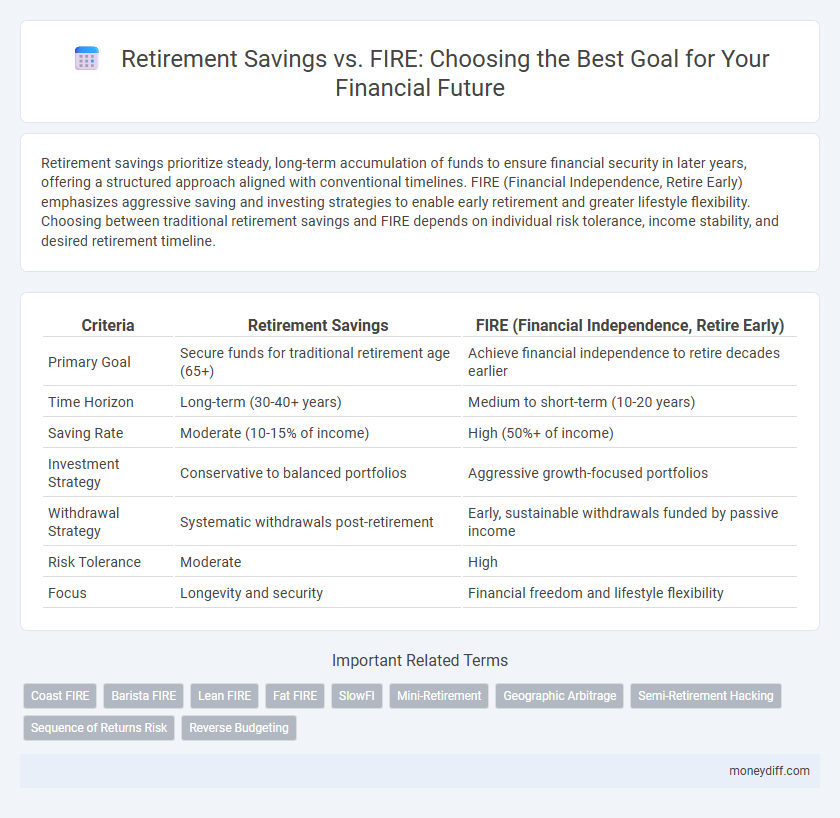

Retirement savings prioritize steady, long-term accumulation of funds to ensure financial security in later years, offering a structured approach aligned with conventional timelines. FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and investing strategies to enable early retirement and greater lifestyle flexibility. Choosing between traditional retirement savings and FIRE depends on individual risk tolerance, income stability, and desired retirement timeline.

Table of Comparison

| Criteria | Retirement Savings | FIRE (Financial Independence, Retire Early) |

|---|---|---|

| Primary Goal | Secure funds for traditional retirement age (65+) | Achieve financial independence to retire decades earlier |

| Time Horizon | Long-term (30-40+ years) | Medium to short-term (10-20 years) |

| Saving Rate | Moderate (10-15% of income) | High (50%+ of income) |

| Investment Strategy | Conservative to balanced portfolios | Aggressive growth-focused portfolios |

| Withdrawal Strategy | Systematic withdrawals post-retirement | Early, sustainable withdrawals funded by passive income |

| Risk Tolerance | Moderate | High |

| Focus | Longevity and security | Financial freedom and lifestyle flexibility |

Understanding Traditional Retirement Savings

Traditional retirement savings involve systematically contributing to employer-sponsored 401(k) plans or individual retirement accounts (IRAs), benefiting from tax advantages and compound growth over time. These savings strategies emphasize steady accumulation and risk management to ensure financial security by the traditional retirement age. Understanding contribution limits, tax implications, and withdrawal rules is essential for maximizing retirement readiness while maintaining long-term financial stability.

What Is the FIRE Movement?

The FIRE movement, or Financial Independence, Retire Early, centers on aggressive saving and investing to achieve early retirement, typically decades ahead of the traditional retirement age. It emphasizes maximizing savings rates, often 50% or more of income, and building a portfolio that generates passive income to cover living expenses. This approach contrasts with conventional retirement savings by prioritizing speed to financial independence over gradual accumulation.

Comparing Retirement Savings and FIRE Goals

Retirement savings focus on accumulating a comfortable nest egg through systematic contributions and employer-sponsored plans, targeting financial security after traditional retirement age. FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and investing to achieve financial independence decades earlier, aiming for early exit from the workforce. Comparing the two, retirement savings prioritize steady growth and risk management, while FIRE demands higher savings rates and lifestyle discipline to accelerate financial freedom.

Key Strategies for Traditional Retirement Planning

Maximizing contributions to tax-advantaged accounts like 401(k)s and IRAs forms the cornerstone of traditional retirement planning, ensuring steady growth through compound interest over time. Diversifying investments across stocks, bonds, and real estate reduces risk and enhances portfolio resilience during market fluctuations. Regularly reviewing and adjusting asset allocation aligns savings with evolving retirement timelines and financial goals, fostering long-term stability and secure income streams.

Essential Steps to Achieve FIRE

Building substantial retirement savings requires consistent contributions, diversified investments, and strategic tax planning to maximize growth over time. Achieving FIRE (Financial Independence, Retire Early) demands rigorous budgeting, aggressive saving rates of 50% or more of income, and investing primarily in low-cost index funds to expedite wealth accumulation. Tracking expenses meticulously and optimizing passive income streams are essential steps to secure financial independence years ahead of traditional retirement age.

Benefits and Drawbacks: Retirement Savings vs FIRE

Retirement savings provide a structured, low-risk approach to financial security with benefits like employer matching and tax advantages, but often require decades of consistent contributions and offer limited flexibility. FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and investing to achieve early retirement, maximizing freedom and lifestyle choices but posing risks such as market volatility and the need for sustained frugality. Balancing these approaches depends on individual goals, risk tolerance, and desired retirement timeline, with retirement savings favoring stability and FIRE prioritizing accelerated wealth accumulation.

Risk Management in Both Approaches

Retirement savings strategies prioritize steady, diversified investments to minimize market volatility risk and ensure long-term financial stability. FIRE (Financial Independence, Retire Early) demands more aggressive risk management due to its reliance on early asset accumulation and withdrawal, requiring precise budgeting and contingency planning for market downturns. Both approaches must integrate risk assessment tools and asset allocation to balance growth potential with protection against economic uncertainties.

Budgeting Methods for Each Goal

Retirement savings typically employ traditional budgeting methods focused on steady income allocation, with emphasis on consistent contributions to 401(k)s or IRAs and gradual expense adjustments over time. FIRE (Financial Independence, Retire Early) budgeting requires aggressive expense tracking and optimized cash flow management, prioritizing high savings rates often above 50% of income to accelerate wealth accumulation. Both strategies benefit from tailored budgeting tools, but FIRE demands stricter fiscal discipline and detailed forecasting to meet early retirement timelines.

Lifestyle Considerations: Retire Later or FIRE Early?

Retirement savings typically emphasize steady accumulation of funds for a comfortable lifestyle later in life, prioritizing security and gradual growth. FIRE (Financial Independence, Retire Early) focuses on extreme savings rates and frugality to achieve early retirement, often requiring lifestyle adjustments and disciplined expense management. Choosing between retiring later with traditional savings or pursuing FIRE depends on individual lifestyle preferences, risk tolerance, and long-term financial goals.

Choosing the Right Approach for Your Financial Future

Retirement savings emphasize steady, long-term wealth accumulation through disciplined contributions to accounts like 401(k)s and IRAs, providing reliable income after traditional retirement age. FIRE (Financial Independence, Retire Early) prioritizes aggressive saving and investing strategies to achieve financial independence much earlier, often in your 30s or 40s, allowing for greater lifestyle flexibility. Selecting the right approach depends on individual goals, risk tolerance, income stability, and desired retirement timeline to create a personalized financial future.

Related Important Terms

Coast FIRE

Coast FIRE allows individuals to stop contributing to retirement savings early while their investments grow tax-advantaged until traditional retirement age, effectively achieving a financial freedom goal without continuous saving. This strategy emphasizes starting early and maximizing compounding returns, minimizing the pressure to save aggressively later and aligning with long-term financial independence objectives.

Barista FIRE

Barista FIRE focuses on accumulating moderate retirement savings to achieve early retirement while maintaining part-time or flexible work, blending financial independence with reduced employment stress. This approach contrasts with traditional retirement savings goals that prioritize fully funded retirement before ceasing work entirely.

Lean FIRE

Lean FIRE emphasizes minimalism and frugality to reach financial independence faster with lower retirement savings compared to traditional retirement goals, targeting an annual expense budget often between $25,000 and $40,000. This approach prioritizes maximizing savings rate, reducing discretionary spending, and optimizing investment returns to achieve early retirement while maintaining a modest but sustainable lifestyle.

Fat FIRE

Focusing on Fat FIRE as a retirement savings goal emphasizes accumulating substantial wealth to enable a luxurious, early retirement with financial independence. This approach requires aggressive saving, strategic investments, and higher income streams compared to traditional retirement plans, ensuring not only financial security but also an elevated lifestyle post-retirement.

SlowFI

SlowFI emphasizes consistent, moderate retirement savings over aggressive financial independence and early retirement (FIRE) strategies, prioritizing sustainable wealth accumulation with reduced stress. This approach aligns with long-term financial security goals by balancing lifestyle enjoyment and gradual asset growth without extreme austerity.

Mini-Retirement

Mini-retirement offers flexible, intermittent breaks from traditional work, enabling individuals to enjoy partial financial freedom without fully relying on complete retirement savings or achieving full FIRE (Financial Independence, Retire Early). This approach balances ongoing income generation with periods of leisure, making it a practical goal for those seeking lifestyle flexibility over strictly reaching a large retirement nest egg.

Geographic Arbitrage

Retirement savings strategies often depend on Geographic Arbitrage, where individuals maximize wealth by relocating to regions with a lower cost of living, enhancing their purchasing power and extending their savings. FIRE (Financial Independence, Retire Early) leverages this concept intensively, as early retirees frequently choose destinations with favorable economic conditions to stretch their accumulated funds further and sustain their lifestyle.

Semi-Retirement Hacking

Semi-retirement hacking leverages strategic retirement savings to achieve Financial Independence, Retire Early (FIRE) goals by balancing partial work income with investment returns, accelerating wealth accumulation while maintaining lifestyle flexibility. Optimizing contributions to tax-advantaged accounts and diversifying income streams enhances the capacity to semi-retire without depleting retirement funds prematurely.

Sequence of Returns Risk

Managing Retirement Savings requires careful attention to Sequence of Returns Risk, which can significantly impact portfolio longevity during early withdrawals. FIRE strategies amplify this risk due to early retirement timelines, demanding robust withdrawal plans and diversified asset allocations to mitigate market volatility effects.

Reverse Budgeting

Reverse budgeting prioritizes retirement savings by allocating funds to long-term investments before covering living expenses, enhancing financial discipline crucial for both traditional retirement plans and FIRE (Financial Independence, Retire Early) goals. This method helps maximize savings growth and accelerates achieving financial independence by ensuring consistent, goal-driven contributions.

Retirement Savings vs FIRE for goal. Infographic

moneydiff.com

moneydiff.com