Setting a rainy day goal ensures you have immediate funds available for unexpected expenses, providing a financial safety net that prevents debt accumulation. In contrast, a financial independence goal focuses on long-term wealth building through disciplined saving and investing, empowering you to achieve freedom from paycheck dependence. Balancing both goals in money management creates stability by addressing urgent needs while securing future financial freedom.

Table of Comparison

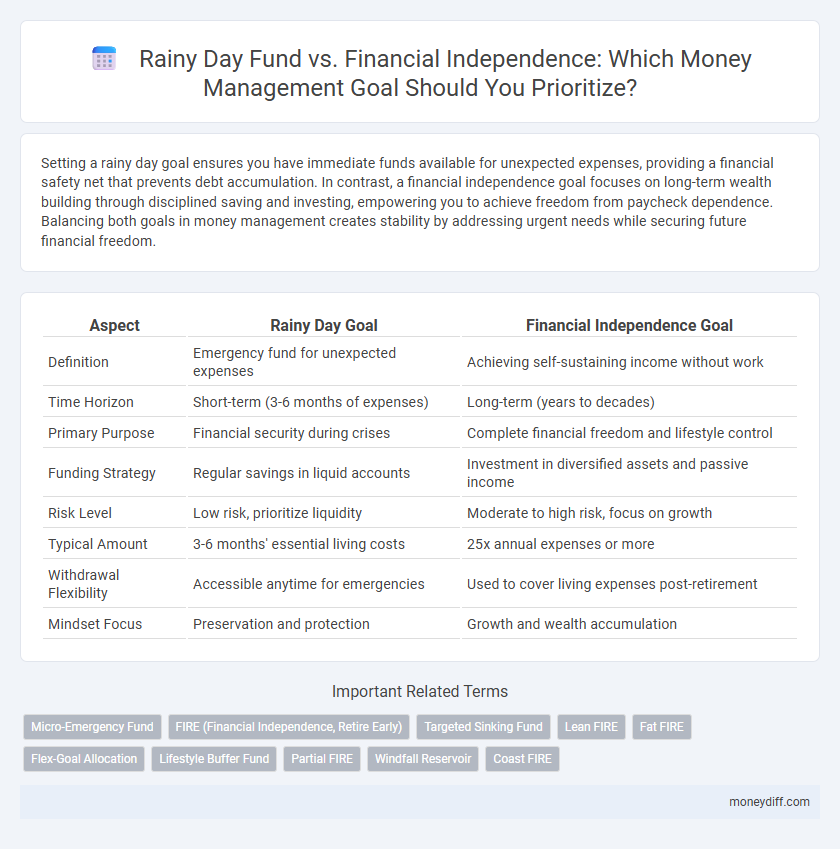

| Aspect | Rainy Day Goal | Financial Independence Goal |

|---|---|---|

| Definition | Emergency fund for unexpected expenses | Achieving self-sustaining income without work |

| Time Horizon | Short-term (3-6 months of expenses) | Long-term (years to decades) |

| Primary Purpose | Financial security during crises | Complete financial freedom and lifestyle control |

| Funding Strategy | Regular savings in liquid accounts | Investment in diversified assets and passive income |

| Risk Level | Low risk, prioritize liquidity | Moderate to high risk, focus on growth |

| Typical Amount | 3-6 months' essential living costs | 25x annual expenses or more |

| Withdrawal Flexibility | Accessible anytime for emergencies | Used to cover living expenses post-retirement |

| Mindset Focus | Preservation and protection | Growth and wealth accumulation |

Understanding Rainy Day Goals in Money Management

Rainy day goals prioritize building an emergency fund to cover unexpected expenses, ensuring financial stability during unforeseen events like medical emergencies or job loss. This goal encourages saving three to six months' worth of essential living costs, creating a safety net that prevents debt accumulation. Establishing a clear rainy day fund is a foundational step in money management that supports long-term financial independence by reducing vulnerability to financial shocks.

Defining Financial Independence Goals

Defining financial independence goals requires setting clear targets beyond emergency funds, such as rainy day savings, to ensure long-term wealth growth and security. Unlike rainy day goals focused on short-term liquidity for unexpected expenses, financial independence aims to create sustainable passive income streams and asset accumulation. Prioritizing investment strategies, retirement planning, and debt reduction are essential components of achieving true financial independence.

Purpose: Short-Term Security vs. Long-Term Freedom

The rainy day goal ensures quick access to funds for unexpected expenses, providing short-term financial security and peace of mind. Financial independence goal focuses on building sustainable wealth through investments and savings, targeting long-term freedom from paycheck reliance. Balancing these goals optimizes money management by protecting immediate needs while securing future financial autonomy.

Building a Rainy Day Fund: Key Strategies

Building a rainy day fund requires setting aside three to six months' worth of essential living expenses in a separate, easily accessible savings account to cover unexpected costs without disrupting your financial stability. Prioritize automating regular contributions to this emergency fund before allocating surplus income towards long-term financial independence investments. Establishing a solid rainy day fund acts as a crucial financial safety net, reducing reliance on credit and providing peace of mind during unforeseen circumstances.

Pathways to Achieving Financial Independence

Building an emergency fund for a rainy day goal provides immediate financial security by covering unexpected expenses, while pursuing financial independence requires strategic long-term planning through diversified investments, passive income streams, and disciplined saving. Prioritizing compound interest growth in retirement accounts such as 401(k)s and IRAs accelerates wealth accumulation, enabling early financial freedom. Effective money management involves balancing short-term liquidity needs with sustained asset growth to create multiple income pathways that support lasting independence.

Risk Management: Emergency Savings vs. Investment Growth

Emergency savings act as a financial safety net during rainy days, providing immediate liquidity to cover unexpected expenses without disrupting daily life. In contrast, financial independence goals emphasize long-term investment growth to build wealth and generate passive income streams. Balancing these priorities ensures risk management by safeguarding against short-term crises while pursuing sustainable financial freedom.

Prioritizing Goals: Which Should Come First?

Prioritizing financial goals requires assessing urgency and impact; a rainy day fund aims to cover unexpected expenses, providing short-term security, while financial independence focuses on long-term wealth accumulation. Establishing an emergency fund with three to six months of living expenses typically comes first to prevent debt during crises. Once the rainy day goal is secure, resources can shift toward investment strategies and passive income streams that drive financial independence.

Measuring Progress: Milestones for Each Goal

Tracking progress for a rainy day fund involves setting short-term milestones like accumulating three to six months of essential expenses to ensure immediate liquidity. Financial independence requires long-term benchmarks such as reaching a specific net worth or generating passive income that covers all living costs. Regularly assessing these milestones provides clear indicators to adjust saving and investment strategies effectively.

Common Pitfalls When Balancing Both Goals

Balancing rainy day goals with financial independence goals often leads to common pitfalls such as underfunding emergency savings in favor of long-term investments, resulting in liquidity issues during unexpected expenses. Over-prioritizing financial independence can cause neglect of short-term financial buffers, increasing reliance on debt during emergencies. Effective money management requires a strategic allocation that safeguards immediate cash flow needs while steadily advancing wealth accumulation.

Integrating Rainy Day and Financial Independence Strategies

Integrating rainy day and financial independence goals involves allocating funds to both emergency savings and long-term investments, ensuring liquidity during unforeseen events while building wealth over time. Prioritizing a well-funded rainy day fund of three to six months' expenses complements systematic contributions to retirement accounts and diversified portfolios. This balanced approach enhances financial resilience and accelerates progress toward independence without sacrificing immediate security.

Related Important Terms

Micro-Emergency Fund

A micro-emergency fund provides immediate liquidity for rainy day expenses such as minor car repairs or unexpected medical visits, preventing reliance on credit or high-interest loans. Prioritizing this small, accessible savings goal complements the broader financial independence objective by maintaining cash flow stability and reducing financial stress during short-term setbacks.

FIRE (Financial Independence, Retire Early)

Rainy day goals prioritize building an emergency fund covering 3-6 months of essential expenses to ensure financial security during unexpected hardships, while Financial Independence Retire Early (FIRE) goals focus on accumulating a sustainable investment portfolio generating passive income that exceeds living costs for early retirement. Balancing these objectives enhances money management by providing short-term liquidity without sacrificing long-term wealth accumulation and financial freedom.

Targeted Sinking Fund

Targeted sinking funds efficiently allocate money toward specific rainy day goals, ensuring emergency expenses are covered without disrupting long-term financial independence plans. Prioritizing sinking funds for short-term liquidity preserves investment growth and accelerates progress toward achieving financial independence.

Lean FIRE

Rainy day goals prioritize building an emergency fund covering 3-6 months of expenses to handle unexpected financial shocks, while Financial Independence Retire Early (FIRE) aims for accumulated assets generating passive income exceeding living costs, focusing on long-term wealth accumulation. Lean FIRE emphasizes minimalistic living and strict budgeting to achieve financial independence faster with lower expenses and a smaller portfolio compared to traditional FIRE, enabling sustainable money management under both immediate and future financial goals.

Fat FIRE

Prioritizing a rainy day goal ensures immediate liquidity for emergencies, while pursuing financial independence through Fat FIRE aims at accumulating substantial wealth for a luxurious, debt-free retirement. Balancing these objectives involves maintaining an accessible emergency fund alongside long-term investments that generate passive income exceeding living expenses.

Flex-Goal Allocation

Flex-Goal Allocation strategically balances Rainy Day goals, ensuring liquidity for emergencies, with long-term Financial Independence goals focused on wealth accumulation and passive income streams. This approach optimizes cash flow management by dynamically adjusting fund distribution based on market conditions and personal risk tolerance, enhancing financial resilience and growth potential.

Lifestyle Buffer Fund

A Lifestyle Buffer Fund serves as a critical rainy day goal by providing immediate cash flow support for unexpected expenses, ensuring financial stability without disrupting long-term investments. Prioritizing this fund enhances overall money management by creating a safety net that complements the broader financial independence goal, safeguarding lifestyle quality during economic downturns or emergencies.

Partial FIRE

Rainy day goals prioritize building a cash reserve covering 3-6 months of essential expenses to protect against unexpected financial setbacks, while partial FIRE (Financial Independence Retire Early) focuses on accumulating assets that generate passive income sufficient to cover a significant portion of living costs. Balancing these objectives enhances money management by ensuring liquidity for emergencies and long-term wealth growth toward financial independence.

Windfall Reservoir

The Windfall Reservoir serves as a crucial component in money management, differentiating rainy day goals from financial independence goals by providing a designated fund for unexpected income or windfalls to prevent impulsive spending. Prioritizing this reservoir helps individuals strategically allocate sudden monetary gains toward long-term financial growth and security rather than short-term emergency needs.

Coast FIRE

A rainy day goal prioritizes building an emergency fund covering 3 to 6 months of essential expenses to handle unexpected financial setbacks, while a Coast FIRE goal focuses on accumulating enough savings early to let investments grow passively, ensuring financial independence without additional contributions. Effective money management integrates both strategies by maintaining liquidity for immediate needs and leveraging compound interest for long-term wealth building.

Rainy day goal vs Financial independence goal for money management. Infographic

moneydiff.com

moneydiff.com