Paying off debt using the debt snowball method focuses on tackling smaller balances first to build momentum and motivation toward financial goals. This approach contrasts with simply targeting high-interest debts, as the psychological boost can accelerate overall progress. Prioritizing debt payoff with the snowball method can lead to more consistent goal achievement and improved financial discipline.

Table of Comparison

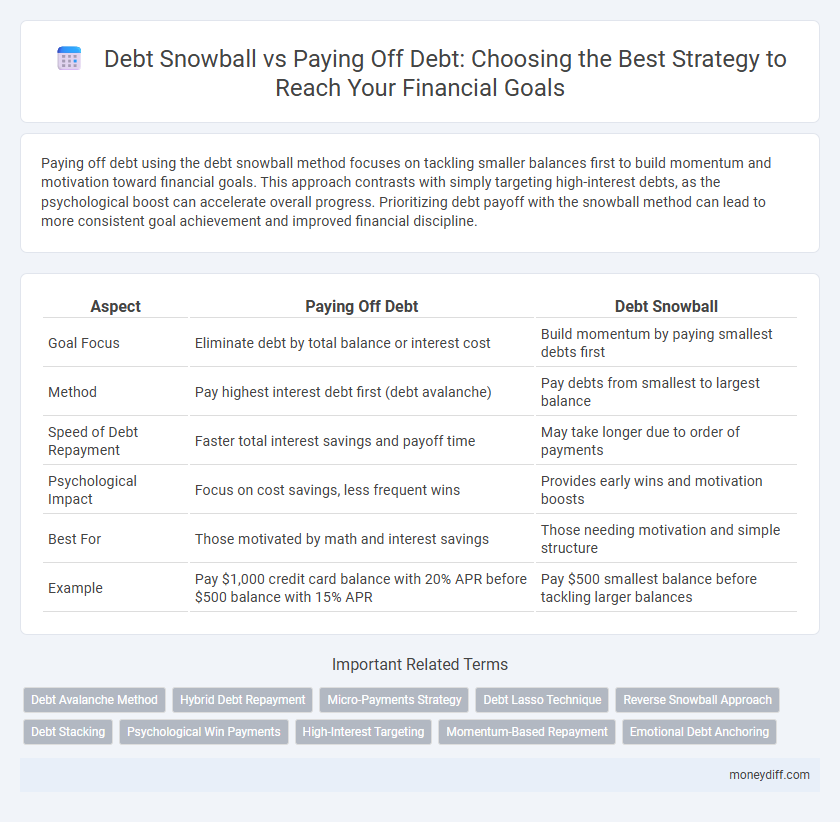

| Aspect | Paying Off Debt | Debt Snowball |

|---|---|---|

| Goal Focus | Eliminate debt by total balance or interest cost | Build momentum by paying smallest debts first |

| Method | Pay highest interest debt first (debt avalanche) | Pay debts from smallest to largest balance |

| Speed of Debt Repayment | Faster total interest savings and payoff time | May take longer due to order of payments |

| Psychological Impact | Focus on cost savings, less frequent wins | Provides early wins and motivation boosts |

| Best For | Those motivated by math and interest savings | Those needing motivation and simple structure |

| Example | Pay $1,000 credit card balance with 20% APR before $500 balance with 15% APR | Pay $500 smallest balance before tackling larger balances |

Understanding the Basics: Paying Off Debt vs Debt Snowball

Paying off debt involves prioritizing high-interest balances to minimize overall interest costs and accelerate financial freedom. The Debt Snowball method focuses on eliminating the smallest debts first, creating motivation through quick wins that build momentum. Understanding these approaches helps tailor a debt repayment strategy that aligns with individual financial goals and psychological preferences.

Key Differences Between Debt Snowball and Traditional Repayment

The key difference between debt snowball and traditional repayment methods lies in the payoff strategy: debt snowball prioritizes paying off the smallest debts first to build momentum and motivation, whereas traditional repayment focuses on targeting the highest-interest debts to minimize overall interest payments. Debt snowball emphasizes psychological benefits and steady progress, while traditional repayment maximizes financial efficiency by reducing total interest costs. Choosing between these methods depends on individual financial goals and behavioral preferences.

Pros and Cons of the Debt Snowball Method

The Debt Snowball method accelerates motivation by prioritizing smaller debts first, creating quick wins that encourage continued progress toward the goal of becoming debt-free. However, this approach may not minimize total interest paid as effectively as targeting higher-interest debts first, potentially increasing overall repayment costs. Users must balance the psychological benefits of early successes with the financial implications of longer-term interest accumulation.

Benefits of Paying Off High-Interest Debt First

Paying off high-interest debt first saves significant money on interest payments, accelerating overall debt reduction and freeing up funds faster for other financial goals. This approach effectively reduces the principal balance more quickly, which decreases the total amount owed and shortens the repayment timeline. Prioritizing high-interest debts like credit cards or payday loans minimizes financial stress and improves credit scores more rapidly than other methods.

Creating a Debt Repayment Strategy Aligned with Your Goals

Creating a debt repayment strategy aligned with your goals involves prioritizing either paying off high-interest debt first or using the debt snowball method to build momentum. The debt snowball method focuses on paying off smaller balances quickly to boost motivation, while interest-first strategies minimize overall cost by targeting expensive debt. Choosing the right approach depends on your financial objectives, whether it's reducing interest payments or maintaining motivation to stay on track.

How to Choose the Right Debt Payoff Method

Choosing the right debt payoff method depends on individual financial goals, psychological motivation, and debt structure. The debt snowball method targets paying off the smallest balances first to build momentum, enhancing motivation through quick wins, while focusing on high-interest debts prioritizes minimizing overall interest paid. Evaluating monthly cash flow, interest rates, and personal discipline helps determine whether to pursue faster savings or sustained motivation for long-term debt elimination.

Psychological Impact: Staying Motivated with Debt Snowball

Paying off debt using the Debt Snowball method leverages psychological momentum by targeting smaller balances first, which creates frequent wins and boosts motivation. This approach enhances commitment to the overall goal by providing clear progress and tangible achievements, reducing feelings of overwhelm. The increased confidence and motivation help maintain consistent payments, accelerating debt reduction compared to focusing strictly on interest rates.

Real-Life Success Stories: Debt Snowball vs Other Methods

Real-life success stories reveal that the debt snowball method boosts motivation by prioritizing smaller debts, leading to quicker wins and increased momentum. Compared to other methods like debt avalanche, which targets high-interest debts first, the debt snowball's psychological benefits often result in higher completion rates. Numerous individuals share testimonials of achieving financial freedom faster through snowball strategies due to consistent progress and improved budgeting habits.

Common Mistakes to Avoid When Paying Off Debt

Failing to create a realistic budget often leads to overspending and stalled progress in debt repayment goals. Ignoring high-interest debts can increase overall costs, diminishing the efficiency of methods like the debt snowball. Underestimating expenses or neglecting an emergency fund can cause unexpected financial setbacks, preventing consistent payments and extending the payoff timeline.

Tracking Progress and Celebrating Milestones in Debt Repayment

Tracking progress in debt repayment involves regularly updating balances and visualizing reductions through charts or apps, which enhances motivation and commitment to financial goals. Celebrating milestones, such as paying off individual debts or reaching specific percentage reductions, reinforces positive behavior and sustains momentum in the debt snowball method. This approach leverages psychological rewards to maintain focus and accelerate the path to becoming debt-free.

Related Important Terms

Debt Avalanche Method

The Debt Avalanche Method accelerates goal achievement by targeting debts with the highest interest rates first, maximizing interest savings over time. This strategic approach reduces overall debt faster compared to the Debt Snowball method, which prioritizes smaller balances regardless of interest cost.

Hybrid Debt Repayment

Hybrid debt repayment combines the psychological boost of the debt snowball method, where smaller debts are paid off first, with the financial efficiency of paying off high-interest debts early. This balanced approach accelerates debt reduction while maintaining motivation to achieve the goal of becoming debt-free.

Micro-Payments Strategy

The Micro-Payments Strategy accelerates debt reduction by making frequent, small payments that reduce principal balance faster and decrease interest accrual compared to traditional Debt Snowball methods. This approach enhances cash flow management and creates momentum without waiting to pay off larger balances first, optimizing goal-driven debt repayment.

Debt Lasso Technique

The Debt Lasso Technique combines the psychological motivation of the Debt Snowball method with the financial efficiency of the Debt Avalanche, prioritizing debts based on interest rates while maintaining momentum through quick wins. This hybrid strategy accelerates debt payoff and maximizes savings on interest, making it a powerful goal for individuals seeking to eliminate debt systematically and sustainably.

Reverse Snowball Approach

The Reverse Snowball Approach prioritizes paying off large debts with the highest interest rates first, maximizing savings on interest payments and accelerating overall debt reduction. This method contrasts with the traditional Debt Snowball by focusing on financial efficiency rather than psychological motivation, helping individuals achieve their goal of becoming debt-free more quickly.

Debt Stacking

Debt stacking focuses on paying off debts with the highest interest rates first, reducing the overall cost of debt faster than the debt snowball method, which prioritizes smaller balances. Choosing debt stacking accelerates financial freedom by minimizing interest payments and improving cash flow efficiency.

Psychological Win Payments

Psychological win payments in debt repayment leverage small victories to boost motivation and reinforce commitment, making the Debt Snowball method effective by prioritizing smaller debts first. This approach capitalizes on immediate positive feedback, enhancing persistence and reducing the emotional burden of debt compared to traditional payoff strategies.

High-Interest Targeting

Focusing on high-interest debt targets maximizes savings by reducing the total interest paid over time, accelerating overall debt payoff. Prioritizing balances with the highest interest rates ensures faster relief from costly debt burdens compared to the debt snowball method's focus on smaller balances first.

Momentum-Based Repayment

Momentum-based repayment strategies like the debt snowball method prioritize paying off smaller debts first to build psychological momentum, which can improve motivation and adherence to a debt reduction plan. This approach contrasts with traditional payoff methods that target high-interest debts first, emphasizing behavior-driven progress over strict financial optimization.

Emotional Debt Anchoring

Paying off debt using the debt snowball method leverages emotional debt anchoring by prioritizing smaller balances, creating quick psychological wins and boosting motivation. This approach strengthens goal commitment as each cleared debt reduces mental burden, encouraging sustained financial discipline.

Paying Off Debt vs Debt Snowball for goal. Infographic

moneydiff.com

moneydiff.com