Budgeting involves allocating funds based on past spending patterns and projected needs, providing a framework to achieve financial goals with flexibility. Zero-based budgeting requires justifying every expense from scratch, ensuring that resources are strictly aligned with current objectives and priorities. For goal achievement, zero-based budgeting offers more precise control and accountability, eliminating unnecessary expenditures and maximizing funds toward specific targets.

Table of Comparison

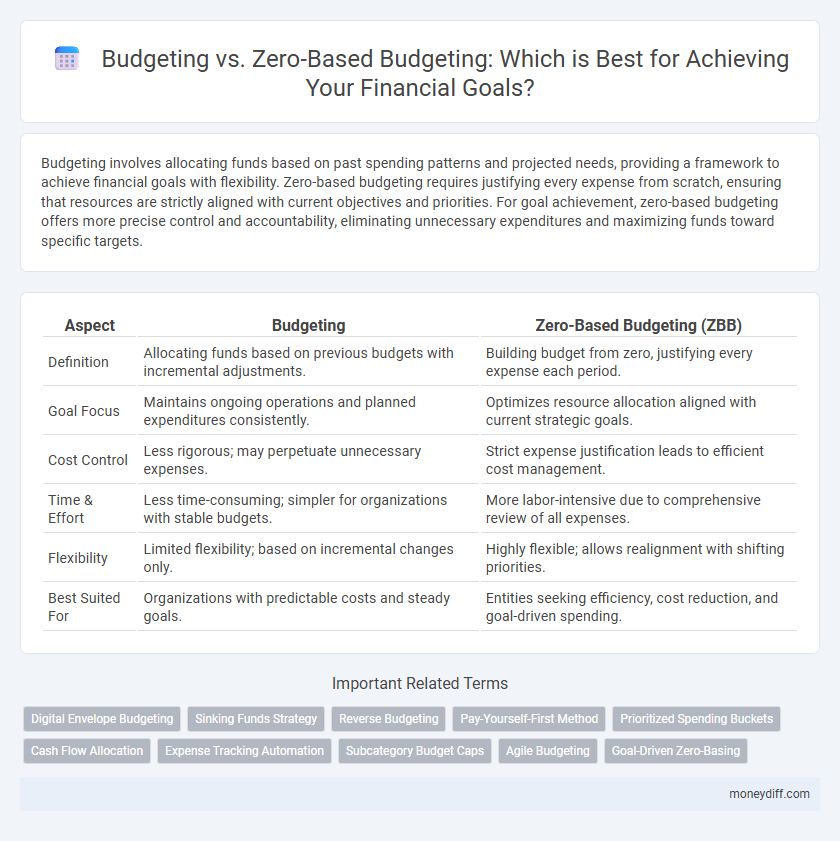

| Aspect | Budgeting | Zero-Based Budgeting (ZBB) |

|---|---|---|

| Definition | Allocating funds based on previous budgets with incremental adjustments. | Building budget from zero, justifying every expense each period. |

| Goal Focus | Maintains ongoing operations and planned expenditures consistently. | Optimizes resource allocation aligned with current strategic goals. |

| Cost Control | Less rigorous; may perpetuate unnecessary expenses. | Strict expense justification leads to efficient cost management. |

| Time & Effort | Less time-consuming; simpler for organizations with stable budgets. | More labor-intensive due to comprehensive review of all expenses. |

| Flexibility | Limited flexibility; based on incremental changes only. | Highly flexible; allows realignment with shifting priorities. |

| Best Suited For | Organizations with predictable costs and steady goals. | Entities seeking efficiency, cost reduction, and goal-driven spending. |

Understanding Traditional Budgeting Approaches

Traditional budgeting approaches allocate funds based on previous periods' expenses with incremental adjustments, emphasizing historical data and predictable financial patterns. This method often involves fixed budget categories that simplify planning but may limit flexibility and responsiveness to changing organizational goals. Understanding these conventional frameworks highlights contrasts with zero-based budgeting, which requires justification for all expenses from scratch, fostering more strategic resource allocation.

What is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) is a financial planning method where every expense must be justified from scratch for each new period, starting from a "zero base" rather than carrying over previous budgets. This approach ensures resources are allocated based on current goals and priorities, promoting efficient use of funds by evaluating the necessity and impact of each expenditure. ZBB contrasts with traditional budgeting by eliminating assumptions about past spending, making it highly effective for aligning budgets directly with organizational or personal objectives.

Key Differences Between Standard and Zero-Based Budgeting

Standard budgeting allocates funds based on previous budgets with incremental adjustments, while zero-based budgeting requires rebuilding the budget from scratch each period, justifying every expense. Zero-based budgeting enhances goal alignment by scrutinizing all expenditures to prioritize resource allocation effectively, reducing unnecessary costs. This approach provides greater flexibility and transparency compared to standard budgeting's reliance on historical data, improving financial discipline and strategic decision-making.

Benefits of Traditional Budgeting for Financial Goals

Traditional budgeting offers a straightforward framework that provides stability and predictability for financial goal planning, allowing individuals and businesses to allocate resources based on historical data and anticipated expenses. This method simplifies tracking progress and maintaining control over expenditures, supporting consistent saving and investment strategies. Its ease of implementation and familiarity make it an effective tool for long-term financial discipline and goal achievement.

Advantages of Zero-Based Budgeting for Goal Achievement

Zero-Based Budgeting enhances goal achievement by requiring a detailed justification of all expenses, promoting efficient resource allocation and eliminating unnecessary costs. This method improves financial discipline and aligns spending directly with strategic objectives, ensuring every dollar supports specific goals. By regularly reassessing budget priorities, organizations can adapt swiftly to changing conditions and optimize their financial plans for maximum impact.

Step-by-Step: Implementing Zero-Based Budgeting

Implementing Zero-Based Budgeting (ZBB) for goal achievement requires a step-by-step approach starting with identifying and categorizing all expenses from zero, rather than using previous budgets as a baseline. Each expense must be justified based on its contribution to the specific goal, ensuring optimal allocation of resources that align with desired outcomes. This method promotes financial discipline by systematically allocating funds only to necessary activities, enhancing goal-oriented budget effectiveness.

Common Challenges in Both Budgeting Systems

Both traditional budgeting and zero-based budgeting face challenges such as inaccurate forecasting and resource misallocation, which can hinder goal achievement. Difficulty in aligning budgets with strategic priorities and resistance to change often lead to inefficiencies in both systems. Ensuring data accuracy and continuous monitoring are critical to overcoming these obstacles for successful financial planning.

Choosing the Right Budgeting Method for Your Goals

Choosing the right budgeting method for your goals depends on the level of financial control and flexibility required; traditional budgeting allocates funds based on previous periods, promoting stability and ease of planning. Zero-based budgeting requires justifying every expense from zero, making it ideal for organizations or individuals aiming for strict cost management and resource optimization. Aligning the budgeting approach with specific financial objectives ensures efficient resource allocation and enhances goal achievement.

Case Study: Reaching Financial Goals with Zero-Based Budgeting

Zero-based budgeting drives goal achievement by allocating every dollar to specific expenses, eliminating waste and enhancing financial discipline. A case study revealed a family reducing unnecessary spending by 20% and accelerating debt repayment, reaching their emergency fund goal six months ahead of schedule. This targeted approach contrasts with traditional budgeting, which often carries over unused funds, delaying progress toward financial objectives.

Tips to Maximize Success with Any Budgeting Approach

To maximize success with any budgeting approach, clearly define specific financial goals and regularly track progress to stay accountable. Prioritize essential expenses and adjust discretionary spending based on goal timelines, ensuring flexibility in your plan. Utilize tools like budgeting apps or spreadsheets to maintain transparency and make data-driven decisions that align with your objectives.

Related Important Terms

Digital Envelope Budgeting

Digital Envelope Budgeting enhances traditional budgeting by allocating funds into virtual envelopes for specific goals, enabling precise control and real-time tracking of expenses. Unlike Zero-Based Budgeting, which requires justifying every expense from scratch, Digital Envelope Budgeting simplifies goal-oriented financial planning by allowing flexible adjustments within pre-set limits.

Sinking Funds Strategy

Budgeting establishes a predefined allocation of funds towards goals, while zero-based budgeting requires justifying every expense from scratch, enhancing precision in financial planning. The sinking funds strategy complements both by systematically setting aside money for specific future goals, ensuring disciplined saving and reducing reliance on credit.

Reverse Budgeting

Reverse budgeting focuses on prioritizing savings and essential expenses by allocating funds backward from financial goals, contrasting traditional budgeting's fixed expense-first approach. Zero-based budgeting supports this method by assigning every dollar a purpose, ensuring goal-driven financial discipline and minimizing waste.

Pay-Yourself-First Method

Pay-Yourself-First budgeting prioritizes saving a predetermined amount before expenses, fostering disciplined goal achievement and financial security. Zero-Based Budgeting enhances this method by allocating every dollar to specific expenses or savings, ensuring no funds are idle and aligning spending directly with goal priorities.

Prioritized Spending Buckets

Budgeting allocates funds based on previous expenses, creating prioritized spending buckets that ensure stable resource distribution, while zero-based budgeting requires justifying every expense from zero for each period, enhancing precision in aligning spending with specific goal priorities. This approach optimizes resource allocation by scrutinizing all spending, enabling targeted investment in high-priority areas to achieve strategic objectives efficiently.

Cash Flow Allocation

Budgeting allocates cash flow based on historical expenses and projected income, providing a steady framework for meeting financial goals. Zero-Based Budgeting requires justifying every expense from scratch, optimizing cash flow allocation to prioritize goal-focused expenditures and eliminate unnecessary costs.

Expense Tracking Automation

Budgeting emphasizes forecasting expenses based on historical data while zero-based budgeting requires expense justification from zero each period, making expense tracking automation crucial for real-time accuracy and streamlined approvals. Automated expense tracking tools integrate with zero-based budgeting systems to enhance financial discipline, reduce manual errors, and provide actionable insights for goal-oriented resource allocation.

Subcategory Budget Caps

Budgeting with Subcategory Budget Caps sets fixed spending limits within categories to control expenses and align with financial goals, while Zero-Based Budgeting allocates funds from zero each period, requiring justification for every subcategory expenditure to maximize resource efficiency. The zero-based approach enhances precision in achieving goals by preventing unnecessary costs and promoting disciplined financial planning through detailed budget resets.

Agile Budgeting

Agile budgeting emphasizes flexibility and iterative adjustments, allowing teams to respond quickly to changing priorities and achieve goals efficiently. Zero-based budgeting complements this by requiring justification of all expenses from scratch, ensuring resources are allocated precisely to activities that directly support goal attainment.

Goal-Driven Zero-Basing

Goal-driven zero-based budgeting prioritizes financial resources by justifying every expense from scratch, ensuring each dollar aligns directly with specific organizational goals. This method enhances fiscal discipline and strategic allocation, unlike traditional budgeting, which often relies on historical expenditures without critical evaluation of goal relevance.

Budgeting vs Zero-Based Budgeting for goal. Infographic

moneydiff.com

moneydiff.com