Setting a wealth goal focuses on building long-term financial stability through consistent saving and investing, aiming to grow assets over time. In contrast, a fat goal emphasizes accumulating a large lump sum quickly, often prioritizing short-term gains and higher risk strategies. Balancing these goals ensures both steady progress and the potential for significant financial milestones, optimizing overall money management.

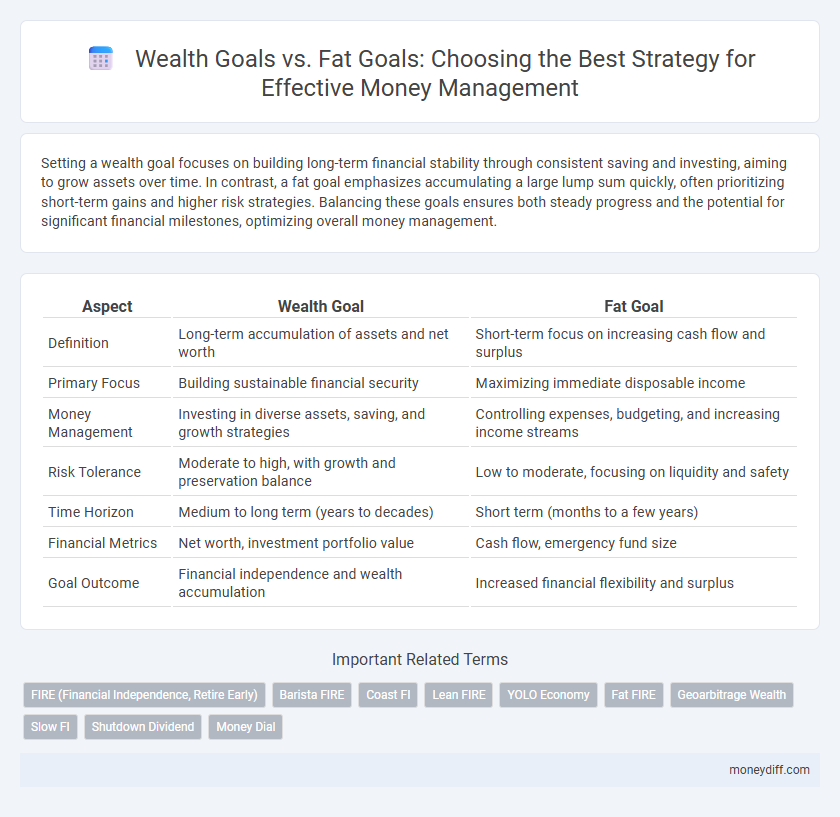

Table of Comparison

| Aspect | Wealth Goal | Fat Goal |

|---|---|---|

| Definition | Long-term accumulation of assets and net worth | Short-term focus on increasing cash flow and surplus |

| Primary Focus | Building sustainable financial security | Maximizing immediate disposable income |

| Money Management | Investing in diverse assets, saving, and growth strategies | Controlling expenses, budgeting, and increasing income streams |

| Risk Tolerance | Moderate to high, with growth and preservation balance | Low to moderate, focusing on liquidity and safety |

| Time Horizon | Medium to long term (years to decades) | Short term (months to a few years) |

| Financial Metrics | Net worth, investment portfolio value | Cash flow, emergency fund size |

| Goal Outcome | Financial independence and wealth accumulation | Increased financial flexibility and surplus |

Understanding Wealth Goals vs. Fat Goals

Wealth goals focus on building long-term financial stability through investments, savings, and asset growth, ensuring sustainable income and financial independence. Fat goals emphasize short-term accumulation of excess cash or luxury spending, often leading to temporary financial satisfaction without lasting security. Prioritizing wealth goals provides a clearer path to financial freedom and resilience against economic fluctuations.

Defining Wealth Goals for Long-Term Financial Health

Wealth goals prioritize building sustainable assets, investments, and passive income streams to ensure long-term financial stability and growth. Focusing on cash flow and net worth rather than short-term quantity of money encourages disciplined saving and strategic investing. Defining clear wealth goals involves setting measurable targets for asset accumulation and financial independence, fostering lasting prosperity over temporary financial satisfaction.

What Are Fat Goals in Money Management?

Fat goals in money management refer to financial objectives centered on accumulating excess cash beyond basic needs, emphasizing surplus wealth for discretionary spending. Unlike wealth goals that aim for long-term financial security and asset growth, fat goals prioritize immediate financial abundance and lifestyle inflation. Setting fat goals often involves budgeting for luxury purchases, entertainment, or non-essential expenses that enhance personal satisfaction but may not contribute to lasting financial stability.

Key Differences: Wealth Goals vs. Fat Goals

Wealth goals prioritize long-term financial security by building assets, investments, and multiple income streams to ensure sustained prosperity and independence. Fat goals focus on accumulating large sums of money quickly, often emphasizing short-term gains and immediate spending capacity without considering asset growth or financial stability. Understanding these distinctions is crucial for effective money management, as wealth goals align with lasting financial growth while fat goals may lead to temporary abundance but lack sustainability.

Benefits of Setting Wealth-Oriented Goals

Setting wealth-oriented goals promotes long-term financial stability by encouraging consistent saving and investing strategies that compound over time. These goals prioritize building assets and passive income streams, which provide security beyond immediate gratification or short-term spending sprees. Focusing on wealth accumulation enhances financial independence and resilience against economic downturns, unlike fat goals that often emphasize superficial or temporary gains.

Risks of Chasing Fat Goals for Quick Gains

Chasing fat goals for quick financial gains often leads to high-risk investments that can jeopardize long-term wealth stability. These aggressive strategies increase vulnerability to market volatility and potential significant losses, undermining sustainable money management practices. Prioritizing steady wealth goals supports consistent growth, reducing exposure to financial pitfalls common in pursuit of rapid profits.

Strategic Planning: Achieving Wealth Goals

Strategic planning for wealth goals centers on long-term financial growth, prioritizing investments, savings, and diversified income streams that build sustainable wealth over time. Unlike fat goals that focus on short-term cash accumulation or excessive spending, wealth goals emphasize disciplined budgeting, risk management, and asset allocation to increase net worth systematically. Effective strategies include setting measurable milestones, regularly reviewing financial portfolios, and adjusting plans based on market trends to ensure consistent progress toward financial independence.

Psychological Impact: Wealth Goals vs. Fat Goals

Wealth goals, centered on building sustainable financial security, foster long-term motivation and positive psychological well-being by emphasizing growth and stability. Fat goals, which prioritize accumulating excess money quickly, often lead to stress, impulsive spending, and a fragile sense of achievement. Psychological research highlights that wealth-focused objectives enhance self-discipline and resilience, while fat goals can trigger anxiety and undermine financial decision-making.

How to Transition from Fat Goals to Wealth Goals

Shifting from fat goals, which emphasize short-term spending and material accumulation, to wealth goals requires adopting a long-term financial mindset centered on asset growth and sustainable income. Prioritize budgeting strategies that increase savings rates and investment in diversified portfolios to build wealth over time. Implementing consistent financial education alongside setting measurable milestones facilitates this transition and drives prudent money management decisions.

Measuring Success: Wealth Goals and Sustainable Growth

Wealth goals prioritize long-term financial stability and compound growth by focusing on assets, investments, and net worth accumulation, rather than short-term gains or excessive spending. Measuring success in wealth goals involves tracking consistent increases in passive income, diversified portfolio growth, and debt reduction. Sustainable growth targets a balanced approach, ensuring financial health through budget discipline, emergency funds, and reinvestment strategies that minimize risk over time.

Related Important Terms

FIRE (Financial Independence, Retire Early)

Wealth goals prioritize building sustainable assets and passive income streams to achieve long-term financial independence and retire early (FIRE), while fat goals emphasize accumulating large cash reserves or net worth without strategic investment growth. Focusing on wealth goals aligns with FIRE principles by ensuring financial freedom through diversified investments rather than solely amassing liquid savings.

Barista FIRE

Barista FIRE emphasizes achieving a sustainable wealth goal by maintaining part-time work to cover living expenses while steadily growing investments, contrasting with a fat FIRE goal that demands full financial independence through a larger, often more aggressive savings target. This balanced approach allows for financial flexibility and reduced stress, optimizing long-term money management without the need for early full retirement.

Coast FI

Wealth goals prioritize long-term financial independence and asset growth, while fat goals emphasize accumulating a large cash cushion for immediate security; Coast FI strategies focus on reaching a point where savings grow passively without additional contributions, allowing one to "coast" to retirement. By achieving Coast FI, individuals can reduce stress on current earnings and shift focus from aggressive saving to sustainable wealth management.

Lean FIRE

Wealth goals prioritize long-term financial independence and sustainable passive income, while fat goals emphasize accumulating substantial savings for early retirement with a comfortable lifestyle. Lean FIRE focuses on minimalistic living by optimizing expenses and maximizing savings to achieve financial freedom faster with lower capital requirements.

YOLO Economy

Wealth goals prioritize long-term financial stability and asset growth, emphasizing investments and savings within the YOLO Economy's dynamic market trends. Fat goals focus on immediate spending and lifestyle upgrades, reflecting the YOLO Economy's consumer-driven mindset that values present enjoyment over future security.

Fat FIRE

Fat FIRE prioritizes achieving financial independence with a lifestyle that maintains or even enhances current spending habits, emphasizing robust investment portfolios and diversified income streams. Unlike traditional Wealth goals aimed purely at asset accumulation, Fat FIRE balances wealth growth with the desire for sustained comfort and discretionary spending in retirement.

Geoarbitrage Wealth

Wealth goals prioritize long-term financial independence and asset growth, while fat goals focus on immediate high cash flow often driven by geoarbitrage strategies leveraging cost-of-living differences to maximize savings. Geoarbitrage enhances wealth accumulation by combining income from high-paying regions with expenses in low-cost areas, optimizing money management for sustainable financial freedom.

Slow FI

Wealth goals emphasize long-term financial independence through strategic saving and investing, prioritizing sustainable growth and asset accumulation over immediate consumption. Fat FIRE goals seek high annual spending levels, often requiring aggressive income generation and rapid wealth building, while Slow FI advocates for a gradual, balanced approach to financial freedom with manageable lifestyle adjustments.

Shutdown Dividend

Wealth goals prioritize sustainable growth and long-term financial stability by reinvesting dividends, whereas fat goals emphasize immediate income maximization without regard for future gains; shutdown dividends, or halting dividend payouts, signal a shift from income-focused strategies to preserving capital for wealth accumulation. Understanding the impact of shutdown dividends helps investors balance between maintaining cash flow and enhancing portfolio value in their money management approach.

Money Dial

Money Dial helps distinguish between wealth goals focused on building long-term financial security and fat goals centered on immediate luxury spending, enabling smarter money management strategies. Prioritizing wealth goals through Money Dial fosters disciplined saving and investment habits, whereas fat goals often lead to short-term gratification with less sustainable outcomes.

Wealth goal vs Fat goal for money management. Infographic

moneydiff.com

moneydiff.com