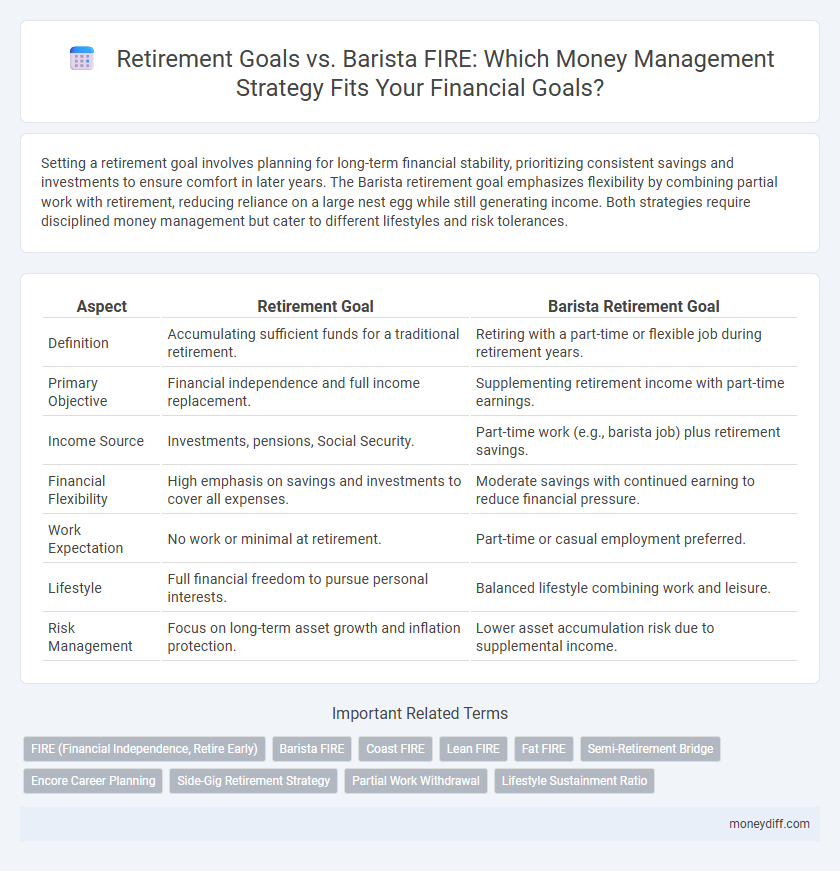

Setting a retirement goal involves planning for long-term financial stability, prioritizing consistent savings and investments to ensure comfort in later years. The Barista retirement goal emphasizes flexibility by combining partial work with retirement, reducing reliance on a large nest egg while still generating income. Both strategies require disciplined money management but cater to different lifestyles and risk tolerances.

Table of Comparison

| Aspect | Retirement Goal | Barista Retirement Goal |

|---|---|---|

| Definition | Accumulating sufficient funds for a traditional retirement. | Retiring with a part-time or flexible job during retirement years. |

| Primary Objective | Financial independence and full income replacement. | Supplementing retirement income with part-time earnings. |

| Income Source | Investments, pensions, Social Security. | Part-time work (e.g., barista job) plus retirement savings. |

| Financial Flexibility | High emphasis on savings and investments to cover all expenses. | Moderate savings with continued earning to reduce financial pressure. |

| Work Expectation | No work or minimal at retirement. | Part-time or casual employment preferred. |

| Lifestyle | Full financial freedom to pursue personal interests. | Balanced lifestyle combining work and leisure. |

| Risk Management | Focus on long-term asset growth and inflation protection. | Lower asset accumulation risk due to supplemental income. |

Understanding Traditional Retirement Goals

Traditional retirement goals emphasize accumulating sufficient savings to sustain income after leaving the workforce, focusing on long-term financial security and predictable expenses. In contrast, a Barista retirement goal centers on generating supplementary income through part-time work, blending active earnings with savings to delay or reduce reliance on retirement funds. Understanding these distinctions helps tailor money management strategies to balance risk tolerance, lifestyle preferences, and income sources for effective retirement planning.

What is the Barista Retirement Strategy?

The Barista Retirement Strategy involves maintaining part-time work during traditional retirement years to supplement income and reduce the need for large retirement savings. This approach balances financial stability with lifestyle flexibility, allowing retirees to access affordable healthcare benefits and delay Social Security withdrawals. By integrating ongoing employment, the Barista Strategy enhances money management through diversified income streams and prolonged investment growth.

Comparing Retirement Lifestyles: Full Retirement vs. Barista FIRE

Full Retirement typically requires substantial savings to cover all living expenses without working, emphasizing long-term financial independence and complete withdrawal from the workforce. Barista FIRE blends partial retirement with part-time work, reducing savings needs by supplementing income through low-stress jobs while maintaining healthcare benefits and a flexible lifestyle. Comparing these goals highlights the trade-off between financial security and lifestyle flexibility, making Barista FIRE a practical choice for those prioritizing balance over full financial independence.

Financial Requirements for Both Retirement Paths

Retirement goals require assessing financial needs based on lifestyle choices, with traditional retirement often demanding a larger retirement fund to cover extended living expenses and healthcare costs. Barista retirement goals focus on a flexible, part-time income that supplements Social Security or savings, reducing the need for a substantial nest egg while maintaining financial stability. Evaluating savings targets and expected cash flow is critical to managing money effectively for either retirement path.

Building an Effective Savings Plan

Creating an effective savings plan for a traditional retirement goal involves consistent contributions to retirement accounts like 401(k)s or IRAs, prioritizing long-term growth and tax advantages. In contrast, a Barista retirement goal emphasizes supplementing income through part-time work while saving strategically to balance immediate expenses and future financial security. Tailoring savings strategies to match these distinct goals ensures optimized money management and sustainable retirement planning.

Investment Strategies for Diverse Retirement Goals

Retirement goals vary widely, with traditional retirement often focusing on long-term growth through diversified portfolios including stocks, bonds, and real estate, aiming for capital preservation and steady income. In contrast, a Barista retirement goal may prioritize flexible, part-time work combined with conservative investments like bonds or dividend-yielding stocks to maintain cash flow while preserving capital. Tailoring investment strategies to these distinct goals ensures effective money management by balancing risk tolerance, income needs, and retirement timelines.

Managing Expenses: Full Retirement vs. Supplemented Income

A traditional retirement goal emphasizes fully covering living expenses through savings and pensions, ensuring financial independence without additional work income. The Barista retirement goal focuses on supplementing income by working part-time or freelancing, reducing the need for extensive savings and allowing more flexible money management. Managing expenses under a Barista retirement involves balancing reduced dependency on savings while maintaining lifestyle quality through steady, smaller income streams.

Healthcare Planning in Retirement Scenarios

Retirement goals require comprehensive healthcare planning to ensure adequate coverage for long-term medical expenses, including chronic conditions and unexpected emergencies. A Barista retirement goal often involves smaller savings and relies on part-time work, so integrating affordable healthcare options like Medicaid or Medicare Supplement plans is critical. Effective money management balances healthcare costs with other retirement expenses to maintain financial stability and peace of mind.

Risk Management for Varying Retirement Approaches

Retirement goals require tailored risk management strategies to ensure financial stability, contrasting with Barista retirement goals that emphasize part-time income to mitigate market volatility. Diversifying income streams reduces dependence on investment returns, protecting against sequence of returns risk in traditional retirement plans. Employing flexible withdrawal rates and conservative asset allocation enhances sustainability for varying retirement income needs.

Choosing the Right Retirement Path for Your Financial Needs

Choosing the right retirement path depends on your financial needs and lifestyle goals, with traditional retirement focused on fully exiting the workforce while barista retirement blends part-time income with reduced work hours. Balancing income sources and expenses allows for sustainable money management, helping avoid depleting savings too quickly. Evaluating factors such as healthcare costs, social security benefits, and personal spending habits ensures the chosen retirement strategy supports long-term financial security.

Related Important Terms

FIRE (Financial Independence, Retire Early)

A traditional retirement goal typically requires accumulating substantial savings to sustain lifestyle after decades of work, while a Barista retirement goal aligns with the FIRE movement by combining partial financial independence with part-time work to maintain income and reduce withdrawal rates. The Barista FIRE strategy emphasizes lower expenses and flexible income streams, enabling earlier retirement with less capital than conventional retirement planning.

Barista FIRE

Barista FIRE focuses on achieving partial financial independence through a combination of part-time work and investment income, allowing individuals to reduce their reliance on full-time employment while maintaining a steady cash flow. This approach differs from traditional retirement goals, which prioritize complete withdrawal from the workforce, emphasizing sustainable money management that balances lifestyle flexibility with long-term financial security.

Coast FIRE

Coast FIRE enables achieving a traditional retirement goal by saving aggressively early, allowing investments to grow passively until retirement without additional contributions. In contrast, the Barista retirement goal blends part-time work with reduced expenses, offering financial flexibility while maintaining a smaller investment portfolio to cover remaining needs.

Lean FIRE

The Lean FIRE approach targets financial independence with minimal expenses, enabling early retirement through disciplined saving and investing, whereas the Barista retirement goal blends part-time work with reduced income, supplementing limited savings. Both strategies prioritize efficient money management but vary in lifestyle commitments and cash flow requirements during retirement.

Fat FIRE

Fat FIRE retirement goals emphasize accumulating substantial wealth to maintain a luxurious lifestyle without working, contrasting with the Barista retirement goal where partial employment provides supplemental income and reduces financial strain. Prioritizing Fat FIRE requires aggressive saving, high investment returns, and meticulous money management to ensure long-term financial independence without reliance on part-time work.

Semi-Retirement Bridge

The Retirement goal focuses on accumulating sufficient funds to sustain full financial independence, while the Barista retirement goal emphasizes partial work during semi-retirement to supplement income and reduce withdrawal rates. Utilizing a Semi-Retirement Bridge strategy allows individuals to transition gradually by combining passive retirement savings with active earnings, optimizing money management and extending portfolio longevity.

Encore Career Planning

Retirement goals typically emphasize financial security through savings and investments, while a Barista Retirement goal prioritizes supplemental income during an Encore Career phase to maintain lifestyle and reduce financial stress. Encore Career Planning integrates strategic part-time work like barista roles to balance income streams and enhance long-term money management stability.

Side-Gig Retirement Strategy

The Side-Gig Retirement Strategy combines consistent income from a primary career with supplemental earnings from barista-style side gigs, enhancing financial security and extending retirement savings. This hybrid approach optimizes cash flow and minimizes reliance on traditional retirement funds by integrating flexible, part-time work with long-term investment plans.

Partial Work Withdrawal

Partial work withdrawal balances income and leisure by allowing gradual reduction in work hours during retirement, supporting sustainable money management without fully relinquishing employment. The barista retirement goal emphasizes flexible part-time engagements to supplement pension funds, optimizing cash flow and preserving financial security.

Lifestyle Sustainment Ratio

Retirement goals often emphasize maximizing the Lifestyle Sustainment Ratio (LSR) to ensure long-term financial independence, whereas barista retirement goals prioritize a balanced LSR that supports partial income replacement alongside continued part-time work. Optimizing LSR in barista retirement allows for sustainable money management that accommodates reduced earnings without sacrificing essential living standards.

Retirement goal vs Barista retirement goal for money management. Infographic

moneydiff.com

moneydiff.com