Choosing homeownership provides stability and long-term investment benefits, allowing individuals to build equity over time. House hacking leverages rental income from spare rooms or units to reduce mortgage costs and accelerate financial goals. Both strategies support homeownership, but house hacking offers an active approach to maximizing property value and cash flow.

Table of Comparison

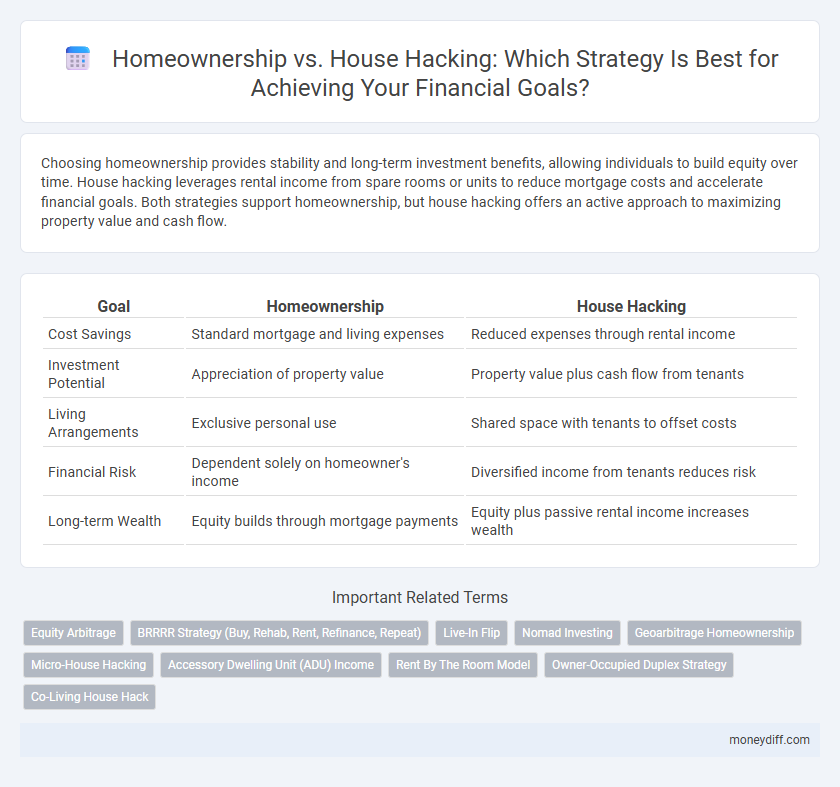

| Goal | Homeownership | House Hacking |

|---|---|---|

| Cost Savings | Standard mortgage and living expenses | Reduced expenses through rental income |

| Investment Potential | Appreciation of property value | Property value plus cash flow from tenants |

| Living Arrangements | Exclusive personal use | Shared space with tenants to offset costs |

| Financial Risk | Dependent solely on homeowner's income | Diversified income from tenants reduces risk |

| Long-term Wealth | Equity builds through mortgage payments | Equity plus passive rental income increases wealth |

Understanding Money Management Goals

Homeownership as a goal emphasizes long-term wealth accumulation and stability through property appreciation and equity building. House hacking prioritizes reducing living expenses by generating rental income from extra space, directly impacting cash flow management and savings goals. Both strategies require disciplined budgeting, financial planning, and clear understanding of money management to maximize investment returns and achieve personal financial objectives.

Defining Homeownership: Traditional Approach

Traditional homeownership involves purchasing a single-family residence primarily for personal use and long-term investment. This approach emphasizes building equity through mortgage payments and property appreciation while assuming full responsibility for maintenance and expenses. Homeowners typically prioritize stability, privacy, and control over their living environment without relying on rental income.

What Is House Hacking?

House hacking is a real estate strategy where homeowners live in one part of their property while renting out other units or rooms to generate income. This approach reduces or eliminates living expenses, making homeownership more affordable and cash-flow positive. It offers a pathway to build equity and wealth faster by leveraging rental income to offset mortgage costs.

Upfront Costs: Comparing Initial Investments

Homeownership typically requires a substantial upfront investment including a down payment, closing costs, and moving expenses, often ranging from 5% to 20% of the property's purchase price. House hacking minimizes initial costs by allowing buyers to offset mortgage payments through rental income from shared living spaces, reducing financial strain during the transition. Evaluating upfront costs between traditional homeownership and house hacking helps determine the most efficient path toward building equity and achieving long-term financial goals.

Monthly Cash Flow Differences

Homeownership typically involves higher monthly expenses due to mortgage payments, property taxes, and maintenance costs, resulting in a negative or neutral monthly cash flow. House hacking allows owners to offset these costs by renting out part of their property, generating positive monthly cash flow and reducing overall living expenses. Comparing the two strategies highlights the financial advantage of house hacking in creating consistent income streams while building equity.

Risk and Reward: Evaluating Financial Security

Homeownership offers long-term equity buildup and stability but involves higher upfront costs and market risk, potentially reducing financial flexibility. House hacking minimizes housing expenses by generating rental income, enhancing cash flow, and mitigating risk through diversified income streams. Evaluating these options requires assessing personal risk tolerance and financial goals to optimize security and investment growth.

Equity Building Over Time

Homeownership builds equity steadily as mortgage payments increase property value and reduce loan principal, creating long-term financial stability. House hacking accelerates equity growth by generating rental income that can cover mortgage costs and enable faster principal repayment. Combining rental revenue with property appreciation maximizes equity accumulation and wealth creation over time.

Impact on Long-Term Financial Freedom

Homeownership builds long-term financial freedom through equity appreciation and stability in housing costs, creating a valuable asset over time. House hacking accelerates this process by generating rental income that offsets mortgage payments, reducing living expenses and increasing cash flow. Both strategies enhance wealth accumulation, but house hacking offers faster debt reduction and more immediate financial flexibility.

Lifestyle Considerations and Flexibility

Homeownership offers long-term stability and the ability to personalize living space, but it often requires a significant financial commitment and limits mobility. House hacking provides greater flexibility by generating rental income that can offset mortgage costs while allowing residents to adapt living arrangements to changing lifestyle needs. Evaluating priorities such as financial goals, lifestyle preferences, and future plans is essential when choosing between traditional homeownership and house hacking strategies.

Choosing the Best Strategy for Your Money Management Goals

Homeownership builds long-term equity and stability, ideal for those prioritizing asset growth and community roots. House hacking reduces monthly expenses by generating rental income, maximizing cash flow and accelerating debt repayment. Evaluating personal financial goals and risk tolerance ensures the best strategy aligns with wealth-building and money management objectives.

Related Important Terms

Equity Arbitrage

Homeownership builds long-term wealth through steady equity appreciation as property value increases and mortgage balances decrease. House hacking accelerates equity arbitrage by reducing living expenses and generating rental income, enabling faster debt repayment and greater equity accumulation.

BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat)

The BRRRR strategy maximizes financial growth by allowing investors to buy undervalued properties, rehab them to increase value, rent for steady income, refinance to pull out equity, and repeat the process to build a scalable real estate portfolio. Homeownership offers stability and personal use benefits, but house hacking through BRRRR accelerates wealth accumulation by leveraging rental income and strategic refinancing to fund ongoing investments.

Live-In Flip

Live-in flipping maximizes homeownership benefits by enabling owners to renovate and increase property value while living on-site, reducing costs and building equity faster. This strategy leverages house hacking principles by generating rental income from part of the property during the renovation, making it a financially strategic path toward property investment goals.

Nomad Investing

Homeownership offers long-term stability and equity building, while house hacking through Nomad Investing maximizes cash flow by leveraging rental income from multiple properties or remote locations. Nomad Investing streamlines financial goals by combining property acquisition with flexible, location-independent income streams, enhancing wealth creation efficiently.

Geoarbitrage Homeownership

Geoarbitrage homeownership leverages lower-cost living areas to maximize real estate investment returns while maintaining property equity growth, making it a strategic approach to building wealth. House hacking involves renting out portions of a primary residence to offset mortgage costs, but geoarbitrage amplifies financial benefits by combining affordable living with targeted market appreciation.

Micro-House Hacking

Micro-house hacking leverages small-scale properties such as tiny homes or accessory dwelling units (ADUs) to generate rental income while minimizing upfront costs and maintenance. This strategy accelerates homeownership goals by combining affordable living with passive income streams, optimizing cash flow and equity growth.

Accessory Dwelling Unit (ADU) Income

Accessory Dwelling Unit (ADU) income significantly enhances the financial viability of house hacking by generating passive rental revenue, which offsets mortgage expenses and accelerates equity building. Homeownership without ADU income typically requires higher personal cash flow, making house hacking with an ADU a strategic goal for maximizing property investment returns.

Rent By The Room Model

Homeownership offers long-term equity growth, while the rent-by-the-room house hacking model maximizes cash flow by generating multiple rental incomes from a single property, accelerating mortgage payoff and wealth accumulation. This strategy leverages shared housing demand, reducing personal housing costs and increasing investment returns, making it a highly effective goal for financial independence.

Owner-Occupied Duplex Strategy

Owner-occupied duplex strategy combines homeownership with house hacking by allowing residents to live in one unit while renting out the other, generating rental income to offset mortgage costs. This approach accelerates wealth building and reduces living expenses compared to traditional single-family homeownership.

Co-Living House Hack

Co-living house hacking maximizes homeownership benefits by reducing living expenses through renting out individual rooms while fostering community and social interaction among tenants. This strategy accelerates mortgage payoff and wealth building by leveraging rental income, contrasting traditional homeownership where financial growth is solely dependent on property appreciation.

Homeownership vs House Hacking for goal. Infographic

moneydiff.com

moneydiff.com