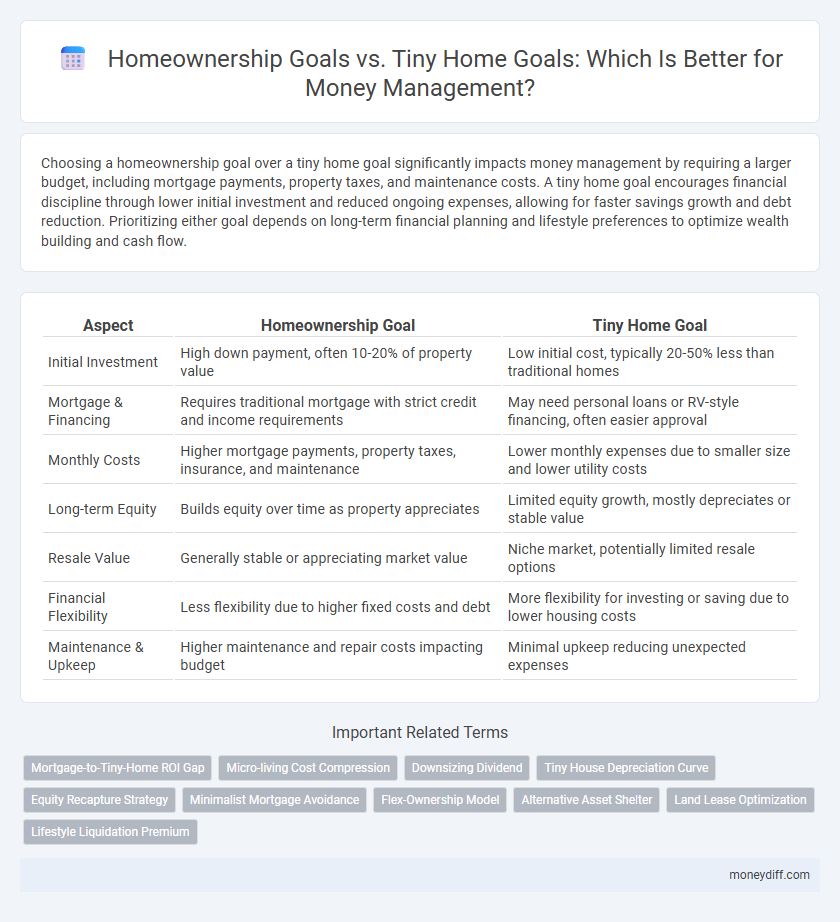

Choosing a homeownership goal over a tiny home goal significantly impacts money management by requiring a larger budget, including mortgage payments, property taxes, and maintenance costs. A tiny home goal encourages financial discipline through lower initial investment and reduced ongoing expenses, allowing for faster savings growth and debt reduction. Prioritizing either goal depends on long-term financial planning and lifestyle preferences to optimize wealth building and cash flow.

Table of Comparison

| Aspect | Homeownership Goal | Tiny Home Goal |

|---|---|---|

| Initial Investment | High down payment, often 10-20% of property value | Low initial cost, typically 20-50% less than traditional homes |

| Mortgage & Financing | Requires traditional mortgage with strict credit and income requirements | May need personal loans or RV-style financing, often easier approval |

| Monthly Costs | Higher mortgage payments, property taxes, insurance, and maintenance | Lower monthly expenses due to smaller size and lower utility costs |

| Long-term Equity | Builds equity over time as property appreciates | Limited equity growth, mostly depreciates or stable value |

| Resale Value | Generally stable or appreciating market value | Niche market, potentially limited resale options |

| Financial Flexibility | Less flexibility due to higher fixed costs and debt | More flexibility for investing or saving due to lower housing costs |

| Maintenance & Upkeep | Higher maintenance and repair costs impacting budget | Minimal upkeep reducing unexpected expenses |

Understanding Homeownership and Tiny Home Goals

Homeownership goals typically involve long-term investment in traditional properties with higher mortgage payments and maintenance costs, requiring substantial savings and credit management. Tiny home goals prioritize affordability, reduced utility expenses, and minimal upkeep, often enabling faster financial independence and flexibility. Understanding these differences helps tailor money management strategies to align with desired lifestyle and financial stability.

Financial Implications of Traditional Homeownership

Traditional homeownership involves significant financial commitments, including a substantial down payment, mortgage payments, property taxes, insurance, and maintenance costs, which can strain budgets and limit liquidity. In contrast, tiny home living offers lower upfront costs and reduced ongoing expenses, providing greater financial flexibility and potential for faster debt repayment or savings accumulation. Evaluating the financial implications of each option is crucial for aligning homeownership goals with long-term money management strategies.

Cost Comparison: Tiny Homes vs Traditional Homes

Tiny homes typically cost between $30,000 and $60,000, significantly lower than traditional homes, which average $300,000 to $400,000 nationally. This cost disparity impacts money management strategies, with tiny home owners able to allocate more funds toward savings or debt reduction. Maintenance and utility expenses for tiny homes also remain substantially lower, enhancing long-term affordability compared to traditional homeownership.

Upfront Investment and Mortgage Considerations

Homeownership goals typically require a substantial upfront investment, including down payments ranging from 3% to 20% of the property's value, along with closing costs and potential renovation expenses. In contrast, tiny home goals significantly reduce initial financial barriers, often allowing buyers to purchase or build a tiny home with minimal down payment or even cash, reducing mortgage dependence. Mortgage considerations for traditional homes involve long-term loans with fixed or variable interest rates, while tiny homes may qualify for personal loans or specialized financing options with shorter terms and lower overall debt commitments.

Long-Term Savings and Ongoing Expenses

Homeownership typically demands higher upfront costs, including down payments and maintenance, but offers long-term equity growth and property value appreciation. Tiny homes require less initial investment and lower ongoing expenses, which can accelerate savings and reduce financial strain. Prioritizing a tiny home goal supports flexibility in money management, while traditional homeownership aligns with wealth-building through real estate.

Resale Value and Investment Potential

Homeownership typically offers higher resale value and long-term investment potential due to property appreciation and equity build-up. Tiny homes often have lower resale value and limited investment growth, but they provide affordability and reduced maintenance costs. Prioritizing traditional homes can maximize financial gains, while tiny homes support flexible, cost-effective lifestyle goals.

Flexibility and Lifestyle Impact on Finances

Homeownership goals often demand substantial financial commitment with long-term mortgage obligations, impacting flexibility in lifestyle choices and limiting liquidity for other investments. Tiny home goals offer greater financial flexibility through lower upfront costs and reduced expenses, enabling more adaptable living arrangements and increased ability to allocate funds toward experiences or savings. Prioritizing a tiny home can enhance lifestyle freedom and financial agility, while traditional homeownership typically ties finances to a fixed asset with less immediate adaptability.

Maintenance Costs: Homes vs Tiny Homes

Maintenance costs for traditional homes typically range from 1% to 4% of the home's value annually, including expenses for repairs, landscaping, and utilities. Tiny homes offer significantly lower upkeep due to their smaller size, reduced utility consumption, and simpler systems, often cutting maintenance costs by more than 50%. Managing a tiny home goal can free up more financial resources for savings or investment compared to the higher, ongoing expenses associated with conventional homeownership.

Debt Reduction Strategies for Each Option

Debt reduction strategies for traditional homeownership often involve leveraging mortgage refinancing to lower interest rates and prioritizing high-interest debt payoff to improve credit scores for better loan terms. In contrast, tiny home buyers can focus on minimizing upfront debt by opting for smaller loans or paying cash to avoid long-term financing, alongside aggressively eliminating existing debts to maximize savings. Both approaches benefit from creating strict budgets and emergency funds to prevent new debt accumulation during the homeownership process.

Aligning Your Money Management Plan with Housing Goals

Aligning your money management plan with housing goals requires evaluating the long-term financial impact of homeownership versus investing in a tiny home. Conventional homeownership typically involves higher mortgage payments, property taxes, and maintenance expenses, while a tiny home lowers costs and increases savings potential. Prioritize budgeting strategies that reflect your chosen housing goal to optimize cash flow, build equity, and achieve financial stability.

Related Important Terms

Mortgage-to-Tiny-Home ROI Gap

Comparing homeownership goals reveals a significant mortgage-to-tiny-home ROI gap, where traditional mortgage payments often yield lower financial returns compared to investing in a tiny home, which offers reduced costs and faster equity growth. Prioritizing a tiny home can optimize money management by minimizing debt and maximizing property appreciation potential in emerging micro-housing markets.

Micro-living Cost Compression

Achieving a homeownership goal typically requires substantial upfront investment and long-term financial commitment, whereas pursuing a tiny home goal emphasizes micro-living cost compression by minimizing expenses related to space, utilities, and maintenance. Prioritizing tiny homes enables more efficient money management through reduced mortgage burdens and lower operational costs, making it a strategic choice for financial flexibility and accelerated savings.

Downsizing Dividend

Prioritizing a homeownership goal typically requires significant financial reserves and long-term mortgage commitments, whereas a tiny home goal emphasizes downsizing dividend by reducing living expenses and freeing up capital for investments or debt repayment. This strategy enhances cash flow management and accelerates wealth accumulation by minimizing maintenance costs and utility bills associated with larger properties.

Tiny House Depreciation Curve

Tiny homes typically experience a steeper depreciation curve than traditional homes, significantly impacting long-term equity growth and money management strategies. Homeownership with a conventional property often results in more stable asset appreciation, making it a more effective goal for building wealth over time.

Equity Recapture Strategy

Homeownership goals often emphasize long-term wealth building through property appreciation and mortgage principal reduction, which strengthens equity recapture strategies by leveraging asset growth and loan amortization. In contrast, tiny home goals prioritize minimizing upfront costs and ongoing expenses, enabling faster equity recapture by reducing debt and accelerating ownership transition to asset accumulation.

Minimalist Mortgage Avoidance

Focusing on a tiny home as a minimalist mortgage avoidance strategy allows for significant savings by reducing upfront costs and monthly payments, promoting efficient money management. Prioritizing tiny home ownership aligns with goals to minimize debt, streamline expenses, and build financial freedom faster than traditional homeownership.

Flex-Ownership Model

The Flex-Ownership Model bridges the gap between traditional homeownership and tiny home investments by offering scalable equity options and diversified asset control, optimizing long-term wealth building and cash flow management. This innovative approach enables flexible capital allocation, mitigating risks tied to single asset dependency while enhancing liquidity compared to conventional homeownership or solely tiny home goals.

Alternative Asset Shelter

Choosing a tiny home as an alternative asset shelter offers a cost-effective approach to achieving homeownership goals while maximizing financial flexibility and reducing long-term debt. This strategy prioritizes efficient money management by minimizing expenses such as property taxes, utility costs, and maintenance typically associated with traditional homes.

Land Lease Optimization

Optimizing land lease costs is crucial for both homeownership and tiny home goals, as minimizing lease expenses directly impacts overall affordability and long-term financial planning. Prioritizing land lease terms and location can maximize investment value, making it a key factor in effective money management for either housing objective.

Lifestyle Liquidation Premium

Choosing a traditional homeownership goal often demands a higher Lifestyle Liquidation Premium due to larger mortgage payments and maintenance costs compared to a tiny home goal, which minimizes financial strain by reducing living expenses and amplifying savings potential. Prioritizing a tiny home facilitates more agile money management and increased investment liquidity, enabling faster wealth accumulation.

Homeownership goal vs Tiny home goal for money management. Infographic

moneydiff.com

moneydiff.com