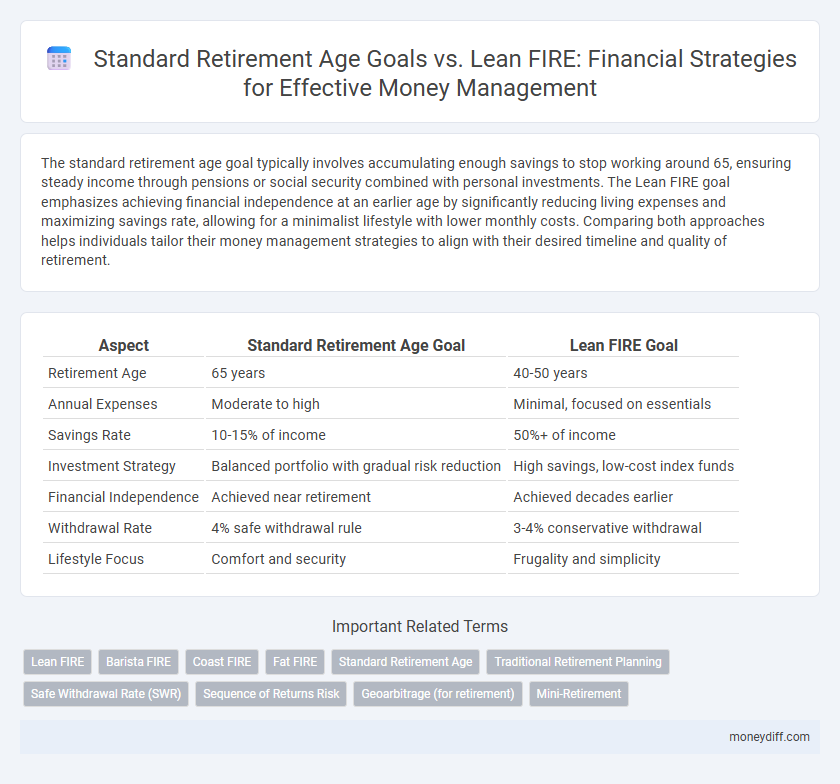

The standard retirement age goal typically involves accumulating enough savings to stop working around 65, ensuring steady income through pensions or social security combined with personal investments. The Lean FIRE goal emphasizes achieving financial independence at an earlier age by significantly reducing living expenses and maximizing savings rate, allowing for a minimalist lifestyle with lower monthly costs. Comparing both approaches helps individuals tailor their money management strategies to align with their desired timeline and quality of retirement.

Table of Comparison

| Aspect | Standard Retirement Age Goal | Lean FIRE Goal |

|---|---|---|

| Retirement Age | 65 years | 40-50 years |

| Annual Expenses | Moderate to high | Minimal, focused on essentials |

| Savings Rate | 10-15% of income | 50%+ of income |

| Investment Strategy | Balanced portfolio with gradual risk reduction | High savings, low-cost index funds |

| Financial Independence | Achieved near retirement | Achieved decades earlier |

| Withdrawal Rate | 4% safe withdrawal rule | 3-4% conservative withdrawal |

| Lifestyle Focus | Comfort and security | Frugality and simplicity |

Understanding Standard Retirement Age vs. Lean FIRE

Understanding the standard retirement age, typically between 65 and 67, provides a clear financial horizon based on Social Security eligibility and pension plans, whereas the Lean FIRE goal emphasizes achieving financial independence earlier through aggressive savings and frugal living. Lean FIRE targets minimum necessary expenses to retire comfortably as early as the 30s or 40s, requiring a lower nest egg but disciplined money management. Comparing these two approaches highlights the trade-offs between longevity of investment growth and lifestyle flexibility in retirement planning.

Key Differences in Financial Targets

Standard retirement age goals typically aim for financial independence around 65, emphasizing stable income streams like pensions and Social Security. Lean FIRE goals target early retirement, often before 40, prioritizing minimal living expenses and aggressive savings rates to accumulate a smaller but sufficient nest egg. Key differences include the retirement timeline, required savings amount, and the balance between lifestyle flexibility and financial security.

Budgeting for Traditional Retirement

Budgeting for traditional retirement revolves around the standard retirement age, typically between 65 and 67, requiring steady accumulation of savings through consistent contributions to retirement accounts such as 401(k)s and IRAs. This approach emphasizes predictable income streams like Social Security and pension plans, ensuring financial stability over a longer retirement horizon. In contrast, Lean FIRE prioritizes aggressive budgeting and reduced expenses to retire significantly earlier, demanding meticulous expense tracking and leaner monthly budgets focused on sustaining minimalist lifestyles.

Lean FIRE: Embracing Frugality for Early Retirement

Lean FIRE emphasizes achieving financial independence through aggressive saving and frugal living, allowing early retirement well before the standard retirement age of 65. This approach prioritizes minimizing expenses and maximizing savings rate, often targeting a portfolio that supports a modest but sustainable lifestyle. Lean FIRE investors focus on optimizing cash flow and reducing discretionary spending to retire in their 30s or 40s instead of waiting decades.

Savings Strategies: Standard vs. Lean FIRE

Standard retirement age goals typically rely on steady contributions to retirement accounts over decades, emphasizing traditional savings vehicles like 401(k)s and IRAs with moderate risk tolerance. Lean FIRE strategies prioritize aggressive savings and frugality, aiming to reduce annual expenses drastically by at least 50%, enabling early retirement often before age 40. Both approaches benefit from maximizing tax-advantaged accounts and minimizing lifestyle inflation, but Lean FIRE demands a higher savings rate--often 50-70% of income--compared to the 10-15% common in standard retirement planning.

Investment Approaches for Both Goals

Standard retirement age goals often rely on long-term, steady investment strategies focused on diversified portfolios of stocks, bonds, and mutual funds to accumulate wealth gradually. Lean FIRE goals prioritize aggressive saving and high-yield investments, such as index funds, real estate, and dividend-paying stocks, to achieve financial independence at an earlier age. Both approaches require disciplined asset allocation and continuous portfolio rebalancing to optimize returns and manage risk effectively.

Risk Tolerance and Asset Allocation

Risk tolerance significantly influences the decision between a standard retirement age goal and a Lean FIRE goal, guiding asset allocation strategies to balance growth and security. Standard retirement plans often favor conservative asset allocations with higher bond proportions to preserve capital as retirement nears, while Lean FIRE pursuers typically adopt more aggressive stock allocations to maximize early growth potential despite higher volatility. Understanding individual risk tolerance ensures asset allocations align with financial goals, supporting sustainable withdrawals under both retirement timelines.

Lifestyle Adjustments Required

Achieving the standard retirement age goal involves gradual lifestyle adjustments, such as consistent saving and moderate budgeting to support long-term financial stability. In contrast, pursuing a Lean FIRE (Financial Independence, Retire Early) goal demands more aggressive lifestyle changes, including significant expense reduction, frugal living, and strict financial discipline to accumulate sufficient savings quickly. The choice between these goals directly impacts spending habits, work-life balance, and overall money management strategies.

Long-Term Sustainability and Withdrawal Rates

Standard retirement age goals typically rely on a traditional withdrawal rate of 4% based on a 30-year horizon, emphasizing steady income during retirement. Lean FIRE goals aim for early retirement with minimal expenses, requiring more conservative withdrawal rates to ensure funds last over potentially 40+ years. Long-term sustainability in both approaches depends on optimizing withdrawal rates against investment returns, inflation, and lifestyle adjustments for maintaining financial stability.

Choosing the Right Retirement Path for You

Evaluating the standard retirement age goal versus the Lean FIRE goal involves assessing your desired lifestyle, savings rate, and financial independence timeline. Embracing Lean FIRE requires aggressive saving and frugality to retire significantly earlier, while the standard retirement age aligns with traditional workforce longevity and more gradual asset accumulation. Selecting the right retirement path depends on personal priorities such as risk tolerance, health considerations, and willingness to adopt minimalist living to achieve financial freedom sooner.

Related Important Terms

Lean FIRE

Lean FIRE prioritizes achieving financial independence with lower living expenses, enabling retirement earlier than the standard retirement age, which typically ranges between 65 and 67 years. This approach emphasizes strict budgeting, increased saving rates of 50% or more, and strategic investment to sustain a minimalist lifestyle while maintaining financial security.

Barista FIRE

Barista FIRE targets financial independence by achieving partial retirement at an earlier age than the standard retirement age, typically mid-50s instead of 65-67, allowing individuals to cover remaining expenses with part-time work and invest less aggressively. This approach balances lifestyle flexibility and reduced income needs by strategically managing savings, expenses, and part-time earnings to bridge gaps until full retirement.

Coast FIRE

Coast FIRE enables individuals to reach financial independence by allowing investments to grow without additional contributions, contrasting with the standard retirement age goal that requires continuous saving until a specific age. This approach leverages compound interest early on, reducing pressure on active income and aligning money management strategies with long-term financial flexibility.

Fat FIRE

Standard retirement age typically targets financial independence around 65, while Lean FIRE emphasizes minimalistic living with earlier retirement by drastically reducing expenses. Fat FIRE focuses on accumulating substantial wealth to maintain a luxurious lifestyle post-retirement, requiring higher savings rates and diversified investment strategies for long-term financial security.

Standard Retirement Age

Standard retirement age, typically between 65 and 67 years, provides a structured timeline for accumulating sufficient savings, benefits from pensions, and Social Security, facilitating financial stability without early withdrawal penalties. This traditional goal emphasizes steady income replacement strategies, maximizing long-term growth through employer-sponsored plans and consistent contributions to retirement accounts like 401(k)s and IRAs.

Traditional Retirement Planning

Traditional retirement planning targets the standard retirement age, typically between 65 and 67, balancing steady income sources such as Social Security, pensions, and conservative investment growth. In contrast, Lean FIRE aims for financial independence earlier by aggressively saving and minimizing expenses, allowing one's portfolio to sustain a leaner lifestyle well before the standard retirement age.

Safe Withdrawal Rate (SWR)

The Standard retirement age goal typically relies on a Safe Withdrawal Rate (SWR) of around 4%, designed to sustain a portfolio over 30 years, whereas the Lean FIRE goal often demands a more conservative SWR below 3% due to a longer retirement horizon and lower spending needs. Accurate calculation of SWR is crucial for effective money management, ensuring financial independence aligns with expected longevity and lifestyle choices.

Sequence of Returns Risk

Standard retirement age goals often face significant Sequence of Returns Risk due to a fixed timeline and reliance on market growth at withdrawal, whereas Lean FIRE strategies mitigate this risk by maintaining lower expenses and allowing more flexible withdrawal patterns, preserving capital during market downturns. Managing Sequence of Returns Risk is critical in Lean FIRE to prevent portfolio depletion while achieving financial independence earlier than traditional retirement timelines.

Geoarbitrage (for retirement)

Standard retirement age goals typically involve accumulating sufficient assets to support living expenses in a fixed location, whereas Lean FIRE emphasizes aggressive savings and geoarbitrage to relocate to lower-cost regions, maximizing retirement funds' longevity. Geoarbitrage leverages regional cost-of-living differences, allowing Lean FIRE adherents to stretch retirement savings by choosing countries or cities with affordable housing, healthcare, and lifestyle expenses.

Mini-Retirement

Standard retirement age usually targets 65 or older, while Lean FIRE aims for financial independence often in the 30s or 40s, enabling mini-retirements that allow intermittent breaks from work without full retirement. This approach emphasizes flexible money management strategies to fund shorter, planned periods of leisure and personal growth while maintaining long-term financial stability.

Standard retirement age goal vs Lean FIRE goal for money management. Infographic

moneydiff.com

moneydiff.com