An Emergency Fund Goal focuses on setting aside three to six months' worth of essential expenses to cover unexpected financial setbacks like job loss or medical emergencies. FU Money Goal represents a larger sum that provides complete financial independence, allowing you to walk away from any situation without worry. Prioritizing an Emergency Fund first ensures immediate security, while building FU Money offers long-term freedom and empowerment.

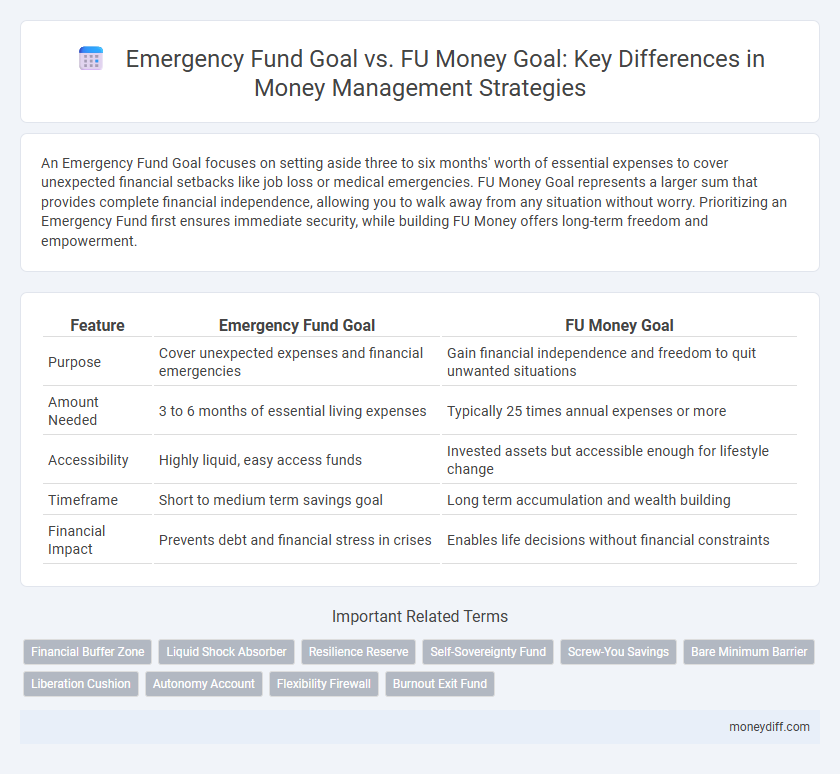

Table of Comparison

| Feature | Emergency Fund Goal | FU Money Goal |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Gain financial independence and freedom to quit unwanted situations |

| Amount Needed | 3 to 6 months of essential living expenses | Typically 25 times annual expenses or more |

| Accessibility | Highly liquid, easy access funds | Invested assets but accessible enough for lifestyle change |

| Timeframe | Short to medium term savings goal | Long term accumulation and wealth building |

| Financial Impact | Prevents debt and financial stress in crises | Enables life decisions without financial constraints |

Understanding Emergency Fund Goals

Emergency fund goals prioritize immediate financial security by covering three to six months' worth of essential expenses, providing a buffer against unexpected events like job loss or medical emergencies. This fund is strictly liquid and easily accessible, ensuring quick response without incurring debt or selling investments. In contrast, FU money goals represent a larger, long-term financial independence amount designed to enable complete lifestyle freedom without reliance on employment income.

What is FU Money and Why It Matters

FU Money refers to a financial reserve designed to provide complete independence and security, allowing individuals to walk away from situations without financial stress. Unlike an emergency fund, which covers unexpected expenses, FU Money empowers long-term control over life choices and career decisions. This financial cushion is crucial for true autonomy, reducing reliance on employment or external pressures.

Key Differences: Emergency Fund vs FU Money

An emergency fund is typically three to six months' worth of essential living expenses set aside to cover unexpected financial setbacks like medical emergencies or job loss, providing a safety net without incurring debt. FU money, or financial independence money, is a larger sum designed to afford complete freedom from undesirable work or situations, enabling immediate lifestyle changes without financial strain. The key difference lies in their purpose and scale: emergency funds ensure short-term security during crises, while FU money empowers long-term autonomy and personal choice.

Setting Your Emergency Fund Target

Setting your emergency fund target involves calculating three to six months' worth of essential living expenses to cover unforeseen financial hardships such as job loss or medical emergencies. This fund acts as a financial safety net distinct from FU money, which is designed for long-term financial independence and freedom beyond immediate needs. Prioritizing your emergency fund ensures liquidity and security, allowing for stability and peace of mind during unexpected situations.

Calculating FU Money: How Much is Enough?

Calculating FU Money involves determining a lump sum that covers living expenses for a prolonged period, typically ranging from six months to several years, ensuring financial independence during unforeseen circumstances. The amount depends on factors like monthly expenses, fixed debts, lifestyle choices, and desired financial security level. Unlike an Emergency Fund aimed at short-term crisis management, FU Money supports long-term freedom and stress-free decision-making.

Benefits of an Emergency Fund

An emergency fund provides immediate financial security by covering unexpected expenses such as medical bills, car repairs, or job loss, reducing reliance on high-interest debt or loans. Unlike FU money, which is designed for complete financial independence and lifestyle freedom, an emergency fund specifically safeguards against short-term crises, ensuring peace of mind and stability. Building an emergency fund enhances money management by creating a focused financial cushion that prevents disruption to long-term financial goals.

Advantages of FU Money for Financial Freedom

FU Money offers unparalleled financial freedom by providing a robust buffer that empowers individuals to make bold life choices without fear of immediate financial repercussions. Unlike an emergency fund, which covers unexpected expenses, FU Money encompasses a larger sum that supports long-term independence, enabling career changes, entrepreneurship, or early retirement. This strategic financial reserve reduces stress and dependence on conventional income sources, fostering a proactive approach to wealth building and personal fulfillment.

Prioritizing: Which Goal Should Come First?

Emergency fund should take priority over FU money as it provides immediate financial security during unexpected expenses, typically covering three to six months of living costs. Building a solid emergency fund reduces reliance on high-interest debt and creates a foundation for long-term financial stability. FU money, designed for ultimate financial independence or significant life changes, becomes relevant only after establishing this essential safety net.

Strategies to Build Both Emergency and FU Funds

Building both an emergency fund and FU money requires distinct yet complementary strategies focused on disciplined savings and investment. Prioritize automating contributions to a high-yield savings account for the emergency fund to cover 3-6 months of essential expenses, while directing surplus income into diversified investments or brokerage accounts to grow FU money for financial independence. Regularly reviewing and adjusting these allocations ensures balanced liquidity for short-term security and long-term freedom.

Choosing the Right Money Management Goal for You

An emergency fund goal focuses on setting aside three to six months' worth of essential expenses to cover unexpected financial crises, ensuring short-term liquidity and peace of mind. FU money goal involves accumulating enough savings to gain financial independence, providing freedom to leave unsatisfying jobs or situations without immediate concern for income. Choosing the right money management goal depends on individual financial stability, risk tolerance, and long-term aspirations, balancing immediate security against ultimate financial freedom.

Related Important Terms

Financial Buffer Zone

An emergency fund goal targets covering 3 to 6 months of essential living expenses to provide a financial buffer zone during unexpected events, ensuring liquidity and immediate access to cash. FU money goal aims for a larger lump sum, often several years' worth of expenses, granting complete financial independence and the freedom to make life choices without reliance on income.

Liquid Shock Absorber

An Emergency Fund Goal aims to create a liquid shock absorber that covers 3 to 6 months of essential expenses, ensuring immediate access to cash during unforeseen financial setbacks. FU Money Goal, often larger and more flexible, prioritizes complete financial independence and empowerment, but may include less liquid assets that are not ideal for urgent emergencies.

Resilience Reserve

An Emergency Fund Goal typically covers 3 to 6 months of essential living expenses, providing a resilience reserve for unexpected financial setbacks such as medical emergencies or job loss. FU Money Goal, often amounting to a larger sum equal to 1 to 2 years of expenses, offers greater financial independence and peace of mind by enabling full control over life choices without reliance on income.

Self-Sovereignty Fund

An Emergency Fund Goal focuses on covering 3 to 6 months of essential living expenses to provide financial security during unforeseen events, while a FU Money Goal aims to accumulate enough wealth for complete self-sovereignty, enabling freedom from employment or external obligations. Prioritizing a Self-Sovereignty Fund integrates both strategies by ensuring immediate stability and long-term independence.

Screw-You Savings

Emergency Fund Goal focuses on covering 3 to 6 months of essential living expenses for financial security during unexpected events, whereas FU Money Goal represents a larger sum that provides complete independence and freedom from unwanted work or situations. Prioritizing Screw-You Savings, or FU Money, empowers financial autonomy by creating a meaningful buffer beyond basic emergency funds.

Bare Minimum Barrier

Emergency Fund Goal focuses on building a Bare Minimum Barrier that covers 3 to 6 months of essential living expenses to provide financial security during unexpected events, while FU Money Goal emphasizes accumulating enough savings to leave an unsatisfactory situation without financial worry. Prioritizing the Emergency Fund ensures immediate stability, whereas FU Money grants long-term freedom and empowerment in money management decisions.

Liberation Cushion

An Emergency Fund Goal provides a short-term financial safety net covering 3-6 months of essential expenses, while FU Money Goal, or Liberation Cushion, emphasizes a larger sum enabling complete financial independence and freedom from obligations. Prioritizing the Liberation Cushion accelerates long-term wealth-building and stress-free decision-making by ensuring funds exceed immediate emergencies and empower personal sovereignty.

Autonomy Account

An Emergency Fund Goal ensures financial security by covering three to six months of essential expenses, providing immediate access to funds during unforeseen events, whereas a FU Money Goal represents a larger, self-sufficient reserve enabling complete autonomy and the freedom to exit unsatisfactory situations without financial constraints. Prioritizing an Autonomy Account that combines both goals can enhance money management by balancing short-term stability with long-term independence.

Flexibility Firewall

An Emergency Fund Goal focuses on building a financial buffer to cover unexpected expenses, ensuring short-term liquidity and peace of mind, while FU Money Goal emphasizes accumulating substantial savings for long-term independence and the freedom to make bold life choices. Prioritizing a Flexibility Firewall within these goals enhances resilience by safeguarding against financial shocks and empowering adaptive decision-making in uncertain situations.

Burnout Exit Fund

An Emergency Fund Goal focuses on covering essential living expenses for 3-6 months during unforeseen events, while FU Money Goal provides financial freedom to exit burnout or toxic situations without immediate income pressure; prioritizing a Burnout Exit Fund empowers individuals to maintain mental health and leverage financial independence effectively. Building a targeted Burnout Exit Fund involves calculating personal monthly expenses and adding a buffer for unexpected costs, creating a strategic financial safety net beyond traditional emergency savings.

Emergency Fund Goal vs FU Money Goal for money management Infographic

moneydiff.com

moneydiff.com