Setting a Net Worth Target provides a clear financial milestone that measures accumulated assets and overall wealth growth. Passive Income Target focuses on generating consistent cash flow without active work, ensuring financial stability and freedom. Balancing both goals in money management helps create a comprehensive strategy that builds wealth while securing ongoing income streams.

Table of Comparison

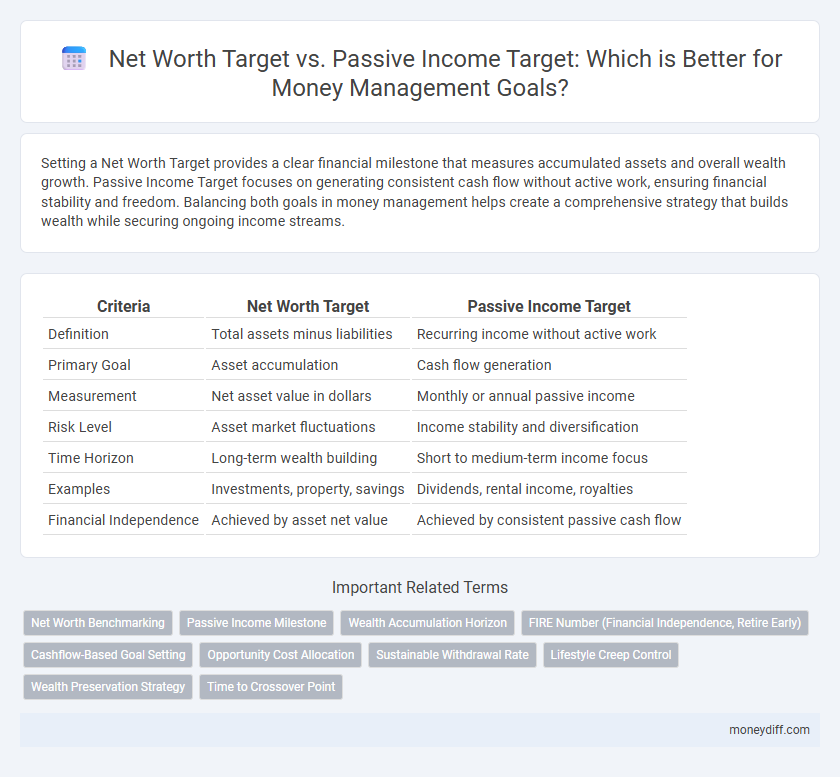

| Criteria | Net Worth Target | Passive Income Target |

|---|---|---|

| Definition | Total assets minus liabilities | Recurring income without active work |

| Primary Goal | Asset accumulation | Cash flow generation |

| Measurement | Net asset value in dollars | Monthly or annual passive income |

| Risk Level | Asset market fluctuations | Income stability and diversification |

| Time Horizon | Long-term wealth building | Short to medium-term income focus |

| Examples | Investments, property, savings | Dividends, rental income, royalties |

| Financial Independence | Achieved by asset net value | Achieved by consistent passive cash flow |

Understanding Net Worth Target in Money Management

Understanding a net worth target is crucial in money management as it represents the total value of assets minus liabilities, providing a clear financial health snapshot. Setting a net worth target helps prioritize long-term wealth accumulation and guides investment strategies, distinguishing it from passive income targets focused on cash flow. Tracking progress toward this target ensures balanced growth between asset acquisition and debt reduction, optimizing overall financial stability.

Defining Passive Income Target for Financial Freedom

Defining a passive income target for financial freedom involves calculating the consistent monthly revenue required to cover all essential expenses without active work. This target should be based on realistic projections of income streams such as dividends, rental income, and royalties, ensuring alignment with desired lifestyle and inflation adjustments. Establishing this passive income goal provides a clear benchmark for wealth-building strategies, distinct from net worth targets focused on asset accumulation.

Key Differences: Net Worth vs Passive Income Goals

Net worth targets measure the total value of assets minus liabilities, reflecting overall financial stability and long-term wealth accumulation. Passive income targets focus on generating consistent cash flow from investments or businesses without active involvement, emphasizing income sustainability and financial independence. Understanding these key differences helps prioritize money management strategies tailored to asset growth or income generation goals.

Pros and Cons of Focusing on Net Worth Target

Focusing on a net worth target allows individuals to track overall financial growth, encompassing assets and liabilities for a comprehensive wealth assessment. This approach provides a clear milestone for long-term security but may overlook cash flow dynamics essential for daily expenses and lifestyle sustainability. Concentrating solely on net worth can lead to undervaluing passive income streams that provide financial independence and liquidity.

Benefits and Challenges of Setting Passive Income Targets

Setting passive income targets provides financial stability by creating consistent cash flow independent of active work, enhancing long-term wealth accumulation. Challenges include the difficulty of accurately predicting passive income streams and the initial time or capital investment required to establish these sources. Net worth targets offer a clear measure of overall financial health, but passive income goals shift focus toward sustainable earnings and financial freedom.

How to Set Realistic Net Worth Goals

Setting realistic net worth goals requires analyzing current assets, liabilities, and income streams to establish achievable benchmarks. Prioritizing consistent passive income generation, such as dividends, rental income, or business profits, supports sustainable wealth growth alongside net worth targets. Regularly reviewing financial statements and adjusting savings rates ensure alignment with evolving market conditions and personal financial objectives.

Strategies to Achieve Sustainable Passive Income

Creating a diversified investment portfolio combining dividend stocks, real estate, and peer-to-peer lending significantly enhances sustainable passive income generation. Automating contributions to high-yield savings accounts and reinvesting earnings through compound interest accelerates growth towards passive income targets. Focusing on long-term cash flow stability rather than short-term net worth spikes ensures enduring financial independence.

Net Worth vs Passive Income: Which Should You Prioritize?

Net worth represents the total value of your assets minus liabilities, providing a comprehensive snapshot of financial health, while passive income indicates the recurring earnings generated without active involvement. Prioritizing net worth helps build a stable financial foundation and long-term wealth accumulation, whereas focusing on passive income ensures consistent cash flow and financial independence. Balancing these goals allows for both security and liquidity, but for long-term wealth, net worth typically takes precedence with passive income serving as a complementary strategy.

Integrating Net Worth and Passive Income Targets

Integrating net worth and passive income targets creates a comprehensive financial strategy that balances asset growth with sustainable cash flow. Tracking net worth offers a snapshot of overall financial health, while passive income targets focus on generating consistent earnings without active work. Aligning these goals ensures long-term wealth accumulation and financial independence by optimizing both capital appreciation and income streams.

Tracking Progress: Tools for Monitoring Financial Goals

Tracking progress toward net worth and passive income targets requires reliable financial tools such as personal finance apps, spreadsheets, and automated tracking software. These tools provide real-time insights into asset growth, cash flow streams, and investment performance, helping users make informed adjustments. Consistent monitoring ensures alignment with long-term money management goals and improves the accuracy of financial forecasting.

Related Important Terms

Net Worth Benchmarking

Net worth benchmarking provides a clear financial framework by comparing assets minus liabilities to set realistic targets aligned with long-term wealth accumulation. Tracking net worth milestones enables precise adjustments in saving and investing strategies, ensuring progress toward financial independence surpasses passive income goals.

Passive Income Milestone

Achieving a passive income milestone signals financial independence by generating consistent cash flow without active work, often surpassing the importance of net worth targets in practical money management. Prioritizing passive income enables sustainable wealth growth and reduces reliance on asset liquidation or market volatility associated with net worth calculations.

Wealth Accumulation Horizon

Net worth target emphasizes the total value of assets minus liabilities, providing a comprehensive measure of wealth accumulation over time, while passive income target focuses on generating recurring earnings to sustain financial independence. Aligning these goals with a long-term wealth accumulation horizon ensures strategic balancing between asset growth and income streams for optimized financial security.

FIRE Number (Financial Independence, Retire Early)

FIRE Number represents the net worth target crucial for achieving financial independence, serving as a benchmark to cover annual expenses through passive income streams. Prioritizing a passive income target aligned with the FIRE Number ensures sustainable money management by funding retirement without depleting principal assets.

Cashflow-Based Goal Setting

Setting a cashflow-based goal prioritizes achieving a sustainable passive income target over a static net worth target, emphasizing consistent monthly earnings that cover expenses and promote financial independence. This approach aligns money management strategies with real-time cash inflows rather than solely focusing on asset accumulation.

Opportunity Cost Allocation

Allocating resources between net worth targets and passive income targets requires analyzing opportunity costs to maximize financial growth and cash flow stability. Prioritizing opportunity cost allocation ensures that investment decisions optimize asset appreciation while sustaining reliable passive income streams.

Sustainable Withdrawal Rate

Setting a net worth target based on the sustainable withdrawal rate ensures long-term financial security by aligning assets with withdrawal needs, typically around 4% annually. Prioritizing passive income targets without considering withdrawal sustainability risks depleting savings prematurely, undermining goal stability.

Lifestyle Creep Control

Setting a net worth target provides a clear financial benchmark, while establishing a passive income target ensures sustainable cash flow, both crucial for controlling lifestyle creep effectively. Balancing these goals helps maintain disciplined spending habits, preventing expenses from rising in tandem with increased earnings and fostering long-term wealth stability.

Wealth Preservation Strategy

Setting a net worth target emphasizes long-term wealth accumulation through diversified investments and asset protection, while a passive income target prioritizes generating steady cash flow to maintain lifestyle without depleting principal assets. A robust wealth preservation strategy balances both by safeguarding asset value against inflation and market volatility while building sustainable income streams for financial independence.

Time to Crossover Point

The time to crossover point marks when passive income surpasses expenses, signaling financial independence ahead of reaching net worth targets. Prioritizing passive income growth accelerates this milestone, reducing reliance on asset accumulation alone for effective money management.

Net Worth Target vs Passive Income Target for money management. Infographic

moneydiff.com

moneydiff.com