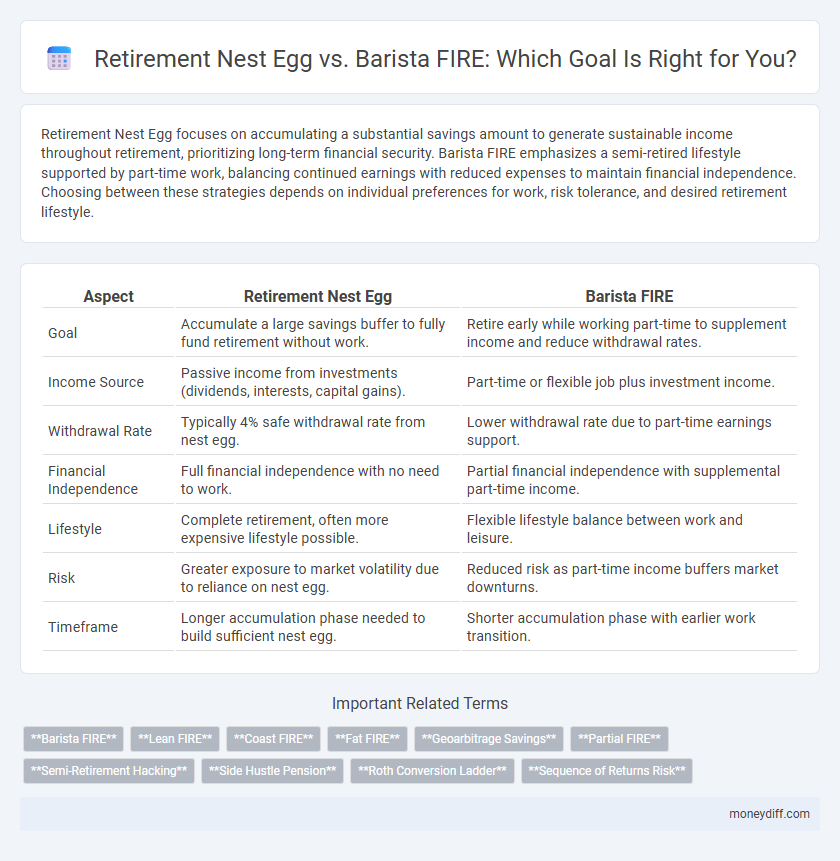

Retirement Nest Egg focuses on accumulating a substantial savings amount to generate sustainable income throughout retirement, prioritizing long-term financial security. Barista FIRE emphasizes a semi-retired lifestyle supported by part-time work, balancing continued earnings with reduced expenses to maintain financial independence. Choosing between these strategies depends on individual preferences for work, risk tolerance, and desired retirement lifestyle.

Table of Comparison

| Aspect | Retirement Nest Egg | Barista FIRE |

|---|---|---|

| Goal | Accumulate a large savings buffer to fully fund retirement without work. | Retire early while working part-time to supplement income and reduce withdrawal rates. |

| Income Source | Passive income from investments (dividends, interests, capital gains). | Part-time or flexible job plus investment income. |

| Withdrawal Rate | Typically 4% safe withdrawal rate from nest egg. | Lower withdrawal rate due to part-time earnings support. |

| Financial Independence | Full financial independence with no need to work. | Partial financial independence with supplemental part-time income. |

| Lifestyle | Complete retirement, often more expensive lifestyle possible. | Flexible lifestyle balance between work and leisure. |

| Risk | Greater exposure to market volatility due to reliance on nest egg. | Reduced risk as part-time income buffers market downturns. |

| Timeframe | Longer accumulation phase needed to build sufficient nest egg. | Shorter accumulation phase with earlier work transition. |

Defining Your Money Management Goal: Retirement Nest Egg vs Barista FIRE

Defining your money management goal requires understanding the differences between building a Retirement Nest Egg and pursuing Barista FIRE. A Retirement Nest Egg focuses on accumulating sufficient wealth to fully retire without work, emphasizing long-term savings and investment growth. Barista FIRE combines partial retirement with part-time work, requiring a smaller savings target and flexible income strategies to maintain financial independence.

Core Principles: Traditional Retirement vs Barista FIRE

Traditional retirement centers on accumulating a substantial nest egg through consistent long-term savings and investments to fund full financial independence. Barista FIRE emphasizes partial financial independence by combining a smaller retirement fund with part-time work, reducing savings needs and providing more flexible lifestyle options. Core principles contrast the all-in savings approach of traditional retirement with the hybrid income and savings strategy of Barista FIRE.

Savings Targets: How Much Do You Need for Each Path?

Retirement Nest Egg typically requires accumulating 25 times your annual living expenses, often amounting to $1 million or more, to generate sustainable passive income through investments. Barista FIRE demands a smaller savings target, around 10 to 15 times annual expenses, since it relies on part-time work income to cover basic costs, reducing withdrawal rates from savings. Understanding these distinct savings targets helps optimize financial strategies for achieving long-term security or flexible, gradual retirement.

Income Strategies: Passive Investments vs Part-Time Work

Retirement Nest Egg income strategies emphasize passive investments such as dividend stocks, bonds, and rental properties to generate steady cash flow without ongoing labor. Barista FIRE combines moderate savings with part-time work or freelance gigs, allowing individuals to supplement their income while maintaining lower withdrawal rates. Passive income in nest egg approaches offers financial security but requires substantial upfront capital, whereas Barista FIRE balances reduced savings goals with active income streams for flexibility.

Lifestyle Expectations: Security vs Flexibility

Retirement nest eggs provide financial security through a lump sum designed to support a stable lifestyle without ongoing employment, emphasizing long-term safety and predictability. Barista FIRE combines part-time work with financial independence, offering flexibility to maintain income while enjoying early retirement benefits. This approach prioritizes lifestyle adaptability over full financial self-sufficiency, balancing security with personal fulfillment.

Risk Assessment: Market Volatility and Career Longevity

Retirement nest egg strategies demand a larger financial cushion to withstand prolonged market volatility and unexpected economic downturns, emphasizing the importance of long-term investment growth and risk management. Barista FIRE combines partial retirement income with continued employment, reducing reliance on market returns and mitigating risks associated with career longevity fluctuations. Evaluating risk tolerance involves balancing market exposure against job stability to ensure sustainable income streams throughout retirement.

Withdrawal Plans: Safe Withdrawal Rate vs Supplemental Earnings

Retirement Nest Egg strategies rely on a Safe Withdrawal Rate, typically around 4%, to sustainably draw income from accumulated savings over decades. Barista FIRE combines a smaller retirement fund with supplemental earnings from part-time or flexible work, reducing withdrawal pressures on savings. This hybrid approach offers greater financial flexibility and lowers sequence of returns risk by supplementing passive income with active earnings.

Tax Implications: Planning for Each Retirement Vision

Retirement Nest Egg strategies often involve withdrawing from tax-advantaged accounts like 401(k)s and IRAs, where distributions are taxed as ordinary income, impacting the overall tax liability. Barista FIRE combines partial retirement with part-time work, allowing continued contributions to tax-advantaged accounts and potentially maintaining lower tax brackets through earned income. Strategic tax planning for each approach ensures optimized withdrawals, reduced penalties, and maximized after-tax income throughout retirement.

Key Challenges: Common Pitfalls and How to Avoid Them

Retirement Nest Egg strategies often face the key challenge of underestimating inflation and healthcare costs, which can erode savings over time; regular portfolio reassessment and realistic expense forecasting help avoid these pitfalls. Barista FIRE presents the challenge of balancing part-time income with lifestyle expectations, risking either burnout or insufficient savings growth; setting clear work boundaries and maintaining flexible budgets are essential strategies. Both approaches require disciplined financial tracking and contingency planning to navigate market volatility and unexpected expenses effectively.

Decision Factors: Choosing the Best Path for Your Unique Goals

Choosing between a Retirement Nest Egg and Barista FIRE depends on individual priorities such as risk tolerance, income needs, and desired lifestyle flexibility. A Retirement Nest Egg emphasizes accumulating a sizable investment portfolio for full financial independence, while Barista FIRE combines partial early retirement with part-time work to maintain steady cash flow and healthcare benefits. Assessing factors like savings rate, healthcare costs, and long-term financial security helps determine the optimal path tailored to personal goals.

Related Important Terms

Barista FIRE

Barista FIRE allows individuals to gradually transition into retirement by working part-time jobs, providing a steady income stream that reduces reliance on a large retirement nest egg. This approach offers financial flexibility and lowers the required savings target, making early retirement more attainable and less risky compared to traditional retirement planning.

Lean FIRE

Lean FIRE emphasizes achieving financial independence with a minimalistic lifestyle by accumulating a smaller retirement nest egg focused on essential expenses only. Compared to traditional retirement nest eggs or Barista FIRE, Lean FIRE requires less capital, allowing individuals to retire earlier while maintaining frugality and low-cost living standards.

Coast FIRE

Coast FIRE allows individuals to stop contributing actively to their retirement savings once they've accumulated enough to grow to their desired nest egg by retirement, contrasting with Barista FIRE where ongoing part-time work supplements income and savings. Prioritizing Coast FIRE leverages early investment growth, reducing financial pressure during mid-career while maintaining long-term retirement security without full-time employment.

Fat FIRE

Fat FIRE focuses on achieving a substantial retirement nest egg that supports a luxurious lifestyle without the need for strict budgeting, contrasting with Barista FIRE which involves supplementing a smaller nest egg through part-time or freelance work. Building a fat FIRE requires aggressive saving and investing strategies to accumulate significantly higher assets, enabling early retirement with financial freedom and comfort.

Geoarbitrage Savings

Geoarbitrage savings significantly enhance the effectiveness of both Retirement Nest Egg and Barista FIRE goals by allowing individuals to leverage lower living costs in different locations, increasing the sustainability of their funds. While Retirement Nest Egg relies on a larger, traditional corpus for long-term security, Barista FIRE uses geoarbitrage to maintain part-time income and reduce withdrawal rates, optimizing overall financial independence.

Partial FIRE

Partial FIRE, also known as Barista FIRE, emphasizes achieving financial independence with a smaller retirement nest egg by supplementing income through part-time work or freelance gigs. This approach allows individuals to reduce savings targets while maintaining lifestyle flexibility compared to traditional full retirement savings goals.

Semi-Retirement Hacking

Semi-retirement hacking involves balancing a sizable retirement nest egg with part-time work typical of Barista FIRE, allowing for financial flexibility and reduced withdrawal rates. Optimizing this approach enhances long-term wealth preservation while maintaining income through low-stress, passion-driven employment.

Side Hustle Pension

A Side Hustle Pension bridges the gap between Retirement Nest Egg and Barista FIRE by generating consistent income streams that reduce reliance on traditional savings. This approach enhances financial flexibility and longevity, allowing individuals to sustain lifestyle choices while minimizing full retirement withdrawals.

Roth Conversion Ladder

Roth Conversion Ladder is a strategic tax optimization method enabling gradual conversion of traditional retirement funds into a Roth IRA to minimize tax impact while accessing funds early without penalties. This approach supports Retirement Nest Egg growth and Barista FIRE flexibility by balancing taxable income, creating a tax-free income stream during early retirement years.

Sequence of Returns Risk

Sequence of Returns Risk critically impacts both Retirement Nest Egg and Barista FIRE strategies, with early negative market returns drastically reducing long-term portfolio sustainability in traditional Retirement Nest Egg plans. Barista FIRE mitigates this risk by combining part-time income with a smaller investment portfolio, providing cash flow flexibility and less dependence on market withdrawals during adverse downturns.

Retirement Nest Egg vs Barista FIRE for goal. Infographic

moneydiff.com

moneydiff.com