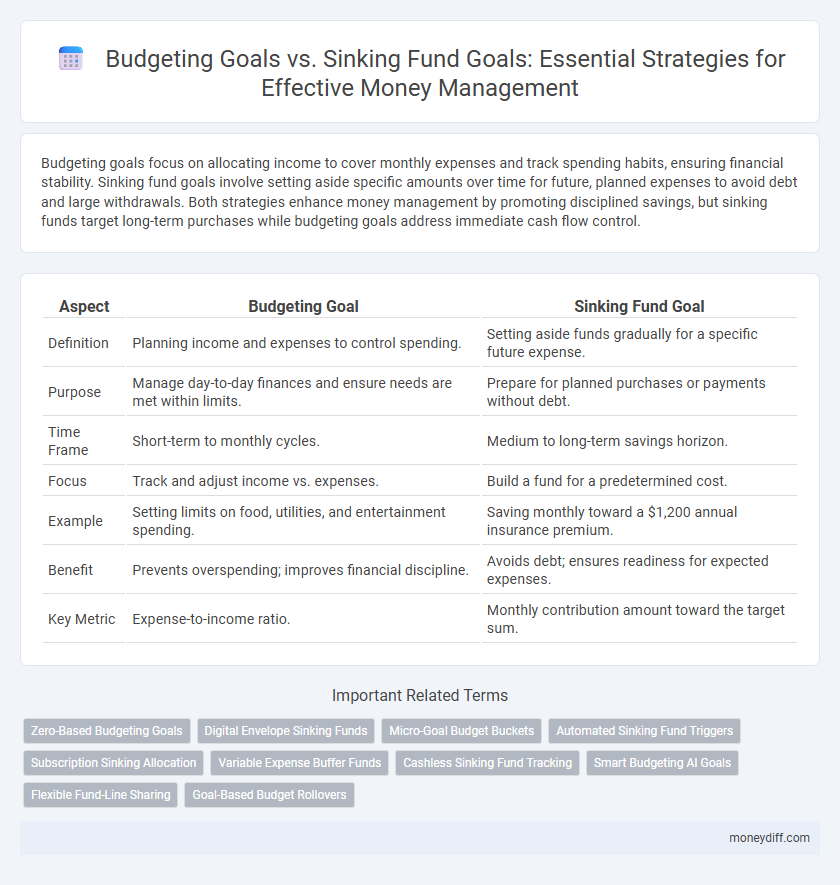

Budgeting goals focus on allocating income to cover monthly expenses and track spending habits, ensuring financial stability. Sinking fund goals involve setting aside specific amounts over time for future, planned expenses to avoid debt and large withdrawals. Both strategies enhance money management by promoting disciplined savings, but sinking funds target long-term purchases while budgeting goals address immediate cash flow control.

Table of Comparison

| Aspect | Budgeting Goal | Sinking Fund Goal |

|---|---|---|

| Definition | Planning income and expenses to control spending. | Setting aside funds gradually for a specific future expense. |

| Purpose | Manage day-to-day finances and ensure needs are met within limits. | Prepare for planned purchases or payments without debt. |

| Time Frame | Short-term to monthly cycles. | Medium to long-term savings horizon. |

| Focus | Track and adjust income vs. expenses. | Build a fund for a predetermined cost. |

| Example | Setting limits on food, utilities, and entertainment spending. | Saving monthly toward a $1,200 annual insurance premium. |

| Benefit | Prevents overspending; improves financial discipline. | Avoids debt; ensures readiness for expected expenses. |

| Key Metric | Expense-to-income ratio. | Monthly contribution amount toward the target sum. |

Understanding Budgeting Goals in Money Management

Budgeting goals focus on allocating monthly income to cover expenses and savings targets, ensuring short-term financial stability and avoiding overspending. Sinking fund goals involve setting aside specific amounts regularly to fund future large expenses, preventing debt accumulation by anticipating costs. Understanding budgeting goals helps prioritize daily financial decisions and maintain control over cash flow for effective money management.

What Are Sinking Fund Goals?

Sinking fund goals involve setting aside specific amounts of money over time to cover upcoming expenses without incurring debt, distinguishing them from traditional budgeting goals which allocate funds for monthly spending categories. These goals enable precise savings for planned purchases such as car repairs, vacations, or holiday gifts by spreading the cost across several months. Utilizing sinking funds improves financial discipline and reduces reliance on credit by creating dedicated pools of money earmarked for future needs.

Budgeting Goals vs Sinking Fund Goals: Key Differences

Budgeting goals focus on allocating income to cover regular expenses and achieve short-term financial targets, ensuring consistent money flow management. Sinking fund goals involve setting aside specific amounts over time to save for larger, anticipated expenses, preventing debt accumulation. The key difference lies in budgeting managing routine cash flow, while sinking funds prepare for future lump-sum payments.

How to Set Effective Budgeting Goals

Setting effective budgeting goals involves clearly defining specific financial targets, such as monthly spending limits and savings percentages, to create a realistic spending plan. Incorporating sinking fund goals helps allocate money systematically for future expenses like car repairs or vacations, preventing debt accumulation. Combining both approaches enhances money management by balancing immediate budget constraints with planned long-term savings.

Purpose of Sinking Funds in Personal Finance

Sinking funds serve as dedicated savings accounts designed to cover anticipated expenses, preventing financial strain during large, irregular payments. Unlike general budgeting goals that track overall income and expenses, sinking funds allocate specific amounts for future costs such as vacations, car repairs, or holiday gifts. This targeted approach enhances personal finance management by promoting disciplined saving and reducing reliance on credit.

Pros and Cons of Budgeting Goals

Budgeting goals provide a clear framework for managing monthly income and expenses, promoting disciplined spending habits and preventing overspending. These goals help prioritize essential costs but may lack flexibility, making it challenging to accommodate unexpected expenses without adjustments. While budgeting goals foster financial awareness, they can sometimes lead to frustration if rigidly adhered to during fluctuating income periods or irregular expenses.

Benefits of Sinking Fund Goals for Financial Planning

Sinking fund goals enhance financial planning by promoting disciplined saving for specific future expenses, reducing reliance on credit and avoiding debt accumulation. This method ensures that funds are available when needed, improving cash flow management and providing peace of mind. By allocating money incrementally, sinking funds allow for more accurate budgeting and long-term financial stability.

Choosing Between Budgeting Goals and Sinking Funds

Choosing between budgeting goals and sinking funds depends on your financial priorities and timeline. Budgeting goals allocate funds toward ongoing expenses and short-term objectives, providing flexibility for variable costs, while sinking funds are earmarked savings specifically set aside for anticipated future expenses, preventing debt accumulation. Effective money management requires balancing these approaches to ensure both immediate cash flow stability and long-term financial preparedness.

Practical Examples: Budgeting Goals vs Sinking Fund Goals

Budgeting goals allocate monthly income to cover regular expenses and savings, such as setting aside $300 for groceries or $200 for utilities to maintain financial stability. Sinking fund goals focus on saving specific amounts over time for future, irregular expenses like accumulating $1,200 for a new laptop purchase in six months or $600 for annual insurance premiums. Practical examples highlight that budgeting goals manage ongoing cash flow, while sinking funds prepare for planned, large expenditures without disrupting monthly budgets.

Best Practices for Achieving Money Management Goals

Budgeting goals focus on planning and controlling monthly expenses to maintain cash flow, while sinking fund goals involve setting aside specific amounts regularly for future large purchases or expenses. Best practices include setting clear, measurable targets, tracking progress consistently, and adjusting contributions based on financial changes to ensure timely achievement of both goals. Using automated savings tools and reviewing budget categories periodically enhances discipline and prevents overspending.

Related Important Terms

Zero-Based Budgeting Goals

Zero-based budgeting goals allocate every dollar of income to specific expenses or savings categories, ensuring no money is left unassigned and promoting disciplined financial control. Sinking fund goals complement this approach by setting aside targeted amounts regularly for future large expenses, preventing debt accumulation while maintaining a balanced budget.

Digital Envelope Sinking Funds

Digital envelope sinking funds enhance money management by allocating specific amounts into virtual envelopes for planned future expenses, ensuring disciplined savings and preventing overspending. Unlike traditional budgeting goals that track overall spending limits, sinking funds provide targeted savings for anticipated costs, improving financial control and goal achievement.

Micro-Goal Budget Buckets

Micro-Goal Budget Buckets allocate specific amounts of money toward short-term objectives, promoting disciplined spending and avoiding debt accumulation. Sinking fund goals differ by setting aside funds gradually for larger, planned expenses, enhancing financial preparedness without disrupting monthly budgets.

Automated Sinking Fund Triggers

Automated sinking fund triggers enhance money management by systematically allocating funds toward specific savings goals, ensuring consistent progress without manual intervention. Unlike general budgeting goals, these triggers prioritize targeted savings for future expenses, optimizing financial discipline and reducing the risk of overspending.

Subscription Sinking Allocation

Subscription sinking allocation enhances money management by systematically setting aside funds to cover recurring subscription costs, preventing budget shortfalls. Unlike budgeting goals that allocate monthly expenses, sinking fund goals accumulate savings in advance, ensuring smooth payment cycles without impacting other financial priorities.

Variable Expense Buffer Funds

Budgeting goals allocate fixed amounts for monthly expenses, while sinking fund goals build variable expense buffer funds gradually to cover irregular or unexpected costs without financial strain. Prioritizing sinking funds enhances cash flow management by preventing debt accumulation during variable spending periods.

Cashless Sinking Fund Tracking

Cashless sinking fund tracking streamlines money management by digitally allocating funds for specific expenses, contrasting with traditional budgeting goals that often lump all expenses into broad categories. This approach enhances financial discipline by ensuring targeted savings without relying on physical cash, improving transparency and accuracy in expense planning.

Smart Budgeting AI Goals

Smart Budgeting AI Goals prioritize a dynamic approach by integrating budgeting goals with sinking fund strategies, enabling precise allocation of funds for both immediate expenses and future savings targets. Utilizing AI-driven insights, users can optimize cash flow management, reduce financial stress, and achieve long-term financial objectives with tailored, data-driven budget adjustments.

Flexible Fund-Line Sharing

Budgeting goals allocate fixed amounts to specific categories for planned expenses, while sinking fund goals focus on accumulating funds over time for future large purchases, enabling flexible fund-line sharing to adjust allocations as priorities change. This strategy enhances cash flow management by allowing surplus funds in one sinking fund to cover shortfalls in another, optimizing overall financial flexibility.

Goal-Based Budget Rollovers

A Goal-Based Budget Rollovers strategy allows unused funds from a budgeting goal to automatically transfer into a sinking fund goal, maximizing flexibility and long-term savings efficiency. This method enhances money management by ensuring continuous funding toward specific objectives while preventing cash flow stagnation.

Budgeting goal vs Sinking fund goal for money management. Infographic

moneydiff.com

moneydiff.com