Setting a debt payoff goal helps create a clear plan for eliminating debt, while debt snowball and avalanche methods provide specific strategies to prioritize repayments. The debt snowball focuses on paying off the smallest balances first to build momentum, whereas the avalanche targets debts with the highest interest rates to save on interest costs. Choosing between these goals depends on whether motivation or financial efficiency is the priority in money management.

Table of Comparison

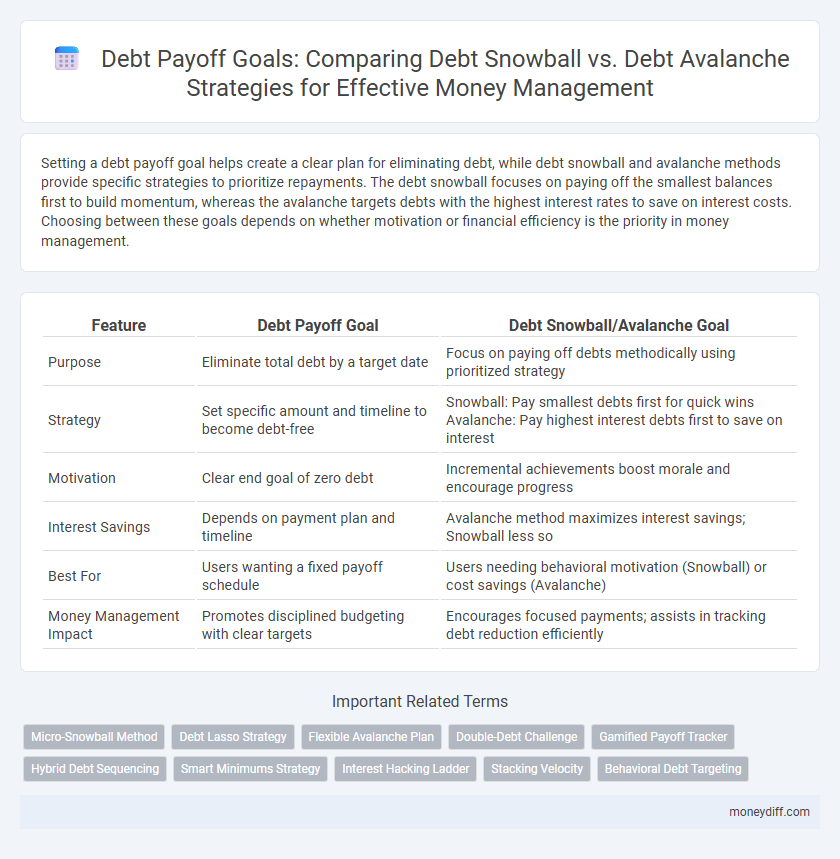

| Feature | Debt Payoff Goal | Debt Snowball/Avalanche Goal |

|---|---|---|

| Purpose | Eliminate total debt by a target date | Focus on paying off debts methodically using prioritized strategy |

| Strategy | Set specific amount and timeline to become debt-free |

Snowball: Pay smallest debts first for quick wins Avalanche: Pay highest interest debts first to save on interest |

| Motivation | Clear end goal of zero debt | Incremental achievements boost morale and encourage progress |

| Interest Savings | Depends on payment plan and timeline | Avalanche method maximizes interest savings; Snowball less so |

| Best For | Users wanting a fixed payoff schedule | Users needing behavioral motivation (Snowball) or cost savings (Avalanche) |

| Money Management Impact | Promotes disciplined budgeting with clear targets | Encourages focused payments; assists in tracking debt reduction efficiently |

Understanding Debt Payoff Goals

Debt payoff goals prioritize eliminating outstanding balances by setting clear targets for repayment, which directly improves credit scores and reduces interest expenses. The debt snowball method focuses on paying off the smallest debts first for psychological motivation, while the avalanche method targets debts with the highest interest rates to minimize total interest paid. Choosing between these strategies depends on whether the primary objective is motivation through quick wins or maximizing financial efficiency to save money over time.

Introducing Debt Snowball and Avalanche Methods

Debt payoff goals can be approached through the Debt Snowball and Debt Avalanche methods, which offer structured strategies for managing money effectively. The Debt Snowball method focuses on paying off the smallest debts first to build momentum, while the Debt Avalanche method targets debts with the highest interest rates to minimize overall cost. Both techniques provide tailored frameworks that help individuals reduce debt systematically and enhance financial discipline.

Key Differences Between Debt Payoff and Structured Methods

Debt payoff goals focus on eliminating total debt by a target date, prioritizing overall reduction rather than order. Debt snowball targets paying off smallest debts first to build momentum, while debt avalanche prioritizes debts with the highest interest rates to minimize total interest paid. Structured methods provide a systematic approach to debt reduction, emphasizing either behavioral motivation (snowball) or financial efficiency (avalanche).

How the Debt Snowball Method Works

The Debt Snowball Method prioritizes paying off debts from smallest to largest by balance, creating quick wins that boost motivation. Each time a debt is fully paid, the freed-up funds are redirected toward the next smallest debt, accelerating overall debt reduction. This strategy contrasts with the Debt Avalanche Method, which targets debts with the highest interest rates first for long-term savings.

How the Debt Avalanche Method Operates

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, minimizing total interest payments and accelerating debt elimination. Payments are consistently directed toward the highest-rate debt while maintaining minimum payments on all other debts, optimizing cash flow efficiency. This strategy results in faster overall debt payoff and reduces the total cost compared to the Debt Snowball method, which prioritizes smaller balances.

Pros and Cons of the Debt Snowball Approach

The debt snowball approach prioritizes paying off debts from smallest to largest, creating quick psychological wins that boost motivation and adherence to a repayment plan. This method enhances user engagement and lowers the risk of becoming overwhelmed, although it may result in paying more interest over time compared to the avalanche approach that targets highest-interest debts first. Ideal for individuals seeking behavioral momentum, the snowball strategy trades optimal financial efficiency for increased emotional satisfaction and sustained commitment to debt elimination.

Pros and Cons of the Debt Avalanche Approach

The Debt Avalanche approach prioritizes paying off debts with the highest interest rates first, reducing overall interest payments and saving money in the long run. This method requires discipline and may delay early motivational wins since smaller debts take longer to clear. It is ideal for individuals focused on minimizing total interest but may pose challenges for those needing quick psychological boosts from rapid debt elimination.

Choosing the Right Debt Repayment Strategy

Choosing the right debt repayment strategy depends on personal financial goals and psychological motivation, with debt snowball focusing on paying off the smallest balances first to build momentum, while debt avalanche targets high-interest debts to minimize overall interest paid. Research shows that using the debt snowball method increases the likelihood of sustained repayment success due to quick wins and increased motivation. Financial experts recommend evaluating interest rates, total debt amount, and individual behavior patterns to optimize debt payoff efficiency and long-term money management.

Impact of Debt Payoff Strategies on Financial Health

Debt payoff strategies such as the debt snowball and debt avalanche methods significantly influence financial health by targeting different aspects of debt reduction and interest savings. The debt snowball focuses on eliminating smaller balances first, which can boost motivation and create a sense of progress, whereas the debt avalanche prioritizes paying off debts with the highest interest rates, minimizing overall interest paid and accelerating debt elimination. Choosing the appropriate strategy impacts cash flow management, credit score improvement, and long-term financial stability.

Setting and Achieving Money Management Goals with Debt Repayment

Setting a debt payoff goal involves targeting the complete elimination of outstanding balances within a specific timeframe, promoting financial discipline and reducing interest costs. The debt snowball method focuses on paying off the smallest debts first to build motivation, while the debt avalanche strategy prioritizes debts with the highest interest rates to minimize total interest payments. Combining goal setting with these repayment strategies enhances money management by providing clear milestones and systematic progress toward financial freedom.

Related Important Terms

Micro-Snowball Method

The Micro-Snowball Method accelerates debt payoff by targeting the smallest debts first, creating quick wins that boost motivation and cash flow. This approach contrasts with traditional Debt Avalanche, which prioritizes high-interest debts, and balances emotional and financial benefits for more sustainable money management.

Debt Lasso Strategy

Debt Lasso Strategy accelerates debt payoff by focusing on high-interest balances first while maintaining consistent payments on all debts, combining the benefits of both debt snowball and avalanche methods for optimized money management. This approach minimizes total interest paid and enhances financial discipline, making it a superior alternative for achieving debt freedom efficiently.

Flexible Avalanche Plan

The Flexible Avalanche Plan prioritizes paying off debts with the highest interest rates first, optimizing interest savings while allowing adjustments based on changing financial situations, unlike the rigid traditional avalanche method. This approach enhances money management by combining the strategic benefits of the debt avalanche with tailored flexibility to maintain motivation and cash flow control.

Double-Debt Challenge

The Double-Debt Challenge accelerates debt repayment by targeting two debts simultaneously, combining the psychological motivation of the Debt Snowball method with the cost-saving focus of the Debt Avalanche strategy. This hybrid approach maximizes interest savings while maintaining momentum, making it an effective money management goal for faster financial freedom.

Gamified Payoff Tracker

Gamified Payoff Trackers enhance motivation by transforming debt payoff goals into engaging challenges, leveraging either the debt snowball method's focus on small wins or the avalanche method's emphasis on interest reduction. These interactive tools provide real-time progress visualization, rewards, and personalized strategies that optimize money management effectiveness.

Hybrid Debt Sequencing

Hybrid debt sequencing combines the strategic benefits of both debt snowball and avalanche methods by ordering debt payoff based on interest rates and remaining balances, optimizing overall savings on interest while maintaining psychological motivation through quick wins. This approach enhances money management by accelerating debt reduction, improving cash flow, and increasing financial discipline.

Smart Minimums Strategy

The Smart Minimums Strategy prioritizes paying the minimum amounts on all debts while allocating extra funds strategically to either the debt snowball or avalanche method, optimizing both psychological motivation and financial efficiency. This approach balances steady progress with cost-effective interest reduction, accelerating overall debt payoff while maintaining manageable cash flow.

Interest Hacking Ladder

The Interest Hacking Ladder strategy accelerates debt payoff by focusing on incrementally higher-interest debts, maximizing interest savings compared to traditional debt snowball or avalanche methods. This approach leverages precise interest rate targeting to reduce overall interest paid and shorten payoff timelines for efficient money management.

Stacking Velocity

Debt payoff goals targeting high-interest balances accelerate financial freedom more effectively through avalanche or snowball methods, enhancing stacking velocity by systematically reducing principal and interest faster. Prioritizing debt with highest interest (avalanche) or smallest balance first (snowball) optimizes cash flow velocity, enabling quicker accumulation of savings and investment capital.

Behavioral Debt Targeting

Behavioral Debt Targeting emphasizes prioritizing debt payoff goals by focusing on psychological motivation rather than strictly following Debt Snowball or Avalanche methods, improving adherence and long-term financial success. This approach strategically targets debts that encourage consistent payments and reduce financial stress, enhancing money management effectiveness.

Debt payoff goal vs Debt snowball/avalanche goal for money management. Infographic

moneydiff.com

moneydiff.com