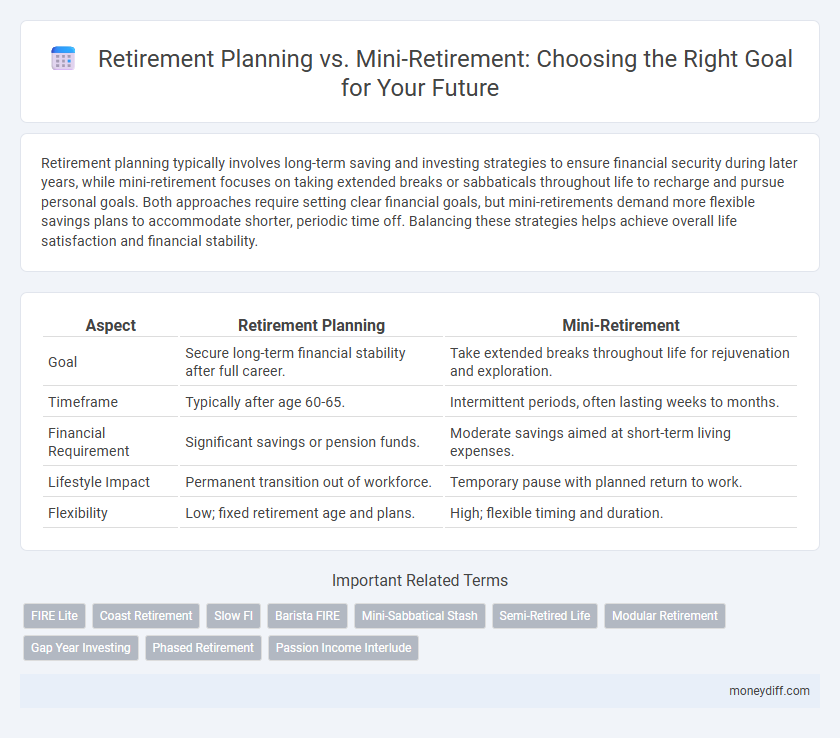

Retirement planning typically involves long-term saving and investing strategies to ensure financial security during later years, while mini-retirement focuses on taking extended breaks or sabbaticals throughout life to recharge and pursue personal goals. Both approaches require setting clear financial goals, but mini-retirements demand more flexible savings plans to accommodate shorter, periodic time off. Balancing these strategies helps achieve overall life satisfaction and financial stability.

Table of Comparison

| Aspect | Retirement Planning | Mini-Retirement |

|---|---|---|

| Goal | Secure long-term financial stability after full career. | Take extended breaks throughout life for rejuvenation and exploration. |

| Timeframe | Typically after age 60-65. | Intermittent periods, often lasting weeks to months. |

| Financial Requirement | Significant savings or pension funds. | Moderate savings aimed at short-term living expenses. |

| Lifestyle Impact | Permanent transition out of workforce. | Temporary pause with planned return to work. |

| Flexibility | Low; fixed retirement age and plans. | High; flexible timing and duration. |

Understanding Retirement Planning: Foundations & Benefits

Retirement planning builds a structured financial strategy to ensure long-term stability and independence by accumulating savings, investing wisely, and managing risks effectively. It focuses on creating a reliable income stream to cover healthcare, housing, and lifestyle expenses during retirement years, leveraging tax-advantaged accounts like 401(k)s and IRAs. This foundational approach provides peace of mind and safeguards against uncertainties, distinguishing it from the intermittent benefits of mini-retirements.

What Is Mini-Retirement? Exploring the Concept

Mini-retirement is a strategic approach to long-term financial planning that involves taking extended breaks from work at various stages of life instead of postponing leisure until traditional retirement age. This concept emphasizes periodic sabbaticals funded by disciplined savings and investments, allowing individuals to enjoy life experiences and reduce burnout while maintaining financial stability. Unlike conventional retirement planning, mini-retirements provide flexibility to balance career goals with personal fulfillment throughout one's lifespan.

Comparing Traditional Retirement vs Mini-Retirement Goals

Traditional retirement planning typically centers on accumulating a substantial nest egg for a long period to support financial security after age 65, emphasizing consistent saving and delayed gratification. Mini-retirement goals prioritize periodic breaks or sabbaticals throughout one's career to recharge and pursue personal interests, requiring flexible financial strategies that balance short-term enjoyment with long-term stability. Comparing these approaches highlights differing priorities: traditional retirement focuses on future security, while mini-retirement emphasizes ongoing life satisfaction and work-life balance.

Financial Requirements: Saving for Retirement vs Mini-Retirement

Retirement planning requires consistent long-term savings to build a substantial nest egg that supports decades of post-career life, often relying on employer-sponsored plans, IRAs, and investment growth. Mini-retirements prioritize shorter, periodic breaks funded by cash reserves or liquid savings, emphasizing more immediate financial flexibility rather than decades-long security. The financial requirements for retirement planning demand disciplined contributions and compound growth, whereas mini-retirements focus on budgeting for time-limited sabbaticals without jeopardizing overall financial stability.

Risk Factors in Retirement and Mini-Retirement Planning

Retirement planning involves mitigating long-term risks such as market volatility, inflation, and healthcare costs, which require stable, diversified investments and contingency funds. Mini-retirement planning emphasizes shorter-term risk management, focusing on ensuring sufficient liquidity and flexible income sources to cover unexpected expenses during temporary breaks from work. Both approaches demand careful assessment of personal risk tolerance and financial resilience to secure sustainable lifestyle and goal achievement.

Impact on Career: Traditional Retirement vs Taking Mini-Retirements

Traditional retirement often leads to a complete career pause, which may result in skill atrophy and reduced professional networks. Mini-retirements, by contrast, allow for intermittent breaks that rejuvenate motivation and creativity without severing career momentum. This approach supports continuous skill development and flexible career trajectories, enhancing long-term professional satisfaction.

Lifestyle Choice: Which Option Fits Your Money Management Goals?

Retirement planning emphasizes long-term financial security with strategies like 401(k) contributions, IRAs, and pension plans to ensure a stable lifestyle after exiting the workforce. Mini-retirement offers periodic breaks to enjoy life now, requiring flexible budgeting and savings that accommodate shorter, intermittent shifts in income and expenses. Evaluating your money management goals involves balancing consistent retirement savings against the desire for lifestyle freedom and experiential spending.

Tax Implications: Retirement Planning versus Mini-Retirement

Retirement planning often benefits from tax-advantaged accounts such as 401(k)s and IRAs, which allow for tax-deferred growth and potential deductions, enhancing long-term savings potential. Mini-retirements typically involve shorter breaks and may require using taxable income or savings, potentially resulting in immediate tax liabilities without the benefit of tax deferral. Understanding the differences in tax treatment between these approaches is crucial for optimizing financial outcomes and ensuring sustainable income throughout retirement periods.

Psychological Benefits: Long-Term vs Short-Term Breaks

Retirement planning offers psychological benefits by providing a clear long-term goal, fostering a sense of security and accomplishment over time. In contrast, mini-retirements deliver short-term psychological relief, reducing stress and boosting motivation by allowing periodic breaks from routine. Balancing long-term retirement strategies with intermittent mini-retreats can enhance overall mental well-being and sustain productivity.

Creating a Personalized Plan: Choosing the Right Path for You

Creating a personalized retirement plan involves evaluating your financial goals, lifestyle preferences, and risk tolerance to determine whether a traditional retirement or a mini-retirement aligns best with your vision. Traditional retirement planning emphasizes long-term saving and investment strategies to secure financial stability, while mini-retirements prioritize periodic breaks throughout your career for work-life balance and personal growth. Tailoring your approach ensures your financial resources and timeline support the retirement lifestyle that suits your individual needs and aspirations.

Related Important Terms

FIRE Lite

FIRE Lite emphasizes a flexible retirement planning approach by integrating mini-retirements, allowing individuals to periodically step away from work while continuing to build financial independence and sustain long-term goals. This strategy contrasts traditional retirement planning that targets a singular endpoint, offering greater balance by prioritizing intermittent breaks to maintain well-being and motivation throughout one's financial journey.

Coast Retirement

Coast Retirement focuses on saving aggressively early to cover essential retirement needs without further contributions later, contrasting with Mini-Retirement strategies that emphasize periodic breaks and lifestyle flexibility. By prioritizing a fully-funded retirement balance early, Coast Retirement ensures long-term financial security while reducing ongoing savings pressure.

Slow FI

Retirement planning traditionally targets long-term wealth accumulation for a distant financial independence milestone, whereas mini-retirements promote periodic breaks that align with Slow FI principles, allowing partial withdrawal from the workforce without fully retiring. Slow FI emphasizes sustainable cash flow and lifestyle flexibility, making mini-retirements a strategic approach to balance work, leisure, and ongoing financial growth toward eventual full retirement.

Barista FIRE

Barista FIRE emphasizes maintaining a part-time income during retirement, blending financial independence with continued work to support modest living expenses. This approach contrasts with traditional retirement planning, which aims for full financial independence before ceasing work, allowing for more flexible lifestyle choices over time.

Mini-Sabbatical Stash

A Mini-Sabbatical Stash offers a flexible financial cushion allowing individuals to take short, rejuvenating breaks without compromising long-term retirement goals. This approach balances immediate life enjoyment with sustained wealth accumulation, contrasting traditional retirement planning's singular, distant savings target.

Semi-Retired Life

Retirement planning traditionally involves accumulating savings for a complete withdrawal from the workforce, while a mini-retirement strategy promotes taking extended breaks or phased retirements to enjoy a semi-retired life with flexible income streams. Semi-retired individuals often balance part-time work or freelancing with leisure, optimizing financial stability and lifestyle satisfaction without fully exiting their careers.

Modular Retirement

Modular retirement breaks down the traditional retirement timeline into flexible, goal-oriented phases, allowing individuals to pursue mini-retirements and maintain financial stability through diversified income streams. This approach contrasts with conventional retirement planning by emphasizing periodic breaks and continuous engagement, optimizing both personal fulfillment and long-term wealth management.

Gap Year Investing

Retirement planning focuses on long-term wealth accumulation and steady income replacement, whereas mini-retirement strategies emphasize shorter, intentional breaks funded by gap year investing to maintain financial flexibility and life balance. Strategic gap year investing allows individuals to grow capital during career pauses, bridging immediate lifestyle goals with long-term retirement security.

Phased Retirement

Phased retirement enables individuals to gradually reduce working hours while steadily increasing retirement income streams and savings, offering a smoother transition compared to traditional retirement planning. Incorporating mini-retirement periods within phased retirement allows for intermittent breaks, providing flexibility to achieve personal goals and enhance work-life balance during the retirement process.

Passion Income Interlude

Retirement planning emphasizes long-term financial security through consistent saving and investment strategies, ensuring sustainable income after traditional career cessation. Mini-retirements offer intermittent passion income interludes, allowing individuals to pursue personal interests and projects while still generating revenue, blending lifestyle enjoyment with economic viability.

Retirement Planning vs Mini-Retirement for goal. Infographic

moneydiff.com

moneydiff.com