A Debt Payoff Goal targets eliminating specific debts by prioritizing balances with the highest interest rates to minimize overall costs. In contrast, a Debt Snowball Stacking Goal focuses on paying off smaller debts first to build momentum and motivation through quick wins. Choosing between these strategies depends on whether you prioritize financial efficiency or psychological encouragement in your money management approach.

Table of Comparison

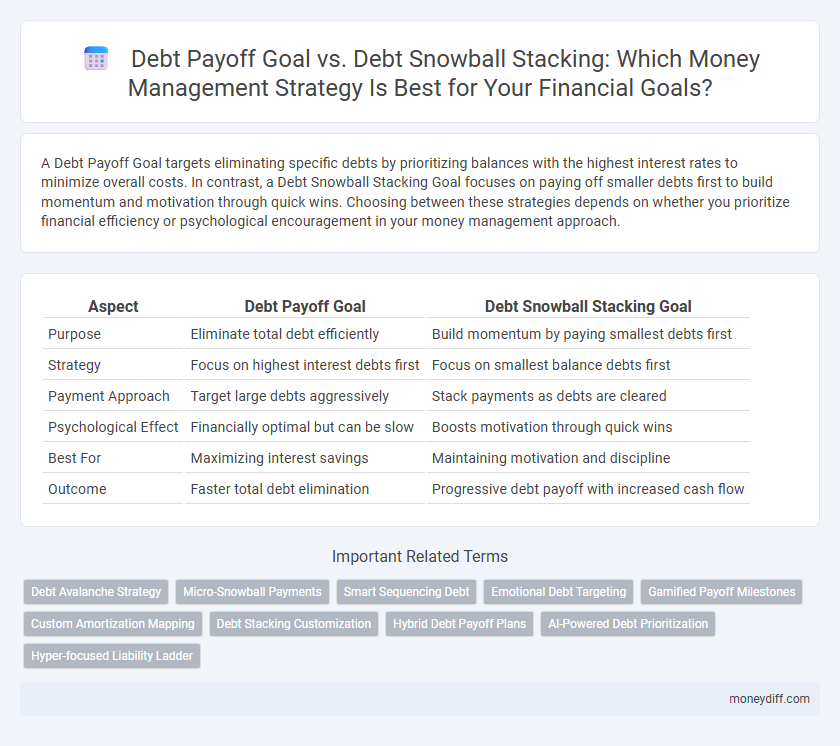

| Aspect | Debt Payoff Goal | Debt Snowball Stacking Goal |

|---|---|---|

| Purpose | Eliminate total debt efficiently | Build momentum by paying smallest debts first |

| Strategy | Focus on highest interest debts first | Focus on smallest balance debts first |

| Payment Approach | Target large debts aggressively | Stack payments as debts are cleared |

| Psychological Effect | Financially optimal but can be slow | Boosts motivation through quick wins |

| Best For | Maximizing interest savings | Maintaining motivation and discipline |

| Outcome | Faster total debt elimination | Progressive debt payoff with increased cash flow |

Understanding Debt Payoff Goals: An Overview

Debt Payoff Goals focus on eliminating outstanding balances through structured repayment plans, prioritizing high-interest debts to minimize total interest paid. The Debt Snowball Stacking Goal emphasizes paying off smaller debts first to build momentum and motivation by quickly clearing balances. Understanding these approaches helps tailor money management strategies to individual financial situations and psychological preferences.

What Is the Debt Snowball Stacking Method?

The Debt Snowball Stacking Method is a debt repayment strategy focused on paying off multiple debts by stacking extra payments toward the smallest balance while maintaining minimum payments on larger debts. This approach accelerates momentum through quick wins, boosting motivation and encouraging consistent progress toward becoming debt-free. Compared to traditional payoff goals, the Debt Snowball Stacking Method prioritizes psychological benefits and steady reduction of overall debt balances.

Key Differences: Debt Payoff vs. Debt Snowball Stacking

Debt Payoff Goal targets eliminating debt by prioritizing balances based on interest rates, minimizing overall interest and accelerating financial freedom. Debt Snowball Stacking Goal focuses on paying off smallest debts first to build momentum and motivation through quicker wins. Key differences include strategic prioritization--interest-driven for Debt Payoff versus balance-driven for Snowball--and psychological impact influencing long-term money management success.

Benefits of Setting a Debt Payoff Goal

Setting a debt payoff goal provides clear financial direction, enhancing motivation and accountability while reducing interest costs over time. This targeted approach enables prioritization of high-interest debts, accelerating overall debt reduction and improving credit scores. Focusing on a specific payoff goal fosters disciplined spending habits and creates a measurable path to financial freedom.

Advantages of Using the Debt Snowball Stacking Strategy

The Debt Snowball Stacking Goal accelerates debt repayment by focusing on paying off smaller balances first, creating quick wins that boost motivation. This strategy minimizes the psychological burden of debt, encouraging consistent progress and better financial discipline. By stacking payments onto cleared debts, individuals can systematically eliminate liabilities faster than traditional payoff methods.

Choosing the Right Approach for Your Financial Situation

Choosing the right debt payoff goal depends on your financial situation and motivation preferences, with the Debt Snowball method focusing on paying off smaller balances first to build momentum, while the Debt Payoff Goal targets higher-interest debts for faster overall savings. Prioritize the Debt Snowball approach if psychological wins and consistency keep you motivated; select a Debt Payoff Goal if minimizing interest payments and total debt duration aligns with your long-term financial objectives. Tailoring your strategy to your income, debt types, and spending habits enhances the effectiveness of your money management plan.

Steps to Create an Effective Debt Payoff Plan

Creating an effective debt payoff plan involves prioritizing high-interest debts to minimize overall interest payments, aligning with the Debt Payoff Goal strategy. The Debt Snowball Stacking Goal focuses on paying off smaller balances first to build momentum and motivation, which can psychologically boost commitment to becoming debt-free. Combining detailed budgeting, automatic payments, and consistent progress tracking enhances the success rate of both debt payoff methods in long-term money management.

Potential Challenges in Debt Snowball Stacking

Debt Snowball Stacking can create challenges such as increased complexity in tracking multiple debts simultaneously, which may lead to confusion and decreased motivation. This strategy might also result in paying more interest over time compared to focusing on high-interest debts first, potentially prolonging the debt payoff period. Managing various payment amounts and schedules requires strong organizational skills to avoid missed payments and maintain financial discipline.

Measuring Progress: Tracking Your Debt Reduction Success

Tracking your debt payoff progress requires precise measurement methods tailored to your chosen strategy, whether it's the Debt Payoff Goal focusing on overall debt reduction or the Debt Snowball Stacking Goal emphasizing the elimination of smaller balances first. Utilize key performance indicators like remaining balance, interest saved, and payment consistency to evaluate effectiveness, ensuring timely adjustments in your repayment plan. Automated debt tracking apps and spreadsheets enhance visibility and motivation by providing real-time updates on progress toward your financial freedom.

Maximizing Results: Combining Debt Payoff and Snowball Strategies

Combining debt payoff and debt snowball stacking strategies maximizes progress by targeting high-interest debts first while maintaining motivational momentum from smaller balances. Prioritizing high-interest debts reduces total interest paid, and sequentially clearing smaller debts builds financial discipline and confidence. This hybrid approach accelerates overall debt elimination, optimizing money management outcomes.

Related Important Terms

Debt Avalanche Strategy

The Debt Avalanche Strategy prioritizes paying off debts with the highest interest rates first, minimizing total interest paid and accelerating overall debt payoff compared to the Debt Snowball Stacking Goal, which focuses on paying smallest balances first. This interest-rate-focused approach enhances money management efficiency by reducing the total repayment period and financial cost.

Micro-Snowball Payments

Micro-Snowball Payments in debt management prioritize making small, consistent extra payments toward the smallest debt balances, accelerating payoff through psychological momentum and interest savings. Compared to traditional Debt Payoff Goals, the Debt Snowball Stacking Goal leverages this method by systematically targeting debts in ascending order, maximizing motivation and financial efficiency in budgeting strategies.

Smart Sequencing Debt

Smart Sequencing Debt prioritizes high-interest balances first, optimizing overall interest savings, while Debt Snowball Stacking Goal focuses on paying off the smallest debts to build momentum through quick wins. This strategic approach enhances money management by balancing psychological motivation with financial efficiency for faster debt elimination.

Emotional Debt Targeting

Debt payoff goals prioritize eliminating high-interest balances to reduce financial stress and improve credit scores, while debt snowball stacking goals focus on paying off smaller debts first, boosting motivation through emotional wins. Targeting emotional debt by celebrating these incremental victories enhances discipline and sustains momentum in money management strategies.

Gamified Payoff Milestones

Debt Payoff Goals focus on eliminating individual debts by aggressively targeting the highest interest balances first, while Debt Snowball Stacking Goals prioritize paying off smaller debts sequentially to build momentum through quick wins. Gamified Payoff Milestones enhance both strategies by introducing engaging rewards and progress tracking, motivating consistent payments and fostering better money management habits.

Custom Amortization Mapping

Custom amortization mapping enhances debt payoff goals by allowing tailored payment schedules that prioritize higher-interest debts, optimizing total interest reduction. Debt snowball stacking goal structures payments to eliminate smaller balances first, fostering momentum, but custom mapping maximizes efficiency by strategically allocating funds based on loan terms and interest rates.

Debt Stacking Customization

Debt Snowball Stacking Goal emphasizes paying off debts by prioritizing and stacking payments on higher-interest or strategically chosen debts for maximum financial impact. Customization in Debt Stacking allows tailoring payment amounts and order based on individual financial situations and goals, optimizing debt reduction speed and interest savings.

Hybrid Debt Payoff Plans

Hybrid Debt Payoff Plans combine elements of the Debt Payoff Goal and Debt Snowball Stacking Goal by targeting high-interest debts first while maintaining momentum through small wins from clearing smaller balances. This approach optimizes money management by balancing financial efficiency with psychological motivation, accelerating overall debt reduction.

AI-Powered Debt Prioritization

AI-powered debt prioritization enhances money management by optimizing Debt Payoff Goals through dynamic allocation based on interest rates and payment schedules, outperforming traditional Debt Snowball Stacking Goals that focus solely on smallest balances first. This intelligent approach accelerates overall debt reduction and minimizes interest costs by analyzing real-time financial data and adapting payoff strategies accordingly.

Hyper-focused Liability Ladder

Debt Payoff Goal prioritizes eliminating high-interest debts first, maximizing financial efficiency and reducing total interest paid, while Debt Snowball Stacking Goal focuses on paying off smaller debts sequentially to build momentum and motivation. The Hyper-focused Liability Ladder integrates both strategies, organizing debts from smallest to highest interest rates to optimize psychological wins and long-term cost savings in money management.

Debt Payoff Goal vs Debt Snowball Stacking Goal for money management Infographic

moneydiff.com

moneydiff.com