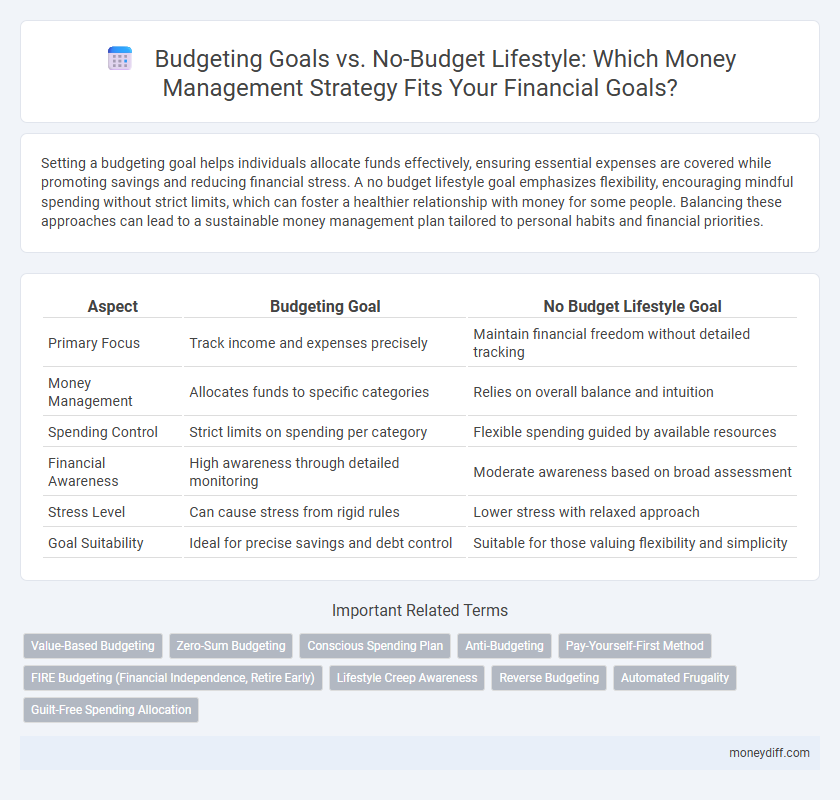

Setting a budgeting goal helps individuals allocate funds effectively, ensuring essential expenses are covered while promoting savings and reducing financial stress. A no budget lifestyle goal emphasizes flexibility, encouraging mindful spending without strict limits, which can foster a healthier relationship with money for some people. Balancing these approaches can lead to a sustainable money management plan tailored to personal habits and financial priorities.

Table of Comparison

| Aspect | Budgeting Goal | No Budget Lifestyle Goal |

|---|---|---|

| Primary Focus | Track income and expenses precisely | Maintain financial freedom without detailed tracking |

| Money Management | Allocates funds to specific categories | Relies on overall balance and intuition |

| Spending Control | Strict limits on spending per category | Flexible spending guided by available resources |

| Financial Awareness | High awareness through detailed monitoring | Moderate awareness based on broad assessment |

| Stress Level | Can cause stress from rigid rules | Lower stress with relaxed approach |

| Goal Suitability | Ideal for precise savings and debt control | Suitable for those valuing flexibility and simplicity |

Understanding Budgeting Goals: A Structured Approach

Budgeting goals offer a structured approach to money management by setting clear financial targets and tracking income and expenses systematically to ensure spending aligns with priorities. This method enhances financial discipline and helps avoid debt by creating a plan based on actual earnings and anticipated expenditures. In contrast, a no-budget lifestyle relies on spending freely without predefined limits, which may work for some but often lacks the predictability and control essential for long-term financial stability.

The No Budget Lifestyle Goal: Embracing Flexibility in Finance

The no budget lifestyle goal emphasizes financial flexibility by allowing individuals to prioritize spending based on real-time needs rather than fixed categories, fostering a more adaptive approach to money management. Unlike traditional budgeting, this method reduces stress and promotes mindful spending habits, enhancing overall financial well-being. Embracing a no budget lifestyle goal encourages autonomy and responsiveness to changing financial circumstances without rigid constraints.

Key Differences: Budgeting Goals vs. No Budget Lifestyle Goals

Budgeting goals involve setting specific spending limits and tracking expenses to maintain financial control, whereas no budget lifestyle goals emphasize freedom from rigid constraints and intuitive money management. Budgeting requires detailed planning and regular monitoring to achieve defined financial targets, while a no budget approach relies on overall cash flow awareness and prioritizing spending based on values without strict categorization. Key differences include the degree of structure, discipline, and the method of decision-making used to manage money effectively.

Financial Discipline: The Case for Budgeting

Establishing a budgeting goal enhances financial discipline by setting clear spending limits and fostering intentional money management. In contrast, a no budget lifestyle often lacks the structured control necessary to track expenses, potentially leading to overspending and financial stress. Consistent budgeting supports savings growth and debt reduction, essential aspects of long-term financial health.

Freedom and Mindfulness: The No Budget Money Management Approach

The no budget lifestyle emphasizes financial freedom and mindfulness by allowing flexible spending without rigid categories, fostering a conscious awareness of money habits instead of strict constraints. This approach encourages living within means naturally, reducing stress associated with tracking every dollar, and promoting intentional decisions that align with personal values. By prioritizing adaptability over control, the no budget money management method cultivates a balanced relationship with finances and enhances overall well-being.

Pros and Cons: Budgeting Goals Compared to No Budget Lifestyles

Budgeting goals provide clear financial boundaries, enabling disciplined saving and spending while reducing debt risk, but they may feel restrictive and hard to maintain consistently. No budget lifestyles offer freedom and flexibility, promoting a stress-free approach to money management, yet they can lead to overspending and lack of clear financial progress. Choosing between budgeting and no budget depends on individual financial habits, goals, and the need for structure versus autonomy in managing money.

Impact on Savings: Structured vs. Flexible Money Management

A budgeting goal enforces disciplined spending limits, directly boosting savings by preventing overspending and promoting allocation toward financial priorities. In contrast, a no budget lifestyle emphasizes flexibility, which can lead to spontaneous expenses and less consistent savings growth. Structured money management typically results in higher and more predictable savings compared to the variable outcomes of flexible approaches.

Emotional and Psychological Effects of Each Approach

Budgeting goals provide a structured financial plan that reduces anxiety by offering control over spending, fostering a sense of security and achievement through tracked progress. In contrast, a no budget lifestyle goal promotes emotional freedom and flexibility, which can decrease stress for individuals overwhelmed by strict rules but may lead to impulsive spending and subsequent regret. Understanding these psychological effects helps tailor money management strategies that align with personal emotional needs and financial stability.

Finding Your Fit: Choosing Between Budgeting and No Budget Goals

Choosing the right money management strategy depends on personal spending habits and financial priorities, with budgeting goals providing structured control over expenses and savings. No budget lifestyle goals offer flexibility by emphasizing mindful spending without strict limits, appealing to those seeking less rigid financial routines. Understanding your financial behavior helps determine whether a detailed budget or a no budget approach better supports your long-term financial stability and goals.

Long-term Success: Combining Budgeting with Financial Flexibility

Balancing a strict budgeting goal with a no-budget lifestyle fosters long-term financial success by allowing structured expense tracking alongside adaptive spending habits. Strategic allocation of funds through budgeting ensures savings growth, while financial flexibility supports unexpected opportunities and market fluctuations. This combined approach enhances sustainable wealth management and reduces financial stress over time.

Related Important Terms

Value-Based Budgeting

Value-Based Budgeting prioritizes spending aligned with personal values, enhancing financial satisfaction and long-term discipline compared to a No Budget lifestyle that relies on intuition and flexibility but risks impulsive expenses. By focusing on meaningful expenditures, Value-Based Budgeting optimizes money management for achieving both financial stability and life fulfillment.

Zero-Sum Budgeting

Zero-sum budgeting allocates every dollar of income to specific expenses, savings, or debt repayment, ensuring no money is left unassigned and promoting disciplined financial control. In contrast, a no-budget lifestyle relies on flexible spending habits without strict allocations, which may lead to inconsistent savings and less predictable financial outcomes.

Conscious Spending Plan

A budgeting goal emphasizes creating a detailed spending plan to allocate income efficiently, ensuring financial discipline and targeted savings. In contrast, a no budget lifestyle goal centers on a Conscious Spending Plan, where spending aligns with personal values and priorities rather than strict numeric limits, fostering mindful money management without rigid constraints.

Anti-Budgeting

Anti-budgeting promotes flexible money management by emphasizing spending aligned with personal values rather than strict financial constraints, reducing stress and increasing overall satisfaction. This approach contrasts traditional budgeting by avoiding rigid limits, instead encouraging mindful expenditures and trust in intuitive financial decisions.

Pay-Yourself-First Method

The Pay-Yourself-First method prioritizes allocating a fixed percentage of income to savings before expenses, enhancing financial discipline compared to a no-budget lifestyle that relies on spending flexibility without predefined limits. This approach increases wealth-building potential by ensuring consistent savings, whereas the absence of budgeting can lead to inconsistent cash flow management and reduced financial security.

FIRE Budgeting (Financial Independence, Retire Early)

FIRE budgeting emphasizes strict expense tracking and aggressive saving rates to achieve early financial independence, contrasting sharply with a no-budget lifestyle that prioritizes flexibility but may risk slower wealth accumulation. Effective money management within FIRE requires precise budgeting to maximize investment contributions and minimize discretionary spending for faster retirement.

Lifestyle Creep Awareness

Budgeting goals provide a structured framework to control spending and prevent lifestyle creep, ensuring financial stability and mindful money management. In contrast, a no-budget lifestyle goal risks incremental increases in expenses, often leading to unnoticed lifestyle creep and potential financial strain.

Reverse Budgeting

Reverse budgeting prioritizes saving and investing a fixed amount before allocating funds for expenses, promoting disciplined money management that aligns with financial goals. This method contrasts with a no-budget lifestyle, where flexibility and minimal tracking risk overspending and hinder long-term wealth accumulation.

Automated Frugality

Automated frugality leverages technology to set fixed spending limits and savings goals, streamlining budgeting without the need for constant manual tracking. Embracing a no-budget lifestyle goal focuses on creating consistent spending habits and financial discipline through automatic payments and savings, reducing decision fatigue while maintaining money management control.

Guilt-Free Spending Allocation

Budgeting goals emphasize structured allocation of finances to balance savings and expenses, reducing stress associated with overspending while promoting guilt-free spending within set limits. No budget lifestyle goals prioritize intuitive money management by trusting personal judgment to spend freely without rigid restrictions, fostering a sense of financial freedom and guilt-free enjoyment.

Budgeting goal vs No budget lifestyle goal for money management. Infographic

moneydiff.com

moneydiff.com