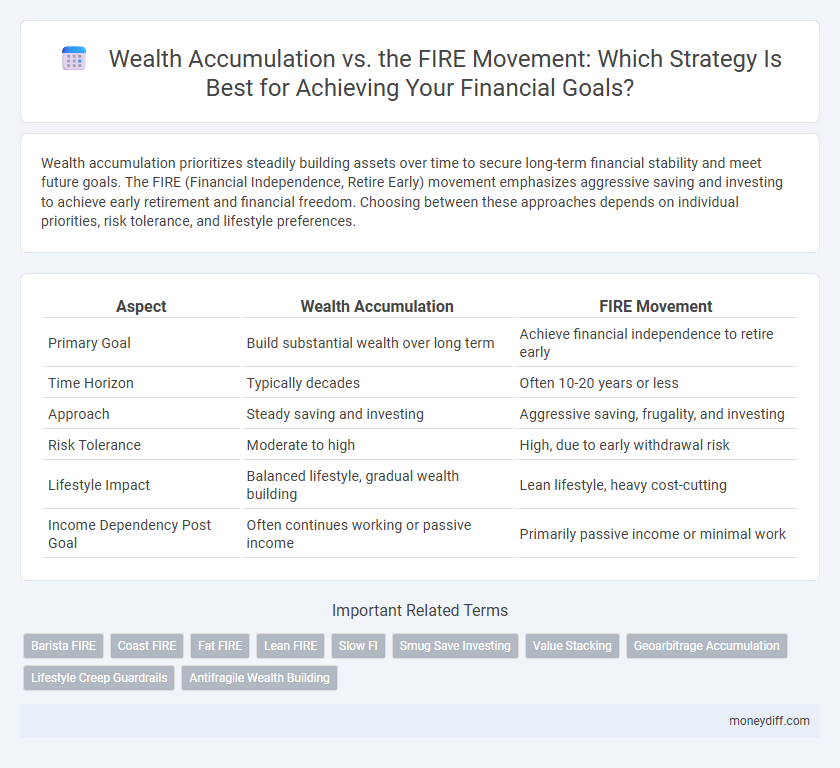

Wealth accumulation prioritizes steadily building assets over time to secure long-term financial stability and meet future goals. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement and financial freedom. Choosing between these approaches depends on individual priorities, risk tolerance, and lifestyle preferences.

Table of Comparison

| Aspect | Wealth Accumulation | FIRE Movement |

|---|---|---|

| Primary Goal | Build substantial wealth over long term | Achieve financial independence to retire early |

| Time Horizon | Typically decades | Often 10-20 years or less |

| Approach | Steady saving and investing | Aggressive saving, frugality, and investing |

| Risk Tolerance | Moderate to high | High, due to early withdrawal risk |

| Lifestyle Impact | Balanced lifestyle, gradual wealth building | Lean lifestyle, heavy cost-cutting |

| Income Dependency Post Goal | Often continues working or passive income | Primarily passive income or minimal work |

Understanding Wealth Accumulation Goals

Wealth accumulation goals center on steadily increasing assets through saving, investing, and income growth to build long-term financial security. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and frugality to achieve early retirement by maximizing wealth accumulation in a condensed timeframe. Understanding these goals requires analyzing personal risk tolerance, income streams, investment strategies, and lifestyle preferences to optimize financial planning and achieve desired financial independence.

Core Principles of the FIRE Movement

The core principles of the FIRE Movement emphasize aggressive saving, frugal living, and strategic investing to achieve financial independence rapidly. Contrasted with traditional wealth accumulation, FIRE prioritizes minimizing expenses and maximizing savings rate, often aiming for a 25x annual expense investment portfolio to retire early. This approach leverages compound interest and market growth to secure long-term financial freedom ahead of conventional retirement timelines.

Comparing Long-Term Wealth Growth vs. Early Retirement

Wealth accumulation emphasizes consistently increasing net worth through diversified investments, compounding returns, and disciplined savings over decades, enabling significant long-term financial security. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving rates and frugal living to achieve early retirement, often within a few decades, allowing individuals to exit the workforce well before traditional retirement age. Comparing these approaches highlights a trade-off between maximizing wealth growth through prolonged market participation and the lifestyle flexibility gained by reducing working years via early financial independence.

Key Strategies for Building Wealth

Wealth accumulation strategies emphasize consistent saving, diversified investments, and leveraging compound interest to grow assets steadily over time. The FIRE (Financial Independence, Retire Early) movement focuses on aggressive expense reduction, high savings rates, and targeted investment portfolios to achieve early financial freedom. Both approaches prioritize disciplined budgeting, maximizing income streams, and strategic asset allocation to optimize long-term wealth building goals.

Essential Steps Toward the FIRE Goal

Establishing a clear budget and aggressively maximizing savings rates are crucial steps toward achieving the FIRE (Financial Independence, Retire Early) goal. Prioritizing high-impact investments, such as low-cost index funds and tax-advantaged accounts like 401(k)s and IRAs, accelerates wealth accumulation. Consistent monitoring of net worth and adjusting spending habits help maintain progress on the path to financial independence and early retirement.

Investment Approaches: Traditional vs. FIRE

Traditional wealth accumulation strategies emphasize long-term, diversified investment portfolios with gradual risk tolerance increase, aiming for steady growth and retirement security. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive savings rates often exceeding 50%, with investments concentrated in low-cost index funds to expedite wealth building and enable early retirement. While traditional methods rely on compounding over decades, FIRE approaches optimize frugality and high investment velocity to achieve financial independence in a compressed timeframe.

Budgeting and Spending for Wealth Maximization

Effective budgeting prioritizes allocating income toward high-impact investments and essential expenses, maximizing wealth accumulation. The FIRE movement emphasizes aggressive spending cuts and disciplined saving rates, accelerating the path to financial independence. Balancing strategic spending with targeted savings creates a sustainable approach to achieving long-term financial goals.

Risk Management in Wealth Accumulation and FIRE

Wealth accumulation prioritizes risk management through diversified investments and steady income streams to build long-term financial security. The FIRE movement emphasizes aggressive saving and early retirement, often accepting higher risks to achieve rapid financial independence. Balancing risk management strategies within both approaches is crucial to sustain wealth and meet personal retirement goals effectively.

Psychological Factors: Wealth Building vs. FIRE Mindset

Wealth accumulation emphasizes long-term financial growth through consistent saving, investing, and risk tolerance, fostering a mindset centered on delayed gratification and compound interest. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving and frugality to achieve early retirement, promoting psychological resilience against consumerism and an emphasis on minimalism. Both strategies demand strong self-discipline but differ in their psychological approach: wealth building aligns with gradual growth and patience, while FIRE embraces rapid goal achievement and lifestyle simplification.

Choosing the Right Path: Which Money Goal Fits You?

Wealth accumulation prioritizes long-term financial growth through steady investments and diversified assets, making it ideal for those seeking gradual security and wealth expansion. The FIRE (Financial Independence, Retire Early) movement focuses on aggressive saving and frugality to achieve early retirement, appealing to individuals valuing time freedom over traditional career timelines. Choosing the right path depends on your risk tolerance, lifestyle preferences, and ultimate vision for financial independence.

Related Important Terms

Barista FIRE

Barista FIRE, a popular branch of the Financial Independence, Retire Early (FIRE) movement, emphasizes accumulating enough wealth to cover basic expenses through part-time work or "barista" jobs while investing in assets for financial stability. This strategy balances moderate wealth accumulation with continued income streams, enabling individuals to achieve early financial independence without full retirement.

Coast FIRE

Coast FIRE enables wealth accumulation by allowing individuals to stop active savings early while their investments grow passively until retirement, contrasting with traditional aggressive wealth accumulation strategies that require continuous high contributions. This method leverages compound interest effectively, reducing financial stress and promoting long-term financial independence with less ongoing effort.

Fat FIRE

Fat FIRE emphasizes achieving financial independence with a lifestyle that includes higher discretionary spending and luxury, differentiating it from traditional Wealth Accumulation strategies which often prioritize conservative saving and gradual asset growth. This approach targets a retirement fund typically exceeding $1 million, enabling individuals to maintain elevated living standards without financial constraint.

Lean FIRE

Lean FIRE prioritizes aggressive saving and frugal living to achieve financial independence at a lower net worth, contrasting traditional wealth accumulation strategies that often emphasize substantial asset growth and higher spending thresholds; this approach enables earlier retirement with a minimalist lifestyle by minimizing expenses and optimizing passive income streams. Adopting Lean FIRE requires disciplined budgeting and strategic investment in low-cost index funds, fostering flexibility and sustainability in reaching financial freedom goals faster.

Slow FI

Slow FI emphasizes consistent saving and investing over decades, prioritizing steady wealth accumulation without drastic lifestyle changes. This approach balances financial independence with long-term security, allowing for gradual growth and reduced stress compared to aggressive FIRE strategies.

Smug Save Investing

Wealth accumulation emphasizes long-term growth through diversified investments and consistent savings, optimizing returns while managing risk to build substantial assets over time. The FIRE Movement prioritizes aggressive saving and early retirement, leveraging high savings rates and strategic asset allocation to achieve financial independence exponentially faster.

Value Stacking

Wealth accumulation emphasizes consistent value stacking through diversified income streams, asset appreciation, and strategic reinvestment to build long-term financial security. The FIRE (Financial Independence, Retire Early) movement accelerates this process by prioritizing aggressive savings rates and minimalist living, maximizing value per dollar to achieve early retirement goals.

Geoarbitrage Accumulation

Geoarbitrage acceleration leverages differences in regional cost of living and income potential to optimize wealth accumulation strategies, maximizing savings rates and investment capacity. This approach contrasts with the traditional FIRE movement by emphasizing strategic geographic relocation to enhance financial growth rather than solely targeting early retirement timelines.

Lifestyle Creep Guardrails

To effectively accumulate wealth and achieve Financial Independence, Retire Early (FIRE) goals, setting strict lifestyle creep guardrails is essential to prevent gradual expenditure increases from eroding savings potential. Implementing budget caps, regular expense audits, and prioritizing value-driven spending ensures disciplined financial growth and preserves long-term wealth accumulation momentum.

Antifragile Wealth Building

Wealth accumulation focuses on steadily increasing assets through diversified investments to build long-term financial security, while the FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and early retirement. Antifragile wealth building incorporates adaptive strategies that thrive under market volatility, enhancing resilience and growth beyond conventional accumulation or FIRE approaches.

Wealth Accumulation vs FIRE Movement for goal. Infographic

moneydiff.com

moneydiff.com