Wealth accumulation focuses on increasing financial assets and net worth to ensure economic security and future opportunities. Value-based goals prioritize personal fulfillment, ethical considerations, and meaningful experiences aligned with individual beliefs and passions. Balancing these approaches allows for both financial stability and a purposeful, satisfying life.

Table of Comparison

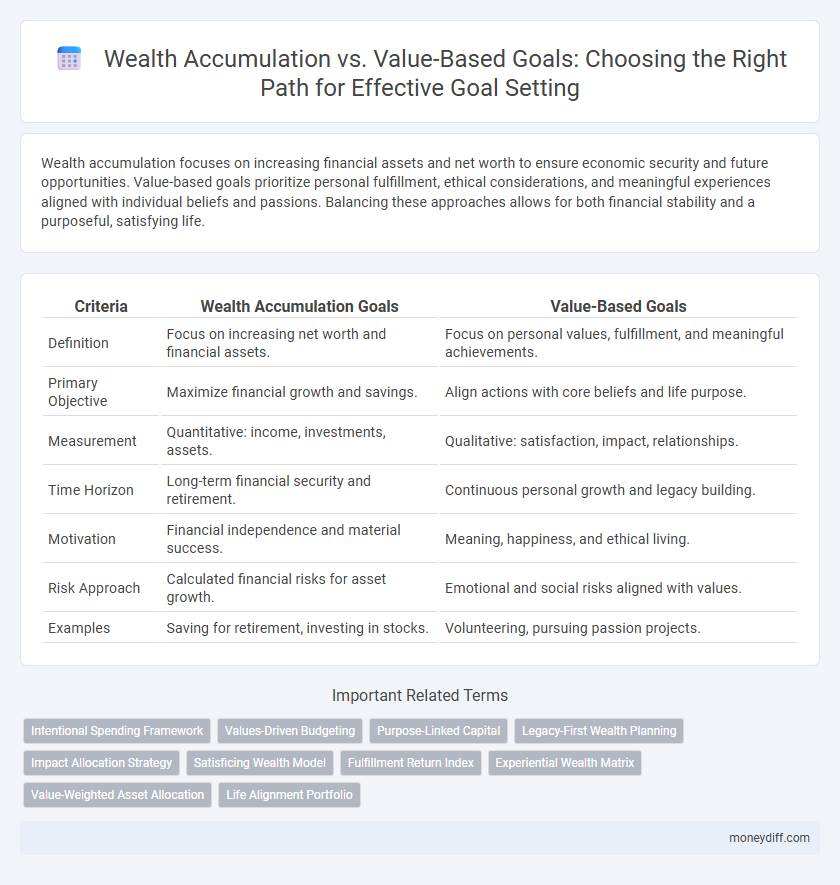

| Criteria | Wealth Accumulation Goals | Value-Based Goals |

|---|---|---|

| Definition | Focus on increasing net worth and financial assets. | Focus on personal values, fulfillment, and meaningful achievements. |

| Primary Objective | Maximize financial growth and savings. | Align actions with core beliefs and life purpose. |

| Measurement | Quantitative: income, investments, assets. | Qualitative: satisfaction, impact, relationships. |

| Time Horizon | Long-term financial security and retirement. | Continuous personal growth and legacy building. |

| Motivation | Financial independence and material success. | Meaning, happiness, and ethical living. |

| Risk Approach | Calculated financial risks for asset growth. | Emotional and social risks aligned with values. |

| Examples | Saving for retirement, investing in stocks. | Volunteering, pursuing passion projects. |

Understanding Wealth Accumulation: Definition and Importance

Wealth accumulation refers to the process of increasing assets and financial resources over time through savings, investments, and income generation. It plays a crucial role in providing financial security, enabling long-term planning, and supporting future goals such as retirement or education funding. Understanding the mechanisms of compound interest, diversification, and asset allocation is essential for effective wealth accumulation and building sustainable financial stability.

What Are Value-Based Financial Goals?

Value-based financial goals prioritize aligning money management with personal values and long-term life satisfaction rather than merely accumulating wealth. These goals emphasize purpose-driven spending, such as supporting causes, achieving work-life balance, or investing in experiences that enhance well-being. Defining value-based financial goals involves identifying core priorities like security, family, or philanthropy to guide budgeting and investment decisions effectively.

Key Differences Between Wealth Accumulation and Value-Based Goals

Wealth accumulation goals prioritize increasing financial assets and net worth through investments, savings, and income growth, emphasizing measurable monetary milestones. Value-based goals focus on personal fulfillment, aligning actions with core beliefs, purpose, and long-term life satisfaction rather than financial gain. The key difference lies in wealth accumulation targeting quantifiable economic success while value-based goals center on qualitative, intrinsic motivations and meaningful impact.

Benefits of Pursuing Wealth Accumulation

Pursuing wealth accumulation provides financial security, enabling individuals to invest in opportunities that promote long-term stability and growth. It allows for increased flexibility in lifestyle choices, supporting both personal ambitions and unexpected expenses. Building wealth also offers the means to contribute meaningfully to philanthropic causes, enhancing social impact and personal fulfillment.

Advantages of Focusing on Value-Based Financial Planning

Focusing on value-based financial planning promotes long-term fulfillment by aligning wealth accumulation with personal priorities such as family, health, and community impact. This approach encourages sustainable decision-making, prioritizing meaningful experiences and ethical investments over mere monetary gain. Clients adopting value-based goals often experience enhanced motivation and clarity, resulting in more consistent savings habits and purposeful financial growth.

Aligning Goals with Personal Values: Why It Matters

Aligning wealth accumulation goals with personal values ensures meaningful motivation and sustainable success by prioritizing what truly matters to the individual. Value-based goals foster long-term fulfillment, guiding financial decisions that reflect personal beliefs and ethical standards. This approach reduces the risk of pursuing wealth for its own sake, promoting a balanced and purpose-driven path to financial security.

Potential Pitfalls of Wealth-Only Financial Targets

Wealth accumulation goals often emphasize numeric financial milestones, risking neglect of personal fulfillment and long-term well-being. Focusing exclusively on monetary targets can lead to stress, burnout, and poor decision-making, undermining overall life satisfaction. Integrating value-based goals ensures alignment with individual priorities, fostering sustainable success and meaningful achievements.

Creating a Balanced Money Management Strategy

Creating a balanced money management strategy involves integrating wealth accumulation objectives with value-based goals to ensure financial growth aligns with personal values and long-term fulfillment. Prioritizing diversified investments and consistent savings plans supports wealth building, while allocating funds towards meaningful experiences or charitable causes reinforces value-driven priorities. This dual approach enhances financial stability and promotes a purposeful, well-rounded financial life.

Practical Steps for Setting Value-Driven Financial Goals

Setting value-driven financial goals requires identifying core personal values such as security, freedom, or legacy before defining specific wealth accumulation targets. Practical steps include prioritizing goals by aligning them with these values, breaking them into measurable milestones, and consistently reviewing progress to ensure financial decisions support long-term fulfillment rather than short-term gains. Incorporating tools like budgeting apps and financial advisors can enhance discipline and clarity in making value-based financial choices.

Choosing the Right Approach: Which Financial Path Suits You?

Wealth accumulation emphasizes building monetary assets and financial security through savings, investments, and income growth, ideal for those prioritizing financial independence and long-term stability. Value-based goals focus on aligning financial decisions with personal values, such as philanthropy, lifestyle, or ethical investments, catering to individuals seeking purpose beyond just wealth. Choosing the right approach depends on your priorities--whether maximizing net worth or fostering meaningful financial impact aligned with your core values.

Related Important Terms

Intentional Spending Framework

Wealth accumulation emphasizes maximizing financial assets through disciplined saving and investment, while value-based goals prioritize aligning spending with personal values and meaningful experiences within the Intentional Spending Framework. This approach encourages deliberate financial choices that enhance life satisfaction rather than solely increasing net worth.

Values-Driven Budgeting

Values-driven budgeting prioritizes allocating resources based on personal principles rather than solely on wealth accumulation targets, fostering financial decisions that enhance long-term fulfillment. This approach aligns spending and saving habits with intrinsic motivations, promoting sustainable economic behavior that transcends mere monetary gain.

Purpose-Linked Capital

Purpose-linked capital aligns wealth accumulation with personal values, directing financial resources toward meaningful, impact-driven objectives that transcend mere monetary growth. Focusing on value-based goals fosters sustainable wealth strategies that prioritize social, environmental, or ethical returns alongside financial success.

Legacy-First Wealth Planning

Legacy-first wealth planning emphasizes value-based goals, prioritizing enduring family values and meaningful impact over mere wealth accumulation. This approach aligns financial strategies with long-term legacy objectives, ensuring assets support generational purpose and philanthropic intentions.

Impact Allocation Strategy

Wealth accumulation prioritizes maximizing monetary gains through strategic investments, while value-based goals emphasize aligning financial decisions with personal or societal values to drive meaningful impact. An impact allocation strategy optimizes resource distribution by balancing financial returns with measurable social or environmental outcomes to achieve sustainable, purpose-driven wealth growth.

Satisficing Wealth Model

The Satisficing Wealth Model prioritizes achieving sufficient wealth to meet essential needs and personal values rather than maximizing financial accumulation. This approach balances economic security with fulfillment by aligning wealth goals to intrinsic motivations and life satisfaction metrics.

Fulfillment Return Index

The Fulfillment Return Index measures the alignment of wealth accumulation with personal values, emphasizing long-term satisfaction over mere financial gain. Prioritizing value-based goals enhances holistic well-being by integrating purpose-driven achievements alongside traditional monetary success.

Experiential Wealth Matrix

Wealth accumulation focuses on increasing financial assets and net worth, while value-based goals prioritize personal fulfillment and meaningful experiences as defined by the Experiential Wealth Matrix. This matrix emphasizes balancing monetary success with enriching life experiences to achieve holistic well-being and sustainable happiness.

Value-Weighted Asset Allocation

Value-weighted asset allocation prioritizes investments based on the proportional market value of assets within a portfolio, aligning wealth accumulation strategies with long-term value creation rather than sheer asset quantity. This approach enhances portfolio efficiency by emphasizing underlying asset value, promoting sustainable growth aligned with personalized, value-based financial goals.

Life Alignment Portfolio

Wealth accumulation focuses on increasing financial assets and net worth, while value-based goals emphasize aligning actions with personal values and long-term fulfillment. A Life Alignment Portfolio integrates both approaches by balancing monetary growth with meaningful pursuits, ensuring that financial decisions support holistic well-being and purposeful living.

Wealth Accumulation vs Value-Based Goals for goal. Infographic

moneydiff.com

moneydiff.com