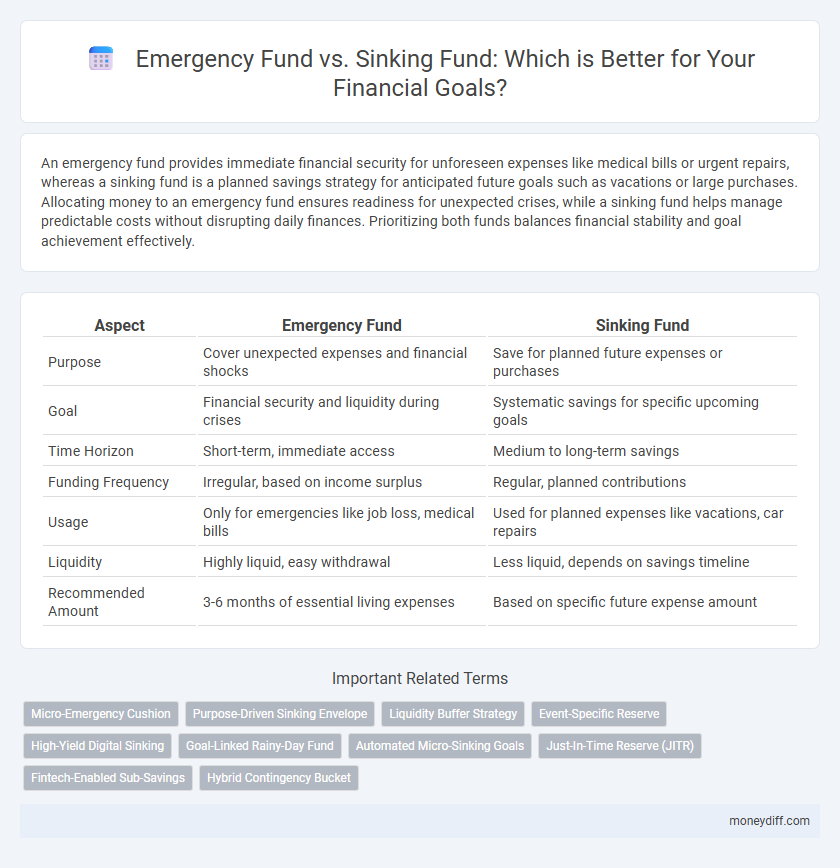

An emergency fund provides immediate financial security for unforeseen expenses like medical bills or urgent repairs, whereas a sinking fund is a planned savings strategy for anticipated future goals such as vacations or large purchases. Allocating money to an emergency fund ensures readiness for unexpected crises, while a sinking fund helps manage predictable costs without disrupting daily finances. Prioritizing both funds balances financial stability and goal achievement effectively.

Table of Comparison

| Aspect | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and financial shocks | Save for planned future expenses or purchases |

| Goal | Financial security and liquidity during crises | Systematic savings for specific upcoming goals |

| Time Horizon | Short-term, immediate access | Medium to long-term savings |

| Funding Frequency | Irregular, based on income surplus | Regular, planned contributions |

| Usage | Only for emergencies like job loss, medical bills | Used for planned expenses like vacations, car repairs |

| Liquidity | Highly liquid, easy withdrawal | Less liquid, depends on savings timeline |

| Recommended Amount | 3-6 months of essential living expenses | Based on specific future expense amount |

Understanding Emergency Funds and Sinking Funds

Emergency funds provide financial security by covering unexpected expenses such as medical emergencies or job loss, typically maintained with three to six months' worth of living expenses. Sinking funds are targeted savings accounts designated for specific future purchases or expenses like a car replacement or vacation, enabling planned goal achievement without debt. Understanding the distinct purposes of emergency and sinking funds allows for more effective financial planning and goal management.

Why Emergency Funds Matter for Financial Security

Emergency funds provide a critical financial safety net that covers unexpected expenses such as medical emergencies, car repairs, or job loss, preventing high-interest debt accumulation. Unlike sinking funds, which are allocated for planned future expenses like vacations or major purchases, emergency funds prioritize liquidity and immediate access. Maintaining an adequately funded emergency reserve enhances overall financial security by reducing stress and enabling better decision-making during unforeseen financial challenges.

Sinking Funds: Purpose and Advantages Explained

Sinking funds are designated savings set aside specifically for anticipated future expenses, such as car repairs or annual insurance premiums, allowing for better financial planning and reduced need for credit. Unlike emergency funds that cover unexpected costs, sinking funds target known goals, helping individuals avoid debt by spreading out payments over time. This approach offers clear advantages in maintaining financial stability and achieving specific monetary objectives efficiently.

Key Differences Between Emergency and Sinking Funds

Emergency funds cover unexpected expenses like medical emergencies or job loss, ensuring financial stability during crises. Sinking funds are designated savings accounts for planned future expenses, such as vacations, home repairs, or large purchases, preventing debt accumulation. The key difference lies in purpose and timing: emergency funds address unforeseen events, while sinking funds prepare for anticipated costs.

Setting Financial Goals: When to Use Each Fund

Emergency funds provide a financial safety net for unexpected expenses such as medical emergencies or job loss, typically covering three to six months of living costs, while sinking funds are designated for planned future expenses like purchasing a car or funding a vacation. Setting clear financial goals helps determine when to prioritize building an emergency fund first to ensure stability before allocating money to sinking funds for specific objectives. Using both funds strategically enhances overall financial security and goal achievement by balancing immediate risk protection with intentional savings for anticipated purchases.

How Much to Save: Emergency vs Sinking Fund Targets

Emergency funds typically target saving three to six months' worth of essential living expenses to cover unexpected financial setbacks. Sinking funds require setting specific monetary goals aligned with planned future expenses, such as a $2,000 car repair or a $5,000 vacation, spread over a defined timeline. Prioritizing emergency fund adequacy ensures financial resilience, while sinking funds enable disciplined saving for anticipated purchases without disrupting regular budgets.

Building Your Emergency Fund: Practical Steps

Building your emergency fund starts with setting a target of three to six months' worth of essential living expenses to cover unexpected financial setbacks. Automate regular monthly contributions to a high-yield savings account to ensure consistent growth and easy access. Prioritize liquidity and low risk, keeping funds separate from sinking funds dedicated to planned future expenses.

Planning Sinking Funds for Upcoming Expenses

Planning sinking funds for upcoming expenses involves setting aside specific amounts regularly to cover anticipated costs such as insurance premiums, car maintenance, or holiday gifts. Unlike emergency funds designed for unexpected crises, sinking funds focus on predictable, planned expenses, allowing better budgeting and avoiding debt. Allocating money to sinking funds enhances financial stability by ensuring readiness for non-monthly, recurring costs.

Common Mistakes to Avoid with Both Funds

Common mistakes with emergency and sinking funds include underestimating the required amount, leading to insufficient coverage during crises or planned expenses. Mixing fund purposes often results in depleted reserves when funds intended for emergencies are used for sinking fund goals, or vice versa. Neglecting regular contributions and failing to adjust fund targets as financial situations change can undermine the effectiveness of both savings strategies.

Integrating Emergency and Sinking Funds into Your Budget

Integrating emergency and sinking funds into your budget enhances financial preparedness by allocating specific amounts for unexpected expenses and planned purchases. Prioritize establishing an emergency fund covering 3-6 months of living expenses while systematically contributing to sinking funds for anticipated costs like vacations or home repairs. Consistent budgeting for both funds reduces financial stress and improves goal achievement by ensuring liquidity for emergencies and saving for future obligations.

Related Important Terms

Micro-Emergency Cushion

A Micro-Emergency Cushion serves as a smaller, more accessible subset of an emergency fund, designed to cover immediate, low-cost unexpected expenses without tapping into a larger sinking fund allocated for planned financial goals. This structure enhances financial resilience by separating urgent liquidity needs from long-term savings targets, optimizing fund management for both short-term emergencies and anticipated expenses.

Purpose-Driven Sinking Envelope

An emergency fund provides immediate financial security during unforeseen expenses, while a sinking fund is a purpose-driven sinking envelope, systematically accumulating money for specific future goals like vacations or large purchases. Allocating funds into separate sinking envelopes ensures disciplined savings tailored to each objective, optimizing financial planning and goal achievement.

Liquidity Buffer Strategy

An emergency fund provides a high-liquidity buffer designed to cover unexpected expenses instantly, typically held in cash or easily accessible accounts. In contrast, a sinking fund targets planned future expenses with moderate liquidity, allowing for strategic saving and investment growth while maintaining availability by the goal deadline.

Event-Specific Reserve

An emergency fund provides immediate access to cash for unexpected expenses like medical emergencies or job loss, ensuring financial stability. In contrast, a sinking fund is an event-specific reserve designed to accumulate savings over time for planned future expenses such as vacations, home repairs, or large purchases.

High-Yield Digital Sinking

High-yield digital sinking funds provide a strategic approach to goal-oriented savings by leveraging competitive interest rates on secure, accessible platforms designed specifically for planned expenditures. Unlike emergency funds, which prioritize liquidity and immediate access, high-yield digital sinking funds optimize growth for targeted financial goals through scheduled contributions and investment in interest-bearing accounts.

Goal-Linked Rainy-Day Fund

A Goal-Linked Rainy-Day Fund differs from a traditional Emergency Fund by being specifically allocated to cover unexpected expenses related to predefined financial goals, ensuring that short-term setbacks do not derail long-term objectives. Unlike a Sinking Fund, which is methodically saved for anticipated expenses, a Goal-Linked Rainy-Day Fund provides flexible protection against unforeseen disruptions directly impacting goal achievement.

Automated Micro-Sinking Goals

Automated micro-sinking goals efficiently allocate small, regular contributions towards specific financial targets, ensuring progress without impacting daily cash flow, whereas an emergency fund serves as a separate, readily accessible reserve for unexpected expenses. Prioritizing automated savings in sinking funds enhances disciplined goal achievement while maintaining financial security through a dedicated emergency fund.

Just-In-Time Reserve (JITR)

A Just-In-Time Reserve (JITR) strategically bridges the gap between an Emergency Fund and a Sinking Fund by providing immediate liquidity for unforeseen expenses while allowing planned savings for future goals. This approach optimizes cash flow management, ensuring adequate financial preparedness without tying up excessive funds prematurely.

Fintech-Enabled Sub-Savings

Fintech-enabled sub-savings platforms facilitate the segregation of emergency funds and sinking funds, enabling precise goal tracking and automated contributions for financial emergencies and planned expenses. These digital tools leverage real-time analytics and customizable rules to optimize fund allocation, ensuring liquidity for unexpected costs while systematically accumulating for future purchases or debt payoff.

Hybrid Contingency Bucket

A Hybrid Contingency Bucket combines the advantages of an Emergency Fund and a Sinking Fund by providing immediate liquidity for unexpected expenses while allowing planned savings for upcoming goals. This approach optimizes financial security by maintaining a balance between accessible cash reserves and allocated funds for anticipated financial commitments.

Emergency Fund vs Sinking Fund for goal. Infographic

moneydiff.com

moneydiff.com