Choosing between a Travel Fund and a Gap Year Fund depends on your planning horizon and financial goals. A Travel Fund targets specific trips, focusing on short-term savings for vacations, while a Gap Year Fund addresses broader expenses during a year off, such as tuition, living costs, and travel. Allocating funds strategically to either option maximizes goal achievement based on your unique timeline and lifestyle priorities.

Table of Comparison

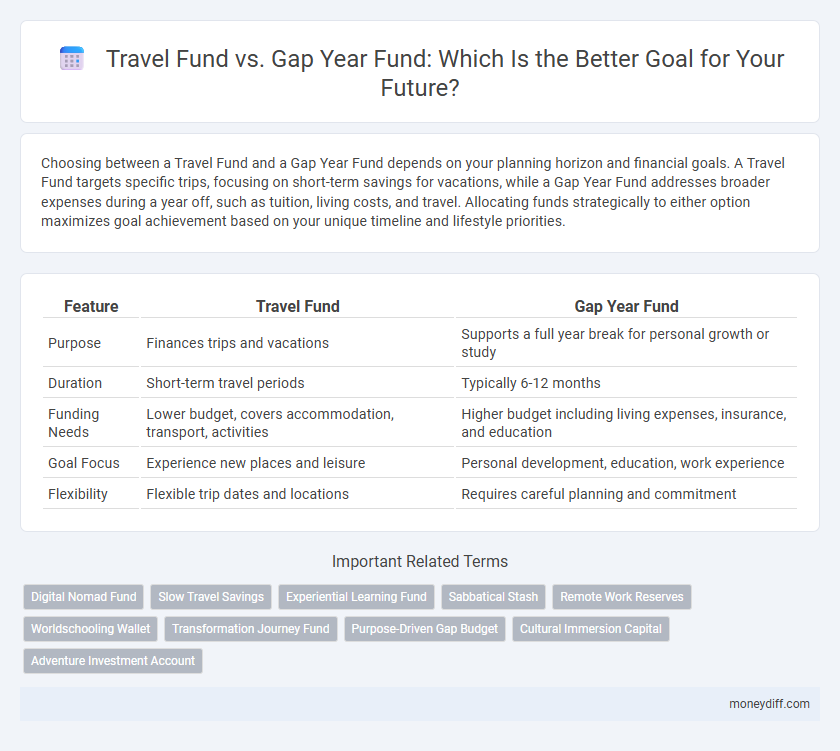

| Feature | Travel Fund | Gap Year Fund |

|---|---|---|

| Purpose | Finances trips and vacations | Supports a full year break for personal growth or study |

| Duration | Short-term travel periods | Typically 6-12 months |

| Funding Needs | Lower budget, covers accommodation, transport, activities | Higher budget including living expenses, insurance, and education |

| Goal Focus | Experience new places and leisure | Personal development, education, work experience |

| Flexibility | Flexible trip dates and locations | Requires careful planning and commitment |

Understanding Travel Fund and Gap Year Fund Goals

A Travel Fund primarily supports short-term trips focused on leisure, exploration, and cultural experiences, often lasting weeks or months. In contrast, a Gap Year Fund is designed to finance an extended period, typically a year, dedicated to personal growth, education, volunteering, or work abroad. Understanding these distinctions helps individuals tailor their savings strategies to match the duration, purpose, and financial requirements of their travel or gap year goals.

Key Differences Between Travel Funds and Gap Year Funds

Travel funds primarily cover short-term expenses related to specific trips, including airfare, accommodation, and activities, while gap year funds are designed to support an extended period of personal growth, skill development, or volunteering between academic or career phases. Travel funds often have immediate, fixed costs tied to a set itinerary, whereas gap year funds must account for a broader range of ongoing expenses such as living costs, travel, and educational programs lasting several months. The key difference lies in the purpose and duration: travel funds focus on discrete trips, and gap year funds facilitate a sustained, multifaceted experience aimed at long-term development.

Setting SMART Goals for Your Fund

Setting SMART goals for your Travel Fund or Gap Year Fund ensures clear, achievable financial objectives tailored to your timeline and destination. Specific targets like saving $3,000 in 12 months for a Europe trip or allocating $500 monthly to a Gap Year Fund create measurable progress. Time-bound and realistic goals enhance motivation and provide a structured roadmap for managing expenses and maximizing travel experiences.

Budget Planning: Travel Fund vs Gap Year Fund

Budget planning for a Travel Fund requires estimating costs for flights, accommodation, activities, and daily expenses, typically spanning a shorter time frame of weeks to months. In contrast, a Gap Year Fund demands more extensive budgeting to cover living expenses, education courses, travel insurance, and potential income gaps over 6 to 12 months or longer. Prioritizing contingency savings and realistic cost projections ensures financial preparedness for either fund, optimizing the goal to avoid debt during travel or a prolonged gap year.

Savings Strategies for Each Fund Goal

Travel Funds prioritize short-term savings strategies such as automated monthly deposits and utilizing high-yield savings accounts to quickly accumulate funds for upcoming trips. Gap Year Funds require long-term financial planning, often incorporating diversified investments and budgeting to cover extended living expenses and travel costs. Tailoring savings approaches to the specific timeline and financial demands of each goal ensures efficient fund growth and goal achievement.

Timeline Considerations for Fund Achievement

Travel Fund goals often require shorter timelines, typically planned within months to one year, allowing for swift accumulation of necessary expenses. Gap Year Fund goals demand longer timelines, often spanning one to two years or more, to cover extended living, education, and travel costs comprehensively. Prioritizing fund achievement based on individual timelines ensures effective budgeting and resource allocation aligned with the planned departure dates.

Fund Amount: How Much Should You Save?

Determining the ideal fund amount depends on destination, duration, and activities planned; typically, a travel fund for short trips ranges from $1,000 to $3,000, while a gap year fund requires $10,000 to $30,000 due to extended living and travel expenses. Prioritizing accommodation, transportation, food, and emergency reserves ensures comprehensive coverage in either fund. Customized budget planning using tools like spreadsheets or apps enhances accurate savings targets aligned with specific goals.

Maximizing Your Fund: Earning Extra Money

Maximizing your travel fund or gap year fund requires strategic earning methods such as freelance work, part-time jobs, or online ventures like tutoring or digital content creation. Utilizing platforms like Upwork, Fiverr, or local gig economy apps can significantly boost your savings, accelerating your financial goal timeline. Consistently reinvesting earned money into high-interest savings accounts also enhances the growth potential of your fund, preparing you efficiently for your travel or gap year expenses.

Tracking Your Progress Toward Each Goal

Tracking your progress toward Travel Fund and Gap Year Fund goals requires setting clear milestones and regularly updating your savings status. Use budgeting tools and apps to monitor contributions, expenses, and forecast the time needed to reach each target. Differentiating between short-term travel expenses and long-term gap year plans helps optimize allocation and ensures steady advancement for both financial goals.

Choosing the Right Fund for Your Lifestyle and Ambitions

Selecting between a Travel Fund and a Gap Year Fund depends largely on your lifestyle preferences and long-term ambitions; a Travel Fund targets short-term exploration with flexible budgeting, ideal for spontaneous trips or annual vacations. In contrast, a Gap Year Fund supports a structured, extended break from academic or professional commitments to focus on personal growth, skill development, or cultural immersion, requiring careful financial planning and goal setting. Assessing your desire for immediate travel experiences against the benefits of a transformative gap year ensures alignment with your financial capacity and life objectives.

Related Important Terms

Digital Nomad Fund

A Digital Nomad Fund strategically combines elements of Travel Fund and Gap Year Fund to support extended remote work and exploration, focusing on flexibility and sustainable budgeting. Prioritizing this fund enables seamless transitions between destinations while maintaining income flow, optimizing resources for both travel costs and workspace essentials.

Slow Travel Savings

Travel fund and gap year fund both serve as financial goals for extended travel experiences, but slow travel savings specifically target budgeting for immersive, longer stays that prioritize cultural depth over rapid sightseeing. Allocating a dedicated slow travel savings account helps manage expenses for accommodations, local experiences, and flexible itineraries, ensuring funds align with the goal of meaningful, unhurried exploration.

Experiential Learning Fund

An Experiential Learning Fund prioritizes hands-on, immersive experiences that enhance personal growth and skill development, distinguishing it from a Travel Fund which mainly covers transportation and accommodation expenses. Unlike a Gap Year Fund that supports a broad range of activities during a sabbatical, an Experiential Learning Fund specifically targets programs designed for educational and career advancement through real-world engagement.

Sabbatical Stash

A Travel Fund allows for flexible, short-term trips enhancing personal growth and cultural experiences, whereas a Gap Year Fund is specifically designed to support an extended break for education or career exploration. The Sabbatical Stash offers tailored financial strategies to efficiently build either fund, ensuring seamless planning for travel goals or gap year ambitions.

Remote Work Reserves

Remote Work Reserves serve as a flexible financial buffer, enabling individuals to sustain income while traveling or taking a gap year without interrupting their work commitments. Allocating funds specifically for remote work ensures continuous productivity and covers essential expenses, distinguishing it from traditional Travel Funds or Gap Year Funds that primarily focus on leisure or long-term breaks.

Worldschooling Wallet

Worldschooling Wallet helps families save for both Travel Fund and Gap Year Fund goals by providing tailored budgeting tools that prioritize flexible spending on unique global learning experiences. Emphasizing a Travel Fund supports short-term international trips, while a Gap Year Fund focuses on extended immersive stays, enabling worldschoolers to strategically allocate resources based on their educational and cultural objectives.

Transformation Journey Fund

A Transformation Journey Fund prioritizes long-term personal growth and skill development by supporting meaningful travel experiences that extend beyond typical vacation purposes, unlike traditional Travel Funds which mainly cover short-term trips or leisure travel. Unlike Gap Year Funds that focus on a break from formal education, a Transformation Journey Fund emphasizes structured experiences designed to foster self-discovery, cultural immersion, and professional transformation.

Purpose-Driven Gap Budget

Travel Fund focuses on covering immediate expenses for exploration and experiences, while Gap Year Fund prioritizes purposeful investment in personal growth through structured learning, volunteering, or internships. A purpose-driven gap budget allocates resources strategically to maximize development opportunities beyond leisure, aligning financial planning with long-term career and educational objectives.

Cultural Immersion Capital

Allocating a Travel Fund specifically enhances cultural immersion capital by enabling authentic experiences such as local homestays, language courses, and community projects, fostering deeper cross-cultural understanding. In contrast, a Gap Year Fund may offer broader financial flexibility but often dilutes investment in targeted cultural engagement activities essential for maximizing immersion benefits.

Adventure Investment Account

The Adventure Investment Account prioritizes long-term growth by allocating funds toward diverse adventure experiences, differentiating it from the more immediate expenses covered by a Travel Fund or the extended planning horizon of a Gap Year Fund. This approach maximizes returns on adventurous goals while maintaining flexibility compared to traditional travel savings.

Travel Fund vs Gap Year Fund for goal. Infographic

moneydiff.com

moneydiff.com