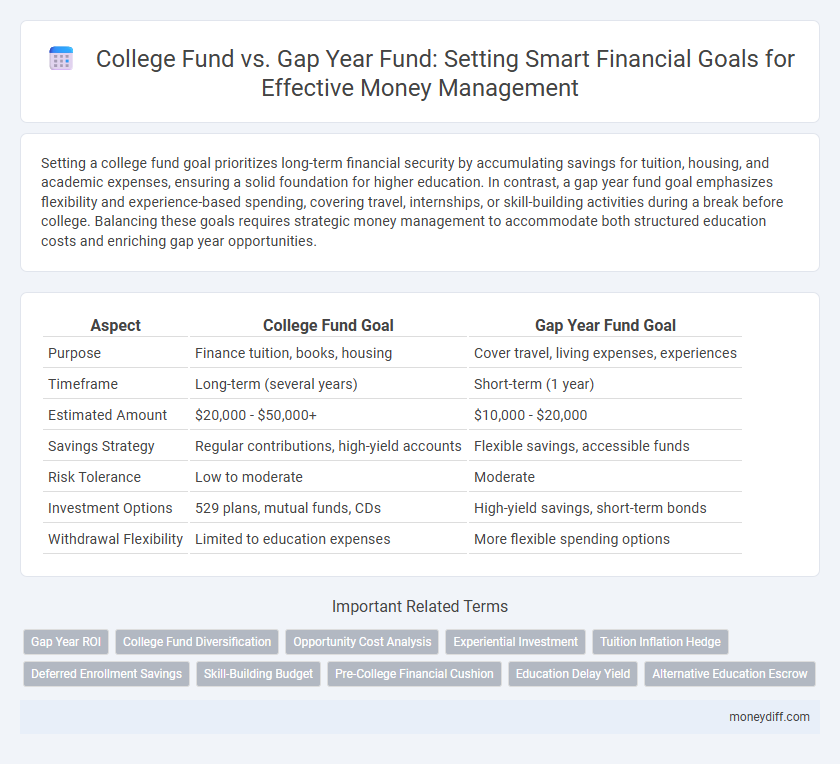

| Aspect | College Fund Goal | Gap Year Fund Goal |

|---|---|---|

| Purpose | Finance tuition, books, housing | Cover travel, living expenses, experiences |

| Timeframe | Long-term (several years) | Short-term (1 year) |

| Estimated Amount | $20,000 - $50,000+ | $10,000 - $20,000 |

| Savings Strategy | Regular contributions, high-yield accounts | Flexible savings, accessible funds |

| Risk Tolerance | Low to moderate | Moderate |

| Investment Options | 529 plans, mutual funds, CDs | High-yield savings, short-term bonds |

| Withdrawal Flexibility | Limited to education expenses | More flexible spending options |

Understanding College Fund Goals vs. Gap Year Fund Goals

College fund goals prioritize long-term savings specifically for tuition, room, and board expenses, often leveraging tax-advantaged education savings accounts like 529 plans. Gap year fund goals require more flexible budgeting to cover travel, living expenses, and experiential learning, demanding liquidity and short-term availability of funds. Distinguishing these goals ensures effective money management strategies tailored to the unique timelines and expenditures of college attendance versus a gap year experience.

Financial Priorities: College Tuition vs. Gap Year Expenses

Allocating savings between a college fund and a gap year fund requires prioritizing college tuition costs, which typically represent a larger, long-term financial commitment. Gap year expenses, though significant, are generally shorter-term and more flexible, allowing for adjustments based on available funds. Focusing on tuition ensures foundational financial security, while gap year funding can be managed with smaller, supplementary savings.

Comparing Short-Term and Long-Term Money Management Strategies

College fund goals typically require long-term money management strategies prioritizing consistent contributions, growth through diversified investments, and minimizing risk to ensure sufficient funds upon enrollment. Gap year fund goals are short-term, focusing on liquidity and accessibility, often utilizing high-yield savings accounts or low-risk instruments to preserve capital and cover immediate expenses. Comparing both highlights the need for balancing growth potential and accessibility based on the time horizon and financial objective.

Estimating the True Costs: College Fund vs. Gap Year Fund

Estimating the true costs of a college fund involves accounting for tuition, housing, textbooks, and other academic-related expenses, while a gap year fund typically includes travel, personal development programs, and living costs. College funds require long-term planning given the rising costs of education, whereas gap year funds demand flexible budgeting due to variable activities and durations. Accurate cost estimation for both funds ensures effective money management and prevents shortfalls during key life transitions.

Setting Realistic Savings Milestones for Each Goal

Setting realistic savings milestones for a college fund goal involves calculating tuition costs, housing, and textbooks to create a clear target amount aligned with the student's timeline. In contrast, a gap year fund goal prioritizes budget planning for travel, living expenses, and experiential learning, often requiring smaller, more flexible saving increments. Segmenting each goal into achievable monthly or quarterly milestones enhances financial discipline and ensures steady progress toward both education and gap year funding objectives.

Investment Options for College and Gap Year Savings

Investment options for college funds typically emphasize long-term growth through 529 plans and low-risk mutual funds, optimizing tax advantages and capital appreciation over several years. Gap year savings prioritize more liquid, short-term vehicles like high-yield savings accounts and short-term CDs to ensure funds are readily accessible within a shorter timeframe. Balancing risk tolerance and time horizon is crucial when selecting investment strategies for both college and gap year financial goals.

Risk Management: Protecting Your Education or Gap Year Savings

Prioritizing risk management when saving for a college fund or a gap year fund ensures financial security against unexpected events like market downturns or emergencies. Utilizing diversified investment strategies and safety nets such as insurance can safeguard the education savings from potential losses. Establishing separate accounts with low-risk options for gap year funds helps maintain liquidity and preserves value for planned experiences.

Balancing Financial Commitments for Dual Goals

Balancing financial commitments between a college fund and a gap year fund requires strategic allocation of resources to ensure both goals are adequately funded. Prioritizing contributions based on estimated costs and timelines for college tuition and gap year experiences helps optimize savings growth and avoid budget shortfalls. Utilizing separate savings accounts or investment vehicles tailored for each goal enhances clarity and facilitates disciplined money management.

Adjusting Your Budget for College and Gap Year Plans

Adjusting your budget for college and gap year plans requires prioritizing college fund goals due to rising tuition costs and associated expenses, while allocating a smaller, flexible amount for gap year activities like travel or internships. Tracking expenses and setting clear savings targets enables efficient fund distribution, ensuring adequate resources for both educational and experiential opportunities. Utilizing budgeting tools or apps can help monitor progress and adapt contributions based on changing financial circumstances.

Evaluating the Return on Investment: College Education vs. Gap Year Experience

Evaluating the return on investment between a college education and a gap year experience requires analyzing long-term financial benefits and personal growth outcomes. College education often leads to higher lifetime earnings, credential acquisition, and career advancement opportunities, which can outweigh the upfront costs. In contrast, a thoughtfully planned gap year can provide valuable life skills, cultural exposure, and mental clarity that contribute to greater academic focus and success, but may delay immediate financial returns.

Related Important Terms

Gap Year ROI

Investing in a gap year fund often yields a higher return on investment (ROI) by providing valuable life experiences, skill development, and increased employability that can enhance future earning potential compared to a traditional college fund. Gap year planning optimizes financial resources by balancing personal growth opportunities with strategic career advancement, making it a viable alternative for money management priorities.

College Fund Diversification

Diversifying a college fund by allocating resources between traditional savings and investment accounts can optimize growth and reduce risk, while a gap year fund often requires more liquid, short-term savings to cover immediate expenses. Balancing these goals ensures both long-term education financing and flexible funding for experiential opportunities outside the classroom.

Opportunity Cost Analysis

Allocating funds between a college fund and a gap year fund involves assessing opportunity costs, where investing in a college fund typically yields long-term educational benefits and potential higher lifetime earnings, while funding a gap year supports experiential growth and personal development but may delay academic progress. Evaluating the opportunity cost helps prioritize financial resources to maximize returns on investment based on individual goals and timelines.

Experiential Investment

Allocating funds for a college savings goal prioritizes long-term educational expenses with stable growth strategies, while a gap year fund goal emphasizes flexible, experiential investments that support travel, internships, and skill development. Balancing these goals requires distinguishing between the structured nature of tuition payments and the dynamic, personalized nature of gap year experiences to optimize overall financial planning.

Tuition Inflation Hedge

Prioritizing a college fund goal over a gap year fund goal better addresses tuition inflation hedge, as college costs typically rise faster and require long-term investment strategies to preserve purchasing power. Gap year funding, being short-term, is less susceptible to inflation impact, making it a lower priority for hedging tuition inflation risks.

Deferred Enrollment Savings

Allocating savings toward a college fund ensures long-term educational security, while a gap year fund offers flexibility for deferred enrollment costs and travel experiences. Prioritizing Deferred Enrollment Savings balances financial preparedness with the opportunity for personal growth during time off before college.

Skill-Building Budget

Allocating a skill-building budget within a college fund provides structured financial growth opportunities, whereas a gap year fund emphasizes flexible spending for experiential learning and personal development. Prioritizing skill-building investments in the college fund enhances long-term career readiness, while gap year budgeting supports immediate life skills and cultural exposure.

Pre-College Financial Cushion

Allocating a pre-college financial cushion ensures readiness for unexpected expenses during gap years or the transition to college, stabilizing the overall fund goal. Prioritizing this buffer enhances financial flexibility and minimizes reliance on high-interest debt when managing college and gap year funds.

Education Delay Yield

Allocating funds for a college education versus a gap year requires balancing immediate financial needs against potential education delay yield, where deferring college enrollment may increase overall expenses and reduce investment growth. Prioritizing a college fund maximizes compound interest benefits, while a gap year fund necessitates careful management to avoid diminishing long-term education returns.

Alternative Education Escrow

Alternative Education Escrow offers a strategic solution for managing College fund goals by securely allocating resources for tuition while also accommodating flexible Gap year fund goals that cover travel, internships, and personal development expenses. Utilizing this specialized escrow enhances financial planning accuracy, ensuring funds are appropriately segmented and accessible according to the distinct timelines and needs of higher education and experiential learning phases.

College fund goal vs Gap year fund goal for money management. Infographic

moneydiff.com

moneydiff.com