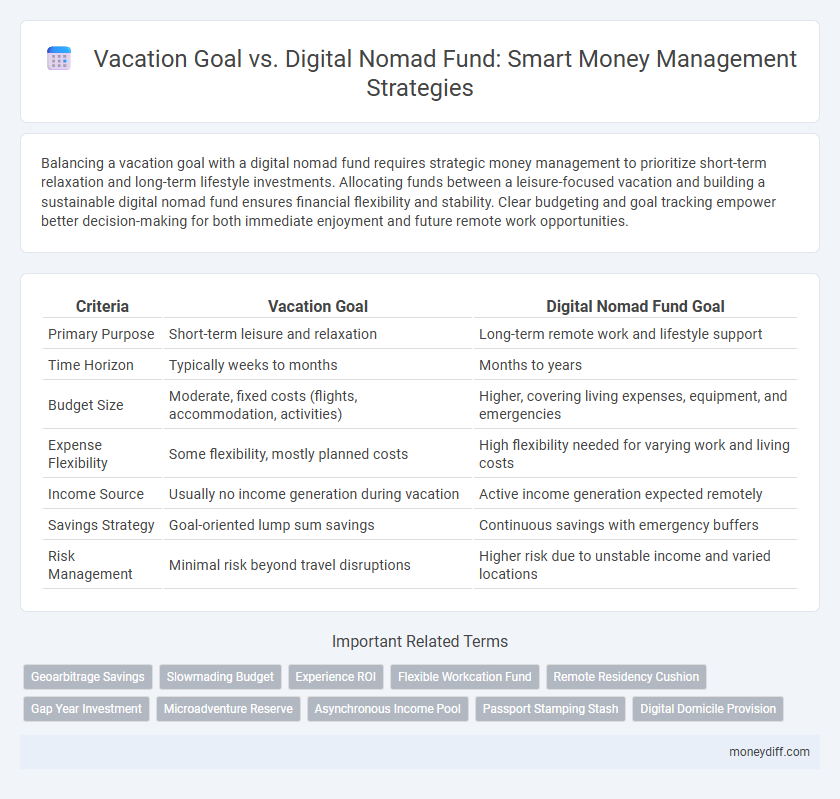

Balancing a vacation goal with a digital nomad fund requires strategic money management to prioritize short-term relaxation and long-term lifestyle investments. Allocating funds between a leisure-focused vacation and building a sustainable digital nomad fund ensures financial flexibility and stability. Clear budgeting and goal tracking empower better decision-making for both immediate enjoyment and future remote work opportunities.

Table of Comparison

| Criteria | Vacation Goal | Digital Nomad Fund Goal |

|---|---|---|

| Primary Purpose | Short-term leisure and relaxation | Long-term remote work and lifestyle support |

| Time Horizon | Typically weeks to months | Months to years |

| Budget Size | Moderate, fixed costs (flights, accommodation, activities) | Higher, covering living expenses, equipment, and emergencies |

| Expense Flexibility | Some flexibility, mostly planned costs | High flexibility needed for varying work and living costs |

| Income Source | Usually no income generation during vacation | Active income generation expected remotely |

| Savings Strategy | Goal-oriented lump sum savings | Continuous savings with emergency buffers |

| Risk Management | Minimal risk beyond travel disruptions | Higher risk due to unstable income and varied locations |

Defining Vacation Goals vs Digital Nomad Fund Goals

Vacation goals prioritize short-term enjoyment and relaxation, typically requiring a fixed budget for travel, accommodation, and activities within a specific timeframe. Digital nomad fund goals emphasize long-term financial sustainability, ensuring consistent income streams, emergency savings, and investment for ongoing remote work and living expenses. Clear distinction helps allocate resources effectively, balancing immediate leisure with extended mobility and career flexibility.

Timeframe Differences: Short-Term vs Long-Term Funding

Vacation goals require short-term funding with a focus on saving enough money quickly for immediate travel expenses, often within months. Digital nomad fund goals demand long-term financial planning and consistent saving over years to support ongoing remote work and living costs across various locations. Balancing these goals involves allocating funds differently based on the urgency and duration of each objective.

Budgeting Strategies for Each Goal

Vacation goals require budgeting strategies that prioritize short-term expenses such as accommodation, transportation, and activities, often using a fixed savings plan to accumulate funds ahead of the trip. Digital nomad fund goals demand a more flexible budget that accounts for ongoing costs like coworking spaces, reliable internet, healthcare, and emergency savings, emphasizing consistent monthly contributions and the creation of an adaptable financial buffer. Effective money management for each goal hinges on tailored budgeting methods that align with the distinct financial timelines and spending patterns involved.

Income Sources for Vacation vs Digital Nomad Lifestyle

Vacation goal income sources typically rely on saved earnings, bonuses, and short-term freelance work, emphasizing lump-sum accumulation for one-time expenses. In contrast, the digital nomad fund goal prioritizes diversified, recurring income streams such as remote job salaries, passive income from investments, and online business revenue to sustain ongoing travel and living costs. Effective money management for these goals involves aligning income generation strategies with the temporal and financial demands of each lifestyle.

Expense Planning and Tracking Approaches

Vacation goals require setting a fixed budget based on anticipated travel costs, accommodation, and daily expenses, making expense planning more predictable. Digital nomad fund goals demand dynamic tracking methods that account for fluctuating living costs, work-related expenses, and variable income streams. Utilizing budgeting apps with real-time expense tracking enhances financial control for both goal types.

Emergency Funds: Needs for Vacationers vs Digital Nomads

Vacationers typically allocate emergency funds to cover unexpected travel delays or medical expenses, ensuring a safe and stress-free trip. Digital nomads require a more substantial emergency fund to address potential income interruptions, equipment failures, or visa issues, reflecting the unpredictability of their remote lifestyle. Building these emergency reserves is crucial for both groups to maintain financial stability during unforeseen circumstances.

Investment Approaches for Each Money Goal

Vacation goals often call for conservative investment approaches, emphasizing low-risk assets like high-yield savings accounts or short-term bonds to ensure funds are readily available and stable. Digital nomad fund goals benefit from diversified portfolios incorporating growth-oriented investments such as stocks, ETFs, and index funds to maximize long-term returns and financial flexibility. Tailoring investment strategies based on time horizon and liquidity needs optimizes fund accumulation for both short-term travel and sustained nomadic lifestyles.

Tools and Apps for Goal-Specific Money Management

Using specialized tools and apps like YNAB (You Need a Budget) and PocketGuard helps tailor money management to specific goals such as vacation savings or building a digital nomad fund by tracking progress and setting spending limits. Vacation goal apps often focus on short-term budgeting features, expense categorization, and reminders to ensure funds are allocated efficiently for travel-related costs. Digital nomad fund management apps emphasize long-term financial planning, multi-currency support, and income tracking from remote work to maintain steady savings and cover unpredictable expenses.

Adapting to Unexpected Costs: Flexibility in Budgeting

Vacation goal budgeting requires setting aside fixed funds for known expenses like flights and accommodations, but unexpected costs such as medical emergencies or last-minute changes demand flexibility. Digital nomad fund goals prioritize a dynamic budget approach that accommodates variable expenses including fluctuating coworking space fees and unforeseen travel delays. Adapting to unexpected costs involves maintaining an emergency reserve within both goals, ensuring financial stability without compromising the overall travel experience or remote work lifestyle.

Measuring Success: Tracking Progress for Both Goals

Measuring success for vacation goals involves tracking savings milestones and budget adherence to ensure funds accumulate timely for planned trips. Digital nomad fund goals require monitoring income streams, expense management, and emergency reserves to sustain a flexible, location-independent lifestyle. Utilizing financial apps and monthly reviews optimizes progress tracking and goal adjustments for both savings strategies.

Related Important Terms

Geoarbitrage Savings

Vacation goals prioritize short-term spending for leisure, while digital nomad fund goals focus on sustainable income streams and long-term geoarbitrage savings by leveraging lower living costs in affordable countries. Effective money management for digital nomads involves strategic budgeting and maximizing remote work income to build a substantial fund that supports extended travel in cost-efficient locations.

Slowmading Budget

Vacation goals prioritize short-term enjoyment and relaxation expenses, requiring a specific budget to cover travel, accommodation, and activities, while digital nomad fund goals focus on long-term sustainable income to support remote work and living costs, necessitating comprehensive financial planning. Slowmading budget strategies optimize resource allocation by balancing immediate leisure spending with steady savings for ongoing digital nomad lifestyle expenses.

Experience ROI

Allocating funds toward a vacation goal prioritizes short-term relaxation and cultural experiences, maximizing immediate Experience ROI through memorable activities and personal rejuvenation. In contrast, saving for a digital nomad fund emphasizes long-term lifestyle flexibility and career development, generating sustained Experience ROI by combining work opportunities with immersive travel experiences.

Flexible Workcation Fund

The Flexible Workcation Fund prioritizes balancing vacation enjoyment with income continuity by allocating savings specifically for remote work-related travel expenses, unlike traditional vacation goals that focus solely on leisure spending. This fund supports seamless transitions between work and leisure, promoting sustainable financial management for digital nomads aiming to optimize both productivity and relaxation.

Remote Residency Cushion

Allocating funds specifically for a Remote Residency Cushion helps digital nomads manage unexpected expenses during extended stays, offering greater financial security than traditional vacation goals. Prioritizing this cushion supports seamless transitions between locations and covers emergencies, which are often overlooked in standard trip budgeting.

Gap Year Investment

Allocating funds between a Vacation goal and a Digital Nomad fund requires strategic money management to maximize long-term benefits, with the Gap Year Investment serving as a pivotal opportunity for experiential growth and financial stability. Prioritizing the Gap Year Investment can bridge the financial gap, enabling a balanced distribution that supports both immediate leisure and sustained remote work lifestyle aspirations.

Microadventure Reserve

Microadventure Reserve prioritizes short-term vacation goals by allocating funds for spontaneous, local trips that refresh without extensive planning or cost. In contrast, a Digital Nomad Fund goal concentrates on accumulating significant resources for long-term travel and remote work stability, balancing flexibility with financial resilience.

Asynchronous Income Pool

Vacation goals often require short-term savings from regular income streams, while Digital Nomad Fund goals benefit from building an Asynchronous Income Pool that generates passive or flexible earnings independent of time zones. Prioritizing an Asynchronous Income Pool enables sustained financial stability and supports long-term mobility without solely relying on synced paychecks.

Passport Stamping Stash

Passport Stamping Stash emphasizes targeted savings for travel experiences, optimizing funds specifically for vacation goals that cover flights, accommodations, and local adventures. In contrast, a Digital Nomad Fund goal allocates resources toward long-term remote work setups, including coworking spaces, reliable internet, and visa fees, ensuring sustained mobility and productivity abroad.

Digital Domicile Provision

Setting a digital nomad fund goal ensures consistent savings for essential digital domicile provisions like co-working spaces, reliable internet, and temporary housing, which differ from traditional vacation goals centered on leisure expenses. Prioritizing this fund enhances financial stability and supports sustained remote work productivity while traveling.

Vacation goal vs Digital nomad fund goal for money management. Infographic

moneydiff.com

moneydiff.com