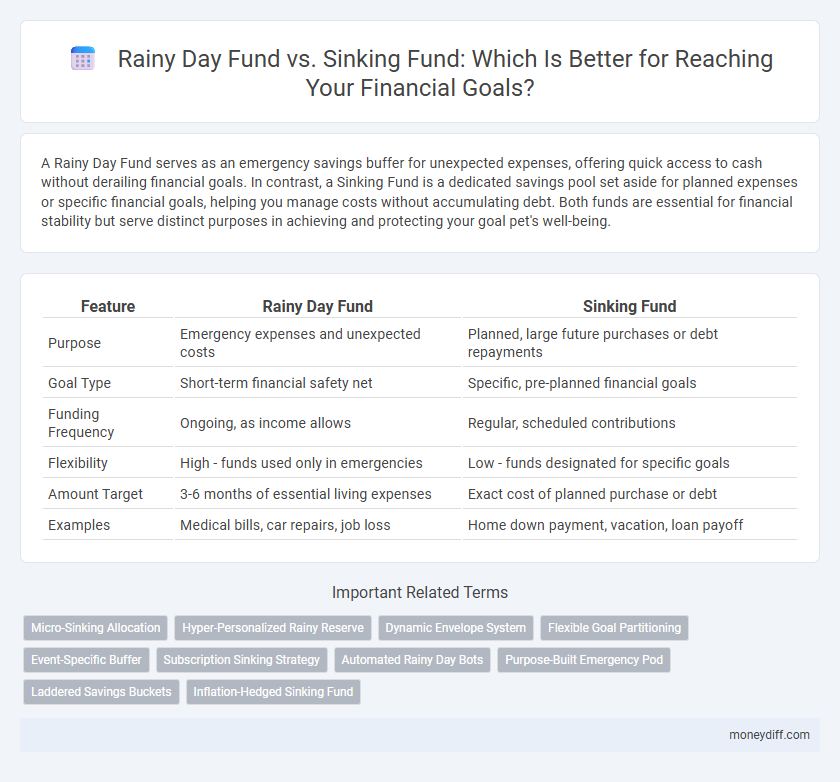

A Rainy Day Fund serves as an emergency savings buffer for unexpected expenses, offering quick access to cash without derailing financial goals. In contrast, a Sinking Fund is a dedicated savings pool set aside for planned expenses or specific financial goals, helping you manage costs without accumulating debt. Both funds are essential for financial stability but serve distinct purposes in achieving and protecting your goal pet's well-being.

Table of Comparison

| Feature | Rainy Day Fund | Sinking Fund |

|---|---|---|

| Purpose | Emergency expenses and unexpected costs | Planned, large future purchases or debt repayments |

| Goal Type | Short-term financial safety net | Specific, pre-planned financial goals |

| Funding Frequency | Ongoing, as income allows | Regular, scheduled contributions |

| Flexibility | High - funds used only in emergencies | Low - funds designated for specific goals |

| Amount Target | 3-6 months of essential living expenses | Exact cost of planned purchase or debt |

| Examples | Medical bills, car repairs, job loss | Home down payment, vacation, loan payoff |

Understanding Rainy Day Funds and Sinking Funds

Rainy day funds serve as emergency savings designed to cover unexpected expenses such as car repairs or medical bills, providing financial security during unforeseen events. Sinking funds, on the other hand, are targeted savings accounts for planned future expenses like vacations, home improvements, or large purchases, allowing for intentional budget management. Distinguishing between these funds helps maintain financial stability by ensuring both immediate emergencies and future goals are adequately funded.

Key Differences Between Rainy Day and Sinking Funds

Rainy day funds are designed to cover unexpected, short-term emergencies such as car repairs or medical bills, while sinking funds are planned savings set aside for specific, anticipated expenses like buying a car or funding a vacation. Rainy day funds typically require liquidity and immediate access, whereas sinking funds allow for scheduled contributions over time, optimizing budgeting. The key difference lies in purpose and timing: rainy day funds address unpredictable needs, and sinking funds prepare for known financial goals.

When to Use a Rainy Day Fund

A Rainy Day Fund is essential for unexpected, short-term emergencies such as car repairs, medical bills, or temporary loss of income, providing immediate financial relief without disrupting long-term savings. Use a Rainy Day Fund before tapping into a Sinking Fund, which is better suited for planned, larger expenses like home renovations or vacations. Maintaining a Rainy Day Fund ensures financial stability and prevents debt during unforeseen financial setbacks.

When to Use a Sinking Fund

Use a sinking fund when saving for a specific, planned expense such as a car replacement, home renovation, or vacation, allowing you to set aside money gradually over time. Unlike a rainy day fund, which is reserved for unexpected emergencies, a sinking fund targets known future costs with clear timelines and fixed amounts. This approach helps maintain financial discipline and prevents borrowing or depleting emergency savings for predictable expenses.

Setting Clear Money Management Goals

A Rainy Day Fund is designed to cover unexpected, short-term expenses like car repairs or medical emergencies, providing immediate financial security. A Sinking Fund, on the other hand, targets planned, specific future expenses such as purchasing a new appliance or funding a vacation, allowing for disciplined, goal-oriented saving over time. Setting clear money management goals involves distinguishing between these funds to allocate resources effectively and ensure both urgent needs and future plans are financially supported.

How to Allocate Funds for Specific Goals

Allocating funds for specific goals involves distinguishing between a Rainy Day Fund and a Sinking Fund based on purpose and timing. A Rainy Day Fund provides immediate liquidity for unexpected expenses, typically holding three to six months' worth of living costs in highly accessible accounts, while a Sinking Fund is earmarked for planned, known expenses with a fixed timeline, such as a vacation or car purchase, and can be invested for potentially higher returns. Effective fund allocation requires assessing goal urgency, amount needed, and risk tolerance to determine proper fund size and investment strategy.

Steps to Build a Rainy Day Fund

Start by setting a clear savings target based on three to six months' worth of essential expenses to cover unexpected financial emergencies. Automate regular contributions to a dedicated Rainy Day Fund account, ensuring consistent growth without impacting monthly budgets. Review and adjust the fund quarterly to stay aligned with changes in living costs and income stability.

Steps to Create Effective Sinking Funds

To create effective sinking funds, start by clearly defining the specific goal, including the total amount needed and the target date for achieving it. Break down the total cost into manageable monthly contributions to ensure consistent savings without straining your budget. Regularly track progress and adjust contributions if necessary to stay on schedule and meet the financial objective.

Common Mistakes in Fund Management

Confusing a Rainy Day Fund with a Sinking Fund often leads to misallocation of resources, as the former is intended for unexpected emergencies, while the latter targets specific debt repayment or large purchases. Common mistakes include using the Rainy Day Fund for planned expenses, which depletes reserves needed for true emergencies, and underfunding the Sinking Fund, risking missed payments or delayed goals. Effective fund management requires clearly distinguishing between these accounts and regularly reviewing contributions according to financial priorities and timelines.

Choosing the Right Fund for Your Financial Goals

A Rainy Day Fund serves as a financial safety net for unexpected expenses such as car repairs or medical bills, while a Sinking Fund is dedicated to saving for planned, specific goals like a vacation or a down payment. Prioritize building a Rainy Day Fund with three to six months' worth of living expenses before allocating money toward a Sinking Fund to ensure financial stability. Assess your financial priorities and timelines carefully to choose the right fund that aligns with your short-term emergency needs and long-term savings goals.

Related Important Terms

Micro-Sinking Allocation

A Rainy Day Fund is designed to cover unexpected short-term expenses, while a Sinking Fund focuses on setting aside money for planned future goals, enhancing financial stability through micro-sinking allocations. Micro-sinking allocations break down larger savings goals into manageable, periodic contributions, optimizing cash flow and ensuring steady progress toward financial objectives.

Hyper-Personalized Rainy Reserve

A Hyper-Personalized Rainy Reserve tailors funds specifically to individual risk profiles and anticipated financial emergencies, providing more precise coverage than a general Rainy Day Fund. Unlike a Sinking Fund that targets predictable expenses, this reserve dynamically adjusts to unexpected personal circumstances, enhancing financial resilience for goal achievement.

Dynamic Envelope System

The Dynamic Envelope System distinguishes Rainy Day Funds as flexible reserves for unexpected expenses, while Sinking Funds are targeted savings allocated for planned, specific financial goals. This strategic separation enhances budget control and ensures both emergent needs and future expenditures are effectively managed.

Flexible Goal Partitioning

Rainy Day Funds provide flexible goal partitioning by covering unexpected expenses without disrupting long-term savings, whereas Sinking Funds allocate fixed amounts toward specific future purchases, limiting adaptability. Optimal financial planning integrates both, allowing dynamic reallocation of resources to balance immediate uncertainties and planned expenditures.

Event-Specific Buffer

A Rainy Day Fund serves as an emergency reserve for unexpected expenses, while a Sinking Fund is an event-specific buffer designed to accumulate money for anticipated future costs like vacations or home repairs. Prioritizing a Sinking Fund enables precise financial planning by allocating funds toward defined goals with clear timelines.

Subscription Sinking Strategy

A Rainy Day Fund provides immediate financial relief for unexpected expenses, while a Subscription Sinking Fund systematically accumulates money for planned periodic payments like subscriptions. Employing a Subscription Sinking Strategy ensures consistent, stress-free funding for recurring costs by allocating fixed amounts regularly, optimizing budget management and avoiding last-minute financial strain.

Automated Rainy Day Bots

Automated Rainy Day Bots efficiently allocate funds for unexpected expenses by automatically transferring small amounts into a Rainy Day Fund, ensuring liquidity without manual intervention. Unlike a Sinking Fund dedicated to planned future expenses, these bots dynamically adjust contributions based on spending patterns and account balances for optimal financial preparedness.

Purpose-Built Emergency Pod

A Rainy Day Fund is designed as a short-term financial buffer for unexpected expenses like minor car repairs or medical bills, whereas a Sinking Fund is a purpose-built emergency pod intended to accumulate savings for specific future goals such as home renovations or vacation costs. Establishing a clear distinction between these funds helps optimize budgeting strategies and ensures targeted financial preparedness.

Laddered Savings Buckets

Rainy Day Funds provide immediate liquidity for unexpected expenses, while Sinking Funds are designated for planned future goals, both optimized through laddered savings buckets to maximize accessibility and growth. By structuring savings into tiered timelines, individuals can efficiently allocate resources, ensuring short-term emergencies and long-term objectives are financially covered.

Inflation-Hedged Sinking Fund

An inflation-hedged sinking fund safeguards long-term financial goals by adjusting contributions and investments to outpace inflation, ensuring the fund maintains purchasing power over time. Unlike a rainy day fund designed for immediate, unforeseen expenses, this fund strategically grows to meet specific future liabilities, protecting against the eroding effects of inflation.

Rainy Day Fund vs Sinking Fund for goal. Infographic

moneydiff.com

moneydiff.com