Setting a debt payoff goal prioritizes eliminating high-interest liabilities to improve financial stability and reduce stress. A 1-year cash cushion goal builds a substantial emergency fund, providing long-term security against unexpected expenses and income disruptions. Balancing these goals ensures effective money management by addressing immediate debt challenges while preparing for future financial resilience.

Table of Comparison

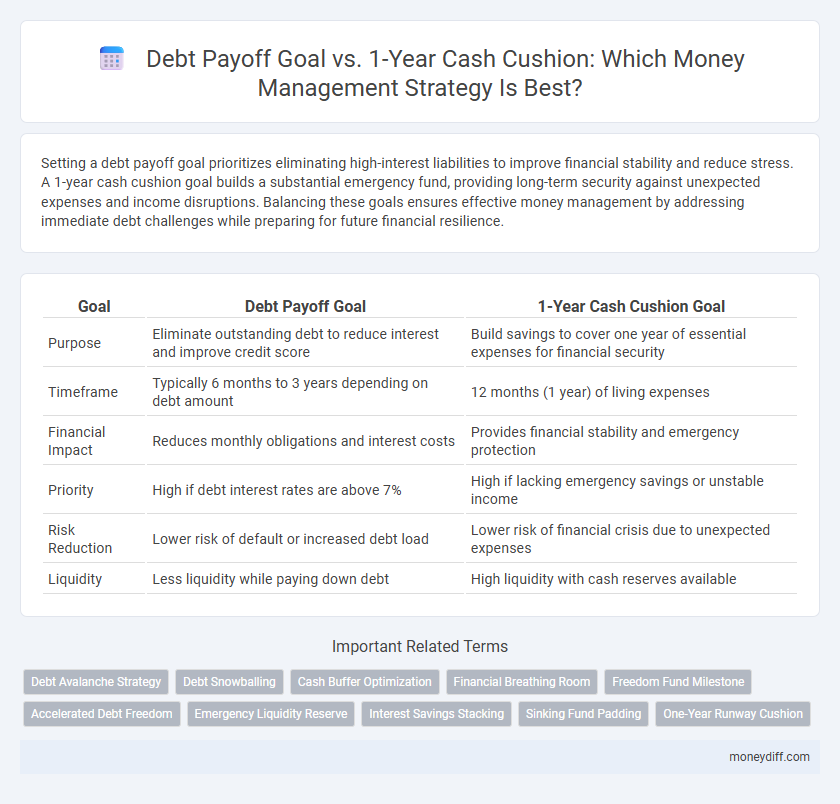

| Goal | Debt Payoff Goal | 1-Year Cash Cushion Goal |

|---|---|---|

| Purpose | Eliminate outstanding debt to reduce interest and improve credit score | Build savings to cover one year of essential expenses for financial security |

| Timeframe | Typically 6 months to 3 years depending on debt amount | 12 months (1 year) of living expenses |

| Financial Impact | Reduces monthly obligations and interest costs | Provides financial stability and emergency protection |

| Priority | High if debt interest rates are above 7% | High if lacking emergency savings or unstable income |

| Risk Reduction | Lower risk of default or increased debt load | Lower risk of financial crisis due to unexpected expenses |

| Liquidity | Less liquidity while paying down debt | High liquidity with cash reserves available |

Understanding Debt Payoff Goals

Focusing on a debt payoff goal accelerates financial freedom by prioritizing high-interest liabilities, reducing total interest payments over time. Establishing a one-year cash cushion goal ensures long-term financial stability, covering living expenses during emergencies or income disruptions. Balancing both goals optimizes money management by addressing immediate debt burdens while maintaining a safety net for unexpected financial challenges.

Defining a 1-Year Cash Cushion

A 1-year cash cushion goal involves saving enough liquid assets to cover all essential living expenses for an entire year, providing financial security during emergencies or income disruptions. This goal prioritizes liquidity and stability over reducing liabilities, contrasting with debt payoff goals which focus on eliminating outstanding balances to reduce interest expenses. Establishing a 1-year cash cushion ensures immediate access to funds without incurring new debt during unforeseen circumstances, making it a foundational element of prudent money management.

Pros and Cons of Focusing on Debt Repayment

Focusing on debt repayment accelerates financial freedom by reducing interest payments and improving credit scores, which can lead to long-term savings and increased borrowing power. However, prioritizing debt payoff over building a 1-year cash cushion may leave individuals vulnerable to unexpected expenses, risking deeper financial instability. Balancing debt reduction with emergency savings ensures both reduced liabilities and preparedness for unforeseen financial shocks.

Advantages of Building a Cash Cushion

Building a 1-year cash cushion provides financial stability by covering unexpected expenses without relying on credit, preventing additional debt accumulation. It enhances peace of mind and offers flexibility to pursue opportunities or handle emergencies. This liquid reserve supports long-term money management by reducing financial stress and promoting smarter spending habits.

Psychological Benefits: Debt-Free vs Financial Security

Paying off debt offers psychological benefits such as reduced stress and increased sense of control, leading to improved mental well-being. Maintaining a 1-year cash cushion fosters a strong sense of financial security, allowing for peace of mind during emergencies. Balancing both goals can provide comprehensive psychological resilience by combining freedom from debt with robust financial stability.

Interest Rates: Impact on Debt vs Savings

High-interest debt typically grows faster than the modest returns from a 1-year cash cushion savings account, making debt payoff a financially strategic priority. Balancing debt repayment with building a cash cushion requires comparing the interest rates: prioritize paying down debts with rates exceeding potential savings yields. Understanding this interest rate impact enhances money management by reducing overall financial costs and increasing long-term stability.

Risk Management in Money Goals

Prioritizing a 1-year cash cushion goal enhances financial security by providing a risk buffer against unexpected expenses, reducing reliance on high-interest debt. While debt payoff improves long-term financial health, maintaining adequate liquidity directly mitigates short-term risks associated with income disruptions. Effective money management balances aggressive debt reduction with a robust cash reserve to optimize risk management strategies.

Balancing Emergency Savings and Debt Payments

Balancing emergency savings and debt payments requires prioritizing a 1-year cash cushion while steadily reducing high-interest debt. Maintaining a cash reserve covering 12 months of expenses prevents financial setbacks during emergencies, ensuring stability as debt payoff accelerates. This dual approach enhances long-term financial health by minimizing reliance on credit while safeguarding against unexpected costs.

Personalization: Which Goal Fits Your Situation?

Choosing between a debt payoff goal and a 1-year cash cushion goal depends on your financial stability and risk tolerance. Prioritize debt payoff if high-interest loans burden your budget, as reducing liabilities improves credit score and cash flow. Opt for a 1-year cash cushion if job security is uncertain, providing a safety net that covers essential expenses and emergencies without accruing more debt.

Step-by-Step Strategies for Prioritizing Goals

Establish a clear hierarchy by comparing interest rates on debt with the urgency of building a 1-year cash cushion to mitigate financial risks. Allocate surplus income first to high-interest debt to minimize overall cost, then systematically divert funds toward an emergency fund capable of covering one year's expenses. Regularly reassess progress and adjust contributions using budgeting tools to maintain balance between debt reduction and savings growth.

Related Important Terms

Debt Avalanche Strategy

The Debt Avalanche Strategy prioritizes paying off high-interest debt first, accelerating overall debt reduction and minimizing total interest paid, which can be more effective than simultaneously building a 1-year cash cushion. Focusing on eliminating costly debt quickly improves cash flow and financial stability, enabling faster accumulation of emergency savings after the highest-interest obligations are cleared.

Debt Snowballing

Debt snowballing accelerates debt payoff by targeting smaller balances first, creating momentum and psychological wins that enhance overall financial discipline. Prioritizing a 1-year cash cushion may delay debt reduction, while snowballing leverages incremental progress to reduce interest costs and improve credit scores more quickly.

Cash Buffer Optimization

Optimizing a cash buffer involves balancing the debt payoff goal against maintaining a 1-year cash cushion, where prioritizing a sufficient emergency fund reduces financial vulnerability while accelerating debt repayment improves long-term financial health. Effective money management requires allocating resources to ensure liquidity for unexpected expenses without delaying the reduction of high-interest debt, maximizing both stability and wealth-building potential.

Financial Breathing Room

Establishing a 1-year cash cushion goal provides essential financial breathing room, allowing for unexpected expenses without incurring additional debt. Prioritizing a robust emergency fund before aggressive debt payoff ensures stability and reduces financial stress during income fluctuations.

Freedom Fund Milestone

Prioritizing the Freedom Fund Milestone, which typically equates to a one-year cash cushion, provides a vital financial safety net that protects against unexpected expenses and income disruptions. Focusing on this goal before aggressive debt payoff ensures stability and preserves credit flexibility, creating a foundation for sustainable money management.

Accelerated Debt Freedom

Accelerated debt freedom is best achieved by prioritizing debt payoff goals over a 1-year cash cushion, as reducing high-interest debt minimizes financial strain and frees up more income for savings. Targeting aggressive debt repayment strategies expedites financial independence and creates long-term stability, surpassing the immediate security offered by a large cash reserve.

Emergency Liquidity Reserve

Prioritizing a 1-year cash cushion goal creates a robust Emergency Liquidity Reserve that ensures immediate access to funds during unexpected financial setbacks, reducing reliance on high-interest debt. Maintaining this reserve enhances financial stability and supports strategic debt payoff by preventing the need to incur new debt during emergencies.

Interest Savings Stacking

Prioritizing a debt payoff goal accelerates interest savings by reducing high-interest liabilities, freeing up cash flow to build a 1-year cash cushion more effectively. Stacking interest savings from paid-off debts contributes to faster accumulation of emergency funds, enhancing overall money management efficiency.

Sinking Fund Padding

Prioritizing a sinking fund padding within a 1-year cash cushion goal ensures liquidity and financial stability, reducing reliance on debt and avoiding high-interest payments. This strategy optimizes money management by balancing immediate debt payoff with a robust emergency fund to cover unexpected expenses.

One-Year Runway Cushion

A One-Year Runway Cushion ensures financial stability by covering essential expenses for an entire year without additional income, providing a safety net during emergencies. Prioritizing this cash cushion over aggressive debt payoff offers long-term security, reducing reliance on credit and preventing future financial stress.

Debt payoff goal vs 1-year cash cushion goal for money management. Infographic

moneydiff.com

moneydiff.com