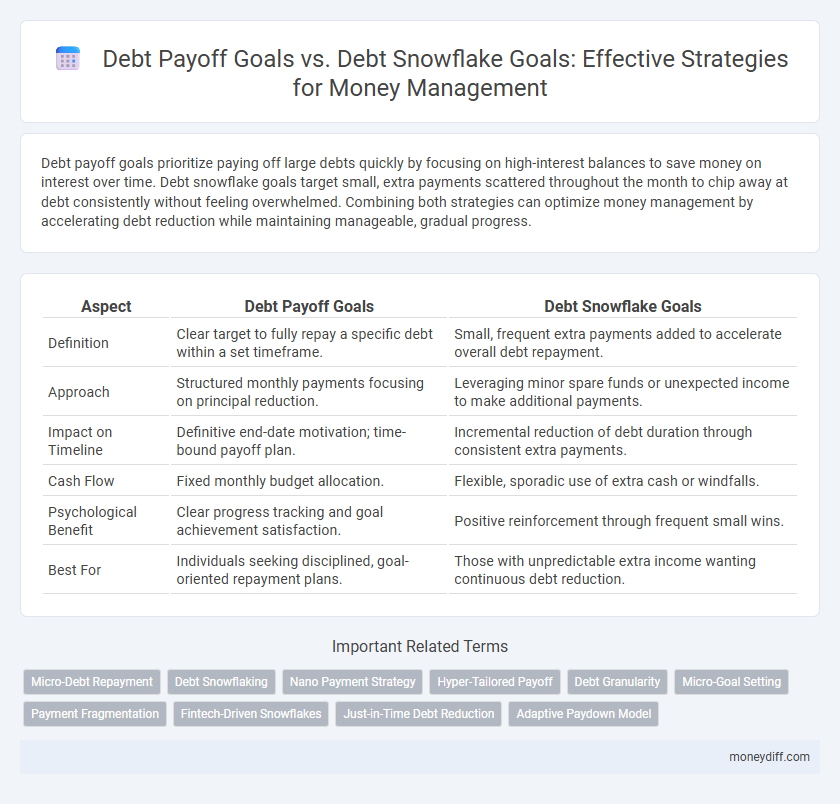

Debt payoff goals prioritize paying off large debts quickly by focusing on high-interest balances to save money on interest over time. Debt snowflake goals target small, extra payments scattered throughout the month to chip away at debt consistently without feeling overwhelmed. Combining both strategies can optimize money management by accelerating debt reduction while maintaining manageable, gradual progress.

Table of Comparison

| Aspect | Debt Payoff Goals | Debt Snowflake Goals |

|---|---|---|

| Definition | Clear target to fully repay a specific debt within a set timeframe. | Small, frequent extra payments added to accelerate overall debt repayment. |

| Approach | Structured monthly payments focusing on principal reduction. | Leveraging minor spare funds or unexpected income to make additional payments. |

| Impact on Timeline | Definitive end-date motivation; time-bound payoff plan. | Incremental reduction of debt duration through consistent extra payments. |

| Cash Flow | Fixed monthly budget allocation. | Flexible, sporadic use of extra cash or windfalls. |

| Psychological Benefit | Clear progress tracking and goal achievement satisfaction. | Positive reinforcement through frequent small wins. |

| Best For | Individuals seeking disciplined, goal-oriented repayment plans. | Those with unpredictable extra income wanting continuous debt reduction. |

Understanding Debt Payoff Goals

Debt payoff goals focus on systematically reducing outstanding balances through targeted payments, prioritizing high-interest debts to minimize total financial costs. This strategic approach contrasts with debt snowflake goals, which involve making small, frequent payments from spare change or incidental funds to accelerate debt reduction. Understanding debt payoff goals enables individuals to develop a clear, prioritized plan for eliminating debt efficiently and improving overall financial health.

Exploring Debt Snowflake Goals

Debt snowflake goals focus on making small, incremental payments toward debt using unexpected or extra funds, accelerating overall debt payoff without relying solely on large, fixed payments. This method leverages everyday savings and windfalls, such as cashback rewards or temporary budget surpluses, to chip away at balances more frequently, reducing interest accumulation. Implementing debt snowflake goals complements traditional debt payoff strategies by increasing payment frequency and fostering consistent progress toward financial freedom.

Core Differences Between Debt Payoff and Snowflake Strategies

Debt payoff goals focus on systematically reducing large debt balances through targeted payments, prioritizing high-interest or larger loans to minimize overall interest costs. Snowflake goals emphasize accumulating extra payments by using small, irregular amounts of spare change or unexpected savings, accelerating debt reduction without strict payment schedules. The core difference lies in the structured, prioritized approach of debt payoff versus the flexible, opportunistic contributions of the snowflake method.

Benefits of Setting Debt Payoff Goals

Setting debt payoff goals accelerates financial freedom by providing clear targets and motivating disciplined repayment strategies. These goals improve budgeting efficiency by prioritizing high-interest debts, reducing overall interest paid over time. Consistent progress tracking fosters accountability and helps avoid accumulating new debt, enhancing long-term financial stability.

Advantages of Debt Snowflake Goals for Quick Wins

Debt snowflake goals enable rapid progress by targeting small, manageable payments that cumulatively reduce debt faster than traditional payoff plans. This method boosts motivation through frequent quick wins, reinforcing positive money management habits and maintaining momentum. Leveraging everyday savings from minor expenses accelerates debt payoff while minimizing financial strain.

Which Debt Reduction Strategy Suits Your Finances?

Debt payoff goals concentrate on systematically eliminating high-interest debts through fixed payments, while debt snowflake goals focus on making small, frequent extra payments to accelerate debt reduction. Understanding your cash flow and financial discipline helps determine whether a structured payoff plan or flexible snowflake strategy fits better with your budget. Evaluate interest rates, income stability, and spending habits to choose the debt reduction method that aligns with your financial priorities.

Integrating Debt Snowflake Methods With Traditional Payoff Plans

Integrating debt snowflake methods with traditional payoff plans accelerates debt reduction by applying small, frequent extra payments toward outstanding balances, complementing structured monthly installments. This hybrid approach enhances cash flow management and maximizes interest savings by targeting high-interest debts more efficiently than standard payoff plans alone. Leveraging automated micro-payments alongside strategic principal reductions creates a sustainable and flexible debt management strategy.

Common Pitfalls in Debt Elimination Tactics

Debt payoff goals often struggle due to underestimating interest accumulation and neglecting high-interest debts, while debt snowflake goals risk fragmentation of payments that delay full debt elimination. Common pitfalls include failing to prioritize debt with the highest interest rates and overlooking budget inconsistencies that reduce payment amounts over time. Optimizing debt elimination requires targeted strategies such as the avalanche method, accurate budgeting, and consistent payment tracking to avoid prolonged financial burdens.

Measuring Progress: Snowflake vs Payoff Goal Success

Debt payoff goals track progress by reducing the total principal balance over time, providing clear milestones and motivating consistent payments toward elimination. Snowflake goals measure incremental gains from small, irregular payments that chip away at debt faster than scheduled, emphasizing flexibility and cumulative impact. Combining both methods enhances money management by balancing structured payoff plans with adaptive, frequent contributions to accelerate debt freedom.

Choosing the Right Goal for Long-Term Financial Freedom

Debt payoff goals target eliminating specific debts by prioritizing balances or interest rates, creating a structured path to financial freedom. Debt snowflake goals involve making small, frequent payments that accelerate debt reduction through consistent extra contributions. Selecting the right approach depends on individual cash flow, motivation style, and commitment level to ensure sustainable progress toward long-term financial freedom.

Related Important Terms

Micro-Debt Repayment

Micro-debt repayment through debt snowflake goals targets small, frequent payments that accelerate overall debt reduction faster than traditional lump-sum payoff methods. Incorporating consistent micro-payments into daily cash flow optimizes money management by minimizing interest accumulation and boosting financial momentum.

Debt Snowflaking

Debt snowflake goals accelerate money management by leveraging small, irregular payments to reduce debt faster than standard debt payoff goals. This strategy capitalizes on everyday savings and windfalls, maximizing progress without requiring significant budget changes.

Nano Payment Strategy

Debt payoff goals prioritize allocating fixed amounts toward reducing principal balances, while the Debt Snowflake strategy leverages small, frequent nano payments from unexpected income or savings to accelerate debt reduction. Nano payment strategies optimize cash flow by applying incremental funds directly to high-interest debts, maximizing interest savings and shortening payoff timelines.

Hyper-Tailored Payoff

Hyper-tailored payoff strategies combine the efficiency of Debt Payoff Goals with the flexibility of Debt Snowflake methods, enabling personalized prioritization based on interest rates, balances, and spending patterns. This approach maximizes acceleration of debt reduction while maintaining manageable monthly payments aligned with individual financial behaviors.

Debt Granularity

Debt payoff goals prioritize reducing overall debt balances systematically, focusing on high-interest accounts first, while debt snowflake goals emphasize making numerous small, irregular payments to multiple debts, enhancing granularity and momentum in money management. Employing fine-grained debt granularity allows for tailored strategies that optimize cash flow allocation and accelerate debt reduction through targeted micro-payments.

Micro-Goal Setting

Micro-goal setting in money management enhances debt payoff strategies by breaking down large balances into manageable payments, often utilized in debt snowflake methods where small, extra amounts accelerate reduction. Unlike traditional debt payoff goals that target specific lump sums, snowflake goals leverage frequent, incremental payments to optimize interest savings and improve financial discipline.

Payment Fragmentation

Debt payoff goals target lump-sum payments to eliminate balances faster, while debt snowflake goals emphasize small, frequent payments that reduce overall interest through payment fragmentation. This fragmentation strategy accelerates progress by utilizing leftover funds consistently, optimizing cash flow without needing large payments.

Fintech-Driven Snowflakes

Fintech-driven snowflake strategies leverage automated micro-payments to accelerate debt payoff by targeting small, frequent amounts beyond minimum payments, optimizing cash flow without disrupting budgets. Compared to traditional debt payoff goals, snowflake goals enhance financial agility and momentum through real-time tracking and AI-powered adjustments, enabling more efficient overall debt reduction.

Just-in-Time Debt Reduction

Debt payoff goals emphasize targeting high-interest debts to minimize total interest paid, while debt snowflake goals focus on using small, frequent payments to chip away at balances incrementally. Just-in-time debt reduction optimizes cash flow by applying extra funds precisely when payments are due, accelerating debt elimination without disrupting essential expenses.

Adaptive Paydown Model

The Adaptive Paydown Model prioritizes flexible debt payoff goals by combining high-interest focus with small, manageable payments inspired by debt snowflake techniques to accelerate overall debt reduction. This approach optimizes cash flow allocation, reduces interest costs, and adapts to financial fluctuations, enhancing long-term money management efficiency.

Debt Payoff Goals vs Debt Snowflake Goals for money management. Infographic

moneydiff.com

moneydiff.com