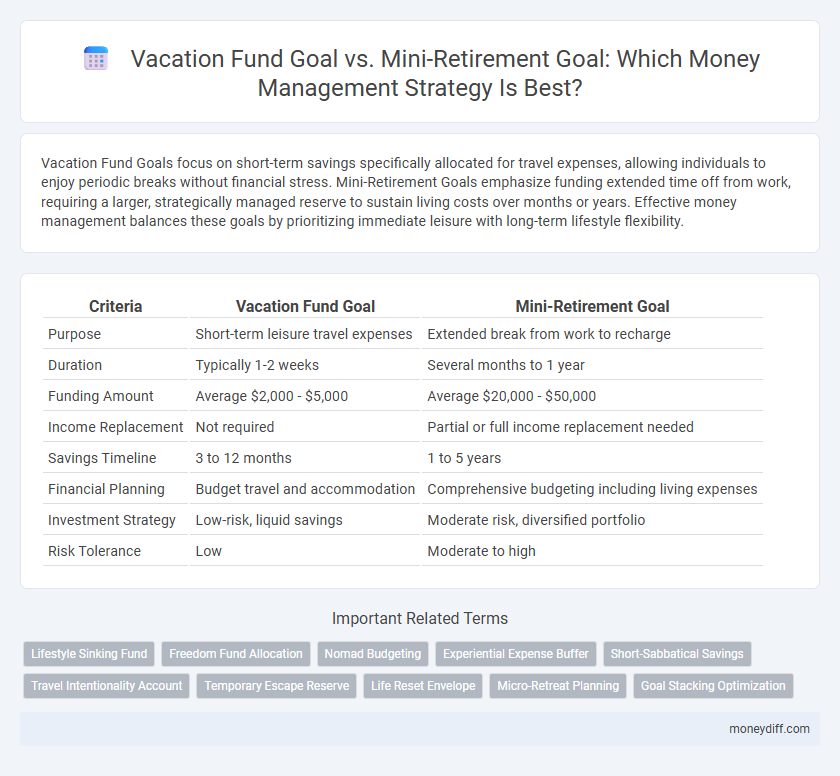

Vacation Fund Goals focus on short-term savings specifically allocated for travel expenses, allowing individuals to enjoy periodic breaks without financial stress. Mini-Retirement Goals emphasize funding extended time off from work, requiring a larger, strategically managed reserve to sustain living costs over months or years. Effective money management balances these goals by prioritizing immediate leisure with long-term lifestyle flexibility.

Table of Comparison

| Criteria | Vacation Fund Goal | Mini-Retirement Goal |

|---|---|---|

| Purpose | Short-term leisure travel expenses | Extended break from work to recharge |

| Duration | Typically 1-2 weeks | Several months to 1 year |

| Funding Amount | Average $2,000 - $5,000 | Average $20,000 - $50,000 |

| Income Replacement | Not required | Partial or full income replacement needed |

| Savings Timeline | 3 to 12 months | 1 to 5 years |

| Financial Planning | Budget travel and accommodation | Comprehensive budgeting including living expenses |

| Investment Strategy | Low-risk, liquid savings | Moderate risk, diversified portfolio |

| Risk Tolerance | Low | Moderate to high |

Understanding Vacation Fund vs Mini-Retirement Goals

Vacation fund goals focus on short-term savings targeted for specific trips or seasonal holidays, emphasizing liquidity and accessible budgeting. Mini-retirement goals require longer planning horizons, prioritizing financial independence and sustained income streams to support extended breaks from work. Effective money management distinguishes these goals by aligning savings strategies, risk tolerance, and timelines to optimize fund growth and availability.

Purpose and Scope: Short-Term vs Long-Term Financial Vision

A Vacation Fund Goal targets short-term financial planning focused on saving for specific trips, emphasizing immediate enjoyment and limited budgeting periods. In contrast, a Mini-Retirement Goal requires long-term financial vision with broader scope, enabling extended sabbaticals or lifestyle changes by accumulating substantial resources over years. Understanding these distinct purposes helps optimize money management strategies aligned with either periodic leisure or prolonged life breaks.

Key Differences Between Vacation Funds and Mini-Retirement Plans

Vacation funds focus on short-term savings for leisure trips, typically spanning days to weeks, emphasizing liquidity and quick access to cash. Mini-retirement plans target extended breaks from work, often lasting months, requiring more substantial financial planning, investment growth, and budgeting for living expenses. The key differences lie in timeframe, financial commitment, and the strategic approach to money management.

Setting Clear Objectives for Your Vacation Fund

Setting clear objectives for your vacation fund involves determining a specific savings target based on destination costs, travel duration, and anticipated expenses like accommodation, meals, and activities. Establishing a timeline to reach this goal ensures consistent contributions and prevents overspending by differentiating short-term needs from long-term financial plans such as a mini-retirement fund. Prioritizing vacation fund clarity helps optimize budgeting strategies, enabling disciplined saving while maintaining focus on immediate travel aspirations.

Planning a Successful Mini-Retirement: Essential Steps

Planning a successful mini-retirement involves setting clear financial milestones that differ from a typical vacation fund goal by emphasizing long-term sustainability and resource allocation. Prioritize creating a dedicated savings plan that accounts for extended living expenses, investment growth, and healthcare costs to ensure financial independence during your mini-retirement. Incorporate periodic reviews and adjustments to maintain alignment with lifestyle changes and economic fluctuations, optimizing your money management strategy for sustained success.

Budgeting Strategies for Each Financial Goal

Vacation Fund goals require short-term budgeting strategies that prioritize allocating specific monthly amounts toward travel expenses, often emphasizing flexible savings accounts to avoid penalties. Mini-Retirement goals demand long-term financial planning, incorporating diversified investment portfolios and automated contributions to build substantial funds for extended time off. Tailoring budgeting techniques to the time horizon and liquidity needs of each goal ensures efficient money management and goal achievement.

Benefits and Drawbacks: Vacation Fund vs Mini-Retirement

Vacation fund goals offer immediate financial relief by enabling short-term travel experiences without debt, enhancing mental well-being, but may encourage frequent spending that disrupts long-term savings. Mini-retirement goals promote extended breaks from work, fostering deeper personal growth and life balance, yet require substantial upfront savings and careful planning to avoid financial strain. Balancing these goals depends on prioritizing either quick leisure benefits or long-term lifestyle flexibility within money management strategies.

Saving Methods and Investment Options Compared

Vacation Fund goals prioritize short-term saving methods like high-yield savings accounts and money market funds to ensure liquidity and low risk. Mini-Retirement goals emphasize diversified investment options including index funds, bonds, and dividend stocks to balance growth and income over a medium-term horizon. The choice of saving or investment tools directly impacts the ability to meet financial targets, with vacation funds favoring conservative strategies and mini-retirements engaging moderate risk portfolios for wealth accumulation.

How to Prioritize Between Vacation and Mini-Retirement Goals

Prioritize your Vacation Fund goal when seeking short-term relaxation and immediate experiences, ensuring regular, manageable contributions to avoid financial strain. Shift focus to the Mini-Retirement goal for long-term financial independence, emphasizing robust savings and investment strategies to support extended breaks from work. Balance both by assessing your current financial stability, time horizon, and personal fulfillment preferences to allocate funds effectively between leisure and future freedom.

Integrating Both Goals Into Your Money Management Plan

Integrating Vacation Fund and Mini-Retirement Goals into your money management plan enhances financial flexibility and long-term satisfaction by allocating dedicated budgets for short-term enjoyment and extended life experiences. Prioritize establishing automatic transfers to separate accounts, ensuring consistent contributions toward both goals while tracking progress with budgeting apps like YNAB or Mint. Balancing these goals promotes disciplined savings habits, prevents overspending, and supports a diversified approach to personal financial wellness.

Related Important Terms

Lifestyle Sinking Fund

A Vacation Fund Goal targets short-term leisure expenses, allowing consistent saving for trips without disrupting monthly budgets, while a Mini-Retirement Goal supports extended lifestyle breaks by accumulating a larger lump sum for semi-retirement living. Prioritizing a Lifestyle Sinking Fund ensures dedicated cash flow management, preventing financial strain during planned lifestyle changes or vacations.

Freedom Fund Allocation

Vacation Fund Goals prioritize short-term savings for leisure travel, emphasizing liquidity and accessibility, whereas Mini-Retirement Goals target extended breaks funded by strategic Freedom Fund Allocation designed to sustain longer financial independence. Effective money management balances these goals by allocating resources to immediate enjoyment and long-term freedom, optimizing fund flexibility and growth potential.

Nomad Budgeting

Vacation Fund Goal prioritizes short-term savings specifically allocated for travel expenses, enabling Nomad Budgeting to maintain financial discipline without disrupting essential living costs. Mini-Retirement Goal involves setting aside larger, long-term funds to support extended breaks from work, emphasizing strategic planning for sustained income replacement during prolonged travel or sabbaticals.

Experiential Expense Buffer

A Vacation Fund Goal targets short-term leisure expenses, emphasizing an Experiential Expense Buffer to cover spontaneous activities and unexpected costs during trips, enhancing financial flexibility. In contrast, a Mini-Retirement Goal requires a larger, sustained Experiential Expense Buffer to support extended living costs and lifestyle maintenance over months, ensuring comfortable sabbaticals without income disruption.

Short-Sabbatical Savings

Short-sabbatical savings prioritize building a dedicated vacation fund that supports brief yet rejuvenating breaks without compromising long-term financial security. This focused approach contrasts with a mini-retirement goal, which requires substantial asset accumulation for extended lifestyle pauses and comprehensive financial planning.

Travel Intentionality Account

Vacation Fund Goal prioritizes short-term travel savings with flexible withdrawal options, ideal for frequent getaways, while Mini-Retirement Goal targets extended travel breaks funded through strategic long-term savings. The Travel Intentionality Account enhances both goals by aligning contributions with specific trip plans, optimizing budgeting for experiences and ensuring timely fund availability.

Temporary Escape Reserve

A Vacation Fund Goal centers on setting aside money for short-term travel experiences, ensuring a dedicated Temporary Escape Reserve without disrupting regular finances. A Mini-Retirement Goal involves accumulating a larger, flexible savings buffer that supports extended breaks from work, allowing for longer-term lifestyle freedom and financial security.

Life Reset Envelope

The Vacation Fund Goal prioritizes short-term savings within the Life Reset Envelope to cover planned leisure trips, enhancing relaxation and mental recharge without long-term financial strain. In contrast, the Mini-Retirement Goal allocates funds for extended breaks or sabbaticals, focusing on strategic life resets that support career breaks or personal growth, requiring more substantial and sustained financial planning.

Micro-Retreat Planning

Vacation Fund Goal targets short-term savings specifically for planned trips, enabling disciplined micro-retreat planning with manageable financial increments. Mini-Retirement Goal encompasses broader long-term financial strategies to support extended breaks from work, requiring more substantial savings and investment management.

Goal Stacking Optimization

Vacation Fund Goal and Mini-Retirement Goal differ in duration and financial scope, with Vacation Fund aiming for short-term, smaller savings and Mini-Retirement requiring larger, long-term capital accumulation. Goal Stacking Optimization leverages simultaneous contributions to both goals, enhancing cash flow management and maximizing overall savings efficiency through prioritized allocation and periodic reassessment.

Vacation Fund Goal vs Mini-Retirement Goal for money management Infographic

moneydiff.com

moneydiff.com