Choosing between cash savings and digital assets for achieving financial goals depends on risk tolerance and liquidity needs. Cash savings offer stability and easy access but typically yield lower returns, while digital assets can provide higher growth potential with increased volatility. Balancing these options allows for diversified portfolios that align with specific goal timelines and financial objectives.

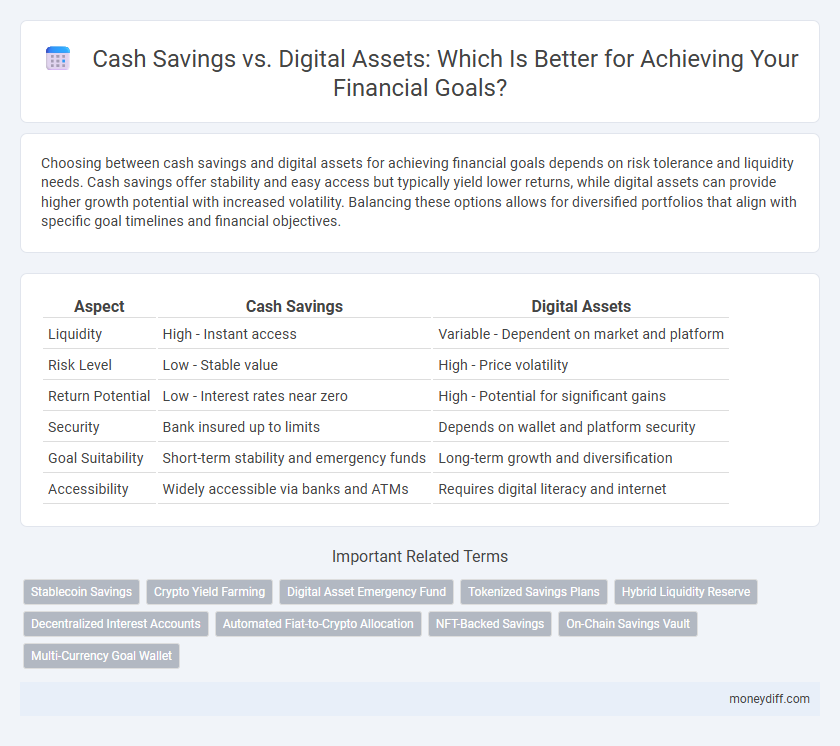

Table of Comparison

| Aspect | Cash Savings | Digital Assets |

|---|---|---|

| Liquidity | High - Instant access | Variable - Dependent on market and platform |

| Risk Level | Low - Stable value | High - Price volatility |

| Return Potential | Low - Interest rates near zero | High - Potential for significant gains |

| Security | Bank insured up to limits | Depends on wallet and platform security |

| Goal Suitability | Short-term stability and emergency funds | Long-term growth and diversification |

| Accessibility | Widely accessible via banks and ATMs | Requires digital literacy and internet |

Understanding Cash Savings and Digital Assets

Cash savings offer liquidity and stability, making them ideal for short-term financial goals and emergency funds. Digital assets, such as cryptocurrencies and tokenized investments, provide higher growth potential but come with increased volatility and risk. Balancing cash savings with digital assets can optimize goal achievement by combining security with growth opportunities.

Key Differences Between Cash Savings and Digital Assets

Cash savings provide stability and liquidity, making them ideal for short-term goals and emergency funds, while digital assets offer higher growth potential with increased volatility, suited for long-term wealth accumulation. Cash savings benefit from low risk and easy access, whereas digital assets involve market fluctuations and require digital security measures. Choosing between these depends on risk tolerance, time horizon, and financial objectives.

Pros and Cons of Cash Savings for Financial Goals

Cash savings provide liquidity and low risk, making them ideal for short-term financial goals and emergency funds, but they often offer lower returns compared to digital assets. The stability of cash savings protects principal value from market volatility, though inflation can erode purchasing power over time. Relying solely on cash savings may limit wealth growth potential, especially for long-term objectives requiring higher yields.

Advantages of Digital Assets in Achieving Goals

Digital assets offer increased liquidity and faster transaction speeds, enabling quicker access to funds needed for goal achievement. Their potential for higher returns compared to traditional cash savings allows for accelerated growth toward financial objectives. Furthermore, blockchain technology ensures transparency and security, enhancing trust in managing and tracking digital assets for goal-oriented investments.

Risk Assessment: Cash Savings vs Digital Assets

Cash savings offer low risk and high liquidity, providing a secure store of value with minimal volatility, ideal for short-term goals and emergencies. Digital assets present higher risk due to price volatility and market uncertainty but can yield significant returns, making them suitable for long-term goals with a higher risk tolerance. Assessing individual risk appetite and investment horizon is crucial when choosing between cash savings and digital assets to achieve financial objectives.

Liquidity and Accessibility Considerations

Cash savings offer high liquidity and immediate accessibility, making them ideal for short-term financial goals and emergency funds. Digital assets, while potentially offering higher returns, often involve variable liquidity and may require additional steps for conversion to cash, impacting immediate accessibility. Evaluating the balance between liquidity needs and growth potential is crucial when choosing between cash savings and digital assets for goal-specific financial planning.

Inflation Impact on Cash and Digital Assets

Cash savings often lose value over time due to inflation eroding purchasing power, making them less effective for long-term goals. Digital assets like cryptocurrencies and tokenized securities can offer higher potential returns that may outpace inflation but come with increased volatility and risk. Balancing cash savings with carefully selected digital assets can provide protection against inflation while supporting growth toward financial objectives.

Security Factors for Your Savings

Cash savings offer strong security through FDIC insurance and low risk of volatility, ensuring principal protection and easy access. Digital assets provide diversification benefits but come with higher security concerns, including hacking risks and wallet management complexities. Prioritizing security features like two-factor authentication and secure custody solutions is essential when considering digital assets for achieving your financial goals.

Diversification Strategies for Goal-Based Savings

Diversification strategies for goal-based savings emphasize balancing cash savings with digital assets to optimize risk and returns. Allocating a portion of funds to stable cash accounts ensures liquidity and security, while investing in digital assets like cryptocurrencies or tokenized securities can enhance growth potential. Utilizing a diversified portfolio aligned with specific financial goals helps mitigate volatility and improve long-term wealth accumulation.

Choosing the Right Mix for Your Money Management Goals

Balancing cash savings with digital assets enhances your financial flexibility and security by combining liquidity with growth potential. Prioritize cash for short-term goals and emergencies, while allocating digital assets like cryptocurrencies or tokenized investments for long-term appreciation. Tailoring the mix based on risk tolerance, time horizon, and financial objectives ensures optimal money management and goal achievement.

Related Important Terms

Stablecoin Savings

Stablecoin savings offer a unique blend of digital asset growth potential and cash-like stability, making them ideal for goal-oriented financial planning. Unlike traditional cash savings, stablecoins maintain price stability by being pegged to fiat currencies, providing liquidity and protection against market volatility while enabling easy access and faster transactions.

Crypto Yield Farming

Cash savings offer stability and liquidity for short-term goals, while digital assets through crypto yield farming provide higher potential returns by leveraging decentralized finance protocols. Yield farming maximizes crypto holdings by earning interest or rewards, but involves volatility and smart contract risks that must be managed carefully.

Digital Asset Emergency Fund

Digital asset emergency funds offer enhanced liquidity and rapid accessibility compared to traditional cash savings, enabling faster response in critical situations. Utilizing stablecoins or cryptocurrencies with low volatility can protect value while providing decentralized, borderless access for financial emergencies.

Tokenized Savings Plans

Tokenized savings plans leverage blockchain technology to offer transparent, flexible, and secure methods for achieving financial goals, outperforming traditional cash savings by enabling fractional ownership, real-time tracking, and higher liquidity. These digital asset-based savings models provide enhanced portfolio diversification and potential for higher returns through programmable smart contracts and reduced intermediation costs.

Hybrid Liquidity Reserve

A hybrid liquidity reserve combines cash savings and digital assets to optimize accessibility and growth potential for financial goals. Balancing stable cash with liquid digital assets ensures both immediate availability and long-term appreciation within a diversified portfolio.

Decentralized Interest Accounts

Decentralized interest accounts offer higher yields on digital assets compared to traditional cash savings, enabling faster goal attainment through compounded returns and reduced reliance on centralized banks. By leveraging blockchain technology, these accounts provide transparent, secure, and accessible interest-earning opportunities for goal-oriented investors seeking diversification and growth beyond standard savings rates.

Automated Fiat-to-Crypto Allocation

Automated fiat-to-crypto allocation streamlines goal-oriented investing by seamlessly converting cash savings into digital assets, enhancing portfolio diversification and growth potential. This strategy leverages algorithmic precision to maintain optimal asset distribution, balancing the stability of traditional savings with the high-yield opportunities in cryptocurrency markets.

NFT-Backed Savings

NFT-backed savings provide a secure and innovative alternative to traditional cash savings by leveraging blockchain technology to offer liquidity and potential appreciation through digital asset ownership. These savings vehicles enable goal-oriented investors to diversify portfolios while maintaining accessibility and transparency in wealth management.

On-Chain Savings Vault

On-chain savings vaults provide enhanced security and transparency for cash savings by leveraging blockchain technology to store digital assets with cryptographic proof, ensuring immutability and reduced risk of fraud. These vaults enable goal-focused saving strategies through programmable smart contracts that automate deposits and withdrawals, aligning with financial targets more efficiently than traditional cash savings accounts.

Multi-Currency Goal Wallet

A Multi-Currency Goal Wallet enables seamless management of cash savings and digital assets, allowing users to allocate funds towards specific goals in various currencies. This approach maximizes portfolio diversification and potential growth by integrating stable cash holdings with high-yield digital assets.

Cash Savings vs Digital Assets for goal. Infographic

moneydiff.com

moneydiff.com