Achieving financial freedom means having enough income to cover all living expenses without relying on a traditional job, enabling complete lifestyle flexibility. In contrast, Coast FIRE focuses on accumulating sufficient savings early to let investments grow passively, allowing one to delay work while still reaching traditional retirement age with financial security. Choosing between these goals depends on whether immediate independence or long-term financial stability aligns better with your personal aspirations and risk tolerance.

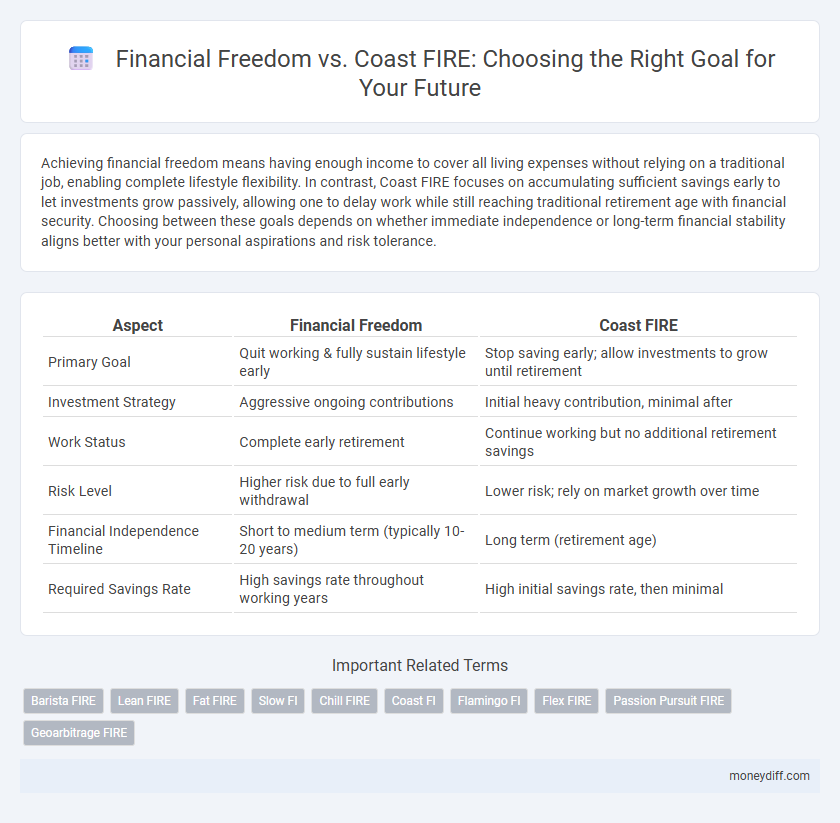

Table of Comparison

| Aspect | Financial Freedom | Coast FIRE |

|---|---|---|

| Primary Goal | Quit working & fully sustain lifestyle early | Stop saving early; allow investments to grow until retirement |

| Investment Strategy | Aggressive ongoing contributions | Initial heavy contribution, minimal after |

| Work Status | Complete early retirement | Continue working but no additional retirement savings |

| Risk Level | Higher risk due to full early withdrawal | Lower risk; rely on market growth over time |

| Financial Independence Timeline | Short to medium term (typically 10-20 years) | Long term (retirement age) |

| Required Savings Rate | High savings rate throughout working years | High initial savings rate, then minimal |

Defining Financial Freedom and Coast FIRE

Financial Freedom represents a state where passive income meets or exceeds living expenses, allowing individuals to live without active employment. Coast FIRE requires accumulating enough savings early on so that, with compound interest, these investments grow to fully fund retirement without additional contributions. Understanding these distinct goals helps tailor saving and investing strategies based on desired lifestyle flexibility and time horizon.

Core Principles: Financial Freedom vs Coast FIRE

Financial Freedom requires actively building wealth through consistent savings, smart investments, and maintaining a sustainable lifestyle to generate income exceeding expenses. Coast FIRE emphasizes reaching a savings milestone early enough that, with compounded growth, retirement funds will grow to cover future expenses without additional contributions. Both strategies prioritize disciplined financial management but differ in timing and the level of current income generation needed to achieve long-term autonomy.

Setting Your Money Management Goals

Setting your money management goals requires understanding the differences between Financial Freedom and Coast FIRE. Financial Freedom demands accumulating sufficient assets to cover living expenses without work, while Coast FIRE focuses on reaching a savings threshold early and letting investments grow over time. Prioritizing a clear target based on your risk tolerance, desired lifestyle, and timeline enhances disciplined budgeting and consistent contribution strategies.

Pathways to Financial Independence

Financial Freedom and Coast FIRE represent distinct pathways to achieving financial independence, where Financial Freedom emphasizes accumulating sufficient assets to support ongoing lifestyle expenses without work, while Coast FIRE focuses on saving aggressively early to allow investments to grow passively over time. Both strategies prioritize disciplined saving, investment optimization, and long-term planning to reduce reliance on active income. Understanding asset growth rates, withdrawal strategies, and risk tolerance is crucial for selecting the most effective route to financial independence.

Coast FIRE: Achieving Early Investment Milestones

Coast FIRE emphasizes reaching early investment milestones that allow your existing savings to grow naturally over time without additional contributions, leveraging compound interest to secure financial independence. This approach reduces the pressure to save aggressively in later years, as your investments are already "coasting" toward your retirement goal. Prioritizing consistent, early investments in diversified portfolios can enable you to achieve financial freedom with more flexibility compared to traditional full financial independence strategies.

Lifestyle Choices: Flexibility vs Security

Financial Freedom offers greater flexibility by enabling diverse income streams and lifestyle adjustments without strict reliance on savings milestones, while Coast FIRE emphasizes security through early savings accumulation, allowing individuals to cover future expenses with minimal ongoing contributions. Lifestyle choices under Financial Freedom often include pursuing passions, travel, or entrepreneurship, whereas Coast FIRE prioritizes a stable, low-stress existence with predictable financial commitments. Balancing these approaches depends on whether one values adaptability in daily living or prefers the assurance of financial stability.

Calculating Your Coast FIRE Number

Calculating your Coast FIRE number involves determining the amount of money you need to invest today to coast to retirement with no additional contributions, assuming a consistent rate of return and inflation. This number is based on your target retirement age, expected annual expenses, and anticipated market growth, allowing you to compare it against your current savings to evaluate financial independence progress. Understanding your Coast FIRE number helps optimize your savings strategy by balancing investment growth with present income needs, distinct from traditional Financial Freedom goals that require fully covering expenses through passive income.

Strategies to Accelerate Financial Freedom

Achieving Financial Freedom requires maximizing income streams through strategic investments in high-yield assets, real estate, and side businesses while maintaining disciplined expense management. Coast FIRE emphasizes early aggressive saving combined with allowing investments to grow passively over time, leveraging compound interest without the pressure to increase current income significantly. Prioritizing tax-efficient retirement accounts and continuous financial education accelerates wealth accumulation and enhances long-term financial independence.

Key Challenges and Trade-offs

Achieving Financial Freedom requires building a substantial investment portfolio to cover all living expenses indefinitely, presenting challenges in saving diligently and managing market risks. Coast FIRE allows individuals to stop saving early by accumulating enough capital to grow over time, but demands precise calculations and discipline to avoid underfunding retirement. Trade-offs involve balancing immediate lifestyle quality against long-term financial independence and the risks of inflation or unexpected expenditures.

Choosing the Right Goal for Your Financial Journey

Financial Freedom represents the ability to cover all living expenses through passive income, granting complete autonomy over work and lifestyle. Coast FIRE requires saving aggressively early on so investments grow independently to fund retirement, minimizing the need for ongoing contributions later. Evaluating personal risk tolerance, lifestyle preferences, and savings capacity helps determine whether the immediate independence of Financial Freedom or the long-term security of Coast FIRE aligns best with your financial journey.

Related Important Terms

Barista FIRE

Barista FIRE offers a hybrid approach to Financial Freedom by combining part-time income streams with reduced expenses, allowing individuals to maintain lifestyle flexibility without fully relying on investment portfolios. Unlike Coast FIRE, which emphasizes early savings to let investments grow independently, Barista FIRE focuses on sustaining financial goals through ongoing work, balancing risk and stability in retirement planning.

Lean FIRE

Lean FIRE prioritizes achieving Financial Freedom with minimal expenses, enabling early retirement by maintaining a frugal lifestyle. This approach contrasts with traditional Coast FIRE, which allows investments to grow passively until retirement, making Lean FIRE ideal for those seeking immediate financial independence through controlled spending.

Fat FIRE

Fat FIRE represents a financial goal where individuals accumulate significantly higher wealth than traditional Financial Freedom or Coast FIRE benchmarks, enabling a luxury lifestyle without compromising future earnings. Pursuing Fat FIRE demands aggressive saving, strategic investments, and maximizing income streams to sustain elevated expenses while maintaining financial independence.

Slow FI

Slow Financial Independence (Slow FI) emphasizes steady saving and moderate investing to achieve Financial Freedom over a longer timeline, contrasting with Coast FIRE which requires a significant early investment to let compound interest grow without additional contributions. Slow FI allows for a balanced lifestyle and less financial pressure, making it a sustainable approach for those prioritizing gradual wealth accumulation and maintaining current income levels.

Chill FIRE

Chill FIRE emphasizes achieving financial freedom with a more relaxed savings rate, allowing flexibility and a balance between work and leisure while maintaining sufficient passive income to cover essential expenses. This approach contrasts with Coast FIRE, where early investments grow independently, requiring minimal ongoing contributions, but Chill FIRE actively combines moderate saving and spending to sustain a comfortable lifestyle without full early retirement pressure.

Coast FI

Coast FIRE allows individuals to achieve financial freedom by saving aggressively early on, enabling their investments to grow passively over time without additional contributions. This strategy emphasizes reaching a savings threshold that, when left to compound, covers future retirement needs, minimizing ongoing work requirements compared to traditional Financial Freedom paths.

Flamingo FI

Flamingo FI emphasizes tailored strategies to achieve Financial Freedom by balancing aggressive savings with lifestyle flexibility, contrasting with the Coast FIRE approach that prioritizes early wealth accumulation to coast passively toward retirement. Their method highlights optimizing investment returns while maintaining manageable expenses to reach sustainable financial independence sooner.

Flex FIRE

Flex FIRE offers a balanced approach to financial independence by allowing individuals to adjust their spending and work commitments, providing greater adaptability compared to strict Financial Freedom or Coast FIRE strategies. This method supports maintaining lifestyle flexibility while steadily progressing toward long-term wealth goals without the pressure of fully retiring early.

Passion Pursuit FIRE

Financial Freedom enables individuals to pursue passion projects without income constraints, while Coast FIRE emphasizes reaching a savings milestone early to let investments grow passively until retirement, freeing time for focused passion pursuit. Choosing Passion Pursuit FIRE combines financial independence with intentional living, prioritizing meaningful activities funded by strategic savings and investment growth.

Geoarbitrage FIRE

Financial freedom offers complete control over income and expenses, while Coast FIRE leverages early investments to grow passively, minimizing active savings efforts; Geoarbitrage FIRE enhances both by relocating to lower-cost regions, maximizing spending power and accelerating financial independence. Embracing geoarbitrage strategies dramatically reduces living expenses, making Coast FIRE attainable sooner and enhancing overall lifestyle quality without sacrificing financial goals.

Financial Freedom vs Coast FIRE for goal. Infographic

moneydiff.com

moneydiff.com