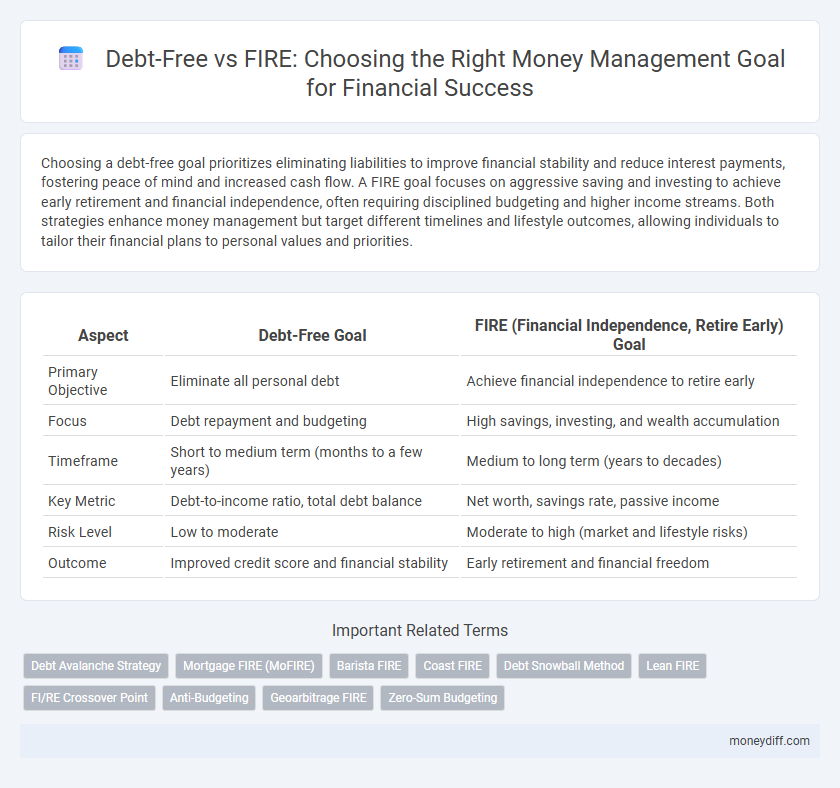

Choosing a debt-free goal prioritizes eliminating liabilities to improve financial stability and reduce interest payments, fostering peace of mind and increased cash flow. A FIRE goal focuses on aggressive saving and investing to achieve early retirement and financial independence, often requiring disciplined budgeting and higher income streams. Both strategies enhance money management but target different timelines and lifestyle outcomes, allowing individuals to tailor their financial plans to personal values and priorities.

Table of Comparison

| Aspect | Debt-Free Goal | FIRE (Financial Independence, Retire Early) Goal |

|---|---|---|

| Primary Objective | Eliminate all personal debt | Achieve financial independence to retire early |

| Focus | Debt repayment and budgeting | High savings, investing, and wealth accumulation |

| Timeframe | Short to medium term (months to a few years) | Medium to long term (years to decades) |

| Key Metric | Debt-to-income ratio, total debt balance | Net worth, savings rate, passive income |

| Risk Level | Low to moderate | Moderate to high (market and lifestyle risks) |

| Outcome | Improved credit score and financial stability | Early retirement and financial freedom |

Understanding Debt-Free and FIRE Goals

The Debt-Free goal emphasizes eliminating all personal liabilities to achieve financial stability and reduce interest expenses, fostering a strong foundation for money management. The FIRE (Financial Independence, Retire Early) goal focuses on accumulating enough passive income and investments to replace living expenses, enabling early retirement and long-term wealth growth. Understanding the distinct objectives and strategies of Debt-Free versus FIRE goals helps individuals tailor their financial plans to prioritize debt elimination or accelerated wealth accumulation.

Core Principles of Debt-Free Living

Prioritizing debt-free living emphasizes eliminating liabilities to build financial stability and reduce stress, which contrasts with the FIRE goal that accelerates wealth accumulation for early retirement. Core principles include disciplined budgeting, avoiding high-interest debt, and cultivating emergency savings to ensure cash flow remains positive. This method strengthens financial resilience and long-term freedom without relying solely on investment returns.

Key Components of the FIRE Movement

The FIRE movement centers on aggressive saving, investing, and reducing expenses to achieve financial independence and retire early, emphasizing a high savings rate of 50% or more of income. Key components include maximizing income streams, minimizing lifestyle inflation, and investing in low-cost index funds to build a passive income that covers living expenses. In contrast to the debt-free goal, which prioritizes eliminating all liabilities, FIRE aims for long-term wealth accumulation and financial freedom through strategic asset growth.

Financial Mindsets: Elimination vs Accumulation

Debt-Free Goal emphasizes a financial mindset centered on elimination, prioritizing the reduction and complete payoff of liabilities to achieve financial peace and stability. FIRE (Financial Independence, Retire Early) Goal adopts an accumulation mindset focused on growing assets and investment portfolios to generate passive income that supports early retirement. Both approaches require disciplined budgeting, but Debt-Free focuses on minimizing obligations, while FIRE targets maximizing wealth creation for long-term freedom.

Budgeting Strategies for Each Approach

Debt-free goals emphasize disciplined budgeting by prioritizing debt repayments and minimizing unnecessary expenses to free cash flow quickly. FIRE strategies require aggressive savings rates, often 50% or more of income, combined with frugal living to maximize investment capital and achieve early retirement. Tailoring budgeting approaches to either debt elimination or long-term wealth accumulation ensures effective money management aligned with individual financial objectives.

Risk Tolerance: Debt Avoidance vs Investment Growth

Debt-free goals prioritize eliminating liabilities to reduce financial risk and stress, appealing to individuals with low risk tolerance who prefer stability and guaranteed returns. In contrast, FIRE goals embrace higher risk tolerance through aggressive investment strategies aimed at maximizing portfolio growth and achieving early retirement. Balancing debt avoidance with investment growth depends on personal risk preferences and long-term financial objectives.

Lifestyle Choices: Minimalism vs Financial Freedom

Choosing a debt-free goal emphasizes minimalism by promoting disciplined spending, reducing liabilities, and simplifying financial commitments. The FIRE goal prioritizes financial freedom, encouraging aggressive saving and investing to enable early retirement and lifestyle flexibility. Both approaches require intentional lifestyle choices but differ in focus: eliminating debt versus accumulating wealth for future independence.

Timeline Differences: Short-Term vs Long-Term Planning

Debt-free goals typically focus on short-term financial planning, emphasizing rapid debt repayment within a defined period, often a few years, to reduce financial burden and improve cash flow. FIRE goals require long-term planning, aiming for sustained investment growth over decades to achieve financial independence and early retirement. The timeline difference influences budgeting strategies, risk tolerance, and the balance between debt reduction and wealth accumulation.

Measuring Success: Zero Debt vs Financial Independence

Measuring success in money management varies distinctly between a Debt-Free Goal and a FIRE (Financial Independence, Retire Early) Goal. Achieving zero debt indicates full repayment of all liabilities, emphasizing financial discipline and reduced risk, while the FIRE goal focuses on accumulating sufficient passive income and investments to cover living expenses indefinitely. Tracking net worth and cash flow stability is crucial for FIRE, whereas debt elimination progress and credit health are primary metrics for the Debt-Free Goal.

Choosing the Right Goal for Your Life Stage

Choosing between a Debt-Free Goal and a FIRE (Financial Independence, Retire Early) Goal depends on your current financial situation and life priorities. A Debt-Free Goal emphasizes eliminating high-interest liabilities to build a stable foundation, ideal for early career stages or those facing financial stress. In contrast, the FIRE Goal prioritizes aggressive saving and investing to achieve early retirement, best suited for mid-career individuals with steady income and fewer immediate obligations.

Related Important Terms

Debt Avalanche Strategy

The Debt Avalanche Strategy accelerates debt elimination by targeting high-interest balances first, making it an effective method for achieving a debt-free goal while optimizing cash flow for future investments. In contrast, the FIRE goal emphasizes early retirement through aggressive saving and investing but may be hindered by outstanding debt, highlighting the importance of prioritizing the Debt Avalanche method to maximize financial independence.

Mortgage FIRE (MoFIRE)

MoFIRE emphasizes paying off the mortgage early to reduce fixed expenses, accelerating the path to financial independence compared to traditional FIRE, which often targets saving 25-30 times annual expenses including mortgage payments. Prioritizing mortgage elimination within FIRE strategies enhances cash flow flexibility and decreases risk, aligning with debt-free goals for sustainable money management.

Barista FIRE

Barista FIRE emphasizes achieving partial financial independence through a combination of retirement savings and part-time work, allowing for reduced work hours while maintaining essential benefits like healthcare. This approach contrasts with full Debt-Free or traditional FIRE goals by balancing manageable debt levels and flexible income streams to support a sustainable lifestyle without complete financial independence.

Coast FIRE

Coast FIRE emphasizes achieving a debt-free status early, allowing investments to grow independently without additional contributions, differing from traditional FIRE which requires aggressive saving and debt elimination simultaneously. Prioritizing a debt-free goal within Coast FIRE enhances financial stability and leverages compound interest to reach retirement with minimal ongoing effort.

Debt Snowball Method

The Debt Snowball Method accelerates debt repayment by prioritizing smaller balances first, building momentum toward a debt-free goal that enhances financial flexibility and stress reduction. Unlike FIRE's broader focus on accumulating investment assets for early retirement, the debt-free goal emphasizes eliminating liabilities to improve cash flow and create a stable foundation for future wealth building.

Lean FIRE

The Lean FIRE approach emphasizes achieving financial independence through minimalistic living and strict expense control, targeting a lower retirement savings threshold compared to traditional FIRE goals. Prioritizing a debt-free status within Lean FIRE ensures that individuals avoid interest burdens, enabling a more sustainable path to early retirement by maximizing cash flow and investment efficiency.

FI/RE Crossover Point

The FI/RE crossover point marks the moment when investment income surpasses living expenses, enabling true financial independence without relying on earned income. Achieving a debt-free status accelerates reaching this milestone by reducing financial obligations and increasing disposable income available for investment growth.

Anti-Budgeting

Choosing a Debt-Free Goal prioritizes eliminating liabilities to reduce financial stress and improve creditworthiness, while the FIRE Goal emphasizes aggressive savings and investments to achieve early retirement through financial independence. Anti-budgeting strategies align more with FIRE by encouraging flexible spending habits and income optimization rather than rigid expense tracking, fostering sustainable wealth growth without strict budgeting constraints.

Geoarbitrage FIRE

Geoarbitrage FIRE leverages low-cost living locations to accelerate wealth building, contrasting with a debt-free goal that prioritizes eliminating liabilities before pursuing financial independence. Emphasizing strategic relocation within FIRE enables maximizing investment returns and reducing expenses, accelerating early retirement beyond traditional debt-free milestones.

Zero-Sum Budgeting

Zero-sum budgeting allocates every dollar of income to expenses, savings, or debt repayment, making it a strategic tool for achieving a debt-free goal by ensuring all income directly reduces liabilities. In contrast, FIRE emphasizes accumulating investments for early retirement, where zero-sum budgeting aids disciplined savings but requires balancing current spending with aggressive investment contributions.

Debt-Free Goal vs FIRE (Financial Independence, Retire Early) Goal for money management. Infographic

moneydiff.com

moneydiff.com