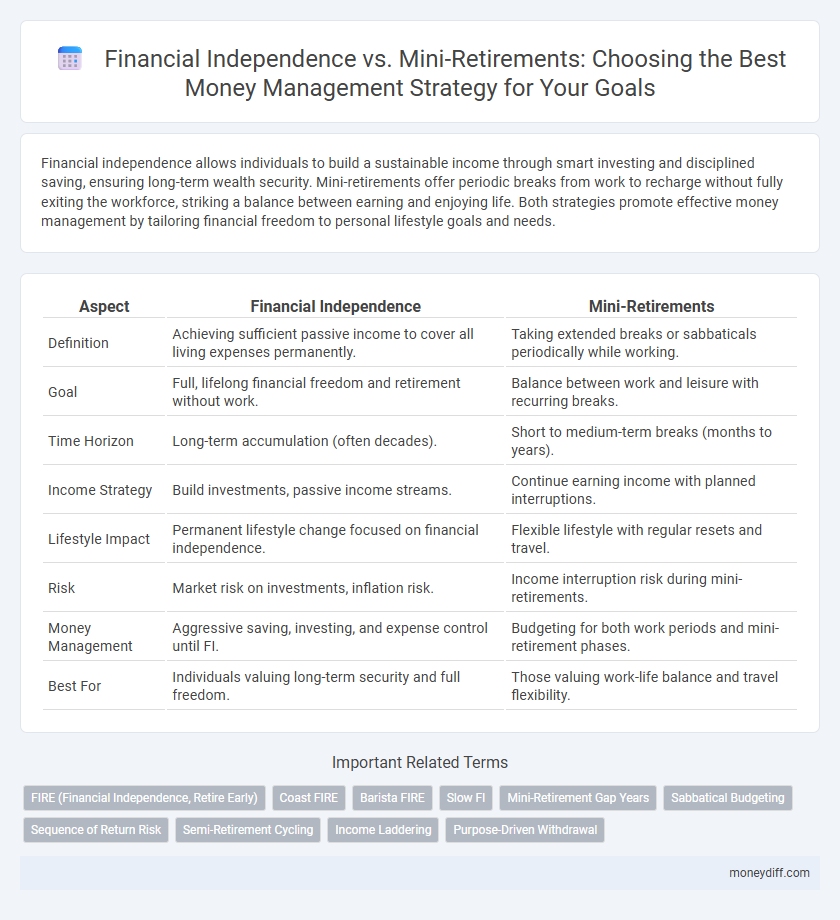

Financial independence allows individuals to build a sustainable income through smart investing and disciplined saving, ensuring long-term wealth security. Mini-retirements offer periodic breaks from work to recharge without fully exiting the workforce, striking a balance between earning and enjoying life. Both strategies promote effective money management by tailoring financial freedom to personal lifestyle goals and needs.

Table of Comparison

| Aspect | Financial Independence | Mini-Retirements |

|---|---|---|

| Definition | Achieving sufficient passive income to cover all living expenses permanently. | Taking extended breaks or sabbaticals periodically while working. |

| Goal | Full, lifelong financial freedom and retirement without work. | Balance between work and leisure with recurring breaks. |

| Time Horizon | Long-term accumulation (often decades). | Short to medium-term breaks (months to years). |

| Income Strategy | Build investments, passive income streams. | Continue earning income with planned interruptions. |

| Lifestyle Impact | Permanent lifestyle change focused on financial independence. | Flexible lifestyle with regular resets and travel. |

| Risk | Market risk on investments, inflation risk. | Income interruption risk during mini-retirements. |

| Money Management | Aggressive saving, investing, and expense control until FI. | Budgeting for both work periods and mini-retirement phases. |

| Best For | Individuals valuing long-term security and full freedom. | Those valuing work-life balance and travel flexibility. |

Understanding Financial Independence and Mini-Retirements

Financial independence is the state where passive income surpasses living expenses, enabling individuals to sustain their lifestyle without active employment. Mini-retirements involve taking extended breaks from work throughout life to enjoy leisure and personal growth, rather than a single retirement phase. Understanding these concepts helps optimize money management by balancing long-term wealth accumulation with periodic life enjoyment.

Key Differences: Financial Independence vs Mini-Retirements

Financial Independence means consistently generating enough passive income to cover living expenses indefinitely, eliminating the need to work permanently. Mini-retirements involve taking extended breaks from work throughout life while maintaining an active career, offering periodic rejuvenation without full financial separation from employment. The key difference lies in financial independence providing a permanent exit from traditional employment, whereas mini-retirements emphasize recurring lifestyle flexibility without total financial detachment.

Pros and Cons of Achieving Financial Independence

Achieving financial independence offers the advantage of long-term security and the freedom to make life choices without relying on a paycheck, but it often requires strict budgeting, significant savings, and delayed gratification. The main downside includes the possibility of missing out on youthful experiences due to the intense focus on accumulating wealth and the risk of unforeseen expenses that could deplete funds earlier than expected. Unlike mini-retirements, which provide periodic breaks and flexibility, financial independence demands continuous discipline and a commitment to sustainable investment strategies for lasting success.

The Benefits and Drawbacks of Mini-Retirements

Mini-retirements offer flexibility by allowing individuals to enjoy extended breaks throughout their lives without waiting for traditional retirement, enhancing work-life balance and reducing burnout. However, mini-retirements may disrupt career progression and income stability, requiring careful financial planning to ensure sustainable funding. Balancing these benefits and drawbacks is crucial for effective money management and long-term financial independence.

Money Management Strategies for Financial Independence

Effective money management strategies for financial independence emphasize consistent saving rates, diversified investments, and controlled spending to build sustainable wealth. Prioritizing long-term growth through index funds, real estate, and retirement accounts enhances financial resilience and early retirement opportunities. Balancing aggressive saving with mindful lifestyle choices prevents burnout and supports both immediate enjoyment and lasting financial security.

Financial Planning for Mini-Retirements

Financial planning for mini-retirements requires strategic allocation of savings, prioritizing flexible income sources, and creating a budget that supports intermittent breaks from full-time work. Emphasizing diversified investments and emergency funds ensures sustained financial security during these planned sabbaticals. Balancing cash flow and expenses through detailed forecasting maximizes the benefits of mini-retirements while maintaining long-term financial independence goals.

Impact on Lifestyle: Long-Term Security vs Periodic Freedom

Financial independence offers long-term security by providing a stable income stream and reducing reliance on employment, allowing individuals to sustain their lifestyle indefinitely. Mini-retirements grant periodic freedom through intentional breaks from work, enabling exploration and personal growth but requiring careful financial planning to avoid compromising future stability. Balancing both strategies can optimize lifestyle flexibility while maintaining economic resilience over time.

Building a Sustainable Savings Plan for Both Approaches

A sustainable savings plan for financial independence emphasizes consistent contributions to diversified investment accounts, focusing on long-term growth through index funds and retirement accounts like 401(k)s or IRAs. Mini-retirements require flexible savings strategies that include liquid emergency funds and periodic allocation toward travel or sabbatical expenses, balancing short-term access with growth potential. Integrating both approaches involves setting clear milestones, automating savings to reduce behavioral risks, and adjusting contributions based on changing life goals and market conditions.

Risk Assessment: Security vs Flexibility

Financial independence emphasizes long-term security by building substantial savings and investments to minimize financial risks during retirement. Mini-retirements offer greater flexibility by allowing periodic breaks from work without full financial cessation, but they require careful risk assessment to avoid depleting resources too quickly. Balancing these approaches involves evaluating market volatility, income stability, and personal spending patterns to safeguard financial health while maintaining lifestyle adaptability.

Choosing the Right Path: Aligning Goals with Money Management

Choosing the right path between Financial Independence and Mini-Retirements hinges on aligning personal goals with effective money management strategies. Financial Independence demands long-term budgeting, disciplined saving, and strategic investing to create sustainable passive income streams. Mini-Retirements require flexible cash flow planning and periodic resource allocation to support intermittent breaks from traditional work schedules.

Related Important Terms

FIRE (Financial Independence, Retire Early)

FIRE (Financial Independence, Retire Early) emphasizes accumulating sufficient assets to generate passive income, allowing complete financial freedom without traditional employment. Mini-retirements offer periodic breaks from work, integrating financial independence with lifestyle flexibility by balancing savings with short-term leisure investments.

Coast FIRE

Coast FIRE emphasizes achieving financial independence by accumulating enough savings early to let investments grow without additional contributions, enabling partial work phases or mini-retirements. This strategy balances long-term wealth growth with lifestyle flexibility, reducing pressure to save aggressively while maintaining financial security.

Barista FIRE

Barista FIRE combines part-time work with financial independence to sustain a comfortable lifestyle while avoiding full retirement, enabling flexible income without depleting savings. This approach balances steady cash flow and reduced expenses, offering an alternative to the traditional FIRE path by integrating semi-retirement with ongoing earnings.

Slow FI

Slow Financial Independence (FI) emphasizes gradual wealth building through consistent saving and investing, allowing for flexible mini-retirements that provide opportunities for rest and exploration without sacrificing long-term financial goals. This approach balances disciplined money management with periodic breaks, reducing burnout and maintaining motivation on the path to full financial freedom.

Mini-Retirement Gap Years

Mini-retirement gap years offer a flexible alternative to traditional financial independence by allowing individuals to take extended breaks throughout their career for personal growth and travel without permanently exiting the workforce. This approach balances financial sustainability with life-enriching experiences, reducing burnout and enhancing long-term productivity while requiring strategic financial planning to maintain income and savings goals during these intervals.

Sabbatical Budgeting

Sabbatical budgeting requires allocating funds for extended breaks without income, balancing essential expenses and savings to ensure financial independence is maintained during mini-retirements. Prioritizing emergency funds and predictable cash flow supports seamless transitions between work and sabbatical periods, optimizing long-term money management strategies.

Sequence of Return Risk

Sequence of return risk significantly impacts financial independence as early negative returns can deplete retirement savings, making it challenging to sustain long-term withdrawals. Mini-retirements reduce exposure to this risk by allowing periodic breaks from work, enabling portfolio recovery between withdrawal phases and improving overall money management flexibility.

Semi-Retirement Cycling

Semi-retirement cycling offers a flexible financial strategy where individuals alternate between periods of work and leisure, optimizing cash flow and lifestyle without committing to full financial independence. This approach balances ongoing income generation with extended breaks, enhancing money management by reducing burnout and maintaining long-term savings growth.

Income Laddering

Income laddering techniques create multiple income streams that support both long-term financial independence and short-term mini-retirements by diversifying cash flow sources. This approach balances steady wealth accumulation with flexible breaks, ensuring ongoing financial stability while enjoying periodic life pauses.

Purpose-Driven Withdrawal

Purpose-driven withdrawal in financial independence emphasizes sustainable income streams that support long-term goals, whereas mini-retirements focus on intermittent breaks funded by savings to recharge without fully exiting the workforce. Balancing these approaches enables strategic money management by aligning cash flow with personal priorities and lifestyle flexibility.

Financial Independence vs Mini-Retirements for money management. Infographic

moneydiff.com

moneydiff.com