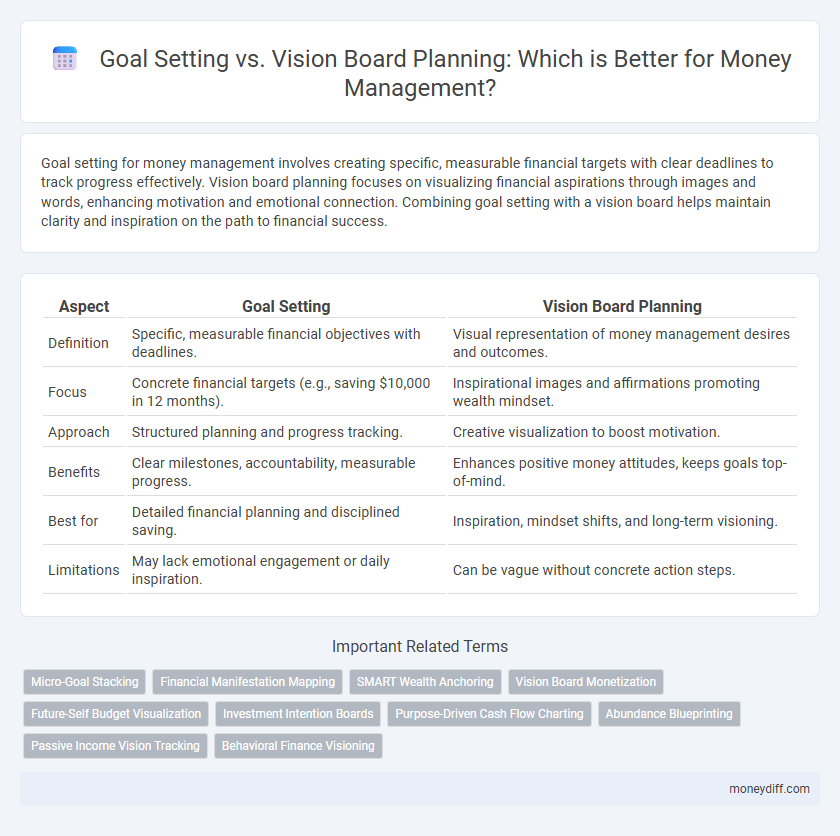

Goal setting for money management involves creating specific, measurable financial targets with clear deadlines to track progress effectively. Vision board planning focuses on visualizing financial aspirations through images and words, enhancing motivation and emotional connection. Combining goal setting with a vision board helps maintain clarity and inspiration on the path to financial success.

Table of Comparison

| Aspect | Goal Setting | Vision Board Planning |

|---|---|---|

| Definition | Specific, measurable financial objectives with deadlines. | Visual representation of money management desires and outcomes. |

| Focus | Concrete financial targets (e.g., saving $10,000 in 12 months). | Inspirational images and affirmations promoting wealth mindset. |

| Approach | Structured planning and progress tracking. | Creative visualization to boost motivation. |

| Benefits | Clear milestones, accountability, measurable progress. | Enhances positive money attitudes, keeps goals top-of-mind. |

| Best for | Detailed financial planning and disciplined saving. | Inspiration, mindset shifts, and long-term visioning. |

| Limitations | May lack emotional engagement or daily inspiration. | Can be vague without concrete action steps. |

Understanding Goal Setting in Money Management

Understanding goal setting in money management involves defining clear, measurable, and time-bound financial objectives that guide spending, saving, and investing behaviors. This structured approach enhances accountability and progress tracking, essential for building wealth and achieving financial stability. Unlike vision boards, which offer visual motivation, goal setting provides specific action plans directly linked to measurable monetary outcomes.

What Is Vision Board Planning for Finances?

Vision board planning for finances involves creating a visual representation of financial goals, using images and symbols to inspire and focus money management efforts. This method taps into the power of visualization to enhance motivation and clarify priorities, making abstract financial targets more tangible and actionable. By combining creativity with intention, vision boards help individuals maintain consistent financial discipline and align daily decisions with long-term wealth-building objectives.

Key Differences: Goal Setting vs Vision Board Planning

Goal setting involves establishing specific, measurable, and time-bound financial targets to track progress and ensure accountability in money management. Vision board planning uses visual representations of financial aspirations to inspire motivation and maintain focus on long-term wealth goals. Key differences lie in goal setting's emphasis on concrete action steps versus vision boards' role in fostering emotional connection and clarity toward financial success.

Benefits of Goal Setting for Financial Success

Goal setting provides clear, measurable targets that enhance financial discipline and accountability, leading to improved money management and savings growth. Unlike vision boards, goals offer specific timelines and actionable steps, enabling more precise tracking of progress and adjustment of strategies. This structured approach increases motivation and resilience, significantly boosting the likelihood of long-term financial success.

How Vision Boards Influence Money Mindset

Vision boards enhance money mindset by visually reinforcing financial goals, increasing motivation, and aligning subconscious beliefs with wealth accumulation. By consistently engaging with images and affirmations related to financial success, individuals strengthen positive spending and saving habits. This focused visualization encourages disciplined money management and attracts opportunities that support fiscal growth.

Steps to Effective Financial Goal Setting

Effective financial goal setting begins with clearly defining specific, measurable objectives such as saving a fixed amount monthly or reducing debt by a certain percentage within a year. Prioritize goals based on urgency and impact, then create a detailed action plan that includes budgeting, tracking expenses, and reviewing progress regularly. Consistent evaluation and adjustment ensure alignment with long-term vision, increasing the likelihood of achieving financial stability and wealth accumulation.

Creating a Money-Focused Vision Board

Creating a money-focused vision board enhances financial goal setting by providing a visual representation of specific monetary targets, such as savings milestones, investment growth, and debt reduction. This method leverages imagery to reinforce motivation and clarify financial intentions, making abstract goals more tangible and actionable. Unlike traditional goal setting, vision boards engage emotional and cognitive pathways, increasing the likelihood of consistent financial discipline and success.

Common Mistakes in Goal Setting and Vision Board Planning

Common mistakes in goal setting for money management include setting vague or unrealistic targets without clear timelines, leading to lack of motivation and progress tracking. Vision board planning often falters by emphasizing wishful thinking over actionable steps, causing disconnect between visual inspiration and practical financial strategies. Successful money management requires combining specific, measurable goals with a vision board that reinforces disciplined, goal-oriented behaviors.

Combining Goal Setting and Vision Boards for Wealth

Combining goal setting with vision board planning enhances wealth management by providing clear financial objectives alongside visual motivation, increasing commitment and focus. Goal setting breaks down wealth targets into measurable steps, while vision boards reinforce these goals through vivid imagery that stimulates positive financial behaviors. This integrated approach fosters consistent saving habits and strategic investments, ultimately accelerating wealth accumulation.

Choosing the Right Approach for Your Money Goals

Goal setting offers a structured framework for money management by defining specific, measurable, and time-bound financial targets, enabling clearer progress tracking and accountability. Vision board planning enhances motivation through visual representation of financial aspirations, fostering emotional connection and long-term inspiration. Selecting the right approach depends on individual preferences for concrete milestones or creative visualization, ensuring alignment with personal money management styles and goal achievement strategies.

Related Important Terms

Micro-Goal Stacking

Micro-goal stacking in money management enhances goal setting by breaking down financial objectives into manageable, incremental steps, ensuring consistent progress and accountability. Vision board planning serves as a visual motivator but lacks the actionable framework that micro-goal stacking provides for systematic budgeting and savings growth.

Financial Manifestation Mapping

Goal setting provides measurable targets and structured timelines critical for effective money management, while vision board planning enhances financial manifestation mapping by visually reinforcing long-term wealth aspirations. Integrating clear financial goals with compelling imagery accelerates subconscious alignment with monetary success and disciplined budgeting habits.

SMART Wealth Anchoring

SMART Wealth Anchoring emphasizes setting Specific, Measurable, Achievable, Relevant, and Time-bound financial goals to create a clear roadmap for money management. While vision board planning inspires long-term wealth aspirations visually, SMART goals provide actionable steps that enhance accountability and track progress in wealth accumulation.

Vision Board Monetization

Vision board monetization transforms abstract financial goals into visual, actionable plans that enhance motivation and clarity for money management. By integrating specific income targets and savings milestones onto a vision board, individuals create a constant visual reminder that drives disciplined financial behaviors and goal achievement.

Future-Self Budget Visualization

Goal setting anchors future-self budget visualization by defining clear, measurable financial targets that guide spending and saving habits over time. Vision board planning complements this by providing a vivid, visual representation of desired financial outcomes, enhancing motivation and commitment toward achieving long-term money management success.

Investment Intention Boards

Investment Intention Boards enhance money management by visually aligning financial goals with specific investment strategies, fostering clarity and commitment. Compared to traditional goal setting, these boards stimulate consistent focus on actionable investment milestones, accelerating wealth growth through intentional planning.

Purpose-Driven Cash Flow Charting

Purpose-driven cash flow charting enhances goal setting by providing a detailed map of income and expenses aligned with financial objectives, unlike vision board planning which offers a broad visualization of aspirations. This method enables precise tracking and adjustment of spending habits to ensure accountability and systematic progress toward monetary goals.

Abundance Blueprinting

Goal setting provides clear, measurable financial targets that drive disciplined money management, while vision board planning harnesses visual motivation to reinforce an abundance mindset. Integrating Abundance Blueprinting techniques enhances this process by aligning subconscious beliefs with specific wealth-building actions for sustained financial growth.

Passive Income Vision Tracking

Goal setting for passive income involves defining specific financial targets, while vision board planning visualizes wealth milestones to maintain motivation. Tracking progress through measurable passive income streams ensures focused actions and aligns daily habits with long-term financial independence.

Behavioral Finance Visioning

Goal setting in money management relies on specific, measurable targets that enhance motivation through clear benchmarks, while vision board planning leverages imagery to evoke emotional connections, strengthening commitment by aligning financial behavior with personal values. Behavioral finance visioning integrates these approaches by using visual cues to influence cognitive biases and promote disciplined saving and investing habits.

Goal Setting vs Vision Board Planning for money management. Infographic

moneydiff.com

moneydiff.com