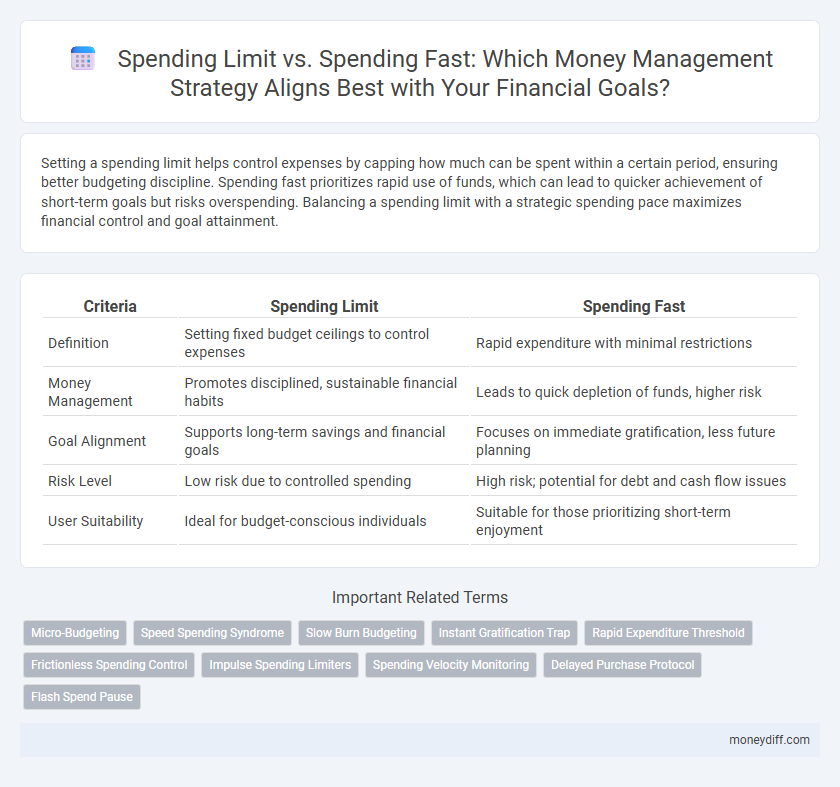

Setting a spending limit helps control expenses by capping how much can be spent within a certain period, ensuring better budgeting discipline. Spending fast prioritizes rapid use of funds, which can lead to quicker achievement of short-term goals but risks overspending. Balancing a spending limit with a strategic spending pace maximizes financial control and goal attainment.

Table of Comparison

| Criteria | Spending Limit | Spending Fast |

|---|---|---|

| Definition | Setting fixed budget ceilings to control expenses | Rapid expenditure with minimal restrictions |

| Money Management | Promotes disciplined, sustainable financial habits | Leads to quick depletion of funds, higher risk |

| Goal Alignment | Supports long-term savings and financial goals | Focuses on immediate gratification, less future planning |

| Risk Level | Low risk due to controlled spending | High risk; potential for debt and cash flow issues |

| User Suitability | Ideal for budget-conscious individuals | Suitable for those prioritizing short-term enjoyment |

Understanding Spending Limits: A Key to Financial Success

Understanding spending limits is crucial for achieving financial success as it helps individuals control expenses, avoid debt, and save effectively. Setting a clear spending limit creates a disciplined approach to money management, ensuring that expenditures align with income and long-term financial goals. By prioritizing spending limits over rapid, unchecked spending, people can build sustainable wealth and enhance financial stability.

The Psychology Behind Spending Fast

Spending fast triggers impulsive decision-making, often driven by emotional responses rather than logical budgeting, which undermines long-term financial goals. Psychological factors such as instant gratification and dopamine release encourage quick expenditures, leading to reduced awareness of spending limits. Understanding these mental habits is essential for developing strategies that promote disciplined money management and prevent financial stress.

Benefits of Setting a Spending Limit

Setting a spending limit enhances financial discipline by preventing overspending and allowing better control over expenses. It promotes consistent savings growth, supporting long-term financial goals with predictable cash flow management. Clear spending boundaries reduce impulsive purchases, fostering mindful budgeting and improved overall money management.

Risks of Impulsive, Fast Spending

Impulsive, fast spending significantly increases the risk of financial instability by depleting funds before essential expenses are covered and emergency savings are established. Without a clear spending limit, individuals may accumulate debt, face difficulty tracking expenses, and experience stress from unpredictable cash flow shortages. Implementing a spending limit helps maintain budget discipline, promotes long-term savings, and reduces the likelihood of costly financial mistakes associated with rapid, unplanned purchases.

Comparing Short-Term vs. Long-Term Financial Goals

Short-term financial goals prioritize spending fast within a set limit to address immediate needs or emergencies, ensuring cash flow remains controlled without jeopardizing present stability. Long-term financial goals emphasize setting a spending limit that aligns with future wealth accumulation, encouraging disciplined saving and investment strategies for sustained financial growth. Comparing these approaches highlights the importance of balancing quick access to funds with strategic restraint to optimize overall money management.

Building Discipline with Spending Limits

Establishing spending limits enhances money management by fostering self-discipline and preventing impulsive purchases, which helps maintain financial goals. Consistently adhering to predefined budgets strengthens control over expenses and supports long-term savings growth. This disciplined approach to spending reduces financial stress and promotes responsible money habits.

Consequences of Over-Spending Quickly

Exceeding spending limits rapidly often leads to depleted savings and increased debt, which undermines financial stability. Quick overspending triggers high-interest payments and late fees, exacerbating monetary stress. Such financial mismanagement hampers long-term goal achievement and emergency fund growth.

Strategies to Establish Effective Spending Limits

Setting clear spending limits involves analyzing monthly income and essential expenses to define realistic financial boundaries. Utilizing budgeting tools and apps helps track daily expenditures, preventing overspending and promoting mindful purchases. Regularly reviewing and adjusting limits ensures alignment with evolving financial goals and unexpected needs.

Tools and Apps for Tracking Spending Habits

Spending limits set clear boundaries to control expenses, while spending fast enables rapid purchases without immediate oversight. Tools and apps like Mint, YNAB (You Need A Budget), and PocketGuard offer real-time tracking, categorizing expenses to monitor adherence to spending limits effectively. These platforms provide customizable alerts and detailed reports, empowering users to analyze habits and adjust behaviors for improved money management.

Achieving Money Management Goals: Balanced Approach

Setting a spending limit enforces discipline by controlling expenditures within a predetermined budget, which helps in steadily progressing toward money management goals. Conversely, spending fast might deplete resources quickly, risking financial instability and derailing long-term objectives. A balanced approach combines mindful spending limits with strategic flexibility, optimizing cash flow while ensuring sustainable progress toward achieving financial goals.

Related Important Terms

Micro-Budgeting

Micro-budgeting emphasizes setting precise spending limits to control cash flow and prevent overspending, enhancing financial discipline. Prioritizing spending limits over spending fast helps maintain sustainable money management by promoting conscientious, goal-oriented expenditures.

Speed Spending Syndrome

Spending limit strategies help control finances by setting predefined boundaries, reducing impulsive purchases associated with Speed Spending Syndrome. In contrast, rapid spending often leads to depleted funds and financial instability, highlighting the importance of disciplined budget management for long-term monetary health.

Slow Burn Budgeting

Slow Burn Budgeting emphasizes setting a spending limit to ensure long-term financial stability rather than spending fast, which often leads to depletion of funds and missed financial goals. By implementing controlled, gradual expenditures, individuals can maintain consistent cash flow and build wealth over time.

Instant Gratification Trap

Setting a spending limit helps prevent falling into the Instant Gratification Trap by promoting mindful financial decisions and long-term goal achievement. Spending fast often leads to impulsive purchases that undermine budget goals and reduce savings potential.

Rapid Expenditure Threshold

Rapid Expenditure Threshold establishes a spending limit designed to control impulsive financial decisions and prevent rapid depletion of funds. Maintaining a carefully set spending limit promotes better money management by balancing immediate expenses with long-term financial goals.

Frictionless Spending Control

Spending limits create clear financial boundaries that prevent overspending and promote disciplined money management by restricting transactions based on predefined thresholds. Frictionless spending control enhances this approach by allowing seamless real-time monitoring and automatic adjustments, ensuring users maintain budget adherence without interrupting their spending experience.

Impulse Spending Limiters

Impulse spending limiters effectively control overspending by setting predefined budgets and time delays before purchases, enhancing disciplined money management. Utilizing tools like spending alerts, frozen accounts, and mandatory cooling-off periods prevents rapid depletion of funds and promotes long-term financial stability.

Spending Velocity Monitoring

Spending velocity monitoring is crucial for effective money management as it tracks how quickly funds are used relative to the set spending limit, helping to prevent overspending and maintain budget discipline. By analyzing real-time transaction speeds, individuals can adjust their habits to stay within financial goals and optimize cash flow control.

Delayed Purchase Protocol

Implementing a Delayed Purchase Protocol effectively enforces a spending limit by requiring individuals to wait before making non-essential purchases, reducing impulse buying and enhancing financial discipline. This strategy optimizes money management by prioritizing thoughtful spending decisions, which ultimately supports long-term savings goals and prevents financial strain caused by rapid, unchecked expenditures.

Flash Spend Pause

Flash Spend Pause allows users to set a temporary spending freeze, helping control impulse purchases while maintaining an overall spending limit. This tool enhances money management by combining real-time spending pauses with predefined budget caps for better financial discipline.

Spending limit vs Spending fast for money management. Infographic

moneydiff.com

moneydiff.com