Savings goals prioritize building a financial cushion for specific needs or emergencies, offering flexibility and short-term security. FIRE goals (Financial Independence, Retire Early) emphasize aggressive saving and investing to achieve long-term financial freedom, enabling early retirement. Choosing between these goals depends on personal priorities, risk tolerance, and desired timeline for financial independence.

Table of Comparison

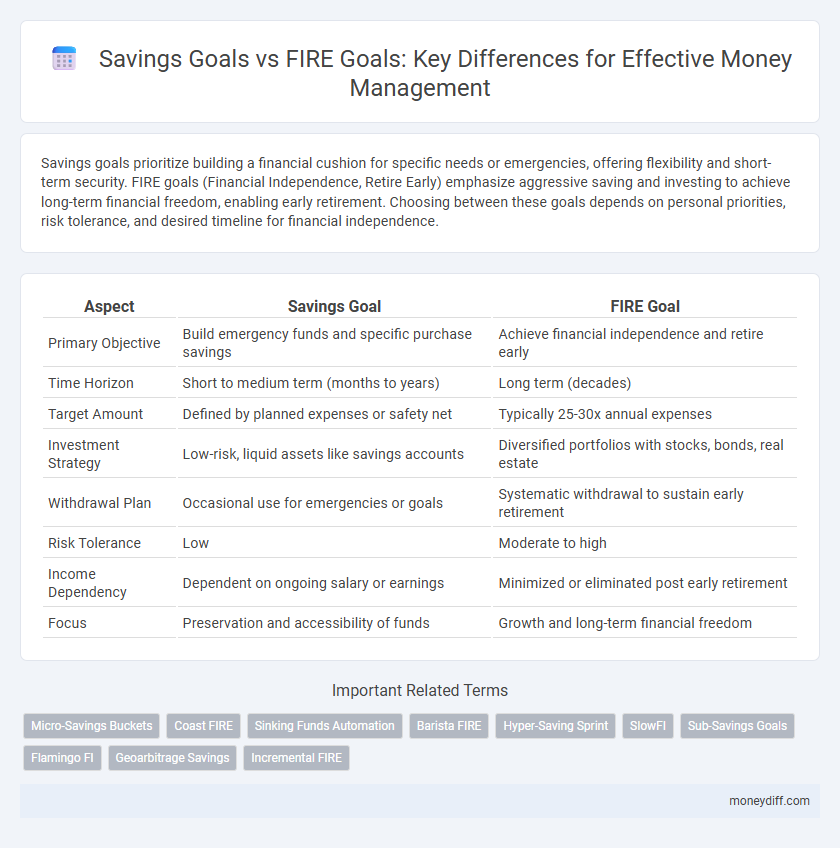

| Aspect | Savings Goal | FIRE Goal |

|---|---|---|

| Primary Objective | Build emergency funds and specific purchase savings | Achieve financial independence and retire early |

| Time Horizon | Short to medium term (months to years) | Long term (decades) |

| Target Amount | Defined by planned expenses or safety net | Typically 25-30x annual expenses |

| Investment Strategy | Low-risk, liquid assets like savings accounts | Diversified portfolios with stocks, bonds, real estate |

| Withdrawal Plan | Occasional use for emergencies or goals | Systematic withdrawal to sustain early retirement |

| Risk Tolerance | Low | Moderate to high |

| Income Dependency | Dependent on ongoing salary or earnings | Minimized or eliminated post early retirement |

| Focus | Preservation and accessibility of funds | Growth and long-term financial freedom |

Understanding Savings Goals vs FIRE Goals

Savings goals prioritize building a specific amount of money for short- or mid-term needs such as emergencies, vacations, or down payments, emphasizing consistent contributions and liquidity. FIRE (Financial Independence, Retire Early) goals focus on accumulating a substantial investment portfolio to generate passive income, allowing early retirement and financial freedom. Understanding the distinction aids in creating tailored financial plans that balance immediate savings needs with long-term independence strategies.

Key Differences Between Savings and FIRE Strategies

Savings goals and FIRE (Financial Independence Retire Early) goals differ primarily in purpose and timeline; savings goals focus on accumulating funds for specific short- to medium-term needs, while FIRE centers on building sustainable wealth to achieve early retirement. The savings strategy emphasizes liquidity and security for predetermined expenses, whereas FIRE requires aggressive investment growth and careful expense management to maintain long-term financial independence. Key metrics distinguishing them include savings rate, investment returns, and withdrawal sustainability aligned with lifestyle objectives.

Setting Realistic Savings Goals

Setting realistic savings goals requires understanding the difference between a general savings goal and a FIRE (Financial Independence, Retire Early) goal. Savings goals are typically short to medium term targets focused on building an emergency fund or saving for specific expenses, while FIRE goals demand aggressive, long-term saving strategies aimed at financial independence. Prioritizing achievable milestones within budget constraints enhances consistent progress and prevents burnout in money management.

Principles of the FIRE (Financial Independence, Retire Early) Movement

The FIRE Movement emphasizes aggressive savings and investment strategies to achieve financial independence and retire early by maximizing the savings rate, often targeting 50% or more of income. Unlike traditional savings goals focused on specific purchases or timelines, FIRE prioritizes building a sustainable passive income portfolio through low-cost index funds and disciplined spending habits. Core principles include minimizing expenses, increasing financial literacy, and maintaining consistent investment growth to reach a net worth that covers 25 to 30 times annual expenses.

Financial Planning: Choosing Your Primary Goal

Choosing between a Savings Goal and a FIRE (Financial Independence, Retire Early) Goal shapes your financial planning strategy by defining your timeline and risk tolerance. Savings Goals emphasize steady accumulation for specific needs or emergencies, while FIRE Goals prioritize aggressive investing and long-term wealth growth to achieve early retirement. Aligning your primary goal with your lifestyle expectations and financial capacity ensures disciplined money management and realistic progress tracking.

Building an Emergency Fund vs Investing for FIRE

Building an emergency fund focuses on liquidity and financial security by saving three to six months of essential expenses to cover unforeseen events, forming a critical foundation for money management. Investing for FIRE (Financial Independence, Retire Early) targets long-term wealth accumulation through diversified portfolios aimed at generating passive income that sustains early retirement. Prioritizing an emergency fund before aggressive investing ensures a safety net that mitigates risks and prevents debt during financial setbacks, making it a strategic step in personal finance planning.

Risk Tolerance: Savings vs FIRE Mindsets

Savings goals typically involve moderate risk tolerance aimed at preserving capital while generating steady returns, reflecting a conservative approach to money management. FIRE (Financial Independence, Retire Early) goals require a higher risk tolerance due to aggressive investment strategies and a longer time horizon focused on wealth accumulation and early retirement. Understanding risk tolerance differences between savings and FIRE mindsets is crucial for aligning investment choices with financial objectives and personal comfort levels.

Long-Term Benefits: Traditional Savings vs Early Retirement

Savings goals build financial security by accumulating funds steadily over time, providing flexibility for unexpected expenses and long-term investments. FIRE (Financial Independence, Retire Early) focuses on maximizing savings rate and investment returns to achieve early retirement, offering the benefit of extended freedom and reduced work-related stress. Emphasizing compound growth and disciplined budgeting, both strategies support wealth accumulation but differ in timeline and lifestyle priorities.

Tracking Progress Toward Each Goal

Tracking progress toward a Savings Goal involves regularly monitoring account balances and contribution consistency to ensure steady growth over time. In contrast, a FIRE (Financial Independence, Retire Early) Goal requires comprehensive assessment of net worth, passive income streams, and expense ratios to gauge readiness for early retirement. Utilizing budgeting tools and investment tracking software enhances accuracy in measuring advancements toward both financial objectives.

Which Money Management Goal Fits Your Lifestyle?

Choosing between a Savings Goal and a FIRE (Financial Independence, Retire Early) Goal depends on your lifestyle priorities and risk tolerance. A Savings Goal typically suits those seeking short- to mid-term financial security, focused on building emergency funds, vacations, or major purchases with moderate risk. The FIRE Goal aligns with individuals aiming for early retirement and financial independence, emphasizing aggressive investment, frugality, and long-term wealth accumulation.

Related Important Terms

Micro-Savings Buckets

Savings goals center on accumulating funds for specific short-term needs by using micro-savings buckets to allocate small, manageable amounts consistently, optimizing cash flow and enhancing budgeting precision. In contrast, FIRE (Financial Independence, Retire Early) goals prioritize aggressive saving and investing strategies within micro-savings buckets to accelerate wealth growth and achieve early retirement through disciplined, incremental cash management.

Coast FIRE

Savings goals prioritize accumulating a specific amount for future needs, while Coast FIRE focuses on investing early to let compound growth cover retirement without additional contributions. Coast FIRE allows individuals to reduce savings rate or increase lifestyle spending now, as investments eventually grow enough to support financial independence.

Sinking Funds Automation

Savings goals target specific, short-term financial needs with automated sinking funds ensuring systematic, disciplined deposits, while FIRE goals emphasize early retirement through aggressive, long-term wealth accumulation and investment growth. Automating sinking funds for savings goals enhances cash flow management and reduces financial stress by earmarking funds for planned expenses ahead of time.

Barista FIRE

Savings goals emphasize accumulating a specific amount for short-term needs or lifestyle upgrades, while Barista FIRE focuses on achieving partial financial independence to cover basic expenses through part-time work. This strategy blends sustainable retirement funding with ongoing employment income, balancing savings growth and reduced work hours.

Hyper-Saving Sprint

A Hyper-Saving Sprint accelerates progress toward a Savings Goal by focusing on short-term, high-intensity saving strategies that build a rapid financial buffer. In contrast, a FIRE Goal--Financial Independence, Retire Early--requires sustained long-term discipline and investment growth to generate passive income sufficient for early retirement.

SlowFI

A Savings Goal emphasizes steady accumulation of funds over time, fostering financial discipline and stability, while a FIRE (Financial Independence, Retire Early) Goal targets rapid wealth building for early retirement through aggressive investment strategies. SlowFI prioritizes balanced money management, combining deliberate savings with mindful spending to achieve financial independence sustainably without the high pressure of accelerated FIRE timelines.

Sub-Savings Goals

Sub-savings goals within a broader savings strategy enable precise allocation of funds towards specific objectives like emergency funds or vacation plans, enhancing financial discipline and motivation. FIRE (Financial Independence, Retire Early) goals emphasize long-term wealth accumulation through aggressive savings and investments, requiring detailed sub-goals to track progress and maintain focus on early retirement milestones.

Flamingo FI

Savings goals prioritize building a financial cushion through steady contributions, while FIRE (Financial Independence, Retire Early) goals target achieving early retirement by maximizing investments and minimizing expenses. Flamingo FI emphasizes tailored strategies that balance disciplined savings with aggressive growth tactics to optimize both traditional savings goals and FIRE aspirations.

Geoarbitrage Savings

Savings goals emphasize disciplined accumulation of funds for specific needs, while FIRE (Financial Independence, Retire Early) goals prioritize building passive income streams to sustain Geoarbitrage savings strategies. Geoarbitrage leverages cost-of-living differences across regions, amplifying the impact of savings and accelerating the path to financial independence.

Incremental FIRE

Savings goals prioritize building a financial cushion through consistent deposits over time, while FIRE goals aim for early retirement by achieving substantial investments that generate passive income; Incremental FIRE balances these by setting progressive milestones that combine savings discipline with strategic asset growth, optimizing long-term financial independence with manageable steps. This approach enhances cash flow control, reduces risk, and accelerates wealth accumulation by blending incremental savings targets with investment in diversified portfolios aligned with FIRE principles.

Savings Goal vs FIRE Goal for money management Infographic

moneydiff.com

moneydiff.com