Traditional investing prioritizes maximizing financial returns through established asset classes without necessarily considering environmental or social impacts. ESG investing integrates environmental, social, and governance criteria to achieve long-term sustainable growth while aligning with ethical values. This approach not only targets financial goals but also contributes positively to societal and environmental outcomes, appealing to investors seeking responsible investment strategies.

Table of Comparison

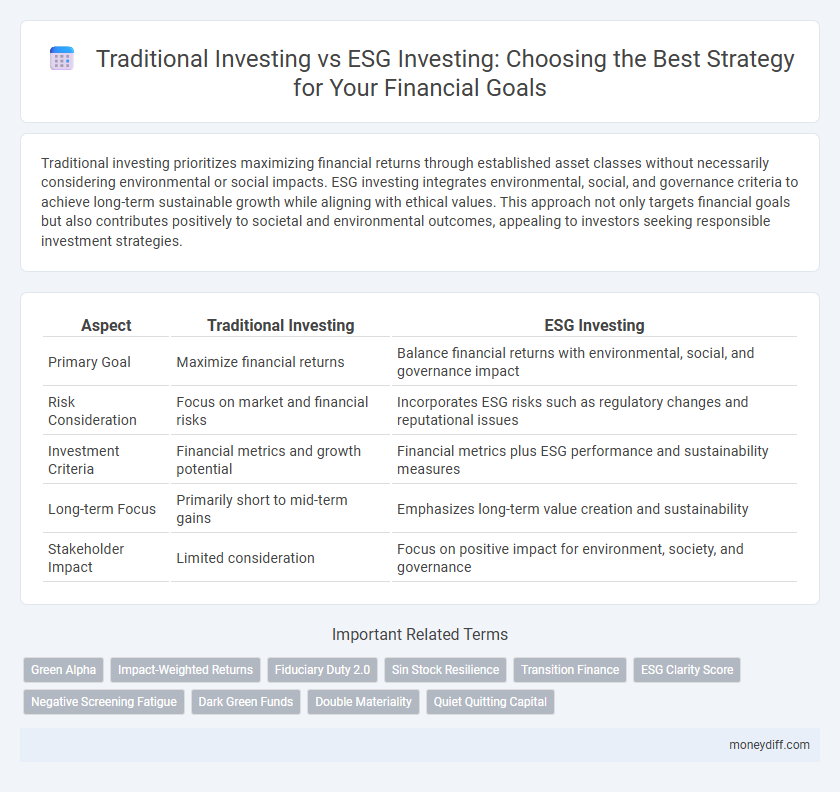

| Aspect | Traditional Investing | ESG Investing |

|---|---|---|

| Primary Goal | Maximize financial returns | Balance financial returns with environmental, social, and governance impact |

| Risk Consideration | Focus on market and financial risks | Incorporates ESG risks such as regulatory changes and reputational issues |

| Investment Criteria | Financial metrics and growth potential | Financial metrics plus ESG performance and sustainability measures |

| Long-term Focus | Primarily short to mid-term gains | Emphasizes long-term value creation and sustainability |

| Stakeholder Impact | Limited consideration | Focus on positive impact for environment, society, and governance |

Understanding Traditional Investing and ESG Investing

Traditional investing emphasizes maximizing financial returns by selecting assets based on historical performance, market trends, and risk assessments. ESG investing integrates environmental, social, and governance criteria into the investment process to promote sustainable and ethical business practices. Understanding these approaches helps investors align their portfolios with personal values and long-term financial goals.

Defining Your Money Management Goals

Defining your money management goals requires a clear distinction between traditional investing and ESG investing, as each approach aligns with different priorities. Traditional investing primarily focuses on maximizing financial returns and managing risk, whereas ESG investing integrates environmental, social, and governance factors to achieve sustainable growth alongside profitability. Establishing whether your primary objective is pure financial gain or responsible impact will guide portfolio construction and asset allocation strategies effectively.

Core Principles of Traditional Investing

Traditional investing centers on maximizing financial returns through fundamental analysis, risk assessment, and market performance evaluation. It emphasizes asset allocation, diversification, and capital growth based on quantitative metrics and historical data. This approach prioritizes shareholder value and short- to medium-term profit objectives over environmental, social, or governance factors.

Key Components of ESG Investing

Key components of ESG investing include environmental factors such as carbon emissions and resource management, social criteria involving labor practices and community impact, and governance aspects like board diversity and corporate transparency. These elements guide investment decisions to align financial goals with sustainable and ethical outcomes. Integrating ESG factors can enhance risk management and long-term value creation compared to traditional investing approaches.

Performance Comparison: Traditional vs ESG Investing

ESG investing has demonstrated competitive performance relative to traditional investing, with numerous studies revealing comparable or superior risk-adjusted returns over the long term. Traditional portfolios often emphasize financial metrics alone, while ESG strategies integrate environmental, social, and governance factors that can mitigate risks and identify sustainable growth opportunities. Data from MSCI and Morningstar indicate that ESG funds frequently exhibit lower volatility and resilience during market downturns, suggesting robust performance aligned with investors' financial and ethical goals.

Risk Factors in Both Investment Approaches

Traditional investing often carries higher exposure to sector-specific risks and market volatility, which can lead to unpredictable returns. ESG investing incorporates environmental, social, and governance criteria to mitigate risks related to regulatory changes, reputational damage, and long-term sustainability. Both approaches require careful assessment of risk tolerance and alignment with financial goals to optimize portfolio resilience.

Aligning Investments with Personal Values

Traditional investing primarily focuses on maximizing financial returns through stocks, bonds, and other assets, often without considering environmental, social, or governance factors. ESG investing integrates these criteria to align investment portfolios with personal values such as sustainability, ethical business practices, and social responsibility. This alignment enables investors to pursue financial goals while promoting positive social and environmental impact.

Long-term Growth Potential in Each Strategy

Traditional investing prioritizes financial returns by focusing on established industries and market cycles, often emphasizing short-to-medium-term growth metrics. ESG investing integrates environmental, social, and governance criteria, aiming to identify sustainable companies with strong ethical practices that may offer resilience and long-term growth potential through risk mitigation and emerging market opportunities. Studies indicate that ESG portfolios can outperform traditional investments over extended periods by capitalizing on the transition to a low-carbon economy and enhanced corporate responsibility.

Measuring Impact: Financial Returns and Social Outcomes

Traditional investing prioritizes financial returns by focusing on historical performance, risk assessment, and market trends to maximize profit. ESG investing integrates environmental, social, and governance criteria, measuring success through both financial returns and positive social or environmental impact. Assessing impact in ESG investing involves quantifying metrics such as carbon footprint reduction, labor practices, and corporate transparency alongside financial performance indicators.

Choosing the Right Investment Path for Your Financial Goals

Selecting between traditional investing and ESG investing depends on aligning your financial goals with your values and risk tolerance. Traditional investing often emphasizes maximizing returns through diverse asset classes, while ESG investing incorporates environmental, social, and governance factors to promote sustainable growth. Evaluating your time horizon, expected returns, and ethical considerations ensures the investment path supports your long-term financial objectives.

Related Important Terms

Green Alpha

Green Alpha focuses on ESG investing by integrating environmental, social, and governance criteria to achieve sustainable financial returns while supporting green innovation and responsible corporate practices. Unlike traditional investing, which prioritizes short-term profits and conventional assets, Green Alpha targets transformative industries that drive long-term environmental impact and economic growth.

Impact-Weighted Returns

Traditional investing primarily measures success through financial returns, often overlooking environmental and social impacts, whereas ESG investing incorporates impact-weighted returns to evaluate how investments contribute to sustainability goals and long-term value creation. By integrating environmental, social, and governance metrics, ESG investing aligns financial performance with positive societal outcomes, enhancing the overall effectiveness of goal-oriented investment strategies.

Fiduciary Duty 2.0

Fiduciary Duty 2.0 integrates ESG investing principles, emphasizing long-term value creation and risk management alongside traditional financial returns to align investment strategies with clients' evolving social and environmental priorities. This modern approach redefines fiduciary responsibility by mandating the consideration of environmental, social, and governance factors as essential components in achieving sustainable and ethical financial goals.

Sin Stock Resilience

Sin stocks, including tobacco, alcohol, and gambling sectors, often demonstrate resilience during market downturns due to steady demand and strong cash flows, contrasting with some ESG investments that may face volatility from regulatory or reputational risks. Investors focused on long-term financial goals should consider the stability and potential risk diversification benefits of sin stocks alongside ESG portfolios to balance ethical considerations with consistent returns.

Transition Finance

Transition finance supports the shift from traditional investing to ESG investing by funding companies committed to reducing carbon emissions while maintaining economic growth. Investors targeting sustainable development goals increasingly allocate capital to transition-focused projects that balance environmental responsibility and financial returns.

ESG Clarity Score

ESG Investing leverages the ESG Clarity Score to evaluate companies based on environmental, social, and governance factors, providing a transparent metric that traditional investing lacks. This score enables investors to align their financial goals with sustainable and ethical practices, potentially reducing risks associated with non-compliance and reputational damage.

Negative Screening Fatigue

Negative screening fatigue in traditional investing arises from the exhaustive elimination of companies based solely on exclusionary criteria, often leading to limited portfolio diversification and missed opportunities. ESG investing addresses this challenge by integrating positive impact metrics and sustainable business practices, fostering resilient portfolios aligned with long-term environmental, social, and governance goals.

Dark Green Funds

Dark Green Funds prioritize environmental and social governance criteria, integrating rigorous sustainability metrics to achieve long-term financial returns while driving positive ecological impact. Traditional investing typically emphasizes financial performance and risk, often overlooking ESG factors critical for addressing climate change and social responsibility within investment goals.

Double Materiality

Traditional investing prioritizes financial returns without fully accounting for environmental and social risks, whereas ESG investing integrates double materiality by evaluating both the impact of companies on society and the financial impacts of sustainability factors on the companies themselves. Incorporating double materiality enhances goal-oriented investing by aligning financial performance with positive environmental and social outcomes, thereby addressing long-term risks and opportunities.

Quiet Quitting Capital

Traditional investing prioritizes financial returns with minimal consideration of environmental, social, and governance (ESG) factors, whereas ESG investing integrates these criteria to align investments with ethical goals and sustainable impact. Quiet Quitting Capital emphasizes the growing investor demand for purposeful portfolios that balance profitability with responsible practices, driving a shift from conventional asset allocation toward value-driven, impact-focused strategies.

Traditional Investing vs ESG Investing for goal. Infographic

moneydiff.com

moneydiff.com