The Rainy Day Goal prioritizes building an emergency fund to cover unexpected expenses, ensuring financial stability during crises. In contrast, the FU Money Goal targets accumulating enough wealth to achieve complete financial independence, granting the freedom to make life choices without financial constraints. Effective money management balances these goals by securing immediate safety while investing in long-term financial freedom.

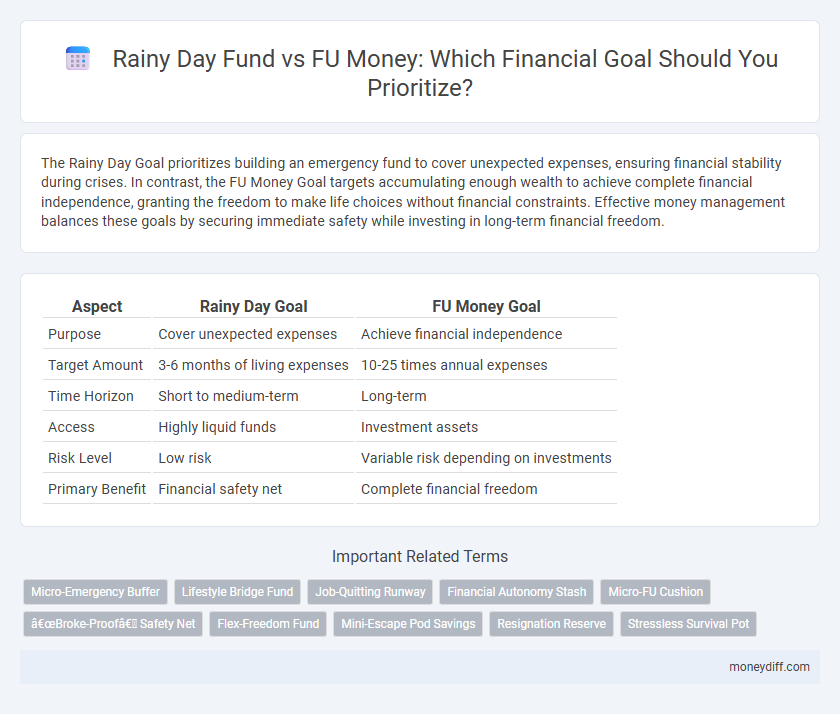

Table of Comparison

| Aspect | Rainy Day Goal | FU Money Goal |

|---|---|---|

| Purpose | Cover unexpected expenses | Achieve financial independence |

| Target Amount | 3-6 months of living expenses | 10-25 times annual expenses |

| Time Horizon | Short to medium-term | Long-term |

| Access | Highly liquid funds | Investment assets |

| Risk Level | Low risk | Variable risk depending on investments |

| Primary Benefit | Financial safety net | Complete financial freedom |

Understanding Rainy Day Funds vs. FU Money Goals

Rainy day funds are designed to cover unexpected expenses such as medical emergencies or urgent home repairs, typically amounting to three to six months of living expenses, ensuring financial stability during short-term crises. FU money goals focus on accumulating enough wealth to achieve financial independence and the freedom to make life choices without dependence on traditional employment, often requiring substantial long-term savings and investments. Understanding the distinction helps prioritize immediate security through rainy day funds while strategically building FU money for ultimate financial autonomy.

Defining Your Financial Safety Nets

Defining your financial safety nets involves distinguishing between a rainy day fund and a FU money goal, each serving unique purposes in money management. A rainy day fund acts as immediate liquidity covering unexpected expenses such as car repairs or medical bills, typically maintaining three to six months of essential living costs. FU money provides long-term financial independence, allowing you to leave unfavorable situations without stress, ideally accumulating enough to cover lifestyle costs for several years.

Key Differences: Rainy Day Fund and FU Money

Rainy day funds are designed for short-term emergencies like car repairs or medical bills, typically covering three to six months of essential expenses, providing financial security during unexpected disruptions. FU money, by contrast, represents a larger, long-term financial cushion that grants complete independence from a paycheck, enabling choices like quitting a job or pursuing passion projects without income pressure. The key difference lies in purpose and scale: rainy day savings protect against temporary setbacks, while FU money offers permanent financial freedom and control.

When to Prioritize a Rainy Day Goal

Prioritize a rainy day fund goal when facing unpredictable expenses or job instability, as this emergency savings provides immediate financial security. Allocating three to six months' worth of living expenses in a liquid, accessible account ensures resilience against unforeseen costs before focusing on FU money, which typically targets longer-term financial independence. This approach stabilizes your foundation, enabling more strategic wealth building once short-term financial risks are mitigated.

Building Your FU Money: Steps and Strategies

Building your FU money requires disciplined saving, strategic investing, and creating multiple income streams to achieve financial independence. Prioritize setting clear milestones, automating contributions to investment accounts, and diversifying assets to protect against market volatility. Consistent focus on long-term wealth accumulation ensures you can make empowered financial decisions without dependence on traditional employment.

Flexibility and Freedom: The Power of FU Money

Rainy day goals focus on creating a safety net for unexpected expenses, providing short-term financial security. FU money emphasizes building substantial wealth to gain ultimate flexibility and freedom, enabling choices without reliance on a paycheck. Prioritizing FU money empowers individuals to escape financial constraints and achieve long-term autonomy.

How Much to Save: Setting Actionable Targets

Setting clear savings targets is essential for effective money management, with rainy day goals typically requiring three to six months' worth of living expenses to cover unexpected emergencies. In contrast, financial independence (FU money) goals demand significantly larger amounts, often calculated to generate sustainable passive income streams covering annual expenses indefinitely. Prioritizing these goals involves allocating funds first to establish a robust emergency fund before aggressively investing towards FU money targets to ensure long-term financial security.

Risk Tolerance and Personality in Goal Selection

Rainy day goals prioritize immediate financial security and typically appeal to individuals with lower risk tolerance who prefer liquidity for unforeseen expenses. In contrast, FU money goals align with higher risk tolerance personalities willing to endure market volatility for long-term financial independence. Selecting the appropriate goal depends on balancing personal risk appetite with financial personality traits, ensuring motivation and effective money management strategies.

Combining Rainy Day and FU Money for Optimal Security

Combining a rainy day fund with a financial independence (FU) money goal ensures optimal financial security by covering both short-term emergencies and long-term freedom. A rainy day fund typically holds three to six months of essential expenses, providing immediate liquidity during unforeseen events. FU money, often amounting to 25 times annual expenses, supports sustained independence and proactive wealth building, creating a comprehensive financial safety net.

Tracking Progress and Staying Motivated

Tracking progress for both rainy day and FU money goals requires setting clear milestones and regularly updating savings balances to visualize growth. Utilizing budgeting apps or spreadsheets enhances motivation by providing tangible evidence of financial discipline and encouraging consistent contributions. Celebrating small victories along the way keeps momentum alive, making long-term money management more achievable and rewarding.

Related Important Terms

Micro-Emergency Buffer

A Rainy Day Goal focuses on establishing a Micro-Emergency Buffer, typically covering essential expenses for 1 to 2 weeks, enabling immediate response to small, unexpected costs without disrupting monthly budgets. This contrasts with the FU Money Goal, which aims for a substantial financial cushion to achieve long-term independence and freedom from employment.

Lifestyle Bridge Fund

A Lifestyle Bridge Fund serves as an essential Rainy Day Goal by covering unexpected expenses and maintaining financial stability without disrupting long-term investments. Unlike FU Money, which provides complete financial independence, a Lifestyle Bridge Fund bridges short-term cash flow gaps to support daily living expenses during emergencies.

Job-Quitting Runway

A rainy day goal ensures immediate financial stability for emergencies, while a FU money goal provides a job-quitting runway that enables long-term career freedom and life choices without reliance on employment income. Prioritizing FU money builds a substantial cash reserve that covers months of living expenses, empowering individuals to leave unsatisfying jobs and pursue personal aspirations confidently.

Financial Autonomy Stash

The Financial Autonomy Stash serves as an essential rainy day fund, providing immediate liquidity for unexpected expenses and preserving financial stability without disrupting long-term investments. Unlike the FU money goal, which prioritizes complete financial independence and discretionary spending freedom, the rainy day stash emphasizes accessible savings to cover emergencies and avoid debt.

Micro-FU Cushion

A Micro-FU Cushion serves as an essential rainy day goal, providing immediate access to funds that covers unexpected expenses without disrupting long-term financial plans. This targeted savings approach complements the larger Financial Independence (FU) money goal by ensuring liquidity and stability before fully prioritizing wealth accumulation.

“Broke-Proof” Safety Net

A "Broke-Proof" Safety Net prioritizes building a Rainy Day goal with three to six months of essential expenses saved, ensuring immediate financial stability during unexpected crises. This foundation supports long-term FU money goals by preventing debt accumulation and preserving investment growth, creating a resilient money management strategy.

Flex-Freedom Fund

The Flex-Freedom Fund balances a rainy day goal with a FU money goal by providing immediate liquidity for emergencies while building long-term financial independence. This dual-purpose fund ensures accessible cash flow during unforeseen expenses and accelerates wealth accumulation for future freedom.

Mini-Escape Pod Savings

Mini-Escape Pod Savings focuses on creating a Rainy Day fund to cover unexpected expenses, ensuring financial stability without disrupting long-term investments. This approach contrasts with FU Money goals that prioritize complete financial independence, emphasizing liquidity and immediate access to emergency cash for short-term security.

Resignation Reserve

Rainy day goals focus on building a Resignation Reserve to cover essential expenses during unexpected unemployment or job resignation, typically aiming for three to six months of living costs. In contrast, FU money goals prioritize financial independence, providing the freedom to resign without financial constraints by accumulating a larger, more flexible savings buffer.

Stressless Survival Pot

The Stressless Survival Pot prioritizes building an emergency fund specifically designed to cover essential expenses during unexpected rainy days, ensuring financial stability without adding stress. This approach contrasts with the FU money goal, which aims for complete financial independence and freedom from work, highlighting the practical importance of accessible, stress-free cash reserves for immediate needs.

Rainy day goal vs FU money goal for money management. Infographic

moneydiff.com

moneydiff.com