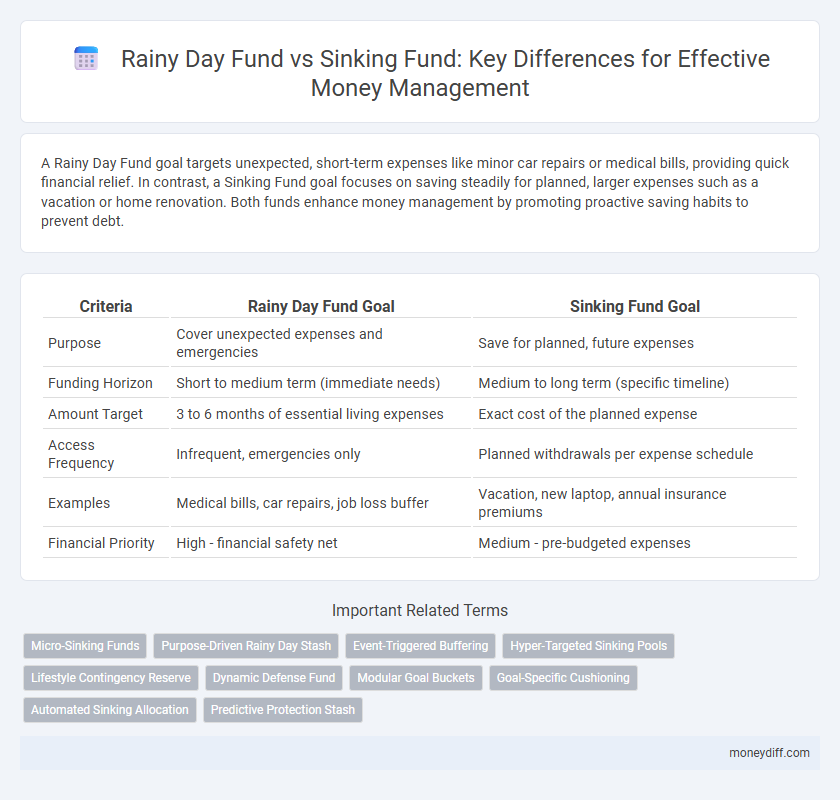

A Rainy Day Fund goal targets unexpected, short-term expenses like minor car repairs or medical bills, providing quick financial relief. In contrast, a Sinking Fund goal focuses on saving steadily for planned, larger expenses such as a vacation or home renovation. Both funds enhance money management by promoting proactive saving habits to prevent debt.

Table of Comparison

| Criteria | Rainy Day Fund Goal | Sinking Fund Goal |

|---|---|---|

| Purpose | Cover unexpected expenses and emergencies | Save for planned, future expenses |

| Funding Horizon | Short to medium term (immediate needs) | Medium to long term (specific timeline) |

| Amount Target | 3 to 6 months of essential living expenses | Exact cost of the planned expense |

| Access Frequency | Infrequent, emergencies only | Planned withdrawals per expense schedule |

| Examples | Medical bills, car repairs, job loss buffer | Vacation, new laptop, annual insurance premiums |

| Financial Priority | High - financial safety net | Medium - pre-budgeted expenses |

Understanding Rainy Day Funds: Purpose and Benefits

A Rainy Day Fund serves as an emergency savings buffer to cover unexpected expenses such as car repairs or medical bills, ensuring financial stability without resorting to debt. This fund is typically smaller, liquid, and intended for short-term, unforeseen financial challenges, unlike a Sinking Fund which is earmarked for planned, future expenses like vacations or major purchases. Establishing a Rainy Day Fund enhances financial resilience by providing quick access to cash and reducing stress during emergencies.

What is a Sinking Fund? Key Features Explained

A sinking fund is a dedicated savings account specifically set aside for planned large expenses, ensuring funds are available without incurring debt. Key features include regular, predetermined contributions, targeted financial goals like vacations or home repairs, and separate tracking to prevent mixing with daily expenses. Unlike a rainy day fund, which covers unexpected emergencies, a sinking fund is proactive money management focused on smoothing out future costs.

Rainy Day Fund vs Sinking Fund: Core Differences

A Rainy Day Fund serves as an emergency savings buffer for unexpected expenses like medical bills or urgent repairs, ensuring financial stability during unforeseen events. In contrast, a Sinking Fund is a planned savings strategy for anticipated future purchases or expenses, such as vacations, school tuition, or home renovations, allowing for targeted funds without incurring debt. The core difference lies in the purpose: Rainy Day Funds cover unexpected emergencies, while Sinking Funds prepare for known, scheduled costs.

When to Use a Rainy Day Fund in Your Finances

Use a Rainy Day Fund specifically for unexpected, short-term emergencies like car repairs or medical bills that arise unexpectedly, providing a financial safety net without disrupting long-term savings. Unlike a Sinking Fund, which is allocated for planned expenses such as a vacation or home maintenance, a Rainy Day Fund remains liquid and readily accessible to cover unforeseen events. Prioritizing a Rainy Day Fund ensures stability during financial shocks, preventing high-interest debt and maintaining cash flow in personal money management.

Setting Up a Sinking Fund: Step-by-Step Guide

Establishing a sinking fund begins with identifying specific future expenses, such as annual insurance premiums or planned home repairs, enabling targeted savings. Calculate the total amount needed and divide it by the number of months until the expense occurs to determine a monthly contribution goal. Consistently contribute to a separate, dedicated account to ensure funds are available when the expense arises, preventing financial strain.

How Much Should You Save: Rainy Day vs Sinking Fund

A Rainy Day Fund typically requires saving three to six months' worth of essential expenses to cover unexpected emergencies like car repairs or medical bills. In contrast, a Sinking Fund is designed for planned expenses, so you calculate the total cost of the item or event and divide that by the number of months until the expense occurs, ensuring disciplined, incremental savings. Prioritizing the Rainy Day Fund maintains financial security for unforeseen crises, while the Sinking Fund aids in goal-oriented saving without incurring debt.

Common Mistakes with Rainy Day and Sinking Funds

Many individuals confuse a rainy day fund with a sinking fund, often using money allocated for emergencies to cover planned expenses, which undermines financial preparedness. A common mistake is failing to distinguish between these funds' purposes: rainy day funds target unexpected, urgent costs, while sinking funds are for predictable, future payments. Mismanagement occurs when rainy day funds are depleted prematurely, leaving no safety net for true emergencies or when sinking funds are not consistently funded, causing financial strain during anticipated expenditures.

Integrating Both Funds in a Budgeting Strategy

Integrating a Rainy Day Fund and a Sinking Fund in a budgeting strategy enhances financial resilience by addressing both unexpected expenses and planned future purchases. Allocating specific amounts monthly ensures the Rainy Day Fund covers emergencies like car repairs or medical bills, while the Sinking Fund methodically accumulates money for predictable costs, such as annual insurance premiums or vacation expenses. Prioritizing contributions based on immediate financial needs and upcoming obligations optimizes cash flow management and reduces reliance on credit.

Real-Life Examples: Rainy Day and Sinking Fund Goals

Rainy Day Fund goals focus on covering unexpected expenses like urgent car repairs or medical bills, providing financial security for emergencies that arise without warning. Sinking Fund goals involve saving gradually for planned purchases such as holiday gifts or a vacation, helping to avoid debt by spreading costs over time. Real-life examples highlight using a Rainy Day Fund to handle sudden job loss, while a Sinking Fund enables budgeting for yearly insurance premiums or home maintenance.

Choosing the Right Fund for Your Money Management Plan

A Rainy Day Fund goal focuses on covering unexpected, short-term emergencies like minor car repairs or medical expenses, usually requiring a smaller, more accessible reserve of three to six months' worth of essential expenses. A Sinking Fund goal targets planned, specific future expenses such as a vacation, home renovation, or annual insurance premiums, allowing for gradual saving without debt. Choosing the right fund depends on prioritizing immediate financial protection versus long-term expense planning, ensuring efficient money management tailored to both urgent needs and upcoming costs.

Related Important Terms

Micro-Sinking Funds

Micro-sinking funds offer a targeted approach to money management by setting aside small, regular amounts for specific expenses, unlike rainy day funds which cover broader, unexpected emergencies. This strategy enhances financial discipline and ensures funds are readily available for planned costs, reducing reliance on credit and boosting overall budgeting efficiency.

Purpose-Driven Rainy Day Stash

A Rainy Day Fund goal is designed to cover unexpected, short-term expenses like minor car repairs or medical bills, providing a purpose-driven rainy day stash that ensures financial stability during unforeseen events. In contrast, a Sinking Fund goal targets planned, larger purchases by setting aside money over time, preventing debt accumulation for known future expenses such as vacations or home improvements.

Event-Triggered Buffering

A Rainy Day Fund Goal serves as an event-triggered buffer designed to cover unexpected minor emergencies, such as car repairs or medical expenses, providing immediate financial security without disrupting monthly budgets. In contrast, a Sinking Fund Goal allocates money gradually for planned future expenses, like a vacation or home renovation, enabling systematic savings that prevent debt accumulation while ensuring readiness for known upcoming costs.

Hyper-Targeted Sinking Pools

Rainy Day Fund Goal primarily covers unexpected, infrequent expenses such as car repairs or medical emergencies, while Sinking Fund Goal targets planned, predictable purchases like vacations or holiday gifts. Hyper-Targeted Sinking Pools enhance money management by allocating precise amounts for specific upcoming expenses, ensuring disciplined savings and reducing financial stress.

Lifestyle Contingency Reserve

A Rainy Day Fund Goal serves as a short-term Lifestyle Contingency Reserve, covering unexpected minor expenses like car repairs or medical copays, whereas a Sinking Fund Goal targets planned, larger purchases or expenses over a longer timeline, such as vacation costs or home renovations. Optimizing money management involves distinguishing these goals to ensure both immediate financial security and future spending needs are adequately met.

Dynamic Defense Fund

A Rainy Day Fund Goal provides short-term financial security for unexpected expenses, while a Sinking Fund Goal targets saving for planned future purchases or debt payments. The Dynamic Defense Fund combines these approaches by adjusting contributions based on cash flow fluctuations, enhancing flexibility and ensuring robust money management in varying economic conditions.

Modular Goal Buckets

Rainy Day Fund Goals provide financial security by covering unexpected expenses, emphasizing liquidity and immediate access, while Sinking Fund Goals focus on planned, modular savings for specific future purchases or debts, promoting disciplined, segmented money management through dedicated goal buckets. Modular Goal Buckets enhance money management by categorizing funds for distinct purposes, ensuring clear allocation between emergency reserves and scheduled financial targets.

Goal-Specific Cushioning

A Rainy Day Fund serves as a general financial cushion for unexpected, short-term emergencies, while a Sinking Fund targets specific future expenses by setting aside money gradually for planned costs. Prioritizing goal-specific cushioning with a Sinking Fund enhances money management by aligning savings directly with anticipated financial goals.

Automated Sinking Allocation

A Rainy Day Fund goal focuses on accumulating emergency savings for unexpected expenses, while a Sinking Fund goal strategically allocates money for planned future purchases or payments. Automated Sinking Allocation enhances money management by systematically directing funds into designated accounts, ensuring consistent progress toward specific financial targets.

Predictive Protection Stash

A Rainy Day Fund Goal provides short-term emergency cash for unforeseen expenses, offering predictive protection stash against sudden financial shocks. In contrast, a Sinking Fund Goal accumulates money for planned future expenditures, ensuring targeted savings without disrupting overall budgeting.

Rainy Day Fund Goal vs Sinking Fund Goal for money management Infographic

moneydiff.com

moneydiff.com