Saving for retirement ensures long-term financial security by building a dedicated fund to cover living expenses after leaving the workforce. FU money provides immediate freedom and confidence to make bold life decisions without financial constraints. Balancing both goals empowers individuals to enjoy personal freedom today while securing a stable future.

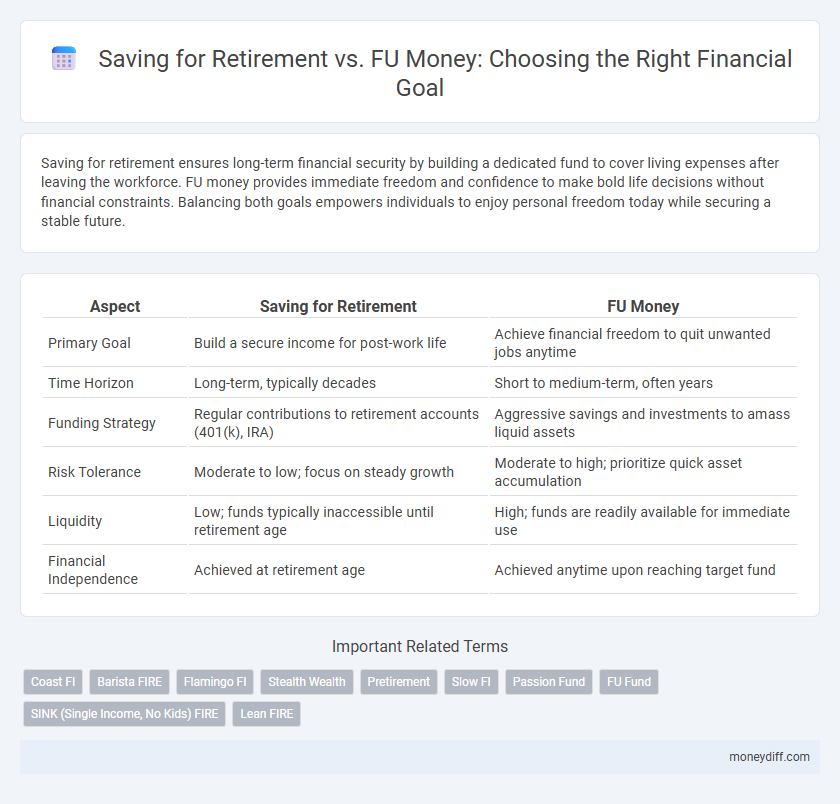

Table of Comparison

| Aspect | Saving for Retirement | FU Money |

|---|---|---|

| Primary Goal | Build a secure income for post-work life | Achieve financial freedom to quit unwanted jobs anytime |

| Time Horizon | Long-term, typically decades | Short to medium-term, often years |

| Funding Strategy | Regular contributions to retirement accounts (401(k), IRA) | Aggressive savings and investments to amass liquid assets |

| Risk Tolerance | Moderate to low; focus on steady growth | Moderate to high; prioritize quick asset accumulation |

| Liquidity | Low; funds typically inaccessible until retirement age | High; funds are readily available for immediate use |

| Financial Independence | Achieved at retirement age | Achieved anytime upon reaching target fund |

Understanding Retirement Savings and FU Money

Retirement savings focus on building a consistent, long-term financial foundation through accounts like 401(k)s and IRAs, designed to provide income after career end. FU Money represents a lump sum of accessible funds giving financial independence and freedom to make life-changing decisions without constraints. Understanding both concepts helps individuals balance steady retirement planning with the flexibility and empowerment FU Money provides.

Defining Your Financial Goals: Security vs Freedom

Defining your financial goals is crucial when choosing between saving for retirement and accumulating FU money, as each serves distinct purposes. Retirement savings prioritize long-term security through steady income streams and risk-managed growth, ensuring financial stability in later years. FU money emphasizes immediate financial freedom, providing the flexibility to make life decisions without external constraints or dependence on traditional employment.

How Much Do You Need for Retirement vs FU Money?

Determining how much you need for retirement typically involves calculating 70-85% of your pre-retirement income annually to sustain your lifestyle, often requiring a nest egg of 20-25 times your yearly expenses. In contrast, FU Money aims for a more flexible and substantial sum, usually equating to 25-30 times your annual living costs, providing the freedom to quit any job or situation instantly. Understanding these financial targets helps prioritize saving strategies and timelines based on your personal goals and risk tolerance.

Investment Strategies for Long-Term Wealth

Prioritizing saving for retirement involves consistent, low-risk investments such as index funds and bonds, aiming for steady, compounding growth over decades. Building FU money requires more aggressive strategies like diversified stock portfolios and alternative assets, emphasizing liquidity and higher returns to achieve early financial independence. Combining tax-advantaged accounts like 401(k)s with brokerage accounts optimizes wealth accumulation and provides flexibility for various long-term financial goals.

Risk Tolerance: Retiring Comfortably or Quitting Early

Risk tolerance plays a crucial role in deciding between saving for retirement and building FU money, as retirees typically prioritize stable, low-risk investments to maintain a comfortable lifestyle, while those seeking FU money often embrace higher-risk options for early financial independence. Retirement savings strategies emphasize asset allocation in bonds, index funds, and dividend stocks to preserve capital and generate steady income streams. In contrast, accumulating FU money may involve aggressive investing in growth stocks, real estate, or entrepreneurial ventures to accelerate wealth growth despite higher volatility.

Building a Savings Plan: Consistency vs Aggressive Accumulation

Building a savings plan for retirement prioritizes consistency, leveraging regular contributions and compound interest over time to ensure steady financial security. In contrast, accumulating FU money emphasizes aggressive saving strategies and higher risk investments to achieve rapid wealth growth for greater financial independence. Balancing these approaches depends on individual goals, risk tolerance, and time horizons to optimize long-term financial success.

Tax Implications: Retirement Accounts vs Flexible Cash

Retirement accounts like 401(k)s and IRAs offer significant tax advantages, including tax-deferred growth or tax-free withdrawals, reducing taxable income during working years and potentially lowering tax brackets in retirement. Flexible cash savings, such as FU money, provides immediate access without withdrawal penalties but lacks tax benefits and is subject to capital gains taxes or ordinary income taxes on interest. Choosing between these options depends on balancing long-term tax efficiency of retirement accounts against the liquidity and flexibility of cash assets.

Milestone Tracking: Measuring Progress Towards Each Goal

Tracking milestones is essential for assessing progress in both saving for retirement and accumulating FU money, as it provides clear, measurable benchmarks. Retirement savings milestones often include reaching specific contribution limits, achieving target asset allocations, and estimating future income replacement ratios. In contrast, FU money milestones focus on building liquid cash reserves, covering fixed expenses for a set number of months, and achieving financial independence metrics that enable immediate lifestyle changes.

Lifestyle Choices: Sustaining Retirement vs Achieving Independence

Saving for retirement emphasizes a structured lifestyle focused on sustaining long-term financial security through steady income streams like pensions, Social Security, and diversified investments. FU Money prioritizes achieving complete financial independence, enabling lifestyle choices free from employment constraints and fostering flexibility, spontaneity, and personal fulfillment. Evaluating goals involves balancing predictable retirement needs against the desire for autonomy and early exit from traditional work-life paradigms.

Choosing the Right Path: Aligning Goals with Personal Values

Choosing between saving for retirement and building FU money depends on aligning financial goals with personal values; retirement savings prioritize long-term security and stability, while FU money emphasizes financial independence and freedom to make bold life choices. Understanding individual priorities shapes effective strategies, ensuring resources support a desired lifestyle and provide peace of mind. Prioritizing goals based on values leads to a tailored approach, maximizing both financial growth and personal fulfillment.

Related Important Terms

Coast FI

Coast FI emphasizes saving aggressively early to let investments grow passively, allowing you to retire comfortably without additional contributions. Prioritizing Coast FI over FU Money enables financial independence through long-term compound interest, reducing stress about aggressive saving later in life.

Barista FIRE

Barista FIRE, a financial independence strategy, balances saving for retirement with accumulating FU money by maintaining part-time work to cover living expenses while steadily building investment assets. This approach reduces reliance on full retirement savings, allowing greater flexibility and financial security by blending immediate income streams with long-term wealth growth.

Flamingo FI

Flamingo FI emphasizes the importance of balancing saving for retirement with building FU Money to achieve financial independence faster, enabling more life choices and freedom. Their strategy integrates tax-advantaged retirement accounts with aggressive savings in liquid assets, optimizing growth and flexibility for long-term security.

Stealth Wealth

Saving for retirement emphasizes long-term financial security through consistent investment in tax-advantaged accounts, prioritizing steady growth and future stability. FU money focuses on accumulating sufficient liquid assets to gain immediate financial independence and maintain privacy through stealth wealth, avoiding conspicuous consumption and public exposure of net worth.

Pretirement

Saving for retirement ensures a stable income after leaving the workforce, allowing for planned expenses and long-term financial security. In contrast, FU Money--a lump sum providing financial independence--enables early pretirement choices without relying on traditional retirement timelines.

Slow FI

Slow FI emphasizes consistent, long-term saving strategies focused on building a secure retirement fund rather than accumulating FU money for immediate freedom. Prioritizing reliable investment growth and disciplined contributions ensures financial stability and stress-free retirement planning.

Passion Fund

Building a Passion Fund within your savings strategy prioritizes financial freedom to pursue meaningful interests without the pressure of traditional retirement goals. This approach emphasizes allocating resources toward experiences and projects that ignite personal fulfillment, contrasting with conventional retirement funds focused solely on long-term security.

FU Fund

Building an FU Fund provides financial independence by accumulating a substantial amount of money that covers multiple years of living expenses, allowing individuals to quit their jobs without immediate financial pressure. Unlike traditional retirement savings focused on long-term growth, an FU Fund emphasizes liquidity and accessibility to support early financial freedom and lifestyle choices.

SINK (Single Income, No Kids) FIRE

SINK individuals pursuing FIRE strategies prioritize saving aggressively for retirement, often allocating higher percentages of income to investments due to lower living expenses without dependents. FU Money serves as a financial independence milestone, providing a buffer for quitting jobs or making lifestyle changes before full retirement, but retirement savings remain essential for long-term security.

Lean FIRE

Saving for retirement through Lean FIRE emphasizes minimalism and financial independence with lower expenses, enabling early withdrawal from the workforce; FU Money focuses on accumulating enough wealth to confidently reject undesirable work, prioritizing personal freedom over frugality. Both strategies aim for financial autonomy but differ in lifestyle expectations and saving targets.

Saving for Retirement vs FU Money for goal. Infographic

moneydiff.com

moneydiff.com