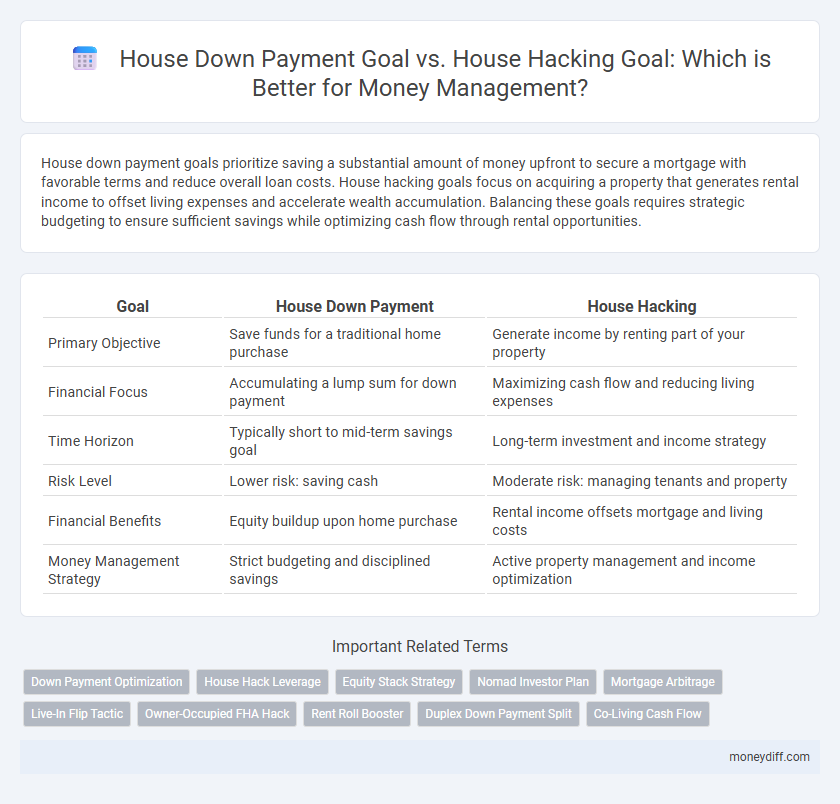

House down payment goals prioritize saving a substantial amount of money upfront to secure a mortgage with favorable terms and reduce overall loan costs. House hacking goals focus on acquiring a property that generates rental income to offset living expenses and accelerate wealth accumulation. Balancing these goals requires strategic budgeting to ensure sufficient savings while optimizing cash flow through rental opportunities.

Table of Comparison

| Goal | House Down Payment | House Hacking |

|---|---|---|

| Primary Objective | Save funds for a traditional home purchase | Generate income by renting part of your property |

| Financial Focus | Accumulating a lump sum for down payment | Maximizing cash flow and reducing living expenses |

| Time Horizon | Typically short to mid-term savings goal | Long-term investment and income strategy |

| Risk Level | Lower risk: saving cash | Moderate risk: managing tenants and property |

| Financial Benefits | Equity buildup upon home purchase | Rental income offsets mortgage and living costs |

| Money Management Strategy | Strict budgeting and disciplined savings | Active property management and income optimization |

Understanding House Down Payment Goals

Understanding house down payment goals involves setting a clear savings target, typically 20% of the home's purchase price, to avoid private mortgage insurance (PMI) and secure favorable loan terms. This financial benchmark helps homebuyers manage cash flow effectively, reduce overall borrowing costs, and build equity faster. Prioritizing this goal over house hacking ensures a strong foundation for long-term homeownership stability and creditworthiness.

What is House Hacking?

House hacking is a real estate investment strategy where an individual purchases a multi-unit property, lives in one unit, and rents out the others to generate rental income that offsets mortgage payments. This method helps reduce housing costs, build equity faster, and create passive income streams while living in the property. Compared to a traditional house down payment goal focused solely on homeownership, house hacking emphasizes leveraging rental income to improve overall money management and accelerate wealth-building.

Comparing Initial Investment Requirements

House down payment goals typically demand a substantial upfront sum, often 20% of the property's purchase price, which can strain personal savings and delay homeownership. House hacking goals require a comparatively lower initial investment, leveraging rental income from shared spaces to offset mortgage costs and reduce financial burden. Comparing these, house hacking offers a more accessible path with smaller initial capital, making it an efficient strategy for managing money and building equity simultaneously.

Impact on Monthly Cash Flow

Allocating funds toward a house down payment reduces initial debt but often requires higher monthly mortgage payments, impacting cash flow more significantly. House hacking leverages rental income from part of the property, offsetting mortgage costs and potentially resulting in positive or neutral monthly cash flow. Prioritizing house hacking as a goal enhances financial flexibility by balancing housing expenses with income generation.

Long-Term Wealth Building Potential

House down payment goals prioritize saving a substantial lump sum to reduce mortgage principal and interest expenses, accelerating home equity accumulation. House hacking goals emphasize generating rental income by leveraging multi-unit properties or spare rooms, enhancing cash flow and offsetting housing costs. Both strategies contribute to long-term wealth building, with down payments reducing debt burden and house hacking creating ongoing passive income streams.

Risk Factors: Down Payment vs. House Hacking

A down payment goal poses risks tied to market volatility and the challenge of saving a substantial lump sum, potentially delaying homeownership. House hacking mitigates financial risk by generating rental income to offset mortgage costs, but it introduces tenant management and property maintenance responsibilities. Balancing these risks requires assessing personal financial stability, tolerance for landlord duties, and long-term wealth-building strategies.

Accessibility for First-Time Buyers

House Down Payment Goal emphasizes saving a substantial lump sum to secure a traditional mortgage, often delaying homeownership for first-time buyers due to high initial costs. House Hacking Goal leverages rental income from additional property units to offset mortgage payments, enhancing financial accessibility and reducing upfront savings burdens. This strategy enables first-time buyers to enter the housing market sooner while building equity and cash flow simultaneously.

Tax Implications of Each Strategy

Allocating funds toward a house down payment often limits tax deductions primarily to mortgage interest and property taxes, which can reduce taxable income but may not maximize tax benefits. House hacking, by renting out part of the property, enables leveraging rental income to offset mortgage costs and unlocks additional deductions like depreciation, maintenance expenses, and portioned utilities. Evaluating tax implications reveals that house hacking offers more dynamic tax advantages, potentially improving cash flow and overall money management compared to a traditional down payment approach.

Lifestyle Considerations and Trade-offs

Choosing between a house down payment goal and a house hacking goal requires evaluating lifestyle preferences and financial trade-offs. A down payment goal prioritizes saving for a traditional home purchase, emphasizing stability and long-term equity, whereas house hacking leverages rental income to offset mortgage costs, often demanding increased management and reduced privacy. Balancing these options depends on one's tolerance for shared living spaces, desire for financial flexibility, and willingness to handle tenant responsibilities.

Choosing the Best Money Management Strategy

Choosing between a house down payment goal and a house hacking goal depends on your financial priorities and risk tolerance. Prioritizing a down payment goal builds equity faster and requires disciplined saving, while house hacking leverages rental income to offset mortgage costs and accelerates wealth accumulation. Evaluating monthly cash flow, local rental market conditions, and your long-term investment strategy ensures selecting the best money management approach for homeownership.

Related Important Terms

Down Payment Optimization

Prioritizing a house down payment goal enhances financial stability by minimizing mortgage insurance costs and reducing interest over time. Focusing on down payment optimization maximizes available funds for investment, accelerating homeownership compared to house hacking strategies that may delay substantial equity building.

House Hack Leverage

House hacking leverages rental income from shared living spaces to accelerate down payment savings and reduce monthly housing expenses, creating a financially strategic approach to homeownership. Compared to a traditional house down payment goal, house hacking enhances cash flow and investment opportunities, optimizing money management and building equity faster.

Equity Stack Strategy

House Down Payment Goal emphasizes accumulating cash reserves to secure a traditional mortgage, while House Hacking Goal leverages rental income to offset mortgage costs and build equity faster. Equity Stack Strategy optimizes financial growth by combining property appreciation, principal paydown, and rental income reinvestment for accelerated wealth accumulation.

Nomad Investor Plan

The Nomad Investor Plan emphasizes prioritizing the House Down Payment Goal to secure stable property ownership and build equity before pursuing the House Hacking Goal, which involves leveraging rental income to offset housing costs and accelerate wealth accumulation. Effective money management under this plan involves allocating funds strategically to meet the down payment target while preparing to optimize cash flow through house hacking once ownership is established.

Mortgage Arbitrage

Focusing on mortgage arbitrage, a house down payment goal prioritizes saving a lump sum to minimize loan amounts and interest costs, while a house hacking goal emphasizes acquiring a property with rental units to generate income that offsets mortgage payments. Leveraging rental income in house hacking can accelerate wealth building by reducing personal housing expenses and enabling reinvestment, contrasting with the traditional approach of minimizing debt through a large down payment.

Live-In Flip Tactic

House Down Payment Goal prioritizes saving a lump sum to secure traditional home financing, while House Hacking Goal emphasizes leveraging rental income to offset mortgage costs and build equity. The Live-In Flip Tactic combines these strategies by purchasing undervalued properties, living on-site to reduce expenses, and renovating for increased market value and faster equity growth.

Owner-Occupied FHA Hack

Owner-occupied FHA house hacking maximizes financial efficiency by leveraging a low down payment requirement, typically 3.5%, compared to traditional house down payments that often require 20% or more, accelerating homeownership and reducing upfront costs. This strategy enables homeowners to offset mortgage expenses through rental income, enhancing cash flow management and long-term wealth building while meeting FHA occupancy and loan criteria.

Rent Roll Booster

Prioritizing a house down payment goal builds equity and leverages traditional homeownership benefits, while a house hacking goal using a rent roll booster maximizes cash flow by renting out portions of the property to cover mortgage costs. Rent roll boosters enhance money management by generating passive income streams that accelerate financial independence and offset housing expenses.

Duplex Down Payment Split

Prioritizing a Duplex down payment split balances immediate cash flow benefits from house hacking with long-term equity goals, optimizing both savings efficiency and investment growth. This strategy leverages rental income to reduce out-of-pocket expenses while accelerating mortgage payoff and building wealth.

Co-Living Cash Flow

Prioritizing a house down payment goal emphasizes accumulating a substantial upfront sum to secure traditional homeownership, whereas a house hacking goal targets acquiring multi-unit properties to generate co-living cash flow and optimize money management through rental income. Leveraging co-living arrangements boosts passive income streams, accelerating mortgage payoff and increasing overall financial flexibility compared to the lump-sum savings approach.

House Down Payment Goal vs House Hacking Goal for money management Infographic

moneydiff.com

moneydiff.com