Choosing between debt payoff and debt snowball methods depends on your financial goals and motivation. Debt payoff prioritizes paying off debts with the highest interest rates first, minimizing overall interest paid and saving money in the long term. Debt snowball focuses on paying off the smallest debts first, providing quick wins that boost motivation and help maintain momentum toward becoming debt-free.

Table of Comparison

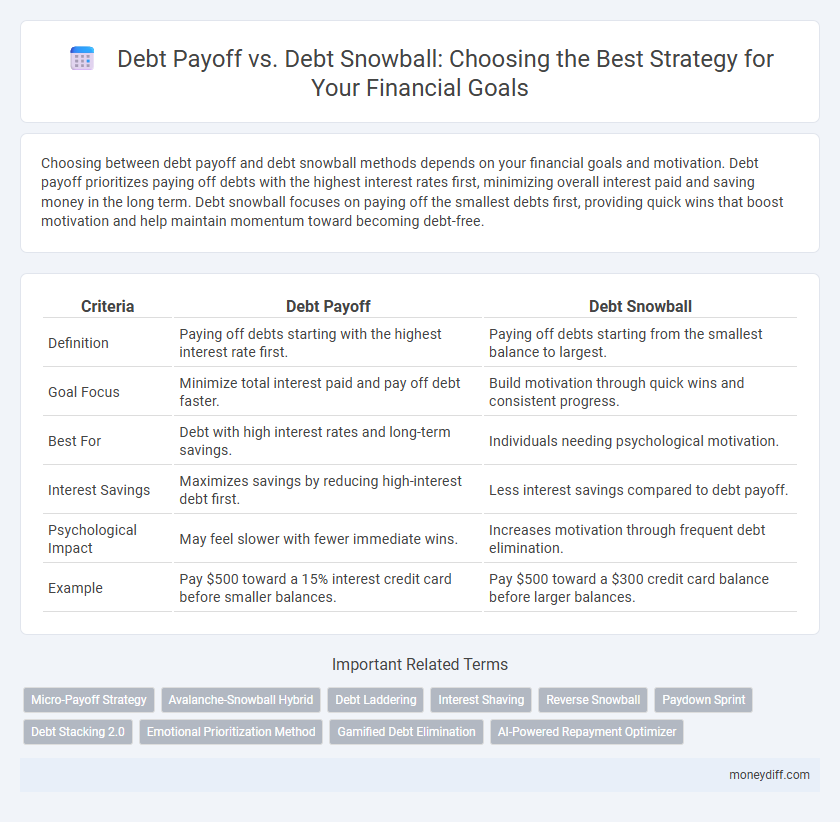

| Criteria | Debt Payoff | Debt Snowball |

|---|---|---|

| Definition | Paying off debts starting with the highest interest rate first. | Paying off debts starting from the smallest balance to largest. |

| Goal Focus | Minimize total interest paid and pay off debt faster. | Build motivation through quick wins and consistent progress. |

| Best For | Debt with high interest rates and long-term savings. | Individuals needing psychological motivation. |

| Interest Savings | Maximizes savings by reducing high-interest debt first. | Less interest savings compared to debt payoff. |

| Psychological Impact | May feel slower with fewer immediate wins. | Increases motivation through frequent debt elimination. |

| Example | Pay $500 toward a 15% interest credit card before smaller balances. | Pay $500 toward a $300 credit card balance before larger balances. |

Understanding Debt Payoff Strategies

Debt payoff strategies such as the debt snowball method prioritize paying off smaller debts first to build momentum and motivation, while other approaches focus on minimizing interest costs by tackling high-interest debts first. Understanding these methods requires analyzing factors like interest rates, debt amounts, and personal financial behavior to select the most effective plan for sustainable debt reduction. Comparing the debt snowball's psychological benefits with the mathematical advantages of the debt avalanche enables goal-oriented decision-making.

What Is the Debt Snowball Method?

The Debt Snowball method focuses on paying off the smallest debts first to build momentum and motivation while tackling larger debts sequentially. This strategy emphasizes psychological wins by reducing the total number of debts quickly, encouraging consistent progress toward financial freedom. It contrasts with other methods by prioritizing debt count over interest rates, making it effective for those seeking motivation in their debt payoff goals.

Debt Avalanche vs. Debt Snowball: Key Differences

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, minimizing total interest paid and shortening the payoff timeline. In contrast, the Debt Snowball method focuses on clearing the smallest balances first to build momentum and motivation through quick wins. Choosing between these strategies depends on individual financial goals, psychological preference, and the desire to save on interest costs versus maintaining motivation.

Pros and Cons of the Debt Snowball Approach

The Debt Snowball approach focuses on paying off the smallest debts first, creating quick wins that boost motivation and maintain momentum toward financial goals. While this method may not minimize interest payments as effectively as the Debt Payoff approach targeting highest-interest debts, its psychological benefits help individuals stay consistent with their repayment plan. However, the potential downside is higher overall interest costs, which might extend the debt-free timeline compared to interest-prioritized strategies.

Pros and Cons of Debt Payoff by Avalanche

Debt payoff by avalanche prioritizes paying off debts with the highest interest rates first, reducing overall interest payments and accelerating financial freedom. This method minimizes total repayment costs and shortens the payoff timeline but can feel less motivating as smaller balances take longer to clear. Individuals with multiple high-interest debts benefit most from the avalanche strategy, while those seeking quick wins may find the slower progress less encouraging.

Choosing the Right Debt Payoff Method for Your Goals

Choosing the right debt payoff method hinges on aligning strategies with your financial goals and psychological motivation. The Debt Snowball method accelerates motivation by targeting smaller debts first, creating quick wins and boosting momentum, while the Debt Payoff method prioritizes high-interest debts, minimizing total interest payments over time for a cost-effective approach. Evaluating your goal to either build confidence or save money shapes the optimal payoff plan tailored to your financial success.

Steps to Implement the Debt Snowball Method

To implement the Debt Snowball method effectively, begin by listing all debts from smallest to largest balance, prioritizing quick wins to build momentum. Make minimum payments on all debts except the smallest, to which you allocate extra funds until it is fully paid off. Once the smallest debt is cleared, roll over its payment amount to the next smallest debt, accelerating repayment and fostering motivation towards your ultimate goal of financial freedom.

Tracking Your Progress Toward Debt Freedom

Tracking your progress toward debt freedom is essential when choosing between debt payoff methods like debt payoff vs debt snowball. The debt snowball method focuses on paying off the smallest debts first, providing quick wins that boost motivation, while the debt payoff strategy targets high-interest debts to minimize overall interest paid. Using budgeting apps and progress charts can help visualize debt reduction, ensuring you stay on track and adjust payments to accelerate your journey to financial freedom.

Common Mistakes in Debt Repayment Strategies

Common mistakes in debt repayment strategies include neglecting to factor in interest rates, leading to prolonged debt payoff periods and increased costs. Ignoring the psychological benefits of the debt snowball method can result in decreased motivation and inconsistent payments. Overemphasizing speed over sustainability often causes individuals to miss deadlines or default, undermining long-term financial goals.

Setting Realistic Financial Goals for Debt Elimination

Setting realistic financial goals for debt elimination involves choosing a repayment strategy that aligns with your income and spending habits. The Debt Snowball method prioritizes paying off smaller debts first to build motivation, while the Debt Payoff approach targets high-interest debt to minimize overall cost. Analyzing interest rates, monthly budget, and psychological factors ensures a practical plan for consistent progress toward becoming debt-free.

Related Important Terms

Micro-Payoff Strategy

The Debt Snowball method accelerates motivation by focusing on paying off the smallest debts first, creating quick wins that build momentum toward overall debt reduction goals. Micro-payoff strategies break down larger debts into manageable chunks, making consistent payments achievable and reinforcing financial discipline throughout the payoff journey.

Avalanche-Snowball Hybrid

The Avalanche-Snowball Hybrid method accelerates debt payoff by targeting high-interest debts first, maximizing interest savings while maintaining motivation through quick wins by clearing smaller balances. This strategic combination balances efficiency and psychological momentum, optimizing the path to financial freedom.

Debt Laddering

Debt laddering accelerates financial freedom by prioritizing loans with escalating interest rates, maximizing interest savings, and reducing total repayment time. This strategy contrasts with the debt snowball method, which targets balances from smallest to largest, emphasizing quick psychological wins over cost efficiency.

Interest Shaving

Debt payoff strategies impact interest costs significantly; the debt snowball method accelerates motivation by focusing on smaller balances first, but the avalanche method shaves more interest by targeting high-rate debts, optimizing long-term savings. Prioritizing high-interest debt repayment reduces overall interest paid, making the avalanche approach more effective for minimizing total financial burden.

Reverse Snowball

The Reverse Debt Snowball method targets paying off the largest debts first to reduce overall interest payments and accelerate financial freedom. This approach contrasts with the traditional Debt Snowball by prioritizing high-balance debts, optimizing long-term savings and achieving goal completion more efficiently.

Paydown Sprint

Debt Payoff strategies, especially the Paydown Sprint method, prioritize rapid reduction of high-interest balances to accelerate financial freedom and minimize interest costs. The Debt Snowball focuses on paying off the smallest debts first to build momentum, but the Paydown Sprint targets maximum impact by aggressively tackling the largest or most costly debts, optimizing goal achievement speed.

Debt Stacking 2.0

Debt Stacking 2.0 accelerates goal achievement by prioritizing debts with the highest interest rates, reducing total interest paid compared to traditional Debt Snowball methods. This strategic payoff approach optimizes cash flow efficiency and shortens the timeline to financial freedom.

Emotional Prioritization Method

Debt Payoff strategies vary, with the Debt Snowball method emphasizing emotional prioritization by targeting smaller balances first to build motivation and momentum. This approach leverages psychological rewards, increasing commitment and reducing stress, compared to purely mathematical strategies focused on interest rates.

Gamified Debt Elimination

Gamified debt elimination leverages the debt snowball method by prioritizing small balances to build quick wins, increasing motivation through interactive tracking and rewards. This approach accelerates goal achievement by transforming debt payoff into an engaging challenge, fostering consistent progress and financial discipline.

AI-Powered Repayment Optimizer

AI-Powered Repayment Optimizer leverages machine learning algorithms to tailor debt payoff strategies, dynamically comparing Debt Payoff and Debt Snowball methods for maximum efficiency. By analyzing interest rates, payment schedules, and personal financial data, it identifies the fastest, most cost-effective path to eliminate debt while improving overall credit health.

Debt Payoff vs Debt Snowball for goal. Infographic

moneydiff.com

moneydiff.com