An emergency fund provides a financial safety net for unexpected expenses, ensuring peace of mind and stability during crises. In contrast, an opportunity fund is designed to capitalize on potential investments or unique chances that can accelerate progress toward your goals. Balancing both funds allows you to protect yourself from setbacks while remaining flexible to seize growth opportunities.

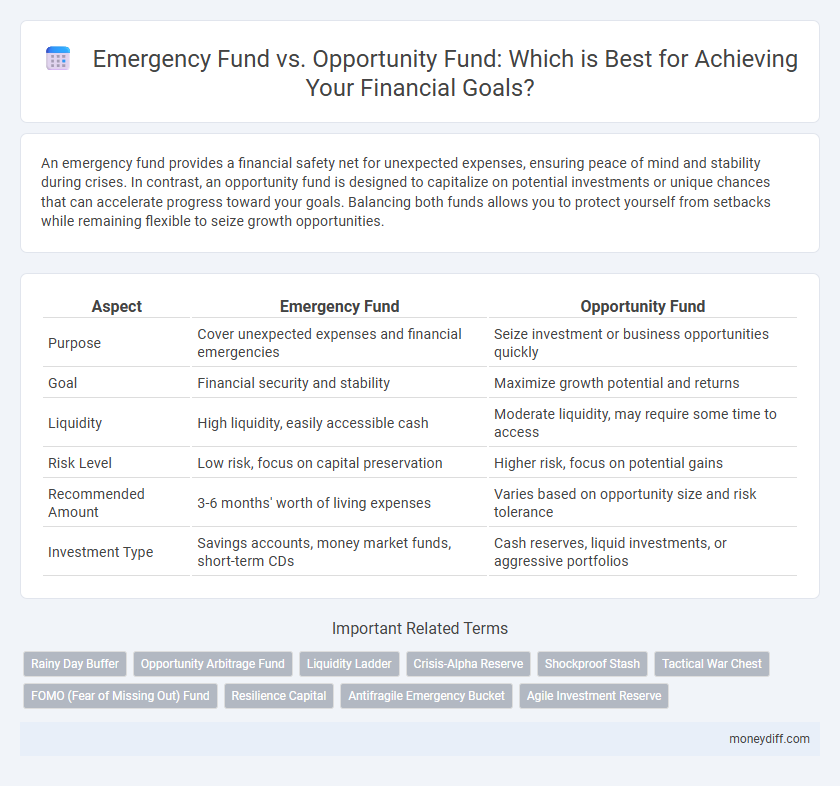

Table of Comparison

| Aspect | Emergency Fund | Opportunity Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Seize investment or business opportunities quickly |

| Goal | Financial security and stability | Maximize growth potential and returns |

| Liquidity | High liquidity, easily accessible cash | Moderate liquidity, may require some time to access |

| Risk Level | Low risk, focus on capital preservation | Higher risk, focus on potential gains |

| Recommended Amount | 3-6 months' worth of living expenses | Varies based on opportunity size and risk tolerance |

| Investment Type | Savings accounts, money market funds, short-term CDs | Cash reserves, liquid investments, or aggressive portfolios |

Defining Emergency Fund and Opportunity Fund

An Emergency Fund is a financial reserve set aside to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring financial stability during unforeseen events. An Opportunity Fund, on the other hand, is a pool of money designated for seizing potential investment or business opportunities, allowing quick access to capital for growth or strategic advantages. Clearly distinguishing between these funds helps in setting precise financial goals and improving overall money management.

Core Purpose: Protection vs. Growth

An emergency fund serves as a financial safety net designed to cover unexpected expenses, emphasizing protection and stability. In contrast, an opportunity fund focuses on growth by allocating resources to potential investments or ventures that can yield higher returns. Balancing these funds ensures both immediate security and long-term financial advancement aligned with specific goals.

How Much to Allocate: Setting Targets

Allocating funds efficiently between an emergency fund and an opportunity fund depends on personal financial goals and risk tolerance. A common target is to set aside three to six months' worth of essential expenses in an emergency fund to cover unexpected costs, ensuring financial stability. For the opportunity fund, a flexible target amount based on potential investment or business chances can be established, often ranging from 10% to 20% of disposable income, allowing quick capital access for favorable situations.

Funding Sources and Strategies

Emergency funds are primarily sourced from liquid assets such as savings accounts or money market funds to ensure quick accessibility during crises, emphasizing risk aversion and financial security. Opportunity funds, in contrast, often draw from discretionary income, dividends, or strategically reallocated investments to capitalize on unexpected investment possibilities or market dips. Effective funding strategies involve maintaining a balanced portfolio where an emergency fund covers 3-6 months of expenses, while an opportunity fund is dynamically adjusted based on market conditions and personal financial goals.

Liquidity and Accessibility Matters

Emergency funds provide high liquidity and immediate accessibility to cover unforeseen expenses like medical emergencies or job loss, typically stored in savings accounts or money market funds. Opportunity funds prioritize flexibility and quick access to capitalize on timely investment opportunities, often held in high-yield or short-term investment vehicles. Balancing liquidity and accessibility ensures both financial security during crises and readiness to seize profitable opportunities without delay.

Risk Profiles: Safety First or Higher Reward?

Emergency funds prioritize safety first, emphasizing liquidity and low-risk assets to cover unexpected expenses and financial shocks. Opportunity funds, on the other hand, focus on higher reward potential by investing in moderate to high-risk instruments aimed at capital growth for future goals. Balancing risk profiles involves allocating adequate resources to emergency funds before pursuing opportunity funds to maintain financial stability while seeking increased returns.

When to Use Each Fund

Emergency funds should be prioritized for unexpected expenses such as medical emergencies, car repairs, or job loss, providing a financial safety net to cover essential costs without incurring debt. Opportunity funds are best used when a favorable investment, business venture, or spontaneous chance arises that requires immediate capital to maximize potential gains. Knowing when to allocate money to each fund depends on assessing current financial stability and weighing the urgency of risks versus growth opportunities.

Role in Achieving Financial Goals

An emergency fund provides a financial safety net to cover unexpected expenses such as medical emergencies or job loss, ensuring stability without derailing long-term goals. Opportunity funds enable individuals to seize timely investments or personal growth opportunities, accelerating progress toward financial aspirations. Balancing both funds is crucial for effective goal achievement, as the emergency fund safeguards against setbacks while the opportunity fund fuels strategic advancements.

Balancing Emergency and Opportunity Reserves

Balancing emergency funds and opportunity reserves is crucial for effective financial planning, ensuring liquidity for unforeseen expenses while maintaining capital to seize investment opportunities. An emergency fund typically covers three to six months of living expenses, providing a safety net against income disruptions. Opportunity funds, on the other hand, enable quick access to capital for timely investments or essential purchases, fostering growth and financial flexibility.

Tips for Managing Both Funds Effectively

Maintain clear distinctions between emergency funds and opportunity funds by allocating separate savings accounts dedicated to each purpose, ensuring liquidity for unexpected expenses while capturing growth opportunities. Regularly review fund balances relative to your financial goals and adjust contributions to maintain optimal funding levels based on changing income and risk factors. Utilize budgeting tools and automate transfers to consistently build both funds, reducing financial stress and maximizing readiness for emergencies and investments alike.

Related Important Terms

Rainy Day Buffer

A Rainy Day Buffer, a critical component of an Emergency Fund, safeguards against unexpected financial disruptions by providing immediate access to cash, typically covering three to six months of essential expenses. In contrast, an Opportunity Fund is strategically allocated for seizing high-return investments or timely purchases, making it more flexible but less stable for urgent needs.

Opportunity Arbitrage Fund

An Opportunity Arbitrage Fund maximizes financial agility by allocating capital toward high-yield, time-sensitive investments while maintaining liquidity, unlike a traditional Emergency Fund that prioritizes safety and immediate access for unforeseen expenses. Leveraging market inefficiencies, this fund specializes in capturing short-term gains through strategic asset shifts, aligning with proactive wealth growth goals.

Liquidity Ladder

An emergency fund provides immediate liquidity to cover unexpected expenses, typically held in highly accessible accounts like savings or money market funds, while an opportunity fund is positioned higher on the liquidity ladder, balancing access with potential growth to capitalize on investment or purchase opportunities. Properly structuring these funds within a liquidity ladder ensures financial flexibility, with emergency funds addressing short-term cash needs and opportunity funds offering medium-term access without sacrificing returns.

Crisis-Alpha Reserve

Emergency funds serve as a Crisis-Alpha Reserve providing immediate financial security during unforeseen events, ensuring liquidity to cover essential expenses without disrupting long-term investments. Opportunity funds, in contrast, offer flexible capital to seize high-return prospects, balancing risk and preparedness while supporting overall goal achievement.

Shockproof Stash

A Shockproof Stash serves as an Emergency Fund designed to cover unexpected expenses and financial shocks, typically amounting to three to six months of living costs. Unlike an Opportunity Fund, which is set aside for seizing investments or business ventures, a Shockproof Stash prioritizes liquidity and stability to ensure immediate access during crises.

Tactical War Chest

A Tactical War Chest serves as a flexible allocation within an emergency fund designed to cover unexpected opportunities and urgent financial needs, balancing liquidity with growth potential. This strategic reserve ensures immediate access to capital while preserving long-term goal investments, enhancing overall financial resilience.

FOMO (Fear of Missing Out) Fund

An Emergency Fund safeguards against unexpected expenses by providing immediate financial security, while an Opportunity Fund specifically targets potential investments or ventures that capitalize on FOMO (Fear of Missing Out) situations. Allocating resources to a FOMO Fund enables individuals to quickly seize time-sensitive opportunities without jeopardizing their essential financial stability.

Resilience Capital

Emergency funds provide essential resilience capital by covering unexpected expenses and financial shocks, ensuring stability during crises. Opportunity funds, while important, prioritize seizing favorable investments or ventures, relying on available resilience capital rather than replacing it.

Antifragile Emergency Bucket

An antifragile emergency fund prioritizes resilience by allocating cash reserves that grow stronger during economic stress, unlike a traditional opportunity fund which targets growth through higher-risk investments. This approach ensures financial stability amid unforeseen crises while preserving capital flexibility for potential emergencies.

Agile Investment Reserve

An Agile Investment Reserve balances liquidity and growth by combining an Emergency Fund's safety net with an Opportunity Fund's potential for higher returns. Allocating 3-6 months of essential expenses in liquid assets while reserving additional capital for timely investments enhances financial agility and goal achievement.

Emergency Fund vs Opportunity Fund for goal. Infographic

moneydiff.com

moneydiff.com