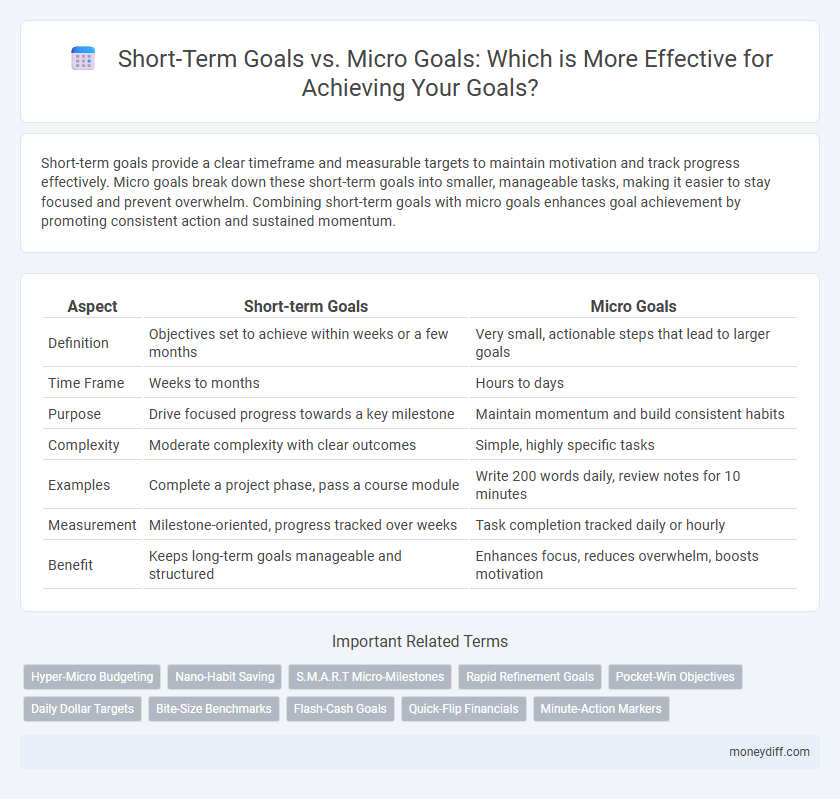

Short-term goals provide a clear timeframe and measurable targets to maintain motivation and track progress effectively. Micro goals break down these short-term goals into smaller, manageable tasks, making it easier to stay focused and prevent overwhelm. Combining short-term goals with micro goals enhances goal achievement by promoting consistent action and sustained momentum.

Table of Comparison

| Aspect | Short-term Goals | Micro Goals |

|---|---|---|

| Definition | Objectives set to achieve within weeks or a few months | Very small, actionable steps that lead to larger goals |

| Time Frame | Weeks to months | Hours to days |

| Purpose | Drive focused progress towards a key milestone | Maintain momentum and build consistent habits |

| Complexity | Moderate complexity with clear outcomes | Simple, highly specific tasks |

| Examples | Complete a project phase, pass a course module | Write 200 words daily, review notes for 10 minutes |

| Measurement | Milestone-oriented, progress tracked over weeks | Task completion tracked daily or hourly |

| Benefit | Keeps long-term goals manageable and structured | Enhances focus, reduces overwhelm, boosts motivation |

Understanding Short-Term Goals in Money Management

Short-term goals in money management typically involve financial targets set to be achieved within a few months to a year, such as saving for an emergency fund or paying off a credit card balance. Micro goals break these objectives into smaller, actionable steps, like saving $50 weekly or reducing monthly dining expenses by 20%. This granular approach enhances motivation and tracking, making it easier to reach overall financial goals effectively.

Defining Micro Goals: The Small Steps to Big Financial Wins

Micro goals break down financial ambitions into manageable, short-term targets that facilitate consistent progress and accountability. Unlike broader short-term goals, micro goals focus on precise actions such as saving a fixed amount daily or tracking expenses weekly, ensuring momentum toward larger financial achievements. Defining micro goals helps maintain motivation, reduces overwhelm, and builds habits essential for long-term fiscal success.

Key Differences Between Short-Term and Micro Goals

Short-term goals typically span weeks to months and focus on achieving broader milestones, while micro goals break these into smaller, manageable tasks that can be completed daily or hourly. The key difference lies in their scale and time frame: short-term goals guide overall progress, whereas micro goals drive consistent, immediate actions. This division enhances motivation and productivity by aligning long-term objectives with actionable steps.

Benefits of Setting Short-Term Financial Goals

Setting short-term financial goals enhances focus and motivation by providing clear, achievable targets that help manage cash flow and prevent overspending. These goals enable frequent progress tracking, boosting confidence and encouraging consistent saving habits. Unlike micro goals, short-term financial goals balance ambition with practicality, facilitating better financial discipline and quicker realization of monetary objectives.

The Power of Micro Goals in Daily Money Habits

Micro goals in daily money habits enhance financial discipline by breaking larger financial objectives into manageable, actionable steps. These small, precise targets increase motivation and consistency, enabling easier tracking of progress and adjustments in spending or saving behaviors. Compared to short-term goals, micro goals create an immediate sense of achievement that reinforces positive money habits and accelerates financial growth.

How to Prioritize Short-Term Goals Over Micro Goals

Short-term goals provide a clear framework for prioritizing tasks by setting achievable milestones within a specific timeframe, which helps maintain focus and motivation. Micro goals, while beneficial for detailed progress tracking, can often cause distraction due to their excessive granularity and may dilute effort across too many small tasks. Prioritizing short-term goals ensures alignment with broader objectives, enabling efficient resource allocation and measurable progress toward long-term success.

When to Use Micro Goals for Effective Budgeting

Micro goals are highly effective for budgeting during times of financial uncertainty or when managing tight cash flow, as they break down larger financial targets into manageable, actionable steps. Implementing micro goals allows for regular tracking and adjustments, enhancing accountability and ensuring consistent progress toward overall savings or expense reduction objectives. This approach is particularly useful in short-term budgeting cycles, where quick wins can motivate ongoing commitment and prevent overspending.

Common Mistakes in Setting Short-Term vs Micro Goals

Common mistakes in setting short-term goals include overly broad objectives lacking clear action steps, leading to ambiguity and stalled progress. Micro goals often fail when they are either too trivial to motivate or too complex to complete quickly, undermining their purpose of fostering consistent momentum. Prioritizing specific, measurable, and achievable targets ensures effective goal-setting strategies that drive tangible results.

Integrating Micro Goals with Short-Term Planning

Integrating micro goals with short-term planning enhances focus and increases the likelihood of achieving larger objectives by breaking down tasks into manageable, actionable steps. Micro goals serve as incremental milestones that provide frequent feedback and motivation within the short-term timeline. This approach optimizes productivity and ensures consistent progress toward overarching ambitions.

Maximizing Financial Success: Short-Term and Micro Goals Combined

Short-term goals provide clear financial milestones within months to a year, facilitating tangible progress and motivation. Micro goals break these targets into daily or weekly actionable steps, ensuring consistent focus and habit formation. Combining both strategies maximizes financial success by offering a structured roadmap while maintaining flexibility and sustained momentum.

Related Important Terms

Hyper-Micro Budgeting

Short-term goals break objectives into manageable time frames, enabling focused progress, while micro goals refine this approach further through hyper-micro budgeting by allocating resources at an ultra-specific level for precise financial control and optimized spending efficiency. This strategy enhances goal achievement by promoting disciplined resource management and clear, measurable milestones.

Nano-Habit Saving

Short-term goals provide clear milestones for immediate progress, while micro goals break these milestones into manageable nano-habit savings that foster consistency and long-term success. Prioritizing nano-habit saving enhances goal achievement by creating sustainable daily actions that compound into significant results over time.

S.M.A.R.T Micro-Milestones

Short-term goals provide clear, time-bound targets that guide progress, while S.M.A.R.T micro-milestones break these goals into actionable, measurable steps enhancing focus and motivation. Implementing Specific, Measurable, Achievable, Relevant, and Time-bound criteria in micro-milestones ensures consistent advancement and adaptability within goal achievement strategies.

Rapid Refinement Goals

Rapid refinement goals prioritize micro goals over short-term goals by breaking down objectives into precise, manageable tasks that accelerate progress and adaptability. This approach enhances focus, allowing continuous adjustments based on immediate feedback, leading to more efficient goal achievement.

Pocket-Win Objectives

Short-term goals provide clear, achievable targets within a limited timeframe, while micro goals break these down into even smaller Pocket-Win Objectives that boost motivation and maintain momentum. Emphasizing Pocket-Win Objectives enhances focus by creating frequent successes that drive consistent progress toward larger ambitions.

Daily Dollar Targets

Short-term goals set broader milestones over weeks or months, while micro goals break these targets into achievable daily dollar amounts enhancing focus and motivation. Tracking daily dollar targets with micro goals improves financial discipline and accelerates progress toward larger financial objectives.

Bite-Size Benchmarks

Short-term goals provide clear, achievable targets within a limited timeframe, while micro goals break these down further into bite-size benchmarks that enhance motivation and track incremental progress. This granular approach increases focus and accountability, helping individuals maintain momentum and achieve larger objectives effectively.

Flash-Cash Goals

Flash-Cash Goals, a type of micro goal, offer immediate financial rewards that boost motivation and maintain momentum toward broader objectives. Unlike short-term goals, which may span weeks or months, flash-cash goals deliver quick wins within days, enhancing focus and accelerating progress in goal achievement.

Quick-Flip Financials

Short-term goals provide clear financial targets within weeks or months to drive Quick-Flip Financials decisions, ensuring measurable progress and cash flow management. Micro goals break these targets into actionable daily tasks, enhancing focus and accelerating rapid property turnovers for maximizing profits.

Minute-Action Markers

Short-term goals provide clear milestones within a larger plan, while micro goals break these into even smaller steps using minute-action markers that enhance focus and momentum. These micro goals enable precise tracking of progress by emphasizing specific, actionable tasks completed within brief time frames.

Short-term Goals vs Micro Goals for goal. Infographic

moneydiff.com

moneydiff.com