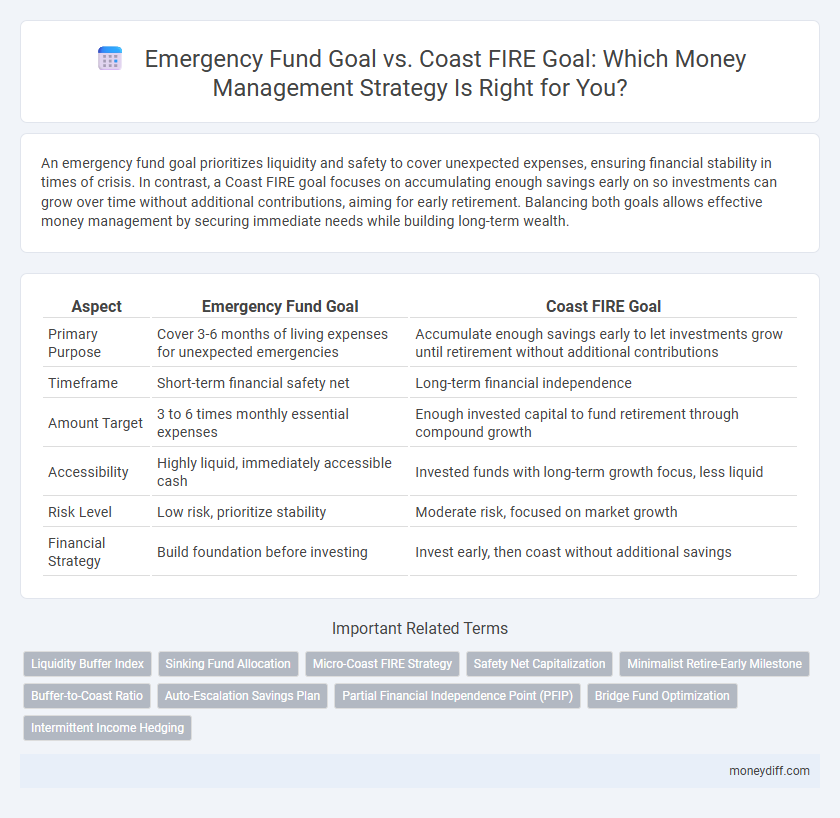

An emergency fund goal prioritizes liquidity and safety to cover unexpected expenses, ensuring financial stability in times of crisis. In contrast, a Coast FIRE goal focuses on accumulating enough savings early on so investments can grow over time without additional contributions, aiming for early retirement. Balancing both goals allows effective money management by securing immediate needs while building long-term wealth.

Table of Comparison

| Aspect | Emergency Fund Goal | Coast FIRE Goal |

|---|---|---|

| Primary Purpose | Cover 3-6 months of living expenses for unexpected emergencies | Accumulate enough savings early to let investments grow until retirement without additional contributions |

| Timeframe | Short-term financial safety net | Long-term financial independence |

| Amount Target | 3 to 6 times monthly essential expenses | Enough invested capital to fund retirement through compound growth |

| Accessibility | Highly liquid, immediately accessible cash | Invested funds with long-term growth focus, less liquid |

| Risk Level | Low risk, prioritize stability | Moderate risk, focused on market growth |

| Financial Strategy | Build foundation before investing | Invest early, then coast without additional savings |

Understanding Emergency Fund Goals

An emergency fund goal typically targets three to six months of essential living expenses to provide financial security during unexpected events like job loss or medical emergencies. This fund is liquid and easily accessible, prioritizing stability over growth compared to a Coast FIRE goal, which emphasizes saving and investing aggressively early on to allow future financial independence without continual contributions. Understanding the distinct purpose and time horizon of an emergency fund helps individuals build a foundation for resilient money management before pursuing long-term goals like Coast FIRE.

What is Coast FIRE?

Coast FIRE is a financial independence strategy where you save aggressively early on and then let your investments grow over time without additional contributions, effectively "coasting" to retirement. Unlike an emergency fund goal, which prioritizes immediate liquidity for unexpected expenses, Coast FIRE emphasizes long-term growth and compounding returns to cover future financial needs. This approach allows individuals to reduce their current work obligations while ensuring they have enough invested to reach full retirement without further savings.

Key Differences Between Emergency Funds and Coast FIRE

Emergency funds are designed to cover unexpected expenses and typically hold three to six months' worth of living costs in highly liquid accounts, ensuring immediate access. Coast FIRE, or Financial Independence Retire Early strategy, involves accumulating enough savings early so future compounding grows the nest egg without additional contributions, focusing on long-term wealth growth rather than short-term liquidity. While emergency funds prioritize safety and accessibility, Coast FIRE prioritizes investment growth and time, highlighting distinct goals in personal finance planning.

Importance of an Emergency Fund in Financial Planning

An emergency fund acts as a crucial financial safety net that covers unexpected expenses such as medical bills, car repairs, or job loss, ensuring short-term stability without disrupting long-term investments. Unlike the Coast FIRE goal, which focuses on building passive income over time, prioritizing an emergency fund prevents high-interest debt and provides peace of mind during financial emergencies. Allocating 3 to 6 months' worth of living expenses to an emergency fund is essential for effective money management and sustainable financial planning.

Coast FIRE: A Long-Term Wealth Building Strategy

Coast FIRE is a financial strategy focused on long-term wealth accumulation by allowing investments to grow passively while minimizing current savings contributions. Unlike an emergency fund goal, which prioritizes liquidity and immediate-access cash for unforeseen expenses, Coast FIRE leverages compound interest to build sufficient retirement funds over time. Emphasizing early investment in diversified portfolios, Coast FIRE aims to reduce future financial pressure and create sustainable financial independence.

How Much Should You Save for an Emergency Fund?

An ideal emergency fund covers three to six months of essential living expenses, typically ranging from $9,000 to $18,000 for the average household. Unlike the Coast FIRE goal, which emphasizes building enough savings early so investments grow to financial independence, an emergency fund prioritizes liquidity and safety to handle unexpected expenses without debt. Prioritizing an emergency fund before aggressive investing ensures financial stability and prevents disruption in long-term money management strategies.

Calculating Your Coast FIRE Number

Calculating your Coast FIRE number involves determining the amount of money you need to invest today to let compound interest grow sufficiently until retirement, allowing you to cover expenses without additional contributions. Unlike an emergency fund goal, which targets liquid savings to handle unexpected expenses typically covering 3 to 6 months of living costs, the Coast FIRE goal focuses on long-term wealth accumulation based on your target retirement age and expected returns. Precision in estimating your expected annual returns, inflation rate, and retirement timeline is critical to accurately calculate the Coast FIRE number and effectively manage your money for financial independence.

Prioritizing: Emergency Fund or Coast FIRE First?

Prioritizing an emergency fund over a Coast FIRE goal is crucial for financial stability, as it provides immediate liquidity for unexpected expenses and prevents debt accumulation. An adequately funded emergency reserve typically covers three to six months of living expenses, serving as a safety net that protects long-term investments from being prematurely liquidated. Only after establishing a robust emergency fund should individuals shift focus to achieving Coast FIRE, which emphasizes early retirement funding by allowing investments to grow passively over time.

Integrating Both Goals in Your Financial Plan

Integrating an emergency fund with a Coast FIRE goal ensures financial stability while optimizing long-term wealth growth by maintaining liquid assets for unexpected expenses and allowing investments to compound over time. Prioritizing contributions to a fully funded emergency fund before aggressively pursuing Coast FIRE investments creates a balanced approach that mitigates risk. This strategy enhances money management by safeguarding against financial setbacks without delaying the achievement of financial independence.

Common Mistakes When Balancing Emergency Funds and Coast FIRE

A common mistake when managing an emergency fund alongside a Coast FIRE goal is neglecting the appropriate allocation of liquid assets, leading to insufficient immediate cash for emergencies or underfunding long-term growth. Overemphasizing emergency savings can delay reaching Coast FIRE by reducing investments in retirement accounts like Roth IRAs or 401(k)s, which benefit from compounding interest. Ignoring the balance between accessible emergency funds--typically three to six months of living expenses--and targeted investment growth impairs effective money management and financial independence planning.

Related Important Terms

Liquidity Buffer Index

Emergency fund goals prioritize maintaining a high Liquidity Buffer Index to cover 3-6 months of essential expenses, ensuring immediate access to cash for unforeseen events. In contrast, Coast FIRE goals emphasize building a sufficient investment balance early on, allowing future contributions to grow without additional deposits, thus the Liquidity Buffer Index plays a secondary role focused on maintaining minimal liquid reserves while maximizing long-term growth.

Sinking Fund Allocation

Emergency fund goals prioritize liquidity and immediate accessibility, ensuring 3-6 months of essential expenses are covered for unexpected events, while Coast FIRE goals emphasize long-term growth through consistent sinking fund allocation to retirement accounts, minimizing active contributions later. Effective sinking fund allocation balances these by allocating short-term savings for emergencies separately from investments targeting financial independence, optimizing both security and future wealth accumulation.

Micro-Coast FIRE Strategy

Emergency fund goals prioritize immediate liquidity to cover 3-6 months of living expenses for financial security during unexpected events, while Micro-Coast FIRE strategy focuses on accumulating enough investments to cover a portion of basic expenses, reducing required savings rates and accelerating financial independence. Balancing an emergency fund with a Micro-Coast FIRE goal optimizes money management by ensuring both short-term stability and long-term wealth growth.

Safety Net Capitalization

Emergency fund goals prioritize building a liquid safety net capital to cover 3-6 months of essential expenses, ensuring immediate financial resilience against unexpected crises. Coast FIRE goals focus on accumulating sufficient investment capital early, allowing compound growth to fund retirement without additional contributions, balancing long-term security with reduced current savings pressure.

Minimalist Retire-Early Milestone

Emergency fund goals prioritize liquidity and short-term financial security, typically covering three to six months of essential expenses, while Coast FIRE goals emphasize building a sufficient retirement nest egg early so future contributions become unnecessary, aligning with minimalist retire-early milestones by reducing ongoing savings pressures. Focusing on Coast FIRE accelerates financial independence through disciplined investing, whereas a robust emergency fund ensures stability against unexpected costs without compromising long-term growth.

Buffer-to-Coast Ratio

The Buffer-to-Coast Ratio measures the stability between emergency fund holdings and Coast FIRE investments, indicating financial resilience and growth potential. A higher ratio prioritizes immediate liquidity for unexpected expenses, while a lower ratio emphasizes accelerated retirement funding through compounded investment growth.

Auto-Escalation Savings Plan

The Emergency Fund goal prioritizes liquidity to cover unexpected expenses, while the Coast FIRE goal emphasizes early investment growth with minimal ongoing contributions; implementing an Auto-Escalation Savings Plan optimizes cash flow by automatically increasing savings rates, accelerating progress toward both financial objectives. This strategy leverages compounding returns for Coast FIRE and ensures a safety net through systematic emergency fund accumulation, balancing risk management with wealth building.

Partial Financial Independence Point (PFIP)

The Partial Financial Independence Point (PFIP) reflects a pivotal stage in money management where emergency fund goals provide liquidity for unexpected expenses, while the Coast FIRE goal emphasizes investing early to grow wealth passively until full retirement funding is achieved. Balancing PFIP involves maintaining sufficient cash reserves for immediate security alongside leveraging compound growth strategies inherent in Coast FIRE to optimize long-term financial stability.

Bridge Fund Optimization

Emergency fund goals prioritize liquidity and immediate access to cover 3-6 months of essential expenses, serving as a financial safety net against unexpected events. Coast FIRE goals focus on investment growth sufficient to cover future retirement needs, making Bridge Fund Optimization crucial for efficiently balancing short-term emergency cash reserves with long-term investment contributions.

Intermittent Income Hedging

Emergency fund goals provide immediate liquidity to cover unexpected expenses, ensuring financial stability during income fluctuations, while Coast FIRE goals focus on long-term financial independence with minimal active contributions. Prioritizing an emergency fund offers a robust buffer against intermittent income disruptions, making it a critical strategy for effective intermittent income hedging.

Emergency fund goal vs Coast FIRE goal for money management. Infographic

moneydiff.com

moneydiff.com