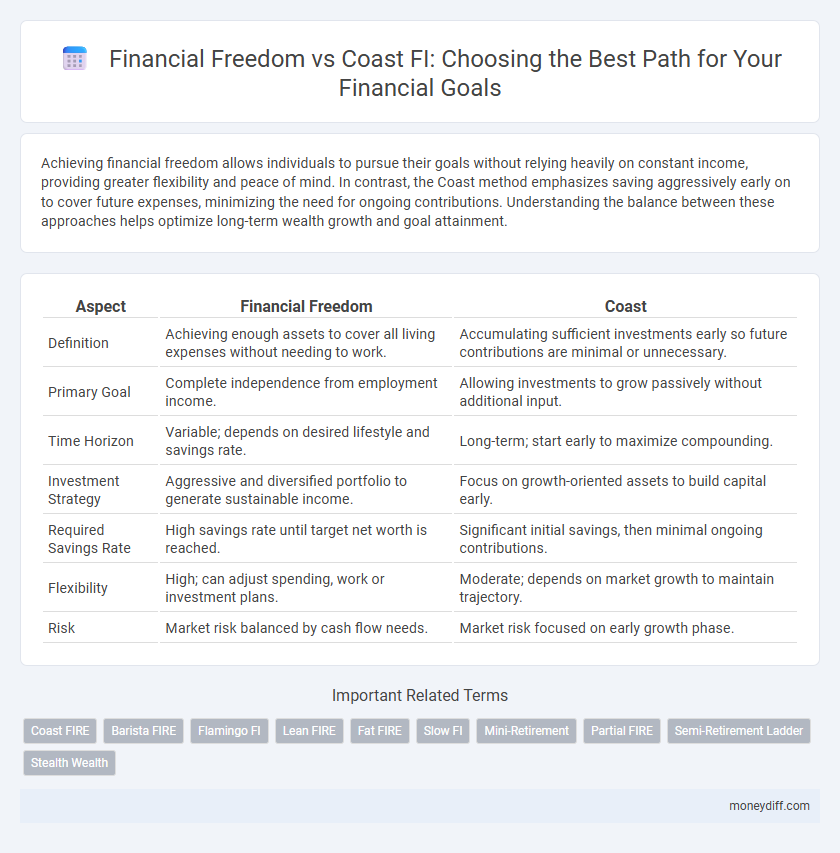

Achieving financial freedom allows individuals to pursue their goals without relying heavily on constant income, providing greater flexibility and peace of mind. In contrast, the Coast method emphasizes saving aggressively early on to cover future expenses, minimizing the need for ongoing contributions. Understanding the balance between these approaches helps optimize long-term wealth growth and goal attainment.

Table of Comparison

| Aspect | Financial Freedom | Coast |

|---|---|---|

| Definition | Achieving enough assets to cover all living expenses without needing to work. | Accumulating sufficient investments early so future contributions are minimal or unnecessary. |

| Primary Goal | Complete independence from employment income. | Allowing investments to grow passively without additional input. |

| Time Horizon | Variable; depends on desired lifestyle and savings rate. | Long-term; start early to maximize compounding. |

| Investment Strategy | Aggressive and diversified portfolio to generate sustainable income. | Focus on growth-oriented assets to build capital early. |

| Required Savings Rate | High savings rate until target net worth is reached. | Significant initial savings, then minimal ongoing contributions. |

| Flexibility | High; can adjust spending, work or investment plans. | Moderate; depends on market growth to maintain trajectory. |

| Risk | Market risk balanced by cash flow needs. | Market risk focused on early growth phase. |

Understanding Financial Freedom: Definition and Importance

Financial freedom is the state where an individual has sufficient income and assets to cover living expenses without active employment, enabling life choices driven by desires rather than financial constraints. Understanding its importance lies in recognizing how this independence fosters security, reduces stress, and provides the foundation for pursuing personal goals and long-term wealth accumulation. Achieving financial freedom requires strategic planning, disciplined saving, and smart investment decisions tailored to individual needs and risk tolerance.

What Does It Mean to "Coast" Financially?

Coasting financially means reaching a point where your current savings and investments are sufficient to support your future lifestyle without additional contributions, relying on compound interest to grow your wealth over time. This strategy contrasts with actively pursuing financial freedom through continuous income generation and aggressive saving, as coasting emphasizes maintaining a steady, self-sustaining financial trajectory. Understanding this concept helps individuals prioritize early savings and investment growth to minimize future financial stress while still achieving long-term goals.

Key Differences: Financial Freedom vs. Coasting

Financial freedom means having enough income from investments, savings, or passive sources to cover all living expenses without relying on employment, providing full financial independence. Coasting refers to having saved enough that with continued moderate growth and minimal additional contributions, one can eventually retire comfortably, but may still require some financial discipline or partial work. The key difference lies in the immediacy of independence: financial freedom allows for quitting work now, while coasting involves maintaining current savings habits to reach retirement.

Pros and Cons of Pursuing Financial Freedom

Pursuing financial freedom offers the advantage of long-term stability and the ability to make life choices without monetary constraints, fostering personal growth and peace of mind. However, it often requires disciplined saving, investment knowledge, and potentially delaying gratification, which can impact short-term enjoyment and lifestyle flexibility. Balancing immediate needs with strategic planning is essential to avoid burnout and maintain motivation toward achieving true financial independence.

Advantages and Challenges of the Coast Approach

The Coast approach to financial freedom allows individuals to stop contributing to their retirement savings early while letting investments grow over time, leveraging compound interest for long-term wealth accumulation. Advantages include reduced financial stress during mid-career years and the flexibility to pursue other goals without ongoing saving pressure. Challenges involve maintaining discipline with early savings, market volatility risks over a prolonged period, and the need for substantial initial capital to ensure future financial security.

Setting Clear Money Management Goals

Setting clear money management goals involves distinguishing between financial freedom and coasting phases to optimize wealth-building strategies. Financial freedom requires targeted savings, strategic investments, and disciplined budgeting to generate passive income exceeding living expenses. Coasting focuses on maintaining stable finances with minimal active financial effort, relying on prior assets and conservative spending to sustain goals over time.

How to Choose Between Financial Freedom and Coasting

Choosing between financial freedom and coasting depends on individual risk tolerance and long-term objectives. Financial freedom entails actively managing investments and income streams to achieve independence, while coasting focuses on accumulating sufficient assets early to minimize ongoing effort. Evaluating personal lifestyle preferences and financial stability helps determine whether to pursue aggressive growth or steady maintenance toward financial goals.

Strategies to Achieve Financial Freedom

Achieving financial freedom involves deliberate strategies such as consistent saving, smart investing, and minimizing debt to build wealth over time. The Coast FIRE strategy emphasizes early aggressive saving and investing to reach a point where future growth covers retirement expenses without further contributions. Prioritizing compound interest and disciplined budgeting enables individuals to secure financial independence efficiently while balancing lifestyle goals.

Practical Steps for Successfully Coasting to Retirement

Achieving financial freedom requires a clear understanding of coast FIRE, a strategy where you accumulate enough savings early to cover future retirement needs without further contributions. Focus on maximizing savings during peak earning years, while minimizing expenses and managing investments to grow passively over time. Tracking progress through retirement calculators and adjusting investments ensures a smooth transition into coast mode and successful retirement.

Aligning Your Financial Goals with Your Lifestyle

Aligning your financial goals with your lifestyle involves balancing the pursuit of financial freedom and the Coast strategy. Financial freedom aims for complete independence through aggressive saving and investing, while the Coast strategy focuses on securing enough early investments to cover future expenses without additional contributions. Choosing the right approach depends on evaluating your current income, spending habits, and long-term desires to create a sustainable plan that supports your unique lifestyle.

Related Important Terms

Coast FIRE

Coast FIRE involves saving aggressively early to allow investments to grow passively until retirement without additional contributions, offering a less stressful path to financial freedom compared to traditional FIRE methods. This strategy emphasizes the power of compound interest and disciplined early savings, enabling individuals to "coast" through their remaining working years without sacrificing lifestyle.

Barista FIRE

Barista FIRE represents a financial independence strategy where individuals achieve partial financial freedom by covering basic expenses through investments and maintaining part-time work to cover additional costs. This approach balances Coast FIRE's emphasis on letting investments grow without new contributions and traditional FIRE's goal of full early retirement, offering flexibility and reduced financial pressure.

Flamingo FI

Flamingo FI emphasizes achieving financial freedom by balancing aggressive savings with strategic coast FIRE, enabling earlier asset growth while minimizing lifestyle sacrifices. This approach optimizes portfolio longevity and flexibility, allowing individuals to reduce working years without compromising long-term financial security.

Lean FIRE

Lean FIRE emphasizes achieving financial freedom with minimal expenses, allowing earlier retirement by maintaining a modest lifestyle instead of saving for a traditional Coast FIRE target. This approach requires aggressive savings and investing strategies to reduce the time needed to reach financial independence without relying on accumulating a large nest egg.

Fat FIRE

Fat FIRE represents a financial independence strategy where individuals accumulate enough wealth to support an affluent lifestyle without working, surpassing basic Coast FIRE principles that rely on passive growth until retirement. Achieving Fat FIRE requires higher savings rates, aggressive investing, and diversifying income streams to surpass the minimal financial threshold needed in Coast FIRE.

Slow FI

Slow FI emphasizes achieving financial freedom gradually by consistently saving and investing while maintaining a balanced lifestyle, rather than aiming for rapid independence. This approach contrasts with Coast FI, where individuals save enough early on to let investments grow passively, allowing them to focus on other life goals without additional savings pressure.

Mini-Retirement

Achieving financial freedom enables individuals to enjoy a mini-retirement by reducing reliance on active income and leveraging passive income streams to cover living expenses. Coast FIRE involves accumulating enough savings early to let investments grow over time, allowing for mini-retirements without full early retirement pressures.

Partial FIRE

Partial FIRE prioritizes achieving financial freedom with reduced savings targets by maintaining a modest lifestyle, allowing earlier retirement without full Coast FIRE's extensive passive income requirements. This approach balances ongoing income generation and investments to cover essential expenses, emphasizing flexibility and gradual wealth accumulation over time.

Semi-Retirement Ladder

The Semi-Retirement Ladder strategy balances financial freedom with the Coast FIRE approach by gradually reducing work commitments while allowing existing investments to grow without further contributions. This method ensures funded retirement goals through staged transitions, leveraging compound interest and minimizing risk without complete early retirement abruptness.

Stealth Wealth

Financial freedom enables individuals to achieve coast status by building enough assets to cover future expenses without active income, embodying the stealth wealth philosophy of quietly accumulating resources without ostentation. Emphasizing long-term asset growth and minimal lifestyle inflation supports financial independence while maintaining discretion and security.

Financial Freedom vs Coast for goal. Infographic

moneydiff.com

moneydiff.com