Choosing between a retirement fund and Coast FIRE depends on your long-term financial goals and risk tolerance. A retirement fund offers structured contributions with potential employer matches and tax advantages, ensuring steady growth over time. Coast FIRE emphasizes early aggressive saving to cover future expenses, allowing greater financial freedom and reduced work years once the target amount is reached.

Table of Comparison

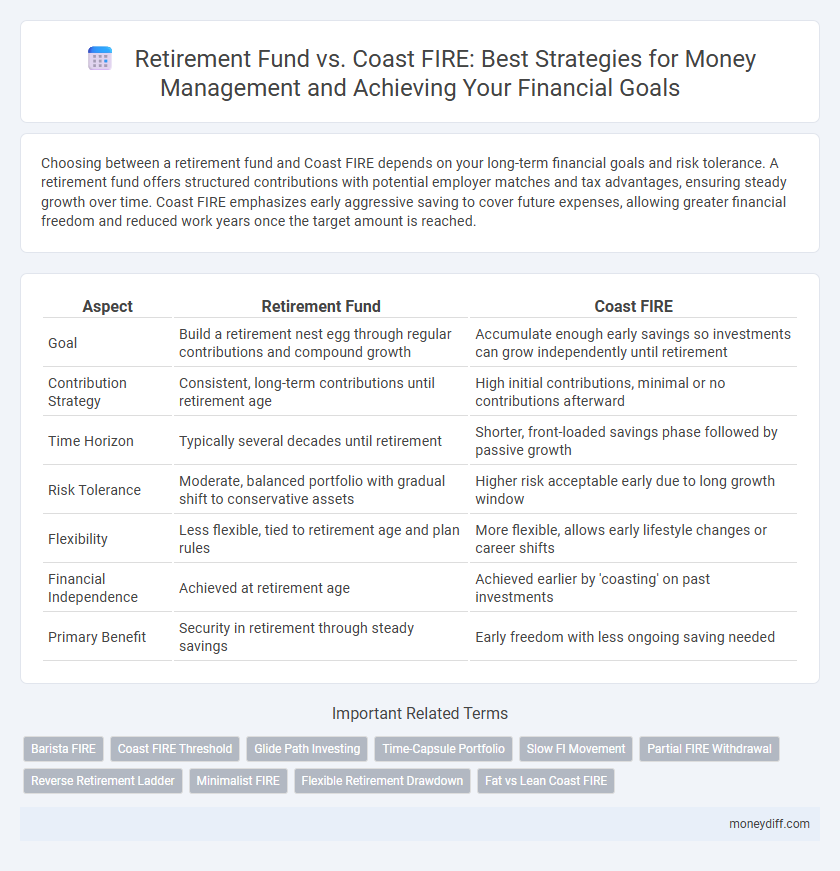

| Aspect | Retirement Fund | Coast FIRE |

|---|---|---|

| Goal | Build a retirement nest egg through regular contributions and compound growth | Accumulate enough early savings so investments can grow independently until retirement |

| Contribution Strategy | Consistent, long-term contributions until retirement age | High initial contributions, minimal or no contributions afterward |

| Time Horizon | Typically several decades until retirement | Shorter, front-loaded savings phase followed by passive growth |

| Risk Tolerance | Moderate, balanced portfolio with gradual shift to conservative assets | Higher risk acceptable early due to long growth window |

| Flexibility | Less flexible, tied to retirement age and plan rules | More flexible, allows early lifestyle changes or career shifts |

| Financial Independence | Achieved at retirement age | Achieved earlier by 'coasting' on past investments |

| Primary Benefit | Security in retirement through steady savings | Early freedom with less ongoing saving needed |

Understanding Retirement Funds: A Traditional Approach

Retirement funds are investment portfolios typically managed through employer-sponsored plans like 401(k)s or IRAs, designed to provide steady income after retirement. These funds benefit from tax-advantaged growth, employer matching contributions, and diversified asset allocations to mitigate risk over a long-term horizon. Understanding the disciplined contribution schedule and compound interest effects within retirement funds highlights their reliability as a traditional approach to financial security in later life.

What Is Coast FIRE? An Emerging Money Management Strategy

Coast FIRE is a money management strategy where individuals save aggressively early in their careers to build a retirement fund sufficient to grow on its own without further contributions. This approach contrasts with traditional retirement funds requiring continuous saving until withdrawal, allowing greater financial flexibility and reduced work pressure later. By achieving a "coast" balance, savers can focus on lifestyle goals or alternative income streams while their investments compound passively over time.

Key Differences: Retirement Fund vs. Coast FIRE

Retirement Fund requires consistent contributions until retirement age, aiming to accumulate sufficient savings to cover expenses without working. Coast FIRE involves building a retirement fund early that grows passively over time, allowing individuals to stop or reduce contributions while still reaching retirement goals. Key differences include contribution timelines, reliance on investment growth, and flexibility in work and saving habits.

Building Wealth: Investing for Traditional Retirement vs. Coast FIRE

Building wealth for traditional retirement centers on consistently contributing to retirement accounts like 401(k)s and IRAs, leveraging compound interest over decades for a secure nest egg. Coast FIRE emphasizes early aggressive investing to grow savings to a point where future contributions are unnecessary, allowing one to "coast" to retirement without additional inputs. Both strategies prioritize long-term market growth, but Coast FIRE requires higher initial saving rates and disciplined portfolio management to maximize compound returns efficiently.

Risk Tolerance: Which Strategy Suits Your Personality?

Retirement Fund investing typically suits individuals with a lower risk tolerance due to its steady, long-term growth focus, offering more stability through diversified assets and employer contributions. Coast FIRE appeals to moderate-risk individuals comfortable with early aggressive investments, as it relies on reaching a point where invested funds grow independently without additional contributions. Assessing risk tolerance is essential to align your money management approach with personal comfort levels and financial goals, ensuring sustainable progress towards financial independence.

Time Horizons: Retirement Planning vs. Coast FIRE Timeline

Retirement Fund strategies typically involve consistent contributions over decades to build a substantial nest egg, aligning with longer time horizons of 20 to 40 years or more. Coast FIRE requires accumulating enough savings early on so that investments can grow passively to meet retirement goals without additional contributions, emphasizing a shorter initial savings phase followed by a hands-off approach. Effective money management for Retirement Fund prioritizes steady growth and compound interest over time, while Coast FIRE focuses on front-loading investments to maximize growth during the early working years.

Flexibility and Lifestyle: Comparing the Two Paths

Retirement Fund strategies emphasize consistent contributions and long-term growth, providing stable financial security tailored for a traditional retirement age. Coast FIRE allows individuals to stop saving aggressively early on, relying on investment growth to fund later years, offering greater flexibility and the possibility to pursue varied lifestyle choices sooner. Choosing between these paths depends on personal goals, risk tolerance, and desired work-life balance during different life stages.

Financial Independence: How Each Method Gets You There

Retirement Fund strategies focus on consistent contributions and compound interest to build a reliable income stream for traditional retirement age, ensuring financial independence through long-term growth. Coast FIRE emphasizes accumulating enough savings early so investments grow passively to fund retirement, allowing for reduced work years or increased lifestyle flexibility. Both methods aim for financial independence but differ in timelines and saving intensity, with Retirement Fund requiring steady dedication and Coast FIRE focusing on early capital accumulation.

Pros and Cons: Retirement Fund vs. Coast FIRE

Retirement funds offer structured growth with tax advantages and employer contributions but may limit access to funds before retirement age. Coast FIRE allows individuals to stop saving aggressively early by ensuring investments grow to cover retirement expenses, providing flexibility but requiring higher initial savings. Both strategies have trade-offs in liquidity, risk tolerance, and time horizon, making them suitable for different financial goals and lifestyles.

Choosing Your Path: Factors to Consider for Effective Money Management

Choosing between a traditional retirement fund and Coast FIRE hinges on your risk tolerance, time horizon, and desired lifestyle. A retirement fund emphasizes consistent contributions and compounding growth for stable long-term security, whereas Coast FIRE focuses on early accumulation and minimal future saving, allowing financial independence sooner. Assess factors like expected retirement age, investment risk, and cash flow needs to determine the optimal strategy for effective money management.

Related Important Terms

Barista FIRE

Barista FIRE offers a flexible approach between traditional Retirement Fund and Coast FIRE by allowing individuals to maintain a part-time income while covering living expenses and building savings, reducing reliance on full retirement assets. This strategy leverages steady part-time work, often in service sectors, enabling gradual wealth accumulation and financial independence without fully exiting the workforce.

Coast FIRE Threshold

The Coast FIRE threshold represents the minimum retirement fund balance needed to allow investments to grow independently until traditional retirement age without additional contributions. Reaching this benchmark enables individuals to cover living expenses through current income while their existing savings compound, differentiating it from actively growing a retirement fund through continuous deposits.

Glide Path Investing

Glide Path Investing strategically adjusts asset allocation to balance risk and growth, making it essential for Retirement Fund management and Coast FIRE planning. By gradually shifting from equities to bonds, this approach ensures sustainable wealth accumulation while minimizing volatility as financial independence or retirement approaches.

Time-Capsule Portfolio

The Time-Capsule Portfolio offers a strategic approach to managing retirement funds by focusing on long-term growth with diversified, low-maintenance investments aligned with Coast FIRE principles. This method allows investors to accumulate sufficient assets early and let their portfolio grow passively over time, minimizing active contributions while ensuring financial independence by traditional retirement age.

Slow FI Movement

Slow FI prioritizes steady, long-term wealth accumulation by balancing retirement fund contributions with conscious spending, contrasting with Coast FIRE which emphasizes early investment growth allowing work-free financial independence later; integrating Slow FI strategies can enhance sustainable money management by reducing financial stress and promoting gradual asset build-up without aggressive saving targets.

Partial FIRE Withdrawal

Partial FIRE withdrawal strategies balance maintaining a retirement fund's longevity with accessing funds early by selectively drawing from investment accounts while preserving tax-advantaged savings. This approach optimizes liquidity and growth potential, enabling a sustainable income stream without fully depleting the retirement fund.

Reverse Retirement Ladder

Reverse Retirement Ladder strategies prioritize maintaining investment growth while gradually increasing withdrawals, allowing flexibility in transitioning between Coast FIRE and traditional Retirement Fund goals. This approach optimizes tax efficiency and liquidity, facilitating sustained financial independence without depleting principal prematurely.

Minimalist FIRE

Minimalist FIRE prioritizes low expenses and financial independence with a streamlined lifestyle, making Coast FIRE a practical strategy by allowing investments to grow passively while maintaining minimal savings contributions. Compared to the traditional Retirement Fund approach, Coast FIRE minimizes active money management and maximizes long-term compound growth, aligning closely with minimalist values of simplicity and financial freedom.

Flexible Retirement Drawdown

Retirement Fund emphasizes consistent contributions and growth to provide dependable income, whereas Coast FIRE allows early investment with minimal future input, focusing on letting savings grow passively. Flexible Retirement Drawdown strategies optimize financial independence by adjusting withdrawals based on market conditions and personal needs, enhancing longevity and lifestyle during retirement.

Fat vs Lean Coast FIRE

Fat Coast FIRE requires a larger retirement fund that supports a higher annual spending rate, offering greater financial flexibility and lifestyle choices, while Lean Coast FIRE necessitates a smaller nest egg by maintaining minimal expenses and a modest standard of living. Choosing between Fat and Lean Coast FIRE depends on balancing desired retirement comfort against current saving capacity and long-term investment returns.

Retirement Fund vs Coast FIRE for money management. Infographic

moneydiff.com

moneydiff.com