An education fund goal prioritizes saving specifically for academic expenses, ensuring a steady financial resource for tuition, books, and related costs. In contrast, a sabbatical fund goal focuses on accumulating money to support time off work for rest, personal growth, or travel, requiring flexible budgeting to cover living expenses without income. Effective money management involves distinguishing these goals clearly to allocate funds appropriately and avoid compromising one by overspending on the other.

Table of Comparison

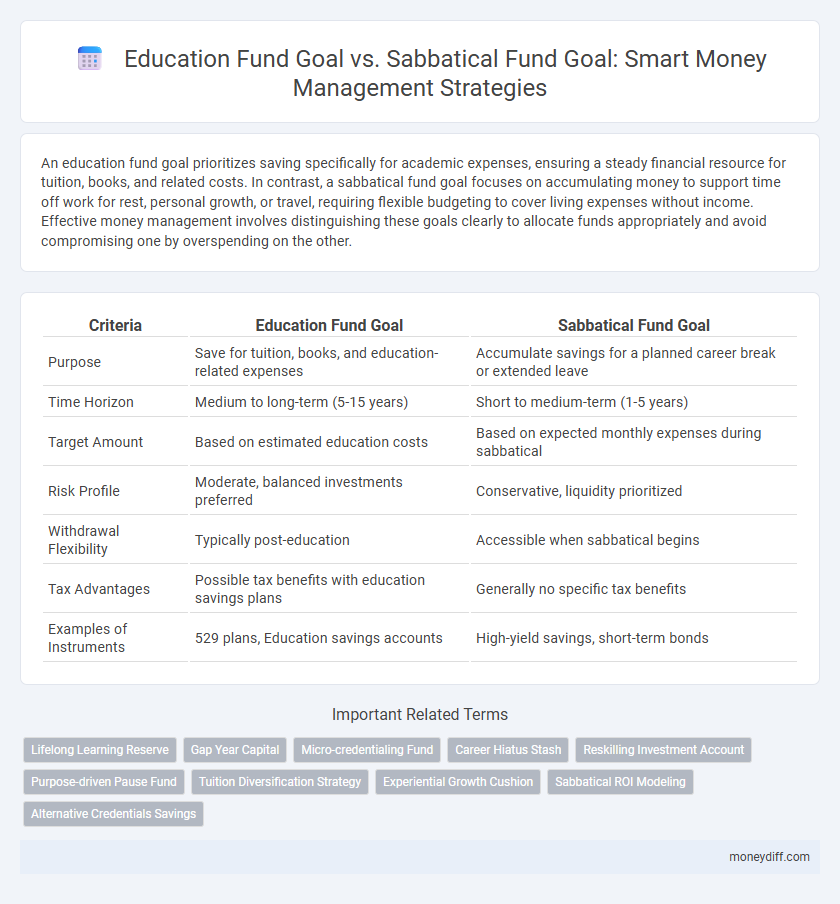

| Criteria | Education Fund Goal | Sabbatical Fund Goal |

|---|---|---|

| Purpose | Save for tuition, books, and education-related expenses | Accumulate savings for a planned career break or extended leave |

| Time Horizon | Medium to long-term (5-15 years) | Short to medium-term (1-5 years) |

| Target Amount | Based on estimated education costs | Based on expected monthly expenses during sabbatical |

| Risk Profile | Moderate, balanced investments preferred | Conservative, liquidity prioritized |

| Withdrawal Flexibility | Typically post-education | Accessible when sabbatical begins |

| Tax Advantages | Possible tax benefits with education savings plans | Generally no specific tax benefits |

| Examples of Instruments | 529 plans, Education savings accounts | High-yield savings, short-term bonds |

Understanding Education Fund Goals

Education fund goals prioritize long-term growth and stability to cover tuition, books, and related expenses, emphasizing consistent contributions and low-risk investments. These goals require detailed planning based on projected education costs, inflation rates, and potential scholarship opportunities. Properly managing an education fund ensures financial readiness for academic milestones and minimizes reliance on student loans.

Defining Sabbatical Fund Goals

Defining sabbatical fund goals involves setting specific financial targets to cover extended periods of unpaid leave, often lasting six months to a year, distinct from education fund goals which focus on tuition, books, and related academic expenses. Prioritizing sabbatical savings ensures sufficient cash flow for travel, personal projects, or professional development without relying on debt. Clear milestones and realistic monthly contributions help balance sabbatical funds with education savings, optimizing overall money management strategies.

Key Differences Between Education and Sabbatical Funds

Education funds primarily focus on accumulating money to cover tuition, books, and other academic expenses, often requiring consistent contributions over a long period. Sabbatical funds, by contrast, are designed to finance time off from work for rest, travel, or personal projects, usually needing a lump sum to support living expenses during the break. The key difference lies in the fund's purpose and withdrawal timing: education funds are invested with a future academic milestone in mind, while sabbatical funds aim for flexible timing aligned with career breaks.

Purpose and Benefits of an Education Fund

An education fund goal prioritizes securing financial resources specifically for tuition, books, and other academic expenses, ensuring uninterrupted learning and academic success. This targeted savings approach offers long-term benefits such as reduced student loan dependency and increased career opportunities. Unlike a sabbatical fund, which focuses on time off for rest or personal growth, an education fund directly invests in knowledge and skill acquisition, promoting lifelong economic stability.

Purpose and Benefits of a Sabbatical Fund

A Sabbatical Fund serves the purpose of providing financial support during extended breaks from work, enabling individuals to pursue personal growth, travel, or skill development without income disruption. Unlike an Education Fund, which is specifically allocated for tuition and academic expenses, a Sabbatical Fund offers flexibility and promotes mental well-being by allowing time off to recharge and prevent burnout. Establishing a Sabbatical Fund enhances long-term productivity and career satisfaction by securing funds for rejuvenation periods.

Assessing Financial Priorities for Life Goals

Assessing financial priorities for life goals involves comparing education fund goals and sabbatical fund goals to allocate resources effectively. Education fund goals prioritize long-term investment in skills and knowledge development, often requiring steady contributions over time. Sabbatical fund goals emphasize short-term financial security for planned breaks from work, demanding flexible savings to cover living expenses during extended leave periods.

Investment Strategies for Education vs Sabbatical Funds

Investment strategies for education funds often prioritize low-risk, growth-oriented options like 529 plans and tax-advantaged mutual funds to ensure capital preservation and steady growth aligned with tuition timelines. Sabbatical fund goals typically involve more flexible, balanced portfolios combining equity and fixed income to support both intermediate liquidity and wealth accumulation over time. Tailoring asset allocation to the specific time horizon and risk tolerance of each fund maximizes financial readiness while optimizing returns.

Time Horizons and Planning Considerations

Education fund goals typically have a medium to long-term time horizon, often spanning several years until the beneficiary reaches college age, requiring consistent, stable contributions and growth-oriented investments to keep pace with rising tuition costs. Sabbatical fund goals usually have a shorter time horizon, focused on accumulating sufficient savings within a few years to cover living expenses during the leave period, emphasizing liquidity and risk management to ensure funds are readily accessible. Effective planning for education funds prioritizes inflation protection and compound growth, while sabbatical funds demand precise budgeting and conservative investment strategies to balance accessibility and preservation of capital.

Risk Management for Education and Sabbatical Goals

Education fund goals typically require conservative risk management strategies to ensure capital preservation and steady growth for timely tuition payments, favoring low-volatility investments and stable returns. Sabbatical fund goals allow for a moderately higher risk tolerance due to flexible timing and potential for longer accumulation periods, enabling diversified portfolios with a balance of equities and fixed income. Effective money management aligns investment risk profiles with the distinct time horizons and liquidity needs of both education and sabbatical funds, minimizing the impact of market downturns on goal achievement.

Making Smart Choices: Aligning Funds with Personal Aspirations

Choosing between an education fund goal and a sabbatical fund goal requires prioritizing financial resources based on long-term personal aspirations and career growth. An education fund focuses on investing in skill development and future earning potential, while a sabbatical fund supports intentional breaks for rest or exploration, enhancing overall well-being. Aligning money management strategies with these goals ensures smart allocation of savings that reflect individual priorities and life stages.

Related Important Terms

Lifelong Learning Reserve

Allocating resources between an Education Fund and a Sabbatical Fund within a Lifelong Learning Reserve ensures consistent investment in personal and professional development. Prioritizing the Education Fund optimizes growth through structured learning, while the Sabbatical Fund supports immersive, extended educational experiences enhancing skill diversification.

Gap Year Capital

Gap Year Capital strategically distinguishes between Education Fund goals, designed for tuition and academic expenses, and Sabbatical Fund goals that support extended personal or professional breaks, optimizing money management for each purpose. Prioritizing contributions to the Education Fund ensures long-term academic investment, while allocating resources to the Sabbatical Fund enables flexibility for career growth or travel during a gap year.

Micro-credentialing Fund

Allocating resources to a Micro-credentialing Fund enhances skill development and career advancement compared to a Sabbatical Fund, which primarily supports extended time off without guaranteed professional growth. Prioritizing an Education Fund with emphasis on micro-credentials drives long-term financial returns by increasing employability and earning potential.

Career Hiatus Stash

Prioritizing a Career Hiatus Stash within your education fund goal ensures financial stability during planned sabbaticals, allowing seamless career breaks without compromising long-term learning investments. Allocating specific amounts toward both education and sabbatical funds enhances money management by balancing immediate skill development with future career reset opportunities.

Reskilling Investment Account

Reskilling Investment Account prioritizes long-term career growth by allocating funds specifically for education and skill development, contrasting with Sabbatical fund goals that target short-term personal rejuvenation costs. This strategic focus maximizes return on investment by enhancing employability and adapting to evolving job market demands.

Purpose-driven Pause Fund

The Purpose-driven Pause Fund prioritizes intentional sabbatical savings over traditional education funds, enabling individuals to invest in personal growth and mental rejuvenation rather than solely academic expenses. This strategic allocation supports holistic financial planning by balancing long-term career development with essential restorative breaks.

Tuition Diversification Strategy

Tuition diversification strategy balances education fund goals with sabbatical fund goals by allocating resources to optimize cash flow and reduce financial risk during career breaks and academic expenses. Prioritizing varied investment vehicles ensures continuous funding for tuition while preserving capital for sabbatical periods.

Experiential Growth Cushion

Allocating funds between an education fund goal and a sabbatical fund goal strategically enhances the Experiential Growth Cushion, ensuring financial readiness for transformative learning opportunities and restorative career breaks. Prioritizing contributions based on anticipated timelines and personal development objectives optimizes resource allocation for sustainable experiential investments.

Sabbatical ROI Modeling

Sabbatical fund goals, when modeled with ROI frameworks, demonstrate potential long-term financial and personal growth benefits that often exceed the more immediate returns of education fund goals. Optimizing money management strategies around sabbatical ROI modeling allows for strategic allocation of resources supporting career breaks that enhance skill development, mental health, and productivity, resulting in elevated lifetime earnings and job satisfaction.

Alternative Credentials Savings

Allocating resources between an Education fund goal and a Sabbatical fund goal optimizes financial flexibility, with Alternative Credentials Savings providing targeted investment for skills acquisition outside traditional degrees. Prioritizing Alternative Credentials Savings enhances career growth while balancing the need for sabbatical planning and long-term education funding.

Education fund goal vs Sabbatical fund goal for money management. Infographic

moneydiff.com

moneydiff.com