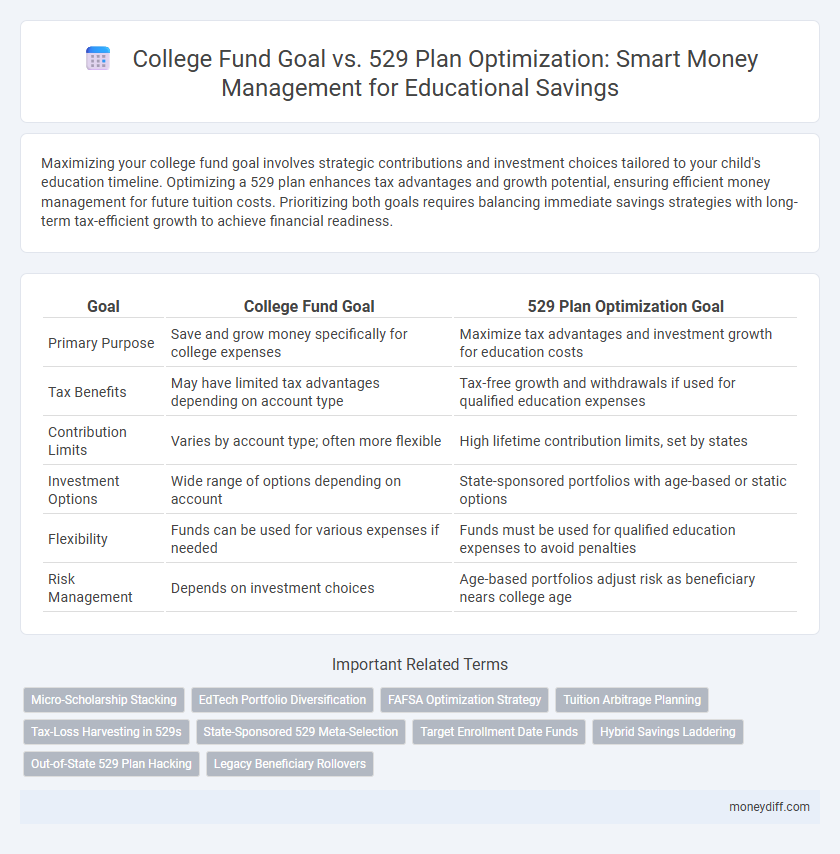

Maximizing your college fund goal involves strategic contributions and investment choices tailored to your child's education timeline. Optimizing a 529 plan enhances tax advantages and growth potential, ensuring efficient money management for future tuition costs. Prioritizing both goals requires balancing immediate savings strategies with long-term tax-efficient growth to achieve financial readiness.

Table of Comparison

| Goal | College Fund Goal | 529 Plan Optimization Goal |

|---|---|---|

| Primary Purpose | Save and grow money specifically for college expenses | Maximize tax advantages and investment growth for education costs |

| Tax Benefits | May have limited tax advantages depending on account type | Tax-free growth and withdrawals if used for qualified education expenses |

| Contribution Limits | Varies by account type; often more flexible | High lifetime contribution limits, set by states |

| Investment Options | Wide range of options depending on account | State-sponsored portfolios with age-based or static options |

| Flexibility | Funds can be used for various expenses if needed | Funds must be used for qualified education expenses to avoid penalties |

| Risk Management | Depends on investment choices | Age-based portfolios adjust risk as beneficiary nears college age |

Understanding College Fund Goals

Understanding college fund goals involves setting clear financial targets for future education expenses, factoring in inflation, tuition increases, and anticipated funding sources. Unlike a 529 plan optimization goal, which centers on maximizing tax advantages and investment growth within a specific savings vehicle, college fund goals encompass a broader strategy including budgeting, potential scholarships, and loan considerations. Effective money management requires aligning these goals with realistic projections and risk tolerance to ensure sufficient funds when college enrollment begins.

What is a 529 Plan Optimization Goal?

A 529 Plan Optimization Goal focuses on maximizing tax advantages and investment growth within a 529 college savings plan to efficiently fund education expenses. This goal involves strategic contributions, selecting optimal investment options, and managing withdrawals to minimize taxes and penalties. Achieving 529 Plan Optimization ensures a disciplined approach to meeting college fund needs while leveraging state-sponsored benefits for higher education funding.

Comparing College Fund and 529 Plan Strategies

Maximizing college savings involves comparing the flexibility of a College Fund with the tax advantages of a 529 Plan, where the latter offers state tax deductions and tax-free withdrawals for qualified education expenses. College Funds provide broader investment options without restrictions on fund usage, appealing to families seeking versatility in financial planning. Optimizing money management requires evaluating the trade-offs between tax benefits and withdrawal flexibility to align investment strategies with long-term educational funding goals.

Key Benefits of Setting a College Fund Goal

Setting a college fund goal enables precise financial planning, ensuring consistent contributions that align with anticipated education costs and inflation rates. This targeted approach maximizes investment growth potential and reduces the need for high-interest loans, making higher education more affordable. A well-defined goal also simplifies decision-making between traditional savings and 529 plan optimization, enhancing tax advantages and withdrawal flexibility.

Optimizing Your 529 Plan for Maximum Growth

Optimizing your 529 plan involves strategic contributions, investment selection, and regular rebalancing to maximize growth potential for college funds. Prioritize low-cost, age-based portfolios and maximize tax advantages to enhance compounding returns over time. Monitoring market trends and adjusting allocations can further secure long-term financial goals while minimizing fees and risks.

Risk Factors: College Fund vs 529 Plan

College Fund risk factors primarily involve market volatility and inflation impacting the fund's growth potential, while 529 Plan risks include tax law changes and limited investment options that can affect future returns. The 529 Plan generally offers tax advantages and state-specific benefits but may expose investors to penalties if funds are not used for qualified educational expenses. Evaluating these risks alongside investment time horizon and financial goals is essential for optimizing long-term college savings strategies.

Tax Implications of 529 Plans

Maximizing a college fund through a 529 plan offers significant tax advantages, including tax-free growth and tax-free withdrawals for qualified education expenses. Contributions to 529 plans are not federally tax-deductible but often benefit from state tax deductions or credits, enhancing overall savings efficiency. Careful management of 529 plan distributions can prevent tax penalties and optimize long-term financial goals for education funding.

Flexibility and Accessibility: Fund Options Compared

Choosing between a College Fund Goal and a 529 Plan hinges on flexibility and accessibility, where traditional college savings accounts offer broader investment options but lack tax advantages. A 529 Plan provides tax-free growth and withdrawals for qualified education expenses, yet imposes restrictions on contributions and non-educational withdrawals. Optimal money management requires weighing these differences to balance immediate access against long-term tax benefits based on individual financial goals.

Contribution Limits and Matching Opportunities

Maximizing college fund goals requires balancing contribution limits and matching opportunities, where 529 plans offer tax-advantaged growth but typically have high maximum contribution limits without employer matches. Employer-sponsored college savings plans may provide matching contributions, increasing the effective savings rate, though they often impose lower contribution limits. Prioritizing a 529 plan for tax benefits while enrolling in a matching employee program can optimize overall college savings strategies.

Choosing the Right Goal for Your Family’s Needs

Selecting the right goal between a College Fund and a 529 Plan hinges on your family's financial priorities and timeline. A College Fund offers flexibility with fewer restrictions on withdrawals, while a 529 Plan provides tax advantages and higher contribution limits tailored for education expenses. Evaluating factors like potential education costs, risk tolerance, and tax benefits ensures optimized money management aligned with your family's specific goals.

Related Important Terms

Micro-Scholarship Stacking

Maximizing a college fund through micro-scholarship stacking leverages small, cumulative awards to reduce reliance on traditional 529 plans, enhancing overall financial efficiency. Optimizing these strategies involves prioritizing diverse scholarship sources while maintaining tax-advantaged growth within a 529 plan for balanced money management.

EdTech Portfolio Diversification

College fund goals prioritize accumulating sufficient capital for tuition and related expenses, requiring strategic allocation across various investment vehicles to mitigate risk and maximize growth. Optimizing a 529 plan within an EdTech portfolio diversification strategy enhances tax advantages and aligns investments with education-focused tech innovations, driving both financial efficiency and sector-specific returns.

FAFSA Optimization Strategy

Maximizing FAFSA aid eligibility requires prioritizing a College Fund Goal structured outside of custodial accounts, contrasting with a 529 Plan Optimization Goal that often increases asset count and reduces aid. Strategic allocation to parent-owned 529 plans or prepaid tuition funds minimizes reported assets, optimizing financial aid outcomes while ensuring targeted college savings growth.

Tuition Arbitrage Planning

Optimizing a 529 plan for college fund goals leverages tax-advantaged growth and flexible withdrawals specifically for education expenses, enhancing tuition arbitrage opportunities by investing in cost-effective institutions while maximizing savings. Strategic allocation within the 529 plan reduces total tuition costs through targeted investments and timing, outperforming general college fund savings by aligning funds with anticipated tuition inflation and scholarship availability.

Tax-Loss Harvesting in 529s

Maximizing a college fund through targeted tax-loss harvesting within 529 plans optimizes after-tax returns by strategically realizing losses to offset gains, enhancing growth potential without jeopardizing tax-advantaged status. Integrating tax-loss harvesting strategies in 529 accounts aligns with overall money management goals by reducing taxable income while preserving funds earmarked for education expenses.

State-Sponsored 529 Meta-Selection

Maximizing college fund growth requires strategic comparison between general College Fund Goals and State-Sponsored 529 Plan Optimization Goals, emphasizing tax advantages and state-specific benefits. Prioritizing Meta-Selection of 529 plans enables tailored investment options and optimized state tax deductions, enhancing long-term education savings efficiency.

Target Enrollment Date Funds

Target Enrollment Date Funds within a 529 Plan optimize college fund goals by automatically adjusting asset allocation to reduce risk as the beneficiary's enrollment date approaches. This strategic alignment enhances money management efficiency by balancing growth potential with capital preservation tailored to the specific time horizon of college expenses.

Hybrid Savings Laddering

Hybrid Savings Laddering optimizes college fund goals by combining traditional savings accounts with 529 plans to maximize tax advantages and liquidity for education expenses. This approach balances growth potential from tax-advantaged 529 investments with accessible funds through laddered savings, enhancing overall money management efficiency.

Out-of-State 529 Plan Hacking

Maximizing college fund growth involves leveraging out-of-state 529 plan options with lower fees, higher investment flexibility, and state tax benefits that outperform in-state plans. Strategic contributions to these optimized 529 accounts accelerate savings while minimizing costs and maximizing returns for future education expenses.

Legacy Beneficiary Rollovers

College fund goals prioritize saving for education expenses, while 529 plan optimization focuses on maximizing tax benefits and flexibility for legacy beneficiary rollovers. Efficient management of 529 plans enables seamless transfers of funds to new beneficiaries, preserving wealth and ensuring continued support for future generations' academic needs.

College Fund Goal vs 529 Plan Optimization Goal for money management Infographic

moneydiff.com

moneydiff.com