Net worth growth directly impacts your financial independence by increasing your asset value and reducing liabilities, which accelerates progress toward reaching your FU (Financial Independence, Retire Early) money goal. Prioritizing consistent savings and smart investments enhances net worth, serving as a reliable metric for achieving long-term financial freedom. Monitoring net worth growth provides a clear and tangible benchmark, making it easier to adjust strategies and stay focused on the FU money target.

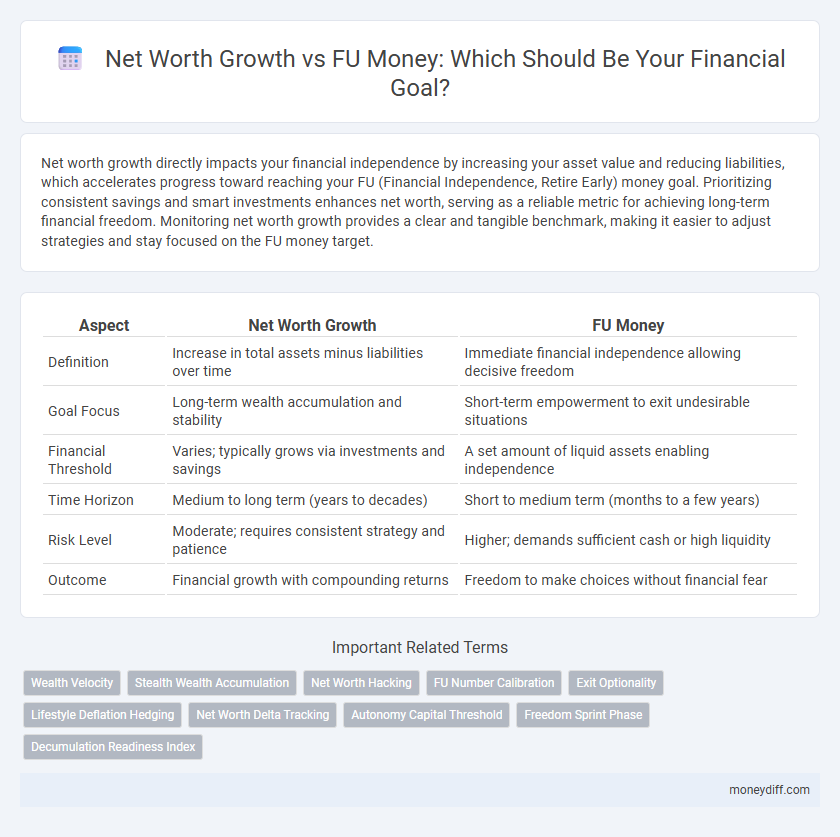

Table of Comparison

| Aspect | Net Worth Growth | FU Money |

|---|---|---|

| Definition | Increase in total assets minus liabilities over time | Immediate financial independence allowing decisive freedom |

| Goal Focus | Long-term wealth accumulation and stability | Short-term empowerment to exit undesirable situations |

| Financial Threshold | Varies; typically grows via investments and savings | A set amount of liquid assets enabling independence |

| Time Horizon | Medium to long term (years to decades) | Short to medium term (months to a few years) |

| Risk Level | Moderate; requires consistent strategy and patience | Higher; demands sufficient cash or high liquidity |

| Outcome | Financial growth with compounding returns | Freedom to make choices without financial fear |

Understanding Net Worth Growth: Definition and Importance

Net worth growth measures the increase in total assets minus liabilities over time, providing a clear indicator of financial progress. Tracking net worth growth is crucial for goal-setting as it highlights the effectiveness of saving, investing, and debt management strategies. Understanding this metric helps individuals align their financial goals with long-term wealth accumulation and financial security.

What is FU Money? Meaning and Mindset

FU Money represents the financial threshold at which an individual attains complete independence and the freedom to exit any undesirable situation without concern for income loss. This amount typically exceeds emergency savings by covering long-term living expenses, empowering a mindset centered on autonomy and control over life choices. Cultivating FU Money requires disciplined net worth growth, strategic investments, and a clear understanding of personal financial goals.

Net Worth Growth vs FU Money: Key Differences

Net worth growth measures the increasing value of all assets minus liabilities over time, reflecting overall financial progress. FU money represents a specific amount of liquid savings that allows complete financial independence, eliminating the need to work. While net worth growth emphasizes long-term wealth accumulation, FU money focuses on achieving immediate freedom from financial obligations.

Advantages of Focusing on Net Worth Growth

Focusing on net worth growth provides a comprehensive measure of financial health by accounting for all assets and liabilities, enabling strategic wealth accumulation beyond basic savings targets. It encourages diversified investments and long-term planning, leading to sustainable wealth creation and greater financial security. Tracking net worth growth also enhances decision-making by highlighting asset appreciation and debt reduction trends, promoting smarter financial habits.

Benefits of Pursuing FU Money as a Goal

Pursuing FU Money as a financial goal offers the benefit of complete autonomy, enabling individuals to make life decisions without financial constraints and stress. This approach often accelerates wealth accumulation by prioritizing high-impact savings and investment strategies designed to maximize independence rather than just net worth figures. Moreover, achieving FU Money provides a psychological advantage of financial security and empowerment that surpasses the numerical milestones typically associated with net worth growth.

Measuring Progress: Net Worth Tracking vs FU Money Milestones

Net worth growth provides a comprehensive measurement of overall financial health by tracking assets minus liabilities, offering detailed insights into progress toward long-term wealth goals. FU money milestones focus on achieving a specific, often fixed, amount of liquid assets sufficient to cover living expenses independently, emphasizing financial freedom. Comparing net worth tracking with FU money milestones helps clarify whether incremental wealth accumulation aligns with or surpasses the threshold needed for true financial independence.

Strategies to Accelerate Net Worth Growth

Accelerating net worth growth requires strategic asset allocation prioritizing high-yield investments like index funds, real estate, and dividend stocks to maximize returns over time. Implementing tax-efficient strategies such as utilizing retirement accounts and capital loss harvesting reduces liabilities and boosts overall portfolio value. Regularly increasing savings rates and reinvesting dividends compound wealth, bringing the FU (Financial Independence) Money goal closer and securing long-term financial freedom.

Steps to Achieve FU Money Faster

Accelerate net worth growth by maximizing high-yield investments and minimizing discretionary expenses to build FU money efficiently. Prioritize automated savings plans and diversify income streams, including side businesses or passive income, to increase capital flow. Consistently track financial milestones and adjust strategies to align with target FU money timelines.

Choosing the Right Goal: Net Worth Growth or FU Money?

Choosing between net worth growth and FU money as a financial goal depends on long-term wealth objectives and personal risk tolerance. Net worth growth emphasizes building diversified assets to achieve sustainable financial independence, while FU money targets accumulating a specific amount to gain immediate freedom from obligations. Prioritizing net worth growth supports balanced wealth accumulation and resilience, whereas FU money focuses on rapid exit strategies from limiting situations.

Integrating Net Worth Growth and FU Money in Your Money Management Plan

Integrating net worth growth and FU money into your money management plan ensures a balanced approach to financial security and freedom. Prioritize building net worth through diversified investments while concurrently allocating funds to your FU money stash, a liquid emergency fund that empowers decisive financial independence. This dual strategy maximizes wealth accumulation potential and safeguards against unexpected life events, aligning with long-term financial goals.

Related Important Terms

Wealth Velocity

Net worth growth measures the increase in total assets minus liabilities over time, reflecting overall financial progress, while FU Money represents a liquid cash buffer that enables financial independence and freedom from obligations. Wealth velocity, the rate at which net worth grows and FU Money accumulates, is critical for accelerating the achievement of financial goals and maximizing long-term wealth sustainability.

Stealth Wealth Accumulation

Net worth growth focuses on steadily increasing assets through diversified investments and disciplined saving, supporting long-term financial security without flaunting wealth. Stealth wealth accumulation emphasizes privacy and subtlety in wealth building, allowing individuals to reach FU money--a threshold of financial independence--while maintaining a low profile and avoiding unnecessary attention.

Net Worth Hacking

Net worth hacking accelerates financial progress by strategically increasing assets and minimizing liabilities to surpass traditional savings goals. Prioritizing net worth growth over reaching Financial Independence (FI) money enables sustainable wealth accumulation and long-term financial security.

FU Number Calibration

FU Money calibration requires accurately determining your financial independence number, which serves as a precise benchmark for net worth growth targets. Aligning your net worth milestones with this FU Number ensures a focused strategy toward achieving sustainable financial freedom.

Exit Optionality

Net worth growth enhances exit optionality by providing flexible financial resources that support various exit strategies without the pressure to sell prematurely. Building sufficient FU money acts as a financial safety net, ensuring freedom of choice and timing in pursuing optimal exit opportunities.

Lifestyle Deflation Hedging

Net worth growth strategies prioritize accumulating assets and investments to build long-term wealth, while FU Money emphasizes immediate financial independence to escape undesirable work situations. Lifestyle deflation hedging balances these goals by reducing expenses and simplifying living standards, ensuring sustainable net worth growth without compromising the freedom that FU Money provides.

Net Worth Delta Tracking

Tracking net worth delta provides a precise measure of financial progress by comparing asset growth against liabilities over time, enabling clearer insights than fixed FU Money targets. Prioritizing net worth growth ensures adaptive goal-setting based on actual financial changes rather than static thresholds, enhancing long-term wealth accumulation strategies.

Autonomy Capital Threshold

Autonomy Capital Threshold represents the precise net worth level where passive income fully covers living expenses, marking the transition from net worth growth to financial independence. Achieving this threshold shifts the goal from accumulating more wealth to preserving and optimizing FU Money for sustainable autonomy.

Freedom Sprint Phase

The Freedom Sprint phase targets rapid net worth growth by prioritizing high-impact investments and aggressive savings to expedite reaching FU Money--sufficient funds to achieve financial independence without reliance on income. Strategic asset allocation and minimizing liabilities accelerate wealth accumulation, ensuring early exit from dependence on traditional employment towards long-term financial freedom.

Decumulation Readiness Index

The Decumulation Readiness Index measures how effectively your net worth growth aligns with your FU Money target, indicating preparedness for financial independence and sustainable retiree spending. Tracking net worth growth relative to FU Money ensures strategic decumulation, optimizing wealth use during retirement.

Net Worth Growth vs FU Money for goal. Infographic

moneydiff.com

moneydiff.com