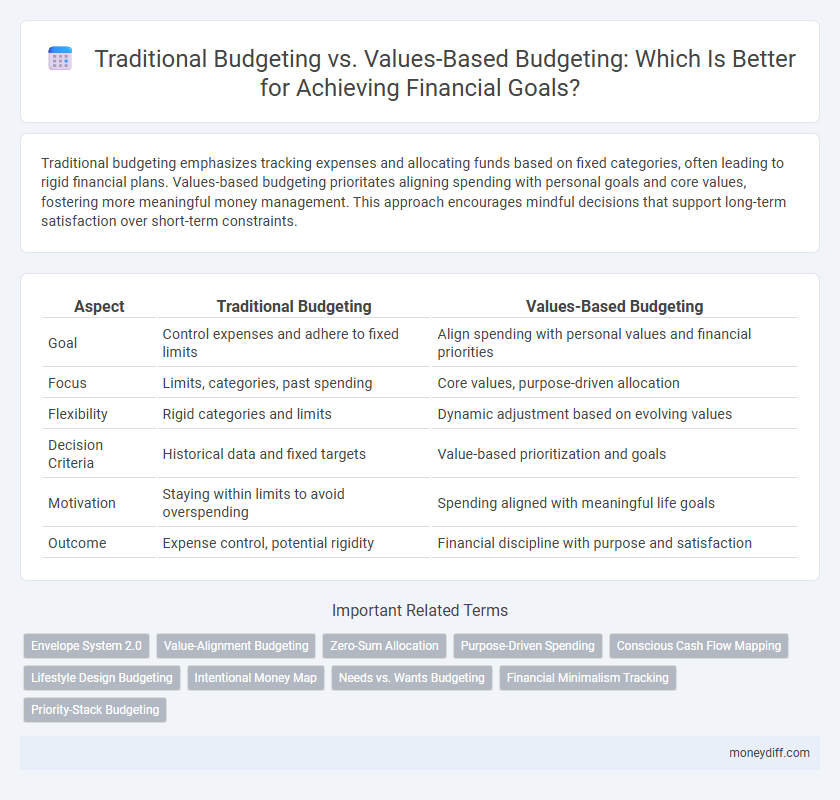

Traditional budgeting emphasizes tracking expenses and allocating funds based on fixed categories, often leading to rigid financial plans. Values-based budgeting prioritates aligning spending with personal goals and core values, fostering more meaningful money management. This approach encourages mindful decisions that support long-term satisfaction over short-term constraints.

Table of Comparison

| Aspect | Traditional Budgeting | Values-Based Budgeting |

|---|---|---|

| Goal | Control expenses and adhere to fixed limits | Align spending with personal values and financial priorities |

| Focus | Limits, categories, past spending | Core values, purpose-driven allocation |

| Flexibility | Rigid categories and limits | Dynamic adjustment based on evolving values |

| Decision Criteria | Historical data and fixed targets | Value-based prioritization and goals |

| Motivation | Staying within limits to avoid overspending | Spending aligned with meaningful life goals |

| Outcome | Expense control, potential rigidity | Financial discipline with purpose and satisfaction |

Understanding Traditional Budgeting Methods

Traditional budgeting methods focus on allocating fixed amounts to specific expense categories based on historical spending patterns and projected income. This approach emphasizes strict expense control and adherence to preset limits to avoid overspending. Understanding these methods highlights their structured, predictable nature but often reveals a lack of flexibility in addressing personal values or changing financial priorities.

What Is Values-Based Budgeting?

Values-based budgeting aligns financial decisions with personal priorities and core beliefs, ensuring that spending reflects what matters most to an individual or family. Unlike traditional budgeting, which often focuses on categories and limits, this approach prioritizes meaningful goals and long-term satisfaction. Implementing values-based budgeting fosters intentional money management by emphasizing purpose-driven expenditures rather than rigid budget constraints.

Key Differences Between Traditional and Values-Based Budgeting

Traditional budgeting centers on allocating funds based on past expenses and fixed categories, emphasizing strict adherence to financial limits. Values-based budgeting prioritizes aligning spending with personal or organizational core values and long-term goals, fostering intentional financial decisions. This approach enhances motivation and satisfaction by ensuring money management supports meaningful priorities rather than solely controlling costs.

Setting Financial Goals: Needs vs. Values

Setting financial goals with traditional budgeting emphasizes allocating funds based on fixed categories such as bills, savings, and discretionary spending, often prioritizing immediate needs over personal values. Values-based budgeting aligns money management with individual core beliefs, directing resources toward what truly matters, such as experiences, personal growth, or charitable giving. This approach fosters greater financial satisfaction by integrating emotional priorities alongside practical needs in goal setting.

Advantages of Traditional Budgeting

Traditional budgeting offers a clear framework for tracking income and expenses, promoting disciplined financial habits and ensuring consistent savings. It provides a structured approach with predefined categories, simplifying expense management and facilitating easier comparisons over time. This method supports predictable cash flow management and helps organizations or individuals set measurable financial targets.

Benefits of Values-Based Budgeting

Values-based budgeting enhances financial decision-making by aligning spending with personal priorities and long-term goals, promoting intentional money management. It improves motivation and commitment to saving by reflecting core values rather than arbitrary limits found in traditional budgeting. This approach fosters greater financial satisfaction and flexibility, encouraging mindful consumption and reducing stress associated with rigid category constraints.

Common Challenges in Both Budgeting Approaches

Traditional budgeting and values-based budgeting both face common challenges such as inaccurate forecasting, difficulty adapting to unexpected expenses, and maintaining consistent discipline over time. Both approaches often struggle with aligning long-term financial goals with day-to-day spending habits, leading to potential overspending or underutilization of resources. Additionally, failure to regularly review and adjust budgets can result in decreased financial control and missed opportunities for growth or savings.

How to Transition from Traditional to Values-Based Budgeting

Transitioning from traditional budgeting to values-based budgeting involves identifying core personal or organizational values that guide spending priorities rather than merely tracking expenses and income. Begin by mapping financial goals to these values, ensuring each budget category aligns with what truly matters, which fosters intentional decision-making and greater financial satisfaction. Regularly review and adjust the budget based on evolving values and goals to maintain alignment and optimize resource allocation.

Choosing the Right Budgeting Method for Your Financial Goals

Traditional budgeting centers on fixed expense categories and historical spending patterns, ensuring stability and predictability in managing finances. Values-Based Budgeting aligns spending priorities with personal values and long-term goals, fostering intentional financial decisions and increased motivation. Selecting between these methods depends on whether you prioritize structured control or personalized goal alignment for effective money management.

Practical Tips for Successful Money Management

Prioritize values-based budgeting by aligning expenses with core personal priorities to enhance financial discipline and satisfaction. Track spending meticulously using digital tools to ensure adherence to budget limits and identify unnecessary costs quickly. Regularly review and adjust the budget based on actual income and changing financial goals to maintain relevance and effectiveness.

Related Important Terms

Envelope System 2.0

The Envelope System 2.0 enhances traditional budgeting by allocating funds into digital envelopes aligned with personal values, allowing precise control over spending categories and promoting mindful financial decisions. This values-based budgeting method increases accountability and adapts to real-time expenses, prioritizing priorities while preventing overspending.

Value-Alignment Budgeting

Value-alignment budgeting prioritizes funding decisions that directly reflect personal or organizational priorities, ensuring resources support core values and long-term goals rather than arbitrary allocations typical of traditional budgeting. This approach enhances financial discipline by integrating ethical considerations and stakeholder interests, driving more meaningful and impactful money management outcomes.

Zero-Sum Allocation

Zero-Sum Allocation in traditional budgeting limits financial flexibility by strictly assigning every dollar to specific expenses, ensuring total income equals total expenses without surplus or deficit. Values-Based Budgeting, however, directs funds according to personal priorities, promoting intentional spending that aligns with core values while maintaining balance through zero-sum principles.

Purpose-Driven Spending

Traditional budgeting allocates funds based on historical expenses and fixed categories, often leading to rigid financial plans with limited flexibility. Values-based budgeting prioritizes purpose-driven spending by aligning financial decisions with personal values and long-term goals, enhancing intentional money management and meaningful resource allocation.

Conscious Cash Flow Mapping

Conscious Cash Flow Mapping integrates values-based budgeting by aligning expenditures with core personal priorities, enhancing intentional money management. Traditional budgeting often centers on rigid expense tracking, whereas conscious mapping promotes fluid financial decisions rooted in meaningful goals.

Lifestyle Design Budgeting

Values-Based Budgeting prioritizes aligning expenses with personal lifestyle goals and core values, fostering intentional spending that supports long-term happiness and financial freedom. Traditional Budgeting often emphasizes expense tracking and category limits without directly connecting expenditures to meaningful life outcomes or purpose-driven goals.

Intentional Money Map

Values-Based Budgeting centers on creating an Intentional Money Map that aligns spending with personal goals and core beliefs, enhancing financial clarity and purpose. Traditional Budgeting follows fixed categories and limits, often neglecting the motivational drive behind financial decisions.

Needs vs. Wants Budgeting

Traditional budgeting prioritizes fixed allocations based on past expenses, often blurring the lines between essential needs and discretionary wants, while values-based budgeting emphasizes aligning spending with personal priorities by clearly distinguishing needs from wants. This approach enhances financial decision-making by ensuring resources are directed toward fulfilling core values and essential goals before non-essential expenditures.

Financial Minimalism Tracking

Traditional budgeting often emphasizes strict category limits and expense tracking, which can lead to complexity and rigidity in money management, whereas values-based budgeting aligns spending with personal priorities, fostering intentional financial minimalism tracking by focusing only on expenses that truly reflect core values. This approach simplifies financial oversight and enhances goal clarity by prioritizing meaningful expenditures over exhaustive line-item control.

Priority-Stack Budgeting

Priority-stack budgeting emphasizes allocating funds according to a hierarchy of values and long-term goals, enhancing financial discipline and alignment with personal or organizational priorities. This method contrasts with traditional budgeting by focusing on funding the most important objectives first, ensuring resources are dedicated to high-impact areas before addressing secondary expenses.

Traditional Budgeting vs Values-Based Budgeting for money management. Infographic

moneydiff.com

moneydiff.com